promotefilemarkets.com

filemarkets.com 时间:2021-03-21 阅读:()

ENEN21.

INTRODUCTIONTaxationiscentraltotheEU'sworktobuildastronger,morecompetitiveandfairereconomy,withaclearsocialdimension.

Europeneedsataxsystemthatfitsitsinternalmarketandthatsupportseconomicgrowthandcompetitiveness,attractsinvestment,helpstocreatejobs,fostersinnovationandupholdstheEuropeansocialmodel.

Taxationshouldprovidestablerevenuesforpublicinvestmentandgrowth-friendlypolicies.

Itshouldensurethatallbusinessesenjoyalevel-playingfield,legalcertaintyandminimalobstacleswhenoperatingcross-border.

Itshouldbepartofawidertaxsysteminwhichcitizenshaveconfidence,becauseitisfairandmeetssociety'ssocio-economicneeds.

TheEU'sprioritiesintaxationarethereforefocussedonthesegoals.

2.

IMMEDIATEACTIONTOMEETIMMEDIATENEEDS:REFORMINGCORPORATETAXATIONTheCommissionhassetanambitiousagendatomakecorporatetaxationfairerandmoreeffective;betteradaptedtothemoderneconomyandmoreresponsivetoemergingchallengesinthisfield.

Thisagendaisadvancingrapidlyandmanyimportantmilestoneshavealreadybeenmet.

AlloftheinitiativesannouncedintheCommission'sActionPlanforFairandEffectiveTaxation1havenowbeenlaunched,andmanynewproposalshavealreadybeenadoptedbyMemberStates.

TheCommissionisalsopushingthescopeofitsworkbeyondtheActionPlan.

AsshownintheCommunicationonfurthermeasurestoenhancetransparencyandthefightagainsttaxevasionandavoidance,whichfollowedthePanamaPapersrevelations,itisreadytodevelopswiftandeffectiveresponsestoissuesastheyarise2.

Inaddition,theCommissionhascarriedoutstateaidinvestigationsintowhethercertainMemberStatesgrantedtaxadvantagestoselectedmultinationalcompanies3,tosafeguardafairandcompetitiveenvironmentforallbusinessesintheEU.

TheCommission'sfirstlineofactionwastoincreasetaxtransparency,asanessentialfoundationforanyfurtherreforms.

Withinaperiodof12months,MemberStatesagreedonproposalsfortheautomaticexchangeofinformationontaxrulings4andcountry-by-countryreportsoftax-relatedinformationconcerningmultinationals5.

Thiswillbringanewandunprecedentedleveloftransparencyandcooperationbetweentaxauthoritiesintheareaofcorporatetaxation.

TheCommissionalsoproposedpubliccountry-by-countryreportingformultinationals,toprovidecitizenswithgreateroversightofcompanies'taxpractices.

Thisproposal,whichiscurrentlybeingnegotiatedbytheCouncilandtheEuropeanParliament,shouldhelprestorepublicconfidenceincorporatetaxationandensurethatbusinessesarenotfacedwithapatchworkofnationalpublicdisclosurerules.

Aproposaltoallowtaxauthoritiesaccesstonationalanti-money1COM(2015)302final2COM(2016)451final3SeenoticeontheNotionofaid§169to174:http://ec.

europa.

eu/competition/state_aid/modernisation/notice_of_aid_en.

pdf4CouncilDirective(EU)2015/23765CouncilDirective(EU)2016/8813launderinginformation6isexpectedtobeagreedbeforetheendoftheyear.

TheEuropeanParliamentandCouncilhavealsostartedtoworkontheirpositionsonproposedamendmentstotheFourthAnti-MoneyLaunderingDirective,andshouldadvanceswiftlyfortriloguestobeginbyearly2017.

Inaddition,theCommissionhasstartedtoexaminethemostappropriateframeworktoimplementtheautomaticexchangeofinformationonbeneficialownership,atEuropeanlevel,andisexploringthebestwaytoincreaseoversightofenablersandpromotersofaggressivetaxplanningschemes.

ThisincreasedtaxtransparencyacrossEuropewillhelptoexposeaggressivetaxplanners,uncoverharmfultaxpracticesandstabiliseacorporatetaxenvironmentbuiltonopennessandtrust.

Inparallel,theCommissionisalsoworkingtoensurethatallcompaniesoperatingintheEUpaytheirtaxeswhereprofitsandvaluearegenerated.

Thisprincipleisessentialforfairandeffectivetaxation,butcanonlybeeffectivelyachievedinaSingleMarketthroughcommonandcoordinatedmeasures.

Therefore,theCommissionproposedanewAnti-TaxAvoidanceDirective7,settingoutlegally-bindinganti-abusemeasuresfortheentireEU,toblocksomeofthemostprevalentformsofbaseerosionandprofitshifting.

Thislegislation,whichMemberStatesadoptedinJuly2016,allowedMemberStatestoimplementinaswift,coordinatedandcoherentway,thecommitmentstheymadeundertheOECD/G20BaseErosionandProfitShifting(BEPS)project.

MemberStates'preferentialregimesandtransferpricingrulesarealsobeingreviewed,toensureacommonEUapproachtonewinternationalstandards.

ThisiscriticaltoprovidecertaintyforbusinessesasreformsareimplementedandtopreventnewloopholesemergingintheSingleMarket.

Finally,theCommissionhaspresentedmeasurestopromotetaxgoodgovernanceglobally,toensureafairandlevel-playingfieldbetweentheEUanditsinternationalpartners.

MemberStateshaveendorsedthenewExternalStrategyforEffectiveTaxation8,presentedbytheCommissioninJanuary2016,toprotecttheirtaxbasesagainstbaseerosionrisksfromabroad.

AkeycomponentofthisStrategyisanewEUlistingprocess,todealwithnon-cooperativetaxjurisdictionsandencourageallthirdcountryjurisdictionstomeetinternationaltaxgoodgovernancestandards.

ThefirststepsinthislistingprocesshavealreadybeentakenandthecommonEUlistshouldbefinalisedin2017.

ThiswillprovideMemberStateswithapowerfultooltodealwithcountriesthatrefusetoplayfairintaxmatters.

TheEU'sFinancialRegulationhasalsobeenrevisedtopreventEUfundsfrombeingroutedthroughtaxhavens,andworkisunderwaytostrengthenthetaxgoodgovernanceclausesinEUagreementswiththirdcountries.

3.

APOSITIVE,FORWARD-LOOKINGAGENDATheinitiativessetoutabovearevitaltoprotectMemberStates'taxbases,providealevel-playingfieldforbusinessesandensurefairandeffectivetaxationforalltaxpayers.

Theyaddressthemostpressingproblemsincorporatetaxationtoday.

However,forthelongerterm,thereisaneedtogofurther.

Shorttermfixescansoonbecomeoutdated,asbusinessmodelsandtaxplanningtechniquesevolvefasterthannewresponsescanbe6COM(2016)452final7CouncilDirective(EU)2016/11648COM(2016)24final4devised.

Inaddition,piecemealupdatestointernational,EUornationaltaxrulescreateturbulenceforboththetaxadministrationsandthebusinessesthatneedtoadapttothem.

Toboostjobs,growthandinvestment,itisnecessarytocreateafavourabletaxenvironmentforbusiness,byreducingcompliancecostsandadministrativeburdens,andbyensuringtaxcertainty.

