中国mmbb.com

mmbb.com 时间:2021-03-21 阅读:()

GTJAResearch国泰君安研究Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage1of8CompanyReport:Sinopec(00386HK)GraceLiu刘谷+8675523976698+85225097516公司报告:中国石化(00386HK)liugu@gtjas.

com19December2011ToBenefitfromIndustryReforms,Upgradeto'Buy'将受益于行业改革,上调评级至"买入"Rating:BuyUpgraded评级:买入(上调)6-18mTP目标价:HK$9.

30Revisedfrom原目标价:HK$9.

10Shareprice股价:HK$8.

000z4Q11refiningmarginsdonotimprovebecauseBrentcrudeoilpricesmaintainathighlevels.

Petrochemicalmarginsdecreaseqoqandresourcestaxincreases.

Therefore,4Q11resultsareestimatedtocomeunderpressure.

Although1-3Q11resultswerebetterthanexpected,weincreaseourFY11earningsforecastsbyonly1.

4%.

zTherefiningsegmentisexpectednottohavelargelossesagainin2012becauseindustryoperatingenvironmentwillimprovein2012,withmildinflation,flatcrudeoilpricesandtheexpectationoffurthergasolineanddieselpricingreform.

Domesticnaturalgaspricesarealsolikelytorisein2012againstthelowinflationbackdrop.

zThefurtherimplementationofresourcestaxreformnationwidewillfurtherdecreaseFY12earningsby6.

27%.

In2012,althoughresourcestaxwillincreaseandpetrochemicalmarginsareexpectedtodecreaseinthechemicalsegment,therewillnotbelargelossesintherefiningsegment.

WereviseupourFY12-13EPSforecastsby8.

96%and9.

77%respectively.

Inaddition,expectedindustrypolicychanges,includingdomesticgasolineanddieselandnaturalgaspricingreform,andspecialoillevythresholdincrease,areallpositivetotheCompany'searnings.

zDilutioneffectofallconvertiblebondsisabout8.

76%.

However,netgearingratiosareestimatedtodecreaseevenwithaboutyearly8%CAPEXincreaseinFY12-13.

ThehealthyoperatingcashflowalsoisexpectedtolayfoundationfortheCompanytoacquireupstreamassetsortodevelopindifferentbusinessareas.

Theparentcompany'supstreamassetsincreasedcontinuously,whichcreatedgoodconditionsforassetsinjection.

IncreasesinequityinterestsinChinaGas(00384)aretooptimizenaturalgasintegratedbusinesschainbuthaveslightearningsimpacts.

zReviseupwardsthetargetpricefromHK$9.

10toHK$9.

30basedonhigherearningsbutlargerdilutioneffects.

Upgradetheinvestmentratingfrom'Accumulate'to'Buy'becauseofexpectationsofmorefavourableindustrypolicychanges.

z由于今年第4季度布伦特原油维持在高位,炼差应无改善.

石化毛利环比下降,资源税增加.

因此,第4季度业绩有压力.

虽然1-3季度业绩好于预期,我们只上调2011年盈利预测1.

4%.

z2012年预期通胀温和、原油价格持平、以及汽柴油定价将改革,行业经营环境比2011年好,炼油分部将不再有大额亏损.

在低通胀背景下,国内天然气价格也可能上调.

z资源税改革推广至全国令2012年盈利将再下降6.

15%.

2012年虽然资源税上升、化工板块石化毛利预期下降,但炼油板块不再有大额亏损.

我们分别上调12-13年每股盈利预测8.

96%和9.

77%.

另外,预期的行业政策改变,包括汽柴油和天然气价格改革、特别收益金起征点上升,均对公司业绩有正面影响.

z现全部可转债的摊薄效应约为8.

76%.

然而,即使资本开支每年增长8%,净资本负债率仍将于12-13年下降.

健康的经营现金流为公司收购上游资产和扩展其他业务打下基础.

母公司上游资产不断增加,为资产注入创造良好条件.

增加中国燃气(003854)权益可增强天然气一体化,但对盈利影响轻微.

z基于调高的盈利预测但增大的摊薄效应,目标价由9.

10港元略上调为9.

30港元.

由于未来行业政策变动有利的预期,上调投资评级为"买入".

Stockperformance股价表现(35.

0)(25.

0)(15.

0)(5.

0)5.

015.

025.

0Nov-10Jan-11Apr-11Jul-11Oct-11%ofreturnHSISinopecChangeinSharePrice股价变动1M1个月3M3个月1Y1年Abs.

%绝对变动%(0.

50)5.

9612.

99Rel.

%toHSindex相对恒指变动%0.

629.

3032.

49Avg.

shareprice(HK$)平均股价(港元)8.

067.

737.

53Source:Bloomberg,GuotaiJunanInternationalYearEnd年结Turnover收入NetProfit股东净利EPS每股净利EPS每股净利变动PER市盈率BPS每股净资产PBR市净率DPS每股股息Yield股息率ROE净资产收益率12/31(RMBm)(RMBm)(RMB)(%)(x)(RMB)(x)(RMB)2009A1,345,05263,1470.

728121.

49.

74.

3711.

60.

1802.

617.

92010A1,913,18271,8000.

82813.

78.

24.

8331.

40.

2103.

118.

02011F2,318,19674,8390.

8634.

27.

45.

4661.

20.

2193.

416.

82012F2,430,26883,9840.

96912.

26.

66.

2231.

00.

2463.

816.

62013F2,570,02588,7001.

0235.

66.

36.

9950.

90.

2594.

115.

5Sharesinissue(m)总股数(m)86,702.

6Majorshareholder大股东ChinaPetrochemicalCorporation75.

8%Marketcap.

(HK$m)市值(HK$m)693,620.

2Freefloat(%)自由流通比率(%)24.

23monthaveragevol.

3个月平均成交股数('000)89,897.

1FY11Netgearing净负债/股东资金(%)38.

552Weekshigh/low(HK$)52周高/低8.

900/6.

220FY11Est.

NAV(HK$)每股估值(港元)9.

7Source︰theCompany,GuotaiJunanInternational.

19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage2of84Q11resultsareexpectedtodecreaseqoq.

ThegovernmentdecreasedthedomesticgasolineanddieselpricesbyRMB300/tonneon9Oct.

Afterthepriceadjustment,therefiningsegmentcancovercrudeoilcostsofaboutUS$108/bbl.

Buttheninternationalcrudeoilpriceswerehigherthanexpected.

Althoughpricesdecreasedfromthe2Q11highlevelsofUS$117/bblasexpected,4Q11averageBrentcrudeoilpriceisestimatedtobeaboutUS$109/bbl,whichishigherthanourpreviousassumption.

Inaddition,4Q11petrochemicalmarginsalsodecreasedbecausedomesticpetrochemicalspricesdroppedresultingfromeconomicslowdown.

Resourcestaxwillincreaseduetothereformtoimplementnationwidesince1Nov.

Therefore,4Q11resultsareestimatedtocomeunderpressureanddecreaseabout35%qoq.

1-3Q11operatingprofitwasup6.

87%yoytoRMB87,461million,whichwasbetterthanexpected.

Withlower-than-expected4Q11results,weincreaseourFY11earningsforecastsbyonly1.

4%.