TheimportanceoftaxcertaintyinpromotinginvestmentandgrowthhasrecentlybeenrecognisedbytheG20leaders,andhasbecomethenewglobalfocus.

MemberStatesneedtofindabalancebetweenimplementingnecessaryreformsandprovidingasteady,clearandpredictabletaxenvironmentforbusinesses.

TheEUneedsapositive,forward-lookingframeworkforcorporatetaxation.

Itmustbegrowth-friendly,efficientandfair,andfullysupporttheEU'swiderpolicypriorities,nowandinthefuture.

ThisistherationalebehindtheCommission'sproposaltore-launchtheCommonConsolidatedCorporateTaxBase(CCCTB).

TheCCCTBcanmeetthetwoprimarydemandsofbusinessesandcitizensinEuropetoday–sustainablegrowthandsocialjustice–andreinforcetheEU'soveralleconomicandsocialagenda.

Indeed,analysisshowsthattheCCCTBcanliftinvestmentintheEUbyupto3.

4%andgrowthby1.

2%9.

TheCommissionfirstproposedtheCCCTBin2011,withaviewtoenhancingtheSingleMarketforbusinesses.

Theproposalwasambitiousandrobust,butitsmagnitudelednegotiationsintheCounciltostall.

However,theEuropeanParliament,businesses,stakeholdersandmanyMemberStatesretainedstrongsupportfortheideaoftheCCCTB,giventhemanybenefitsithadtooffer.

Moreover,inthepastfewyears,ithasbecomeclearthattheCCCTBoffersmorethanjustabusiness-friendlytaxsystemforastrongerSingleMarket.

Therefore,intheJune2015ActionPlan,theCommissionannouncedthatitwouldre-launchthisimportantprojectthroughamoremanageabletwo-stepprocess.

Thefirststepfocussesonsecuringthecommonbase.

Oncethisisimplemented,themorecomplexaspectofconsolidationwillbeintroduced.

ManyofthemostimportantbenefitsoftheCCCTBliewiththeconsolidationaspect.

Therefore,thissecondstepinthere-launchedCCCTBcannotbeneglectedorputaside.

TheworkonthisPackagewillonlybecompleteoncethefullCCCTBisinplace.

There-launchoftheCCCTBprovidestheopportunitytoupdatetheoriginalproposalandalignitwithnewchallengesemergingintheglobaltaxenvironment.

ThemostnotablechangeisthattheCCCTBwillbemandatoryforallfinancialaccountinggroupswithconsolidatedgrouprevenuesofmorethanEUR750million.

Thisshouldhelptomaximiseitspotentialasananti-avoidancetool.

ItalsomeansthatbusinesseswillknowwheretheystandwhenitcomestotheEU'santi-abuserulesandwillnothavetomakeunnecessaryadjustments.

Assuch,itwillhelptocreateamorepredictableenvironmentforbusinessesintheEU.

TheCommissionhasalsointroducedtwonewelementsintotheproposalwhichdirectlysupporttheEU'swidereconomicagenda.

Researchanddevelopmentcostswillbegivenasuper-deduction,toencourageR&Dandinnovation,whicharekeydriversofgrowth.

Moreover,tosupportsmallandinnovativeentrepreneurship,anenhancedsuper-deductionwillbegiventosmallstartingcompanieswithoutassociatedenterprises.

TheCCCTBwillalsoaddressthedistortivepreferentialtreatmentofdebtcomparedtoequity,9ImpactAssessmentonaCommonConsolidatedCorporateTaxBase(CCCTB)[SWD(2016)341]5asacontributiontoastrongCapitalMarketsUnionandgreaterfinancialstabilityintheEU.

4.

MODERN,SIMPLE,CERTAIN:ABETTERANDMOREEFFICIENTTAXENVIRONMENTFORBUSINESSESBusinessesintheSingleMarketneedasimple,stableandlegallycertainenvironmentinwhichtothrive.

Theyshouldencounterminimaltaxobstacleswhenoperatingcross-borderandshouldnotbeburdenedbyunnecessaryadministrativeburdensandcosts.

TheEUneedsacorporatetaxframeworkadaptedtotherealitiesof21stcenturybusiness,whichencouragesenterprise,attractsinvestorsandfacilitatesallcompanies–bigandsmall.

4.

1ASingleCorporateTaxSystemForASingleMarketTheCCCTBwillconsiderablyimprovethefunctioningoftheSingleMarketfromataxperspective.

Cross-bordercompanieswillbenefitfromasinglesetofrulestocalculatetheirtaxableprofitsintheEU,ratherthanamedleyofdifferentnationalsystems.

TheywillbeabletofileasingletaxreturnforalltheirEUactivitiesthrougha"One-Stop-Shop"system,dealingwithjustoneMemberStateratherthanmultipletaxauthorities.

ConsolidationwillalsomeanthatlossesinoneMemberStatecanbeautomaticallysetoffagainstprofitsinanother,therebyallowingcross-bordercompaniestoenjoythesametreatmentaspurelydomesticones.

IntheproposedDirectivetore-launchtheCCCTB,theCommissionhaskeptthesameambitiousapproachtoconsolidationaswasintheoriginalproposal.

However,thetwo-stepapproachwilldelaythisadvantage.

Tocompensate,theCommissionhasproposedthat,untilconsolidationisagreed,companiesshouldhaveaccesstoasimple,robustandtemporarysystemofcross-borderlossoffsetwithinthecommonbase.

TheCCCTBwillbeclear,stableandboundinEUlaw.

ItwillbeunanimouslyagreedbyallMemberStates,guaranteeingastablesystemwhichisnotpronetoregularchanges.

Thiswillprovidebusinesseswithanunprecedentedleveloftaxcertainty.

CompanieswillnolongerhavetoadjusttothedivergenttaxrulesofeachMemberStateastheyexpandcross-border.

TheywillnolongerhavetostruggletounderstandMemberStates'differentapproachestotaxingcertainincome.

Theywillnolongersufferhighadministrativeandlegalcosts,todealwiththecomplexitiesoftransferpricing.

WiththeCCCTB,themaintaxobstaclesforbusinessesintheSingleMarkettodaywillberemoved.

TheCCCTBoffersmajorbenefitstosmallandmediumsizedenterprises(SMEs),aswellaslargecompanies,intheEU.

TheCCCTBwillonlybemandatoryforthelargestcompanies.

HoweverSMEsandstart-upscanoptintothesystemiftheywanttobenefitfromthesimplificationandcost-savingsitoffers.

Currently,SMEsareestimatedtospendaround30%oftaxespaidoncompliancecosts,andevenmoreiftheyexpandcross-border.

TheCCCTBwillcutthesecostssubstantiallyandreducetheexpenseofsettingupasubsidiaryinanotherMemberState.

Thesesavings,togetherwiththestreamlinedrulesandsimplertaxreturnsystem,willmakeitmucheasierforsmallandyoungcompaniestogrowandexpandintheSingleMarket.

64.

2ImprovedToolsToPreventDoubleTaxationCompaniesmustpaytheirfairshareoftaxwheretheymaketheirprofits,buttheyshouldnothavetopaymorethanthis.

OneofthebiggesttaxobstaclestotheSingleMarketisdoubletaxation.