Nolargerefininglossesagainin2012becauseoperatingenvironmentisexpectedtoimprove.

1-3Q11operatinglossoftherefiningsegmentwasRMB23,094million.

LossesinFY11areestimatedtobeRMB33,000million.

However,wethinkthereshouldnotbelargerefininglossesagainin2012becauseoperatingenvironmentisexpectedtoimprove.

Firstly,domesticinflationwentdownsinceAugustandCPIdroppedto4.

2%inNovember.

Itiswidelybelievedthatinflationwillbemildin2012.

Secondly,theChinesegovernmentisexpectedtofurtheracceleratethedomesticgasolineanddieselpricingreform,whichshouldfollowinternationalcrudeoilpricetrendsmoreclosely.

TheNDRCmentionedinthepriceadjustmentcircularof9Oct.

that,inordertoimprovetherefinedoilpricingmechanism,thegovernmentmayreducethepriceadjustmentperiodandincreaseadjustmentfrequency,improvepriceadjustmentoperatingmethod,andchangethebenchmarkoils.

Thirdly,weexpectBrentcrudeoilpricetobeflatin2012comparedtothatof2011.

Therefore,industryoperatingenvironmentisbetterthanthatin2011andtheCompany'srefiningsegmentisexpectednottosufferfromlargelossesagain.

Naturalgaspricingmechanismisalsoexpectedtochangein2012againstthelowinflationbackdrop.

ItissaidthatChinahastoimport35%naturalgastomeetdomesticneedof260,000mm3in2015accordingtotheforthcoming12thFiveYearPlanofthenaturalgasindustry.

In2011,PetroChina(00857)willmakehugelossesonitsimportednaturalgasbecausedomesticpricelevelsaremuchlowerthantheimportedgaslevels.

Webelievenaturalgaspricestoincreasein2012againstthemildinflationbackdropandthegrowthtobeabout30%.

Wearestillconservativeonpetrochemicalmarginsin2012-2013.

1-3Q11operatingprofitofthechemicalsegmentwasup128.

4%yoytoRMB23,688million,whichwasmuchbetterthanourpreviousassumptions.

However,becausenewcapacitywillcontinuetocommenceproductioninbothdomesticandtheMiddle-Eastmarkets,togetherwithglobaleconomicslowdown,wearestillcautiousonestimationofpetrochemicalmarginsin2012-2013.

ThefurtherimplementationofresourcestaxreformnationwidehasnegativeimpactsontheCompany'sresults.

SinceJune,2010,thecrudeoilandgasresourcestaxreformhasbeenintroducedinXinjiang.

ThenthereformhasbeenimplementedtothewesternregionofChinaincludingother11provincesfromDec.

,2010.

TheStateCouncilannouncedon10Octtorevisetheresourcestaxpolicy.

Witheffectfrom1Nov.

,2011,producersofmineralandsaltinthePRCandoffshoreChinashouldbetaxed.

Ofwhich,crudeoilandnaturalgasresourcesareleviedbasedon5%-10%ofsalesvalueratherthansalesvolume(RMB14-30/tonneandRMB7-15/Mcm).

Thenthegovernmentsetstheprovisionaltaxrateas5%.

Theannouncementon10Oct.

meansthatthegovernmentfurtherimplementstheresourcestaxreformnationwide.

AccordingtoourcalculationbasedonSinopec'soilfielddistribution,thefurtherimplementationofresourcestaxreformnationwidewillfurtherdecreasesitsFY12earningsby6.

27%.

Theparentcompany'supstreamassetsincreasedcontinuously,whichcreatedgoodconditionsforassetsinjection.

SinopecGroup(Sinopec'sparentcompany)isveryactiveinacquiringoverseasupstreamassetsinrecentyears.

Afteracquisitionsof40%RepsolBrazil,9.

03%SyncrudeandAddaxin2009-2010,theparentcompanyannouncedtoacquireDaylightEnergywithC$10.

08percommonshareforacashconsiderationofapproximatelyC$2.

2b,and30%GalpBrazilfora19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage3of8considerationofUS$3.

54binOctoberandNovemberrespectivelythisyear.

Basedonourcalculation,theparentcompany'sremainingequityshareofoverseascrudeoilproductionwasabout14.

87milliontonnesin2010.

Plustheacquiredassets,theoverseasproductionwasmorethan70%ofSinopec'stotalproductioninFY11.

TheCompanystatedthatitwillstrengthenitsexplorationandproductionbusinessaggressivelyandrapidly.

Therefore,iftheparentcompanyinjectspartofoverseasupstreamassetsintothelistedcompany,itwillnotonlyenhanceSinopec'sprofitability,butalsoimproveSinopec'sbusinessmodel,whichcurrentlyhasrelativelysmallscaleofupstreamassets.

Raisemorecapitaltopromotedevelopmentbuthavelargerdilutioneffectsinshort-term.

TheCompanyannouncedtoissueRMB20,000milliondomesticcorporatebondsandRBM30,000millionAShareconvertiblebonds.

Thecorporatebondsaretosatisfythedemandforworkingcapitalandreducethefinancingcosts.

TheproceedsfromtheissuanceoftheconvertiblebondsareproposedtobeappliedontheShandongLNGProjectandaseriesofrefiningprojects.

Sofar,dilutioneffectofallconvertiblebondsoftheCompanyisabout8.

76%.

However,withhealthygrowthofoperatingcashflow,weestimatethatthenetgearingratiotodecreaseevenwithaboutyearly8%CAPEXincreasesinFY12-13.

ThehealthyoperatingcashflowalsowilllayfoundationfortheCompanytoacquireupstreamassetsortodevelopindifferentbusinessareas.

IncreasesinequityinterestsinChinaGas(00384)tooptimizenaturalgasintegratedbusinesschainbuthaveslightearningsimpacts.

ENNEnergy(02688)andSinopecannouncedtomakeavoluntaryconditionalcashofferofHK$3.

50persharetoacquirealloftheoutstandingsharesintheissuedsharecapitalandcancelalloutstandingoptionsofChinaGas.

ThemaximumofferconsiderationisaboutHK$16,699,756,843andwillbefinancedasto55%byENNEnergyand45%bySinopec(HK$7,514,890,579).

SinopecisexpectedtopayaboutHK$5,553millionfortheofferassuming25%sharesheldbypublic.

Sinopecheld4.

79%oftheissuedsharecapitalofChinaGasbeforetheofferandwillholdfrom24.

86%(assumingminimumacceptance)to33.

75%(assuming25%publicfloatand45%ofthetotalconcertparties).

Theofferpricehas25.

0%premiumovertheclosingpriceofHK$2.

80onthelasttradingdateandhas40.

1%premiumovertheaverageclosingpriceforthelast30tradingdays.

Theofferpriceisequivalentto27.

9xFY11APEand1.

99xFY11APB,comparedtothesectoraverageofabout21.

9xand2.

38xrespectively.

ChinaGasisagasservicesoperatorandserviceprovider.

AsofSeptember30,2011,ithadsecured151citypipedgasprojects(withexclusiveconcessionrights),9long-distancenaturalgaspipelineprojects,112compressednaturalgasrefillingstationsforvehicles,1naturalgasdevelopmentprojectand44LPGdistributionprojectsin20provinces,autonomousregionsanddirectlyadministeredcities.

SinopecGroupsignedaframeworkwithAPLNGon12Dec.

topurchasemore330mt/yLNGto760mt/yfromAustraliauntil2035andcouldincreaseitsequityinterestto25%from15%.

Sinopeccanexpandrapidlyitssupplyofnaturalgastoendusersandoptimizeitsintegratedbusinesschain.

Theofferisstillsubjecttoapprovalsbyauthoritiesandshareholders.

ImpactsonFY12earringsareexpectedtobelowerthan0.

5%.

WereviseupourFY12-13earningsforecastsby8.

96%and9.

77%respectively.

In2012,althoughresourcestaxwillincreaseandpetrochemicalmarginsareexpectedtodecreaseinthechemicalsegment,therewillnotbelargelossesintherefiningsegment.

Inaddition,webelieveexpectedindustrypolicychanges,includingdomesticgasolineanddieselpricingreform,naturalgaspricereformandspecialoillevythresholdincrease,areallpositivetotheCompany'searnings.

Ifthegovernmentincreasesnaturalgasbenchmarkex-factorypricebyRMB100/cm3,or7.

8%,itwillincreasetheCompany'sFY12earningsby1.

18%.

IfthegovernmentraisesthespecialoillevythresholdfromUS$40/bbltoUS$50/bbl,itwillincreasetheCompany'sFY12earningsby6.

58%.

Ourearningsforecastsdonotreflectallfavourableindustrialpolicychanges.

ReviseupwardstargetpricefromHK$9.

10toHK$9.

30;upgradeinvestmentratingfrom'Accumulate'to'Buy'.

WereviseupwardsthetargetpricefromHK$9.

10toHK$9.

30basedonhigherearningsbutlargerdilutioneffects.

Thetargetpricecorrespondsto8.

62xFY11PER,7.

68xFY12PERand7.

27xFY13PER,whichisalsoequivalentto1.

36xFY11P/B,1.

20xFY12P/Band1.

06xFY13P/B.

Weupgradetheinvestmentratingfrom'Accumulate'to'Buy'becauseofexpectationsofmorefavourableindustrypolicychanges.

19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage4of8SinopecValuationComparisonPEPBROE%Yield%P/CFEV/EBITDACompanyPriceTradecurrency201020112012201320102011201220132011201120112011Average:9.

77.

87.

77.

21.

61.

41.

31.

118.

84.

44.

74.

0PETROCHINA9.

0610.

09.

58.

78.

21.

51.

31.

21.

114.

24.

74.

45.

9SINOPEC87.

97.

46.

86.

51.

31.

21.

11.

016.

83.

54.

14.

9ENI15.

098.

07.

36.

86.

21.

11.

00.

90.

913.

96.

93.

43.

3ROYALDUTCHSH-A2,275.

511.

48.

17.

87.

41.

51.

31.

21.

117.

84.

75.

23.

8EXXONMOBIL80.

1613.

49.

49.

78.

92.

72.

42.

11.

926.

52.

36.

84.

5BPPLC445.

756.

16.

16.

15.

81.

41.

21.

00.

920.

64.

14.

63.

4CHEVRON100.

8610.

87.

37.

87.

51.

81.

61.

41.

323.

93.

15.

03.

2CONOCOPHILLIPS68.

411.

57.

98.

17.

61.

41.

41.

31.

116.

93.

84.

83.

5TOTAL36.

8557.

97.

17.

06.

71.

41.

21.

11.

018.

56.

24.

13.

2Source︰BloombergSinopecIndustryPolicyChangeEffectSensitivityEffectsonFY12PBTFurtherdomesticgasolineanddieselpricingreformRefiningsegmentwillreturntooperatingprofitaboutRMB15,000-25,000mfromlossofaboutRMB33,000minFY11.

Naturalgaspricereform,wellheadpriceupRMB100/km3+1.

18%Adjustmentinthresholdofspecialoillevy,fromUS$40/bbltoUS$50/bbl+6.

58%Source:GuotaiJunanInternationalSinopecGroupAcquisitionActivitiesProductionReserveDateProjectConsiderationCrudeoilNaturalgasBoeCrudeoilNaturalgasBoeNov.

,2011GalpBrazil30%US$3.

54b2015:21.

3kboe/d2024:112.

5kboe/dOct.

,2011DaylightEnergyC$2.

2b2010:oil&liquid:17,017bbl/d2010:144,866kcf/d2010:41,161boe/doil&liquid:23,995kbbl322,286mmcf77,709kboeMay,2011Pecten80%US$538m2011:11.

9kbbl/d2P:3.

59mbblOct.

,2010RepsolBrazil40%US$7.

109b8.

8mt/y1.

86bcm/y10.

57mtoe881mbblApr.

,2010Syncrude9.

03%C$4.

675b350kbbl/d2P:5.

1bbblAug.

,2009AddaxC$8.

27b143kbbl/d2P:537mbblDec.

,2008TanganyikaRMB13b184mbblNote:Someoilfieldproductionmayincreaseafteracquisitions.

Source:SinopecGroupChinaGas(00384)FinancialandValuationDataHK$00030Sept.

,2011(interim)31Mar.

2011(annual)FY11APEFY11APB30Sept.

,2011PBEquityattributabletoowners9,093,0538,764,6761.

991.

92Netprofitaftertaxation443,622781,322Profitattributabletoowners373,608625,89627.

9Source︰ChinaGas,GuotaiJunanInternationalSinopecRatiosandAssumptions200920102011F2012F2013FGrowth%:Revenue-6.

88%42.

62%21.

80%4.

89%5.

78%Operatingprofit244.

39%15.

77%0.

03%11.

36%4.

95%Netprofit121.

37%13.

70%4.

23%12.

22%5.

61%Margins:Grossmargin27.

70%22.

95%21.

18%21.

74%21.

80%Operatingmargin6.

74%5.

49%4.

53%4.

81%4.

78%Netmargin4.

98%4.

08%3.

51%3.

75%3.

75%Debtmanagement:Netgearing62.

01%48.

35%38.

46%29.

40%22.

02%Totaldebttoequity60.

15%50.

09%40.

75%32.

21%25.

22%Valuation:PE9.

678.

217.

416.

616.

26Bookvalue/share(RMB)4.

3714.

8335.

4666.

2236.

995PB1.

611.

411.

171.

030.

91P/CF3.

693.

463.

243.

092.

88Assumptions:Brentprice(US$/bbl)62.

0579.

73111.

00111.

00116.

00Realisedcrudeoilprice(US$/bbl)50.

8270.

8899.

0099.

00104.

00Source:TheCompany,GuotaiJunanInternational19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage5of8Sinopec1-3Q11OperatingProfit(RMBm)SegmentTurnoverChangeyoyOperatingprofitChangeyoyExploration&Production33,97639.

22%55,27335.

35%Refining143,07923.

66%-23,094n.

a.

Marketing999,97633.

09%31,88836.

82%Chemicals276,89136.

13%23,688128.

36%Corporateandothers395,02027.

37%-1,31712.

85%Eliminationn.

a.

n.

a.

1,023n.

a.

Total1,848,94231.

60%87,4616.