DisagreementsamongstMemberStatesoverwhohastherighttotaxcertainprofitsoftenresultincompaniesbeingtaxedtwiceormoreonthesameincome.

Mostrecentfiguresindicatetherearearound900doubletaxationdisputesongoingintheEU,withEUR10.

5billionatstake.

MostMemberStateshavebilateraltaxtreatieswitheachother,torelievedoubletaxationandthereareprocedurestoresolvedisputes.

However,theseproceduresarelong,costlyanddonotalwaysresultinanagreement.

ThemultilateralArbitrationConvention,whichhasbeenagreedbetweenMemberStates,providessomerelief.

Howeveritsscopeislimitedtotransferpricingdisputesandthereisnorecoursetorepealtheinterpretationoftherules.

ForcompanieswithintheCCCTBsystem,doubletaxationshouldgenerallybecomeathingofthepast.

Asinglesetofrulestocalculatebusinessprofits,combinedwiththenewapportionmentformulathatclearlydistributestaxingrights,willmakeitclearwhatprofitsshouldbetaxedandwhere.

However,casesmaystillarise,forexamplewhentherearetransferpricingarrangementsbetweenagroupentitywithinandoutsidetheEU,andforcompaniesnotwithintheCCCTB.

Forthesecases,amoreefficientsystemofresolvingdoubletaxationdisputesisneeded.

Moreover,untiltheCCCTBisagreed,aneffectivesystemisneededmorewidelytoresolvedoubletaxationdisputes.

TheCommissionhastodayproposedaDirectivetoimproveDoubleTaxationDisputeResolutionMechanismsintheEU,toreinforceafairer,certainandmorestabletaxenvironment.

ThenewruleswillensurethatcasesofdoubletaxationareresolvedmorequicklyandmoredecisivelywhentheyarisebetweenMemberStates.

IfMemberStatescannotagreeonhowtoresolveacase,thetaxpayercanaskitsnationalcourttosetupanArbitrationCommitteetodeliverafinal,bindingdecisiononthecase,withinafixedtimeframe.

Thiswillhelptoavoidincertitudeforthebusinessesinvolved.

Awiderscopeofcaseswillalsobeabletobenefitfromtheresolutionmechanismsundertoday'sproposal.

TheseimprovementstoDisputeResolutionMechanismswillsavebothbusinessesandadministrationsaconsiderableamountoftime,moneyandresourcesandwillreinforcetaxcertaintyforcompaniesintheEU.

5.

TRANSPARENT,EFFECTIVE,COHERENT:FAIRERTAXATIONFORALLFairnesshasbecomeacentralrequirementforcorporatetaxpolicy,inEuropeandinternationally.

CompaniesthatbenefitfromtheSingleMarketmustpaytaxwheretheymaketheirprofitsandallcompaniesshouldbetreatedneutrallyfortaxpurposes.

TheEUneedsacorporatetaxsystemthatensuresrobustdefencesagainstcorporatetaxabuse,alevel-playingfieldforbusinessesandfairburden-sharingforalltax-payers.

5.

1AFairerCorporateTaxSystemTheCCCTBistheembodimentofafaircorporatetaxsystem.

Itwilladdressimportantweaknessesinthecurrenttaxframeworkwhichenableaggressivetaxplanning.

Itwillremovemismatchesandloopholesbetweennationaltaxsystems,whichareexploitedbytaxavoiders,asallMemberStateswillapplythesamerulesfor7calculatingcompanies'taxableprofits.

Transferpricing,whichaccountsforaround70%ofallprofit-shifting,willbeeliminated.

Moreover,tostrengthentheanti-avoidancecapacityoftheCCCTB,itwillbemandatoryforthelargestcompaniesoperatingintheEU.

TheincentiveforMemberStatestoengageinharmfultaxcompetitionwillberemoved.

MemberStateswillnolongerneedtodevotelargeresourcestochasingmobiletaxbases,becausetheCCCTBapportionsprofitstoensurethattaxationbetterreflectswheretherealeconomicactivitytakesplace.

ThiswillallowMemberStatestore-focustheirresourcesongrowth-friendlytaxation,whichincentivisesinvestmentandemploymentandsupportswidersocio-economicneeds.

TheCCCTBwillalsointroducecompletetransparencyoneachMemberState'ssystemandtheireffectivetaxrates.

MemberStateshaveasovereignrighttosettheirowntaxratesandtheCCCTBdoesnotcompromisethisinanyway.

However,itwillensurethatwhenaMemberStatesdecidesonitstaxrate,thisrateistheneffectivelyappliedtoallcompanies.

Hiddenpreferentialregimesandharmfultaxrulingswillnolongerbepossible.

Thisshouldincreasecitizens'confidenceinthewaycompaniesaretaxedandensureamorelevel-playingfieldforallcompaniesintheSingleMarket.

5.

2FurtherAnti-AbuseMeasuresTheCCCTBcontainsanti-abuseprovisionstoprotectMemberStatesagainstbaseerosionandprofitshifting,bothwithintheEUandwithrespecttothirdcountries.

Thiswillreinforceitsimpactasaninstrumenttopreventtaxavoidance.

Theanti-abusemeasureswithintheCCCTBmirrorthoseintheAntiTaxAvoidanceDirective(ATAD),whichwereagreedbyMemberStatesinJuly2016.

Thiswillensurethatallcompaniesaresubjecttothesameanti-abuserules,whethertheyareinsidetheCCCTBsystemornot.

TheCommissionhasalsopresentedanotherproposaltodaytotacklehybridmismatchesinvolvingthirdcountries,tofurtherreinforceEUanti-abuseprovisionsandaddressexternalrisks.

TheAnti-TaxAvoidanceDirective(ATAD)alreadydealswithhybridmismatcheswithintheEU,eliminatingamajorchannelofbaseerosionandprofit-shifting.

However,thesemismatchesarenotlimitedtotheSingleMarketandasolutionisneededtocounter-actexternalrisks.

WhenagreeingontheATAD,MemberStatesaskedtheCommissiontobringforwardanotherproposal,toensurethatthisgapiseffectivelyaddressed.

TheCommissionhasthereforeproposednewmeasurestoaddressabroadrangeofmismatches,includinghybridpermanentestablishmentmismatches,importedmismatches,hybridtransfersanddualresidentmismatches,bothwithintheEUandinrelationtothird-countries.

LikethemeasuresintheATAD,therulesinthisnewproposalareinlinewiththeOECDBEPSapproach.

6.

STABLE,SUPPORTIVE,UNBIASED:AMODERNTAXSYSTEMFORAHEALTHYECONOMYTheEUneedsacorporatetaxsystemshapedtosupportamorecompetitive,innovativeandeconomically-stableEU.

Growthandinvestmentrelyonanenvironmentthatenablesbusiness,encouragesproductivefinancingandrewardsgrowth-friendlyactivitiessuchasresearchandinnovation.

TheCCCTBwillmaketheEUahighlyattractivemarkettoinvestin,byofferingcompaniessolidandpredictablerules,alevel-playingfield,andreducedcostsandadministration.

Inaddition,theCommissionhasreinforcedthe8CCCTBproposalwithnewprovisionsthatspecificallyfocusongrowth-promotingactivities.

6.

1BetterIncentivesforInnovationTheCCCTBwillsupportResearchandDevelopment,whicharekeydriversofgrowthandcompetitiveness.

Currently,theEUisfallingbehindotheradvancedeconomieswhenitcomestoinvestmentinresearchandinnovation.

AlthoughnearlyallMemberStateshavesometaxincentiveforR&D,notalloftheseareeffectiveandsomeareevenexploitedbylargerfirmsfortaxavoidancepurposes.

DivergentnationalincentivesalsocreateacomplextaxenvironmentforcompaniesinvestinginR&D.

TheCCCTBwillofferanEU-widetaxdeductiontocompaniesthatinvestinrealresearchactivities.

Thisdeductionwillbeevenmoregenerousforstart-upcompanies,giventheirimportanceinjobcreation,thepromotionofhealthycompetitionandtheestablishmentofmoreefficientbusinessmodels.

TheR&Dincentivewillgiveaboosttocompanieswithsmallerbudgets,toallowthemtogrow,andwillencouragethecreationandexpansionofyoung,innovativeenterprises.

Itisalsodesignedonthebasisofabestpracticemodel,sothatitcan'tbeusedforavoidancepurposes.

6.

2AnInvestment-FriendlyTaxEnvironmentTheCCCTBwillalsoaddressdistortionsincurrenttaxsystemsthatcandestabilisetheeconomy.

MostMemberStates'corporatetaxsystemsfavourdebtbyallowinginterestpaymentstobededucted,withoutgrantingsimilartreatmenttoequity.

Thispreferentialtreatmentencouragescompaniestotakeonmoredebt,makingthemmorefragileandmakingeconomiesmorepronetocrises.

ThispresentsanobstacletothecreationofastrongerequitybaseinEuropeancompanies.

Ittiltsthestructureofthefinancialmarkettowardsdebtinstrumentsandmayimpedeefficientcapitalmarketfinancing.

ThisgoesagainstthefundamentalgoalsoftheCapitalMarketsUnionandthecapitalbaserequirementsfortheBankingUnion.

TheCCCTBwillremovethedebtbiasdistortion,byofferinganAllowanceforGrowthandInvestment(AGI).

Thisallowancewillensurethatequityreceivesasimilarleveloftaxbenefitsasdebtdoes,creatingamoreneutralandinvestment-friendlytaxenvironment.

TheAGIwillrewardcompaniesthatstrengthentheirfinancingstructuresandtapintocapitalmarkets10.

SMEs,thatoftenstruggletosecureloans,willparticularlybenefitfromthisnewprovision.

GiventhepositiveimpactthattheAGIwillhaveonbothbusinessesandthewidereconomy,theCommissionalsoinvitesMemberStatetoconsiderusingitforcompaniesoutsidetheCCCTBsystemtoo.

7.

CONCLUSIONTheCommissionisproposingacomprehensiveresponsetocurrentandemergingchallengesincorporatetaxationandapositivenewapproachtotaxingcompaniesinthefuture.

TheCCCTBwilldelivernotableimprovementstotheEU'scorporatetaxframework,intermsofsimplicity,taxcertaintyandfairness.

Itwillensurethatcorporate10Giventhehigherriskslinkedtoequityfinancingcomparedtodebtfinancing,ariskpremiumwillbeaddedtotheyieldfordeterminingtheamountfordeduction.

Giventhatincreasesintheequitybasemaygoback10years,thereferenceyieldfordeductionwillbethe10-yeargovernmentbenchmarkbondintheeuroarea.

9taxationisalignedtothemoderneconomyandthatitsupportsthegoalofastrongerandmorecompetitiveSingleMarket.

TheproposalonDoubleTaxationDisputeResolutionandtheproposaltotacklehybridmismatcheswiththirdcountries,whichtheCommissionhasalsopresentedtoday,willfurthercontributetofairerandmoreefficientcorporatetaxationintheEU.

TheCommissionthereforecallsonMemberStatestoswiftlyagreeonalloftheproposalspresentedtoday,sothatbusinesses,administrations,citizensandtheEuropeaneconomycanstarttoenjoythefulladvantagesofthisfair,competitiveandstablecorporatetaxenvironment.

INTRODUCTIONTaxationiscentraltotheEU'sworktobuildastronger,morecompetitiveandfairereconomy,withaclearsocialdimension.

Europeneedsataxsystemthatfitsitsinternalmarketandthatsupportseconomicgrowthandcompetitiveness,attractsinvestment,helpstocreatejobs,fostersinnovationandupholdstheEuropeansocialmodel.

Taxationshouldprovidestablerevenuesforpublicinvestmentandgrowth-friendlypolicies.

Itshouldensurethatallbusinessesenjoyalevel-playingfield,legalcertaintyandminimalobstacleswhenoperatingcross-border.

Itshouldbepartofawidertaxsysteminwhichcitizenshaveconfidence,becauseitisfairandmeetssociety'ssocio-economicneeds.

TheEU'sprioritiesintaxationarethereforefocussedonthesegoals.

2.

IMMEDIATEACTIONTOMEETIMMEDIATENEEDS:REFORMINGCORPORATETAXATIONTheCommissionhassetanambitiousagendatomakecorporatetaxationfairerandmoreeffective;betteradaptedtothemoderneconomyandmoreresponsivetoemergingchallengesinthisfield.

Thisagendaisadvancingrapidlyandmanyimportantmilestoneshavealreadybeenmet.

AlloftheinitiativesannouncedintheCommission'sActionPlanforFairandEffectiveTaxation1havenowbeenlaunched,andmanynewproposalshavealreadybeenadoptedbyMemberStates.

TheCommissionisalsopushingthescopeofitsworkbeyondtheActionPlan.

AsshownintheCommunicationonfurthermeasurestoenhancetransparencyandthefightagainsttaxevasionandavoidance,whichfollowedthePanamaPapersrevelations,itisreadytodevelopswiftandeffectiveresponsestoissuesastheyarise2.

Inaddition,theCommissionhascarriedoutstateaidinvestigationsintowhethercertainMemberStatesgrantedtaxadvantagestoselectedmultinationalcompanies3,tosafeguardafairandcompetitiveenvironmentforallbusinessesintheEU.

TheCommission'sfirstlineofactionwastoincreasetaxtransparency,asanessentialfoundationforanyfurtherreforms.

Withinaperiodof12months,MemberStatesagreedonproposalsfortheautomaticexchangeofinformationontaxrulings4andcountry-by-countryreportsoftax-relatedinformationconcerningmultinationals5.

Thiswillbringanewandunprecedentedleveloftransparencyandcooperationbetweentaxauthoritiesintheareaofcorporatetaxation.

TheCommissionalsoproposedpubliccountry-by-countryreportingformultinationals,toprovidecitizenswithgreateroversightofcompanies'taxpractices.

Thisproposal,whichiscurrentlybeingnegotiatedbytheCouncilandtheEuropeanParliament,shouldhelprestorepublicconfidenceincorporatetaxationandensurethatbusinessesarenotfacedwithapatchworkofnationalpublicdisclosurerules.

Aproposaltoallowtaxauthoritiesaccesstonationalanti-money1COM(2015)302final2COM(2016)451final3SeenoticeontheNotionofaid§169to174:http://ec.

europa.

eu/competition/state_aid/modernisation/notice_of_aid_en.

pdf4CouncilDirective(EU)2015/23765CouncilDirective(EU)2016/8813launderinginformation6isexpectedtobeagreedbeforetheendoftheyear.