87%Source︰theCompanyDomesticRefinedOilPriceAdjustment19-Dec-0815-Jan-0925-Mar-091-Jun-0930-Jun-0929-Jul-092-Sep-0930-Sep-0910-Nov-0914-Apr-101-Jun-1026-Oct-1022-Dec-1020-Feb-117-Apr-119-Oct-11Ex-factoryGasoline5,5805,4405,7306,1306,7306,5106,8106,6207,1007,4207,1907,4207,7308,0808,5808,280Diesel4,9704,8104,9905,3905,9905,7706,0705,8806,3606,6806,4606,6806,9807,3307,7307,430RetailcapGasoline6,3976,2576,5476,9477,5517,3317,6317,4417,9218,2508,0218,2518,5618,9119,4119,111Diesel5,7945,6345,8146,2146,8186,5986,8986,7087,1897,5207,3017,5217,8218,1718,5718,271Source:theNDRCSinopecOperationalDataandPlanUnit1-3Q11Change2011newtargetchangeExplorationandProductionCrudeOilmmbbls239.

56-3.

6%321.

321.

99%Chinammbbls226.

810.

5%Africammbbls12.

75-44.

3%NaturalGasbcf382.

2522.

1%501.

0813.

5%Totaloilandgasproductionmmboe303.

270.

8%RealisedcrudeoilpriceUS$/bbl98.

2339.

2%RealisednaturalgaspriceUS$/kcf5.

4716.

1%RefiningCrudeoilthroughputKbbl/d4,3703.

6%4,4815.

4%Gasoline,dieselandkeroseneproductionmilliontonnes95.

453.

5%ofwhich:Gasolinemilliontonnes27.

592.

6%Dieselmilliontonnes57.

632.

9%Kerosenemilliontonnes10.

239.

2%Lightchemicalfeedstockmilliontonnes27.

375.

8%Lightproductsyield%76.

180.

47ptsRefiningyield%95.

200.

42ptsChemicalEthylene'000tonnes7,35611.

3%9,8508.

7%Syntheticresin'000tonnes10,0675.

6%Syntheticrubber'000tonnes7463.

8%Syntheticfibremonomerandpolymer'000tonnes7,0868.

6%Syntheticfibre'000tonnes1,0441.

4%Urea'000tonnes680-39.

7%MarketingandDistributionTotalsalesvolumeofoilproductsmilliontonnes121.

5810.

3%TotalDomesticSalesofRefinedOilProductsmilliontonnes113.

578.

8%147.

04.

60%Ofwhich:Retailvolumemilliontonnes75.

5517.

8%Directsalesvolumemilliontonnes24.

12-1.

3%Wholesalevolumemilliontonnes13.

9-11.

9%TotalnumberofservicestationsunderSINOPECbrand30,1030.

0%Ofwhich:Company-operated30,0731.

6%Franchised30-94.

2%AverageannualthroughputperpetrolstationTonne/station3,34813.

1%Source:theCompanySinopec1H11SalesVolumeandPricesSalesvolume(000tonne)ChangeyoyAveragerealisedprice(RMB/tonne,RMB/000m3)ChangeyoyCrudeoil2,386-9.

5%4,60034.

2%Naturalgas(millioncubicmeters)5,93643.

5%1,26823.

5%Gasoline23,70511.

7%8,23614.

3%Diesel48,61211.

2%6,99419.

6%Kerosene8,05325.

1%5,92827.

1%Basicchemicalfeedstock9,93720.

4%6,95925.

8%Syntheticfibremonomersandpolymer3,14114.

2%10,37027.

4%Syntheticresin5,1769.

8%10,1349.

8%Syntheticfibre7644.

9%13,99525.

3%Syntheticrubber6314.

1%22,02840.

4%Chemicalfertilizer468-48.

9%2,04924.

3%Source:theCompany19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage6of8Sinopec1-3Q11RevenueBreakdownSinopec1-3Q11OperatingProfitCorporate&Others21.

4%Chemicals15.

0%Marketing&Distribution54.

1%Refining7.

7%Exploration&Production1.

8%-30,000-20,000-10,000010,00020,00030,00040,00050,00060,000Exploration&ProductionRefiningMarketing&DistributionChemicalsCorporate&OthersRMBm20102011Source:theCompanySource:theCompanyDomesticGasoline&DieselRetailPrices203040506070809010011012013014020042005200620072008200920102011US$/bblgasolineretailpricedieselretailpricecrudeoilcostsSource:CEIC,BloombergDomesticPetrochemicals-NaphthaSpreadDomesticPetrochemicalsPrices01,0002,0003,0004,0005,0006,0007,0008,0009,00010,000200620072008200920102011RMB/tonnePropyleneTolueneStyreneHDPE3,0008,00013,00018,00023,00028,00033,00038,00020042005200620072008200920102011RMB/tonneHDPEStyreneSBRAcrylonitrileSource:CEIC、Bloomberg、GuotaiJunanInternationalSource:CEICIncomeStatementYearendDec31(RMBm)200920102011F2012F2013FTurnover1,315,9151,876,7582,285,9802,397,6752,536,281Otheroperatingrevenues29,13736,42432,21632,59233,7441,345,0521,913,1822,318,1962,430,2682,570,025Otherincome00000Purchasedcrudeoil,productsandoperatingsuppliesandexpenses-980,564-1,482,484-1,834,061-1,909,118-2,017,235SG&A&Personnel-69,434-84,720-103,193-108,235-114,492DD&A-54,016-59,223-63,253-68,287-74,509Explorationexpenses-10,545-10,955-13,344-13,996-14,805Taxesotherthanincometax-132,884-157,189-191,465-205,252-217,597Otheroperatingexpenses,net-6,910-13,607-7,848-8,417-8,629Totaloperatingexpenses-1,254,353-1,808,178-2,213,163-2,313,305-2,447,267Operatingprofit90,699105,004105,033116,963122,758Netfinancecosts-7,466-6,974-6,552-5,342-4,597Profitbeforetaxation86,604103,693105,652119,000125,793Taxation-19,599-25,689-24,346-27,759-29,42919December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage7of8Minorityinterests-3,858-6,204-6,467-7,257-7,664ProfitattributabletoequityshareholdersoftheCompany63,14771,80074,83983,98488,700BasicEPS0.

730.

830.

860.

971.

02DilutedEPS0.

720.

820.

790.

890.

94Source:theCompany,GuotaiJunanInternational.

BalanceSheetYearendDec31(RMBm)200920102011F2012F2013FProperty,plantandequipment484,815540,700556,428602,148649,440Constructioninprogress120,37589,599119,980124,089130,446Others91,594104,62698,175106,767115,192Non-currentassets696,784734,925774,583833,005895,077Cashandcashequivalents8,78217,00821,40224,84226,797Inventories141,727156,546190,680199,997211,559Billsreceivable28,70259,04371,91775,43179,792Others22,26827,63233,46735,10337,123Currentassets201,479260,229317,467335,374355,270Short-termdebts59,35017,01915,62411,5928,400Billspayable119,873136,346166,076174,191184,260Accruedexpensesandotherpayables117,798153,478186,943196,078207,413Others18,90029,56328,09228,82728,459Currentliabilities315,921336,406396,735410,688428,532Netcurrentliabilities-114,442-76,177-79,268-75,314-73,263Totalassetslesscurrentliabilities582,342658,748695,315757,691821,815Long-termdebts152,725174,075160,149144,134126,838Others24,80134,30523,43429,00535,813Non-currentliabilities177,526208,380183,583173,139162,651404,816450,368511,732584,552659,164EquitySharecapital86,70286,70286,70386,70386,703Reserves292,238332,345387,242452,805519,752378,940419,047473,945539,508606,455Minorityinterests25,87631,32137,78845,04452,709Totalequity404,816450,368511,732584,552659,164Source:theCompany,GuotaiJunanInternational.