TheEuropeanParliamentandCouncilhavealsostartedtoworkontheirpositionsonproposedamendmentstotheFourthAnti-MoneyLaunderingDirective,andshouldadvanceswiftlyfortriloguestobeginbyearly2017.

Inaddition,theCommissionhasstartedtoexaminethemostappropriateframeworktoimplementtheautomaticexchangeofinformationonbeneficialownership,atEuropeanlevel,andisexploringthebestwaytoincreaseoversightofenablersandpromotersofaggressivetaxplanningschemes.

ThisincreasedtaxtransparencyacrossEuropewillhelptoexposeaggressivetaxplanners,uncoverharmfultaxpracticesandstabiliseacorporatetaxenvironmentbuiltonopennessandtrust.

Inparallel,theCommissionisalsoworkingtoensurethatallcompaniesoperatingintheEUpaytheirtaxeswhereprofitsandvaluearegenerated.

Thisprincipleisessentialforfairandeffectivetaxation,butcanonlybeeffectivelyachievedinaSingleMarketthroughcommonandcoordinatedmeasures.

Therefore,theCommissionproposedanewAnti-TaxAvoidanceDirective7,settingoutlegally-bindinganti-abusemeasuresfortheentireEU,toblocksomeofthemostprevalentformsofbaseerosionandprofitshifting.

Thislegislation,whichMemberStatesadoptedinJuly2016,allowedMemberStatestoimplementinaswift,coordinatedandcoherentway,thecommitmentstheymadeundertheOECD/G20BaseErosionandProfitShifting(BEPS)project.

MemberStates'preferentialregimesandtransferpricingrulesarealsobeingreviewed,toensureacommonEUapproachtonewinternationalstandards.

ThisiscriticaltoprovidecertaintyforbusinessesasreformsareimplementedandtopreventnewloopholesemergingintheSingleMarket.

Finally,theCommissionhaspresentedmeasurestopromotetaxgoodgovernanceglobally,toensureafairandlevel-playingfieldbetweentheEUanditsinternationalpartners.

MemberStateshaveendorsedthenewExternalStrategyforEffectiveTaxation8,presentedbytheCommissioninJanuary2016,toprotecttheirtaxbasesagainstbaseerosionrisksfromabroad.

AkeycomponentofthisStrategyisanewEUlistingprocess,todealwithnon-cooperativetaxjurisdictionsandencourageallthirdcountryjurisdictionstomeetinternationaltaxgoodgovernancestandards.

ThefirststepsinthislistingprocesshavealreadybeentakenandthecommonEUlistshouldbefinalisedin2017.

ThiswillprovideMemberStateswithapowerfultooltodealwithcountriesthatrefusetoplayfairintaxmatters.

TheEU'sFinancialRegulationhasalsobeenrevisedtopreventEUfundsfrombeingroutedthroughtaxhavens,andworkisunderwaytostrengthenthetaxgoodgovernanceclausesinEUagreementswiththirdcountries.

3.

APOSITIVE,FORWARD-LOOKINGAGENDATheinitiativessetoutabovearevitaltoprotectMemberStates'taxbases,providealevel-playingfieldforbusinessesandensurefairandeffectivetaxationforalltaxpayers.

Theyaddressthemostpressingproblemsincorporatetaxationtoday.

However,forthelongerterm,thereisaneedtogofurther.

Shorttermfixescansoonbecomeoutdated,asbusinessmodelsandtaxplanningtechniquesevolvefasterthannewresponsescanbe6COM(2016)452final7CouncilDirective(EU)2016/11648COM(2016)24final4devised.

Inaddition,piecemealupdatestointernational,EUornationaltaxrulescreateturbulenceforboththetaxadministrationsandthebusinessesthatneedtoadapttothem.

Toboostjobs,growthandinvestment,itisnecessarytocreateafavourabletaxenvironmentforbusiness,byreducingcompliancecostsandadministrativeburdens,andbyensuringtaxcertainty.

TheimportanceoftaxcertaintyinpromotinginvestmentandgrowthhasrecentlybeenrecognisedbytheG20leaders,andhasbecomethenewglobalfocus.

MemberStatesneedtofindabalancebetweenimplementingnecessaryreformsandprovidingasteady,clearandpredictabletaxenvironmentforbusinesses.

TheEUneedsapositive,forward-lookingframeworkforcorporatetaxation.

Itmustbegrowth-friendly,efficientandfair,andfullysupporttheEU'swiderpolicypriorities,nowandinthefuture.

ThisistherationalebehindtheCommission'sproposaltore-launchtheCommonConsolidatedCorporateTaxBase(CCCTB).

TheCCCTBcanmeetthetwoprimarydemandsofbusinessesandcitizensinEuropetoday–sustainablegrowthandsocialjustice–andreinforcetheEU'soveralleconomicandsocialagenda.

Indeed,analysisshowsthattheCCCTBcanliftinvestmentintheEUbyupto3.

4%andgrowthby1.

2%9.

TheCommissionfirstproposedtheCCCTBin2011,withaviewtoenhancingtheSingleMarketforbusinesses.

Theproposalwasambitiousandrobust,butitsmagnitudelednegotiationsintheCounciltostall.

However,theEuropeanParliament,businesses,stakeholdersandmanyMemberStatesretainedstrongsupportfortheideaoftheCCCTB,giventhemanybenefitsithadtooffer.

Moreover,inthepastfewyears,ithasbecomeclearthattheCCCTBoffersmorethanjustabusiness-friendlytaxsystemforastrongerSingleMarket.

Therefore,intheJune2015ActionPlan,theCommissionannouncedthatitwouldre-launchthisimportantprojectthroughamoremanageabletwo-stepprocess.

Thefirststepfocussesonsecuringthecommonbase.

Oncethisisimplemented,themorecomplexaspectofconsolidationwillbeintroduced.

ManyofthemostimportantbenefitsoftheCCCTBliewiththeconsolidationaspect.

Therefore,thissecondstepinthere-launchedCCCTBcannotbeneglectedorputaside.

TheworkonthisPackagewillonlybecompleteoncethefullCCCTBisinplace.

There-launchoftheCCCTBprovidestheopportunitytoupdatetheoriginalproposalandalignitwithnewchallengesemergingintheglobaltaxenvironment.

ThemostnotablechangeisthattheCCCTBwillbemandatoryforallfinancialaccountinggroupswithconsolidatedgrouprevenuesofmorethanEUR750million.

Thisshouldhelptomaximiseitspotentialasananti-avoidancetool.

ItalsomeansthatbusinesseswillknowwheretheystandwhenitcomestotheEU'santi-abuserulesandwillnothavetomakeunnecessaryadjustments.

Assuch,itwillhelptocreateamorepredictableenvironmentforbusinessesintheEU.

TheCommissionhasalsointroducedtwonewelementsintotheproposalwhichdirectlysupporttheEU'swidereconomicagenda.

Researchanddevelopmentcostswillbegivenasuper-deduction,toencourageR&Dandinnovation,whicharekeydriversofgrowth.

Moreover,tosupportsmallandinnovativeentrepreneurship,anenhancedsuper-deductionwillbegiventosmallstartingcompanieswithoutassociatedenterprises.