CashFlowStatementYearendDec31(RMBm)200920102011F2012F2013FPBT86,604103,693105,652119,000125,793DD&A54,01659,22363,25368,28774,509Netinterest7,3327,3127,2215,6604,847Changeinworkingcapital14,5021,1748,6191,1411,689Others9,10413,08910,91613,25414,841Cashgeneratedfromoperations171,558184,491195,661207,342221,680Incometaxpaid-6,045-14,158-24,330-27,644-28,696Netcashgeneratedfromoperatingactivities165,513170,333171,331179,698192,985InvestingactivitiesCapitalexpenditure-107,487-106,371-124,100-134,028-144,750Interestincome2776601,0841,1871,349Others-10,145-772,7432,8963,031Netcashusedininvestingactivities-117,355-105,788-120,273-129,945-140,371FinancingactivitiesLoanschange-23,471-19,311-16,792-19,311-20,856Dividendpaid-13,559-16,391-19,942-18,421-21,753Interestpaid-7,762-6,739-9,929-8,581-8,050Others-1,619-13,853000Netcash(usedin)/generatedfromfinancingactivities-46,411-56,294-46,663-46,314-50,659Netincrease/(decrease)incashandcashequivalents1,7478,2514,3943,4391,955Cashandcashequivalentsat1January7,0408,78217,00821,40224,842Cashandcashequivalentsat31December8,78217,00821,40224,84226,797Source:theCompany,GuotaiJunanInternational.

19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage8of8CompanyRatingDefinitionTheBenchmark:HongKongHangSengIndexTimeHorizon:6to18monthsRatingDefinitionBuyRelativePerformance>15%;orthefundamentaloutlookofthecompanyorsectorisfavorable.

AccumulateRelativePerformanceis5%to15%;orthefundamentaloutlookofthecompanyorsectorisfavorable.

NeutralRelativePerformanceis-5%to5%;orthefundamentaloutlookofthecompanyorsectorisneutral.

ReduceRelativePerformanceis-5%to-15%;orthefundamentaloutlookofthecompanyorsectorisunfavorable.

SellRelativePerformance5%;orthefundamentaloutlookofthesectorisfavorable.

NeutralRelativePerformanceis-5%to5%;orthefundamentaloutlookofthesectorisneutral.

UnderperformRelativePerformance<-5%;orthefundamentaloutlookofthesectorisunfavorable.

DISCLOSUREOFINTERESTS(1)TheAnalystsandtheirassociatesdonotserveasanofficeroftheissuermentionedinthisResearchReport.

(2)TheAnalystsandtheirassociatesdonothaveanyfinancialinterestsinrelationtotheissuermentionedinthisResearchReport.

(3)ExceptforShandongChenming(01812),GuotaiJunananditsgroupcompaniesdonotholdequaltoormorethan1%ofthemarketcapitalizationoftheissuermentionedinthisResearchReport.

(4)GuotaiJunananditsgroupcompanieshavenothadinvestmentbankingrelationshipswiththeissuermentionedinthisResearchReportwithinthepreceding12months.

DISCLAIMERThisResearchReportdoesnotconstituteaninvitationoroffertoacquire,purchaseorsubscribeforsecuritiesbyGuotaiJunanSecurities(HongKong)Limited("GuotaiJunan").

GuotaiJunananditsgroupcompaniesmaydobusinessthatrelatestocompaniescoveredinresearchreports,includinginvestmentbanking,investmentservicesandetc.

(forexample,theplacingagent,leadmanager,sponsor,underwriterorinvestproprietarily).

Anyopinionsexpressedinthisreportmaydifferorbecontrarytoopinionsorinvestmentstrategiesexpressedorallyorinwrittenformbysalespersons,dealersandotherprofessionalexecutivesofGuotaiJunangroupofcompanies.

AnyopinionsexpressedinthisreportmaydifferorbecontrarytoopinionsorinvestmentdecisionsmadebytheassetmanagementandinvestmentbankinggroupsofGuotaiJunan.

ThoughbestefforthasbeenmadetoensuretheaccuracyoftheinformationanddatacontainedinthisResearchReport,GuotaiJunandoesnotguaranteetheaccuracyandcompletenessoftheinformationanddataherein.

ThisResearchReportmaycontainsomeforward-lookingestimatesandforecastsderivedfromtheassumptionsofthefuturepoliticalandeconomicconditionswithinherentlyunpredictableandmutablesituation,souncertaintymaycontain.

Investorsshouldunderstandandcomprehendtheinvestmentobjectivesanditsrelatedrisks,andwherenecessaryconsulttheirownfinancialadviserspriortoanyinvestmentdecision.

ThisResearchReportisnotdirectedat,orintendedfordistributiontooruseby,anypersonorentitywhoisacitizenorresidentoforlocatedinanyjurisdictionwheresuchdistribution,publication,availabilityorusewouldbecontrarytoapplicablelaworregulationorwhichwouldsubjectGuotaiJunananditsgroupcompaniestoanyregistrationorlicensingrequirementwithinsuchjurisdiction.

2011GuotaiJunanSecurities(HongKong)Limited.

AllRightsReserved.

27/F.

,LowBlock,GrandMillenniumPlaza,181Queens'RoadCentral,HongKong.

Tel.

:(852)2509-9118Fax:(852)2509-7793Website:www.

gtja.

com.

hk

com19December2011ToBenefitfromIndustryReforms,Upgradeto'Buy'将受益于行业改革,上调评级至"买入"Rating:BuyUpgraded评级:买入(上调)6-18mTP目标价:HK$9.

30Revisedfrom原目标价:HK$9.

10Shareprice股价:HK$8.

000z4Q11refiningmarginsdonotimprovebecauseBrentcrudeoilpricesmaintainathighlevels.

Petrochemicalmarginsdecreaseqoqandresourcestaxincreases.

Therefore,4Q11resultsareestimatedtocomeunderpressure.

Although1-3Q11resultswerebetterthanexpected,weincreaseourFY11earningsforecastsbyonly1.

4%.

zTherefiningsegmentisexpectednottohavelargelossesagainin2012becauseindustryoperatingenvironmentwillimprovein2012,withmildinflation,flatcrudeoilpricesandtheexpectationoffurthergasolineanddieselpricingreform.

Domesticnaturalgaspricesarealsolikelytorisein2012againstthelowinflationbackdrop.

zThefurtherimplementationofresourcestaxreformnationwidewillfurtherdecreaseFY12earningsby6.

27%.

In2012,althoughresourcestaxwillincreaseandpetrochemicalmarginsareexpectedtodecreaseinthechemicalsegment,therewillnotbelargelossesintherefiningsegment.

WereviseupourFY12-13EPSforecastsby8.