TheCCCTBwillalsoaddressthedistortivepreferentialtreatmentofdebtcomparedtoequity,9ImpactAssessmentonaCommonConsolidatedCorporateTaxBase(CCCTB)[SWD(2016)341]5asacontributiontoastrongCapitalMarketsUnionandgreaterfinancialstabilityintheEU.

4.

MODERN,SIMPLE,CERTAIN:ABETTERANDMOREEFFICIENTTAXENVIRONMENTFORBUSINESSESBusinessesintheSingleMarketneedasimple,stableandlegallycertainenvironmentinwhichtothrive.

Theyshouldencounterminimaltaxobstacleswhenoperatingcross-borderandshouldnotbeburdenedbyunnecessaryadministrativeburdensandcosts.

TheEUneedsacorporatetaxframeworkadaptedtotherealitiesof21stcenturybusiness,whichencouragesenterprise,attractsinvestorsandfacilitatesallcompanies–bigandsmall.

4.

1ASingleCorporateTaxSystemForASingleMarketTheCCCTBwillconsiderablyimprovethefunctioningoftheSingleMarketfromataxperspective.

Cross-bordercompanieswillbenefitfromasinglesetofrulestocalculatetheirtaxableprofitsintheEU,ratherthanamedleyofdifferentnationalsystems.

TheywillbeabletofileasingletaxreturnforalltheirEUactivitiesthrougha"One-Stop-Shop"system,dealingwithjustoneMemberStateratherthanmultipletaxauthorities.

ConsolidationwillalsomeanthatlossesinoneMemberStatecanbeautomaticallysetoffagainstprofitsinanother,therebyallowingcross-bordercompaniestoenjoythesametreatmentaspurelydomesticones.

IntheproposedDirectivetore-launchtheCCCTB,theCommissionhaskeptthesameambitiousapproachtoconsolidationaswasintheoriginalproposal.

However,thetwo-stepapproachwilldelaythisadvantage.

Tocompensate,theCommissionhasproposedthat,untilconsolidationisagreed,companiesshouldhaveaccesstoasimple,robustandtemporarysystemofcross-borderlossoffsetwithinthecommonbase.

TheCCCTBwillbeclear,stableandboundinEUlaw.

ItwillbeunanimouslyagreedbyallMemberStates,guaranteeingastablesystemwhichisnotpronetoregularchanges.

Thiswillprovidebusinesseswithanunprecedentedleveloftaxcertainty.

CompanieswillnolongerhavetoadjusttothedivergenttaxrulesofeachMemberStateastheyexpandcross-border.

TheywillnolongerhavetostruggletounderstandMemberStates'differentapproachestotaxingcertainincome.

Theywillnolongersufferhighadministrativeandlegalcosts,todealwiththecomplexitiesoftransferpricing.

WiththeCCCTB,themaintaxobstaclesforbusinessesintheSingleMarkettodaywillberemoved.

TheCCCTBoffersmajorbenefitstosmallandmediumsizedenterprises(SMEs),aswellaslargecompanies,intheEU.

TheCCCTBwillonlybemandatoryforthelargestcompanies.

HoweverSMEsandstart-upscanoptintothesystemiftheywanttobenefitfromthesimplificationandcost-savingsitoffers.

Currently,SMEsareestimatedtospendaround30%oftaxespaidoncompliancecosts,andevenmoreiftheyexpandcross-border.

TheCCCTBwillcutthesecostssubstantiallyandreducetheexpenseofsettingupasubsidiaryinanotherMemberState.

Thesesavings,togetherwiththestreamlinedrulesandsimplertaxreturnsystem,willmakeitmucheasierforsmallandyoungcompaniestogrowandexpandintheSingleMarket.

64.

2ImprovedToolsToPreventDoubleTaxationCompaniesmustpaytheirfairshareoftaxwheretheymaketheirprofits,buttheyshouldnothavetopaymorethanthis.

OneofthebiggesttaxobstaclestotheSingleMarketisdoubletaxation.

DisagreementsamongstMemberStatesoverwhohastherighttotaxcertainprofitsoftenresultincompaniesbeingtaxedtwiceormoreonthesameincome.

Mostrecentfiguresindicatetherearearound900doubletaxationdisputesongoingintheEU,withEUR10.

5billionatstake.

MostMemberStateshavebilateraltaxtreatieswitheachother,torelievedoubletaxationandthereareprocedurestoresolvedisputes.

However,theseproceduresarelong,costlyanddonotalwaysresultinanagreement.

ThemultilateralArbitrationConvention,whichhasbeenagreedbetweenMemberStates,providessomerelief.

Howeveritsscopeislimitedtotransferpricingdisputesandthereisnorecoursetorepealtheinterpretationoftherules.

ForcompanieswithintheCCCTBsystem,doubletaxationshouldgenerallybecomeathingofthepast.

Asinglesetofrulestocalculatebusinessprofits,combinedwiththenewapportionmentformulathatclearlydistributestaxingrights,willmakeitclearwhatprofitsshouldbetaxedandwhere.

However,casesmaystillarise,forexamplewhentherearetransferpricingarrangementsbetweenagroupentitywithinandoutsidetheEU,andforcompaniesnotwithintheCCCTB.

Forthesecases,amoreefficientsystemofresolvingdoubletaxationdisputesisneeded.

Moreover,untiltheCCCTBisagreed,aneffectivesystemisneededmorewidelytoresolvedoubletaxationdisputes.

TheCommissionhastodayproposedaDirectivetoimproveDoubleTaxationDisputeResolutionMechanismsintheEU,toreinforceafairer,certainandmorestabletaxenvironment.

ThenewruleswillensurethatcasesofdoubletaxationareresolvedmorequicklyandmoredecisivelywhentheyarisebetweenMemberStates.

IfMemberStatescannotagreeonhowtoresolveacase,thetaxpayercanaskitsnationalcourttosetupanArbitrationCommitteetodeliverafinal,bindingdecisiononthecase,withinafixedtimeframe.

Thiswillhelptoavoidincertitudeforthebusinessesinvolved.

Awiderscopeofcaseswillalsobeabletobenefitfromtheresolutionmechanismsundertoday'sproposal.

TheseimprovementstoDisputeResolutionMechanismswillsavebothbusinessesandadministrationsaconsiderableamountoftime,moneyandresourcesandwillreinforcetaxcertaintyforcompaniesintheEU.

5.

TRANSPARENT,EFFECTIVE,COHERENT:FAIRERTAXATIONFORALLFairnesshasbecomeacentralrequirementforcorporatetaxpolicy,inEuropeandinternationally.

CompaniesthatbenefitfromtheSingleMarketmustpaytaxwheretheymaketheirprofitsandallcompaniesshouldbetreatedneutrallyfortaxpurposes.

TheEUneedsacorporatetaxsystemthatensuresrobustdefencesagainstcorporatetaxabuse,alevel-playingfieldforbusinessesandfairburden-sharingforalltax-payers.

5.

1AFairerCorporateTaxSystemTheCCCTBistheembodimentofafaircorporatetaxsystem.

Itwilladdressimportantweaknessesinthecurrenttaxframeworkwhichenableaggressivetaxplanning.

Itwillremovemismatchesandloopholesbetweennationaltaxsystems,whichareexploitedbytaxavoiders,asallMemberStateswillapplythesamerulesfor7calculatingcompanies'taxableprofits.