96%and9.

77%respectively.

Inaddition,expectedindustrypolicychanges,includingdomesticgasolineanddieselandnaturalgaspricingreform,andspecialoillevythresholdincrease,areallpositivetotheCompany'searnings.

zDilutioneffectofallconvertiblebondsisabout8.

76%.

However,netgearingratiosareestimatedtodecreaseevenwithaboutyearly8%CAPEXincreaseinFY12-13.

ThehealthyoperatingcashflowalsoisexpectedtolayfoundationfortheCompanytoacquireupstreamassetsortodevelopindifferentbusinessareas.

Theparentcompany'supstreamassetsincreasedcontinuously,whichcreatedgoodconditionsforassetsinjection.

IncreasesinequityinterestsinChinaGas(00384)aretooptimizenaturalgasintegratedbusinesschainbuthaveslightearningsimpacts.

zReviseupwardsthetargetpricefromHK$9.

10toHK$9.

30basedonhigherearningsbutlargerdilutioneffects.

Upgradetheinvestmentratingfrom'Accumulate'to'Buy'becauseofexpectationsofmorefavourableindustrypolicychanges.

z由于今年第4季度布伦特原油维持在高位,炼差应无改善.

石化毛利环比下降,资源税增加.

因此,第4季度业绩有压力.

虽然1-3季度业绩好于预期,我们只上调2011年盈利预测1.

4%.

z2012年预期通胀温和、原油价格持平、以及汽柴油定价将改革,行业经营环境比2011年好,炼油分部将不再有大额亏损.

在低通胀背景下,国内天然气价格也可能上调.

z资源税改革推广至全国令2012年盈利将再下降6.

15%.

2012年虽然资源税上升、化工板块石化毛利预期下降,但炼油板块不再有大额亏损.

我们分别上调12-13年每股盈利预测8.

96%和9.

77%.

另外,预期的行业政策改变,包括汽柴油和天然气价格改革、特别收益金起征点上升,均对公司业绩有正面影响.

z现全部可转债的摊薄效应约为8.

76%.

然而,即使资本开支每年增长8%,净资本负债率仍将于12-13年下降.

健康的经营现金流为公司收购上游资产和扩展其他业务打下基础.

母公司上游资产不断增加,为资产注入创造良好条件.

增加中国燃气(003854)权益可增强天然气一体化,但对盈利影响轻微.

z基于调高的盈利预测但增大的摊薄效应,目标价由9.

10港元略上调为9.

30港元.

由于未来行业政策变动有利的预期,上调投资评级为"买入".

Stockperformance股价表现(35.

0)(25.

0)(15.

0)(5.

0)5.

015.

025.

0Nov-10Jan-11Apr-11Jul-11Oct-11%ofreturnHSISinopecChangeinSharePrice股价变动1M1个月3M3个月1Y1年Abs.

%绝对变动%(0.

50)5.

9612.

99Rel.

%toHSindex相对恒指变动%0.

629.

3032.

49Avg.

shareprice(HK$)平均股价(港元)8.

067.

737.

53Source:Bloomberg,GuotaiJunanInternationalYearEnd年结Turnover收入NetProfit股东净利EPS每股净利EPS每股净利变动PER市盈率BPS每股净资产PBR市净率DPS每股股息Yield股息率ROE净资产收益率12/31(RMBm)(RMBm)(RMB)(%)(x)(RMB)(x)(RMB)2009A1,345,05263,1470.

728121.

49.

74.

3711.

60.

1802.

617.

92010A1,913,18271,8000.

82813.

78.

24.

8331.

40.

2103.

118.

02011F2,318,19674,8390.

8634.

27.

45.

4661.

20.

2193.

416.

82012F2,430,26883,9840.

96912.

26.

66.

2231.

00.

2463.

816.

62013F2,570,02588,7001.

0235.

66.

36.

9950.

90.

2594.

115.

5Sharesinissue(m)总股数(m)86,702.

6Majorshareholder大股东ChinaPetrochemicalCorporation75.

8%Marketcap.

(HK$m)市值(HK$m)693,620.

2Freefloat(%)自由流通比率(%)24.

23monthaveragevol.

3个月平均成交股数('000)89,897.

1FY11Netgearing净负债/股东资金(%)38.

552Weekshigh/low(HK$)52周高/低8.

900/6.

220FY11Est.

NAV(HK$)每股估值(港元)9.

7Source︰theCompany,GuotaiJunanInternational.

19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage2of84Q11resultsareexpectedtodecreaseqoq.

ThegovernmentdecreasedthedomesticgasolineanddieselpricesbyRMB300/tonneon9Oct.

Afterthepriceadjustment,therefiningsegmentcancovercrudeoilcostsofaboutUS$108/bbl.

Buttheninternationalcrudeoilpriceswerehigherthanexpected.

Althoughpricesdecreasedfromthe2Q11highlevelsofUS$117/bblasexpected,4Q11averageBrentcrudeoilpriceisestimatedtobeaboutUS$109/bbl,whichishigherthanourpreviousassumption.

Inaddition,4Q11petrochemicalmarginsalsodecreasedbecausedomesticpetrochemicalspricesdroppedresultingfromeconomicslowdown.

Resourcestaxwillincreaseduetothereformtoimplementnationwidesince1Nov.

Therefore,4Q11resultsareestimatedtocomeunderpressureanddecreaseabout35%qoq.

1-3Q11operatingprofitwasup6.

87%yoytoRMB87,461million,whichwasbetterthanexpected.

Withlower-than-expected4Q11results,weincreaseourFY11earningsforecastsbyonly1.

4%.

Nolargerefininglossesagainin2012becauseoperatingenvironmentisexpectedtoimprove.

1-3Q11operatinglossoftherefiningsegmentwasRMB23,094million.

LossesinFY11areestimatedtobeRMB33,000million.

However,wethinkthereshouldnotbelargerefininglossesagainin2012becauseoperatingenvironmentisexpectedtoimprove.

Firstly,domesticinflationwentdownsinceAugustandCPIdroppedto4.

2%inNovember.

Itiswidelybelievedthatinflationwillbemildin2012.

Secondly,theChinesegovernmentisexpectedtofurtheracceleratethedomesticgasolineanddieselpricingreform,whichshouldfollowinternationalcrudeoilpricetrendsmoreclosely.

TheNDRCmentionedinthepriceadjustmentcircularof9Oct.

that,inordertoimprovetherefinedoilpricingmechanism,thegovernmentmayreducethepriceadjustmentperiodandincreaseadjustmentfrequency,improvepriceadjustmentoperatingmethod,andchangethebenchmarkoils.

Thirdly,weexpectBrentcrudeoilpricetobeflatin2012comparedtothatof2011.

Therefore,industryoperatingenvironmentisbetterthanthatin2011andtheCompany'srefiningsegmentisexpectednottosufferfromlargelossesagain.

Naturalgaspricingmechanismisalsoexpectedtochangein2012againstthelowinflationbackdrop.

ItissaidthatChinahastoimport35%naturalgastomeetdomesticneedof260,000mm3in2015accordingtotheforthcoming12thFiveYearPlanofthenaturalgasindustry.

In2011,PetroChina(00857)willmakehugelossesonitsimportednaturalgasbecausedomesticpricelevelsaremuchlowerthantheimportedgaslevels.