Transferpricing,whichaccountsforaround70%ofallprofit-shifting,willbeeliminated.

Moreover,tostrengthentheanti-avoidancecapacityoftheCCCTB,itwillbemandatoryforthelargestcompaniesoperatingintheEU.

TheincentiveforMemberStatestoengageinharmfultaxcompetitionwillberemoved.

MemberStateswillnolongerneedtodevotelargeresourcestochasingmobiletaxbases,becausetheCCCTBapportionsprofitstoensurethattaxationbetterreflectswheretherealeconomicactivitytakesplace.

ThiswillallowMemberStatestore-focustheirresourcesongrowth-friendlytaxation,whichincentivisesinvestmentandemploymentandsupportswidersocio-economicneeds.

TheCCCTBwillalsointroducecompletetransparencyoneachMemberState'ssystemandtheireffectivetaxrates.

MemberStateshaveasovereignrighttosettheirowntaxratesandtheCCCTBdoesnotcompromisethisinanyway.

However,itwillensurethatwhenaMemberStatesdecidesonitstaxrate,thisrateistheneffectivelyappliedtoallcompanies.

Hiddenpreferentialregimesandharmfultaxrulingswillnolongerbepossible.

Thisshouldincreasecitizens'confidenceinthewaycompaniesaretaxedandensureamorelevel-playingfieldforallcompaniesintheSingleMarket.

5.

2FurtherAnti-AbuseMeasuresTheCCCTBcontainsanti-abuseprovisionstoprotectMemberStatesagainstbaseerosionandprofitshifting,bothwithintheEUandwithrespecttothirdcountries.

Thiswillreinforceitsimpactasaninstrumenttopreventtaxavoidance.

Theanti-abusemeasureswithintheCCCTBmirrorthoseintheAntiTaxAvoidanceDirective(ATAD),whichwereagreedbyMemberStatesinJuly2016.

Thiswillensurethatallcompaniesaresubjecttothesameanti-abuserules,whethertheyareinsidetheCCCTBsystemornot.

TheCommissionhasalsopresentedanotherproposaltodaytotacklehybridmismatchesinvolvingthirdcountries,tofurtherreinforceEUanti-abuseprovisionsandaddressexternalrisks.

TheAnti-TaxAvoidanceDirective(ATAD)alreadydealswithhybridmismatcheswithintheEU,eliminatingamajorchannelofbaseerosionandprofit-shifting.

However,thesemismatchesarenotlimitedtotheSingleMarketandasolutionisneededtocounter-actexternalrisks.

WhenagreeingontheATAD,MemberStatesaskedtheCommissiontobringforwardanotherproposal,toensurethatthisgapiseffectivelyaddressed.

TheCommissionhasthereforeproposednewmeasurestoaddressabroadrangeofmismatches,includinghybridpermanentestablishmentmismatches,importedmismatches,hybridtransfersanddualresidentmismatches,bothwithintheEUandinrelationtothird-countries.

LikethemeasuresintheATAD,therulesinthisnewproposalareinlinewiththeOECDBEPSapproach.

6.

STABLE,SUPPORTIVE,UNBIASED:AMODERNTAXSYSTEMFORAHEALTHYECONOMYTheEUneedsacorporatetaxsystemshapedtosupportamorecompetitive,innovativeandeconomically-stableEU.

Growthandinvestmentrelyonanenvironmentthatenablesbusiness,encouragesproductivefinancingandrewardsgrowth-friendlyactivitiessuchasresearchandinnovation.

TheCCCTBwillmaketheEUahighlyattractivemarkettoinvestin,byofferingcompaniessolidandpredictablerules,alevel-playingfield,andreducedcostsandadministration.

Inaddition,theCommissionhasreinforcedthe8CCCTBproposalwithnewprovisionsthatspecificallyfocusongrowth-promotingactivities.

6.

1BetterIncentivesforInnovationTheCCCTBwillsupportResearchandDevelopment,whicharekeydriversofgrowthandcompetitiveness.

Currently,theEUisfallingbehindotheradvancedeconomieswhenitcomestoinvestmentinresearchandinnovation.

AlthoughnearlyallMemberStateshavesometaxincentiveforR&D,notalloftheseareeffectiveandsomeareevenexploitedbylargerfirmsfortaxavoidancepurposes.

DivergentnationalincentivesalsocreateacomplextaxenvironmentforcompaniesinvestinginR&D.

TheCCCTBwillofferanEU-widetaxdeductiontocompaniesthatinvestinrealresearchactivities.

Thisdeductionwillbeevenmoregenerousforstart-upcompanies,giventheirimportanceinjobcreation,thepromotionofhealthycompetitionandtheestablishmentofmoreefficientbusinessmodels.

TheR&Dincentivewillgiveaboosttocompanieswithsmallerbudgets,toallowthemtogrow,andwillencouragethecreationandexpansionofyoung,innovativeenterprises.

Itisalsodesignedonthebasisofabestpracticemodel,sothatitcan'tbeusedforavoidancepurposes.

6.

2AnInvestment-FriendlyTaxEnvironmentTheCCCTBwillalsoaddressdistortionsincurrenttaxsystemsthatcandestabilisetheeconomy.

MostMemberStates'corporatetaxsystemsfavourdebtbyallowinginterestpaymentstobededucted,withoutgrantingsimilartreatmenttoequity.

Thispreferentialtreatmentencouragescompaniestotakeonmoredebt,makingthemmorefragileandmakingeconomiesmorepronetocrises.

ThispresentsanobstacletothecreationofastrongerequitybaseinEuropeancompanies.

Ittiltsthestructureofthefinancialmarkettowardsdebtinstrumentsandmayimpedeefficientcapitalmarketfinancing.

ThisgoesagainstthefundamentalgoalsoftheCapitalMarketsUnionandthecapitalbaserequirementsfortheBankingUnion.

TheCCCTBwillremovethedebtbiasdistortion,byofferinganAllowanceforGrowthandInvestment(AGI).

Thisallowancewillensurethatequityreceivesasimilarleveloftaxbenefitsasdebtdoes,creatingamoreneutralandinvestment-friendlytaxenvironment.

TheAGIwillrewardcompaniesthatstrengthentheirfinancingstructuresandtapintocapitalmarkets10.

SMEs,thatoftenstruggletosecureloans,willparticularlybenefitfromthisnewprovision.

GiventhepositiveimpactthattheAGIwillhaveonbothbusinessesandthewidereconomy,theCommissionalsoinvitesMemberStatetoconsiderusingitforcompaniesoutsidetheCCCTBsystemtoo.

7.

CONCLUSIONTheCommissionisproposingacomprehensiveresponsetocurrentandemergingchallengesincorporatetaxationandapositivenewapproachtotaxingcompaniesinthefuture.

TheCCCTBwilldelivernotableimprovementstotheEU'scorporatetaxframework,intermsofsimplicity,taxcertaintyandfairness.

Itwillensurethatcorporate10Giventhehigherriskslinkedtoequityfinancingcomparedtodebtfinancing,ariskpremiumwillbeaddedtotheyieldfordeterminingtheamountfordeduction.

Giventhatincreasesintheequitybasemaygoback10years,thereferenceyieldfordeductionwillbethe10-yeargovernmentbenchmarkbondintheeuroarea.

9taxationisalignedtothemoderneconomyandthatitsupportsthegoalofastrongerandmorecompetitiveSingleMarket.

TheproposalonDoubleTaxationDisputeResolutionandtheproposaltotacklehybridmismatcheswiththirdcountries,whichtheCommissionhasalsopresentedtoday,willfurthercontributetofairerandmoreefficientcorporatetaxationintheEU.

TheCommissionthereforecallsonMemberStatestoswiftlyagreeonalloftheproposalspresentedtoday,sothatbusinesses,administrations,citizensandtheEuropeaneconomycanstarttoenjoythefulladvantagesofthisfair,competitiveandstablecorporatetaxenvironment.

- promotefilemarkets.com相关文档

- Imagefilemarkets.com

- grantedfilemarkets.com

- householdsfilemarkets.com

- indexesfilemarkets.com

- tierfilemarkets.com

- Sourcefilemarkets.com

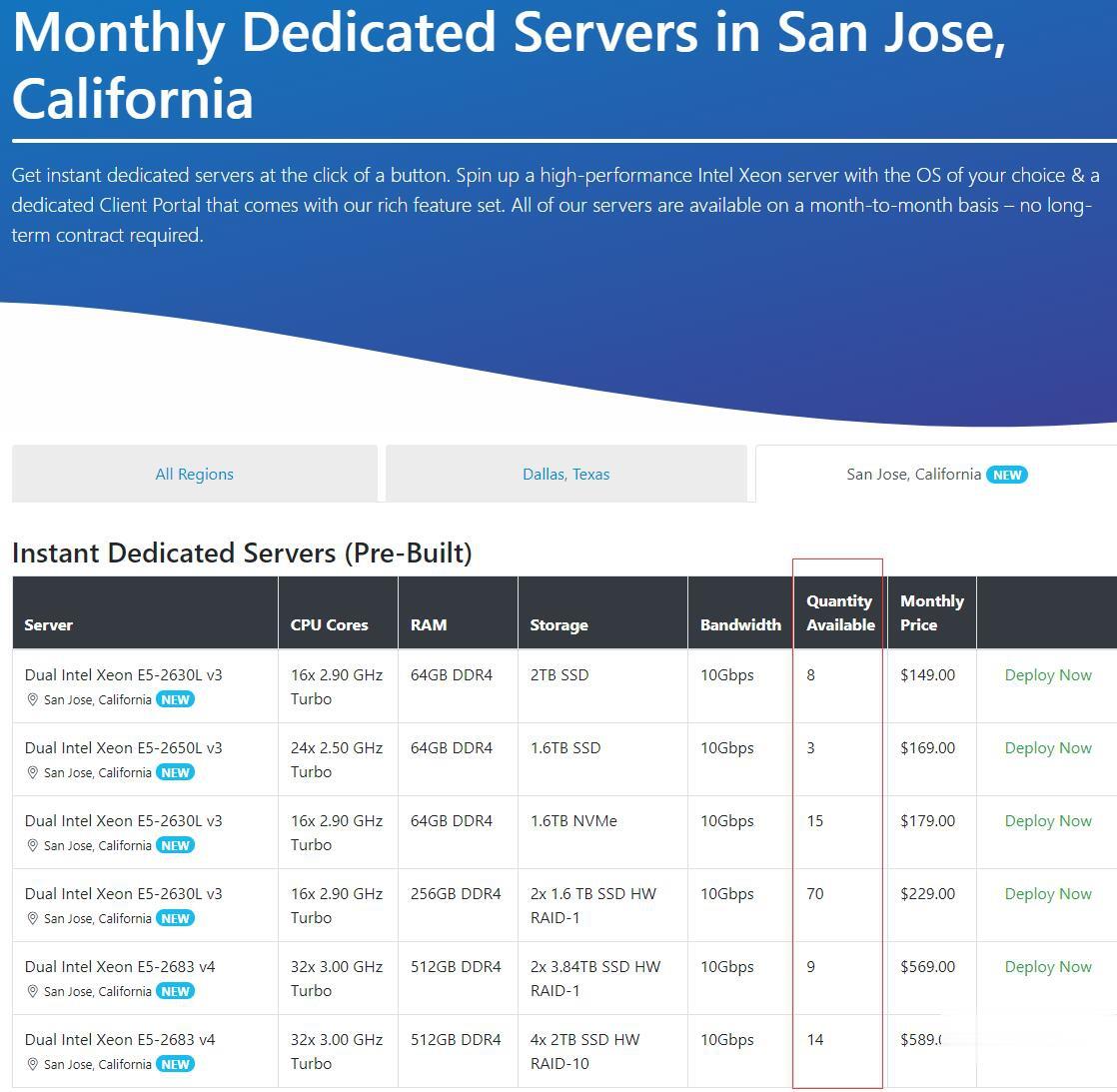

Spinservers:美国圣何塞机房少量补货/双E5/64GB DDR4/2TB SSD/10Gbps端口月流量10TB/$111/月

Chia矿机,Spinservers怎么样?Spinservers好不好,Spinservers大硬盘服务器。Spinservers刚刚在美国圣何塞机房补货120台独立服务器,CPU都是双E5系列,64-512GB DDR4内存,超大SSD或NVMe存储,数量有限,机器都是预部署好的,下单即可上架,无需人工干预,有需要的朋友抓紧下单哦。Spinservers是Majestic Hosting So...

青果云(590元/年),美国vps洛杉矶CN2 GIA主机测评 1核1G 10M

青果网络QG.NET定位为高效多云管理服务商,已拥有工信部颁发的全网云计算/CDN/IDC/ISP/IP-VPN等多项资质,是CNNIC/APNIC联盟的成员之一,2019年荣获国家高薪技术企业、福建省省级高新技术企业双项荣誉。那么青果网络作为国内主流的IDC厂商之一,那么其旗下美国洛杉矶CN2 GIA线路云服务器到底怎么样?官方网站:https://www.qg.net/CPU内存系统盘流量宽带...

华纳云,3折低至优惠云服务器,独立服务器/高防御服务器低至6折,免备案香港云服务器CN2 GIA三网直连线路月付18元起,10Mbps带宽不限流量

近日华纳云发布了最新的618返场优惠活动,主要针对旗下的免备案香港云服务器、香港独立服务器、香港高防御服务器等产品,月付6折优惠起,高防御服务器可提供20G DDOS防御,采用E5处理器V4CPU性能,10Mbps独享CN2 GIA高速优质带宽,有需要免备案香港服务器、香港云服务器、香港独立服务器、香港高防御服务器、香港物理服务器的朋友可以尝试一下。华纳云好不好?华纳云怎么样?华纳云服务器怎么样?...

filemarkets.com为你推荐

-

易烊千玺弟弟创魔方世界纪录王俊凯.易烊千玺编舞吉尼斯记录刘祚天你们知道21世纪的DJ分为几种类型吗?(答对者重赏)22zizi.com河南福利彩票22选52010175开奖结果原代码什么叫源代码,源代码有什么作用porndao单词prondao的汉语是什么16668.com香港最快开奖现场直播今晚开dadi.tvapple TV 功能介绍45gtv.comLETSCOM是什么牌子?朴容熙这个网诺红人叫什么1377.com真实.女友下载地址谁有