Webelievenaturalgaspricestoincreasein2012againstthemildinflationbackdropandthegrowthtobeabout30%.

Wearestillconservativeonpetrochemicalmarginsin2012-2013.

1-3Q11operatingprofitofthechemicalsegmentwasup128.

4%yoytoRMB23,688million,whichwasmuchbetterthanourpreviousassumptions.

However,becausenewcapacitywillcontinuetocommenceproductioninbothdomesticandtheMiddle-Eastmarkets,togetherwithglobaleconomicslowdown,wearestillcautiousonestimationofpetrochemicalmarginsin2012-2013.

ThefurtherimplementationofresourcestaxreformnationwidehasnegativeimpactsontheCompany'sresults.

SinceJune,2010,thecrudeoilandgasresourcestaxreformhasbeenintroducedinXinjiang.

ThenthereformhasbeenimplementedtothewesternregionofChinaincludingother11provincesfromDec.

,2010.

TheStateCouncilannouncedon10Octtorevisetheresourcestaxpolicy.

Witheffectfrom1Nov.

,2011,producersofmineralandsaltinthePRCandoffshoreChinashouldbetaxed.

Ofwhich,crudeoilandnaturalgasresourcesareleviedbasedon5%-10%ofsalesvalueratherthansalesvolume(RMB14-30/tonneandRMB7-15/Mcm).

Thenthegovernmentsetstheprovisionaltaxrateas5%.

Theannouncementon10Oct.

meansthatthegovernmentfurtherimplementstheresourcestaxreformnationwide.

AccordingtoourcalculationbasedonSinopec'soilfielddistribution,thefurtherimplementationofresourcestaxreformnationwidewillfurtherdecreasesitsFY12earningsby6.

27%.

Theparentcompany'supstreamassetsincreasedcontinuously,whichcreatedgoodconditionsforassetsinjection.

SinopecGroup(Sinopec'sparentcompany)isveryactiveinacquiringoverseasupstreamassetsinrecentyears.

Afteracquisitionsof40%RepsolBrazil,9.

03%SyncrudeandAddaxin2009-2010,theparentcompanyannouncedtoacquireDaylightEnergywithC$10.

08percommonshareforacashconsiderationofapproximatelyC$2.

2b,and30%GalpBrazilfora19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage3of8considerationofUS$3.

54binOctoberandNovemberrespectivelythisyear.

Basedonourcalculation,theparentcompany'sremainingequityshareofoverseascrudeoilproductionwasabout14.

87milliontonnesin2010.

Plustheacquiredassets,theoverseasproductionwasmorethan70%ofSinopec'stotalproductioninFY11.

TheCompanystatedthatitwillstrengthenitsexplorationandproductionbusinessaggressivelyandrapidly.

Therefore,iftheparentcompanyinjectspartofoverseasupstreamassetsintothelistedcompany,itwillnotonlyenhanceSinopec'sprofitability,butalsoimproveSinopec'sbusinessmodel,whichcurrentlyhasrelativelysmallscaleofupstreamassets.

Raisemorecapitaltopromotedevelopmentbuthavelargerdilutioneffectsinshort-term.

TheCompanyannouncedtoissueRMB20,000milliondomesticcorporatebondsandRBM30,000millionAShareconvertiblebonds.

Thecorporatebondsaretosatisfythedemandforworkingcapitalandreducethefinancingcosts.

TheproceedsfromtheissuanceoftheconvertiblebondsareproposedtobeappliedontheShandongLNGProjectandaseriesofrefiningprojects.

Sofar,dilutioneffectofallconvertiblebondsoftheCompanyisabout8.

76%.

However,withhealthygrowthofoperatingcashflow,weestimatethatthenetgearingratiotodecreaseevenwithaboutyearly8%CAPEXincreasesinFY12-13.

ThehealthyoperatingcashflowalsowilllayfoundationfortheCompanytoacquireupstreamassetsortodevelopindifferentbusinessareas.

IncreasesinequityinterestsinChinaGas(00384)tooptimizenaturalgasintegratedbusinesschainbuthaveslightearningsimpacts.

ENNEnergy(02688)andSinopecannouncedtomakeavoluntaryconditionalcashofferofHK$3.

50persharetoacquirealloftheoutstandingsharesintheissuedsharecapitalandcancelalloutstandingoptionsofChinaGas.

ThemaximumofferconsiderationisaboutHK$16,699,756,843andwillbefinancedasto55%byENNEnergyand45%bySinopec(HK$7,514,890,579).

SinopecisexpectedtopayaboutHK$5,553millionfortheofferassuming25%sharesheldbypublic.

Sinopecheld4.

79%oftheissuedsharecapitalofChinaGasbeforetheofferandwillholdfrom24.

86%(assumingminimumacceptance)to33.

75%(assuming25%publicfloatand45%ofthetotalconcertparties).

Theofferpricehas25.

0%premiumovertheclosingpriceofHK$2.

80onthelasttradingdateandhas40.

1%premiumovertheaverageclosingpriceforthelast30tradingdays.

Theofferpriceisequivalentto27.

9xFY11APEand1.

99xFY11APB,comparedtothesectoraverageofabout21.

9xand2.

38xrespectively.

ChinaGasisagasservicesoperatorandserviceprovider.

AsofSeptember30,2011,ithadsecured151citypipedgasprojects(withexclusiveconcessionrights),9long-distancenaturalgaspipelineprojects,112compressednaturalgasrefillingstationsforvehicles,1naturalgasdevelopmentprojectand44LPGdistributionprojectsin20provinces,autonomousregionsanddirectlyadministeredcities.

SinopecGroupsignedaframeworkwithAPLNGon12Dec.

topurchasemore330mt/yLNGto760mt/yfromAustraliauntil2035andcouldincreaseitsequityinterestto25%from15%.

Sinopeccanexpandrapidlyitssupplyofnaturalgastoendusersandoptimizeitsintegratedbusinesschain.

Theofferisstillsubjecttoapprovalsbyauthoritiesandshareholders.

ImpactsonFY12earringsareexpectedtobelowerthan0.

5%.

WereviseupourFY12-13earningsforecastsby8.

96%and9.

77%respectively.

In2012,althoughresourcestaxwillincreaseandpetrochemicalmarginsareexpectedtodecreaseinthechemicalsegment,therewillnotbelargelossesintherefiningsegment.

Inaddition,webelieveexpectedindustrypolicychanges,includingdomesticgasolineanddieselpricingreform,naturalgaspricereformandspecialoillevythresholdincrease,areallpositivetotheCompany'searnings.

Ifthegovernmentincreasesnaturalgasbenchmarkex-factorypricebyRMB100/cm3,or7.

8%,itwillincreasetheCompany'sFY12earningsby1.

18%.

IfthegovernmentraisesthespecialoillevythresholdfromUS$40/bbltoUS$50/bbl,itwillincreasetheCompany'sFY12earningsby6.

58%.

Ourearningsforecastsdonotreflectallfavourableindustrialpolicychanges.

ReviseupwardstargetpricefromHK$9.

10toHK$9.

30;upgradeinvestmentratingfrom'Accumulate'to'Buy'.

WereviseupwardsthetargetpricefromHK$9.

10toHK$9.

30basedonhigherearningsbutlargerdilutioneffects.

Thetargetpricecorrespondsto8.

62xFY11PER,7.

68xFY12PERand7.

27xFY13PER,whichisalsoequivalentto1.

36xFY11P/B,1.

20xFY12P/Band1.

06xFY13P/B.

Weupgradetheinvestmentratingfrom'Accumulate'to'Buy'becauseofexpectationsofmorefavourableindustrypolicychanges.

19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage4of8SinopecValuationComparisonPEPBROE%Yield%P/CFEV/EBITDACompanyPriceTradecurrency201020112012201320102011201220132011201120112011Average:9.

77.

87.

77.

21.

61.

41.

31.

118.

84.

44.

74.

0PETROCHINA9.

0610.

09.

58.

78.

21.

51.

31.

21.

114.

24.

74.

45.

9SINOPEC87.

97.

46.

86.

51.

31.

21.

11.

016.

83.

54.

14.

9ENI15.

098.

07.

36.

86.

21.

11.

00.

90.

913.

96.

93.

43.

3ROYALDUTCHSH-A2,275.

511.

48.

17.

87.

41.

51.

31.

21.

117.

84.

75.

23.

8EXXONMOBIL80.

1613.

49.

49.

78.

92.

72.

42.

11.

926.

52.

36.

84.

5BPPLC445.

756.

16.

16.

15.

81.

41.

21.

00.

920.

64.

14.

63.

4CHEVRON100.

8610.

87.

37.

87.

51.

81.

61.

41.

323.

93.

15.

03.

2CONOCOPHILLIPS68.

411.

57.

98.

17.

61.

41.

41.

31.

116.

93.

84.

83.

5TOTAL36.

8557.

97.

17.

06.

71.

41.

21.

11.

018.

56.

24.

13.

2Source︰BloombergSinopecIndustryPolicyChangeEffectSensitivityEffectsonFY12PBTFurtherdomesticgasolineanddieselpricingreformRefiningsegmentwillreturntooperatingprofitaboutRMB15,000-25,000mfromlossofaboutRMB33,000minFY11.

Naturalgaspricereform,wellheadpriceupRMB100/km3+1.

18%Adjustmentinthresholdofspecialoillevy,fromUS$40/bbltoUS$50/bbl+6.

58%Source:GuotaiJunanInternationalSinopecGroupAcquisitionActivitiesProductionReserveDateProjectConsiderationCrudeoilNaturalgasBoeCrudeoilNaturalgasBoeNov.

,2011GalpBrazil30%US$3.

54b2015:21.

3kboe/d2024:112.

5kboe/dOct.

,2011DaylightEnergyC$2.

2b2010:oil&liquid:17,017bbl/d2010:144,866kcf/d2010:41,161boe/doil&liquid:23,995kbbl322,286mmcf77,709kboeMay,2011Pecten80%US$538m2011:11.

9kbbl/d2P:3.

59mbblOct.

,2010RepsolBrazil40%US$7.

109b8.

8mt/y1.

86bcm/y10.

57mtoe881mbblApr.

,2010Syncrude9.

03%C$4.

675b350kbbl/d2P:5.

1bbblAug.

,2009AddaxC$8.

27b143kbbl/d2P:537mbblDec.

,2008TanganyikaRMB13b184mbblNote:Someoilfieldproductionmayincreaseafteracquisitions.

Source:SinopecGroupChinaGas(00384)FinancialandValuationDataHK$00030Sept.

,2011(interim)31Mar.

2011(annual)FY11APEFY11APB30Sept.

,2011PBEquityattributabletoowners9,093,0538,764,6761.

991.

92Netprofitaftertaxation443,622781,322Profitattributabletoowners373,608625,89627.

9Source︰ChinaGas,GuotaiJunanInternationalSinopecRatiosandAssumptions200920102011F2012F2013FGrowth%:Revenue-6.

88%42.

62%21.

80%4.

89%5.

78%Operatingprofit244.

39%15.

77%0.

03%11.

36%4.

95%Netprofit121.

37%13.

70%4.

23%12.

22%5.

61%Margins:Grossmargin27.

70%22.

95%21.

18%21.

74%21.

80%Operatingmargin6.

74%5.

49%4.

53%4.

81%4.

78%Netmargin4.

98%4.

08%3.

51%3.

75%3.

75%Debtmanagement:Netgearing62.

01%48.

35%38.

46%29.

40%22.

02%Totaldebttoequity60.

15%50.

09%40.

75%32.

21%25.

22%Valuation:PE9.

678.

217.

416.

616.

26Bookvalue/share(RMB)4.

3714.

8335.

4666.

2236.

995PB1.

611.

411.

171.

030.

91P/CF3.

693.

463.

243.

092.

88Assumptions:Brentprice(US$/bbl)62.

0579.

73111.

00111.

00116.

00Realisedcrudeoilprice(US$/bbl)50.

8270.

8899.

0099.

00104.

00Source:TheCompany,GuotaiJunanInternational19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage5of8Sinopec1-3Q11OperatingProfit(RMBm)SegmentTurnoverChangeyoyOperatingprofitChangeyoyExploration&Production33,97639.

22%55,27335.

35%Refining143,07923.

66%-23,094n.

a.

Marketing999,97633.

09%31,88836.

82%Chemicals276,89136.

13%23,688128.

36%Corporateandothers395,02027.

37%-1,31712.

85%Eliminationn.

a.

n.

a.

1,023n.

a.

Total1,848,94231.

60%87,4616.

87%Source︰theCompanyDomesticRefinedOilPriceAdjustment19-Dec-0815-Jan-0925-Mar-091-Jun-0930-Jun-0929-Jul-092-Sep-0930-Sep-0910-Nov-0914-Apr-101-Jun-1026-Oct-1022-Dec-1020-Feb-117-Apr-119-Oct-11Ex-factoryGasoline5,5805,4405,7306,1306,7306,5106,8106,6207,1007,4207,1907,4207,7308,0808,5808,280Diesel4,9704,8104,9905,3905,9905,7706,0705,8806,3606,6806,4606,6806,9807,3307,7307,430RetailcapGasoline6,3976,2576,5476,9477,5517,3317,6317,4417,9218,2508,0218,2518,5618,9119,4119,111Diesel5,7945,6345,8146,2146,8186,5986,8986,7087,1897,5207,3017,5217,8218,1718,5718,271Source:theNDRCSinopecOperationalDataandPlanUnit1-3Q11Change2011newtargetchangeExplorationandProductionCrudeOilmmbbls239.

56-3.

6%321.

321.

99%Chinammbbls226.

810.

5%Africammbbls12.

75-44.

3%NaturalGasbcf382.

2522.

1%501.

0813.

5%Totaloilandgasproductionmmboe303.

270.

8%RealisedcrudeoilpriceUS$/bbl98.

2339.

2%RealisednaturalgaspriceUS$/kcf5.

4716.

1%RefiningCrudeoilthroughputKbbl/d4,3703.

6%4,4815.

4%Gasoline,dieselandkeroseneproductionmilliontonnes95.

453.

5%ofwhich:Gasolinemilliontonnes27.

592.

6%Dieselmilliontonnes57.

632.

9%Kerosenemilliontonnes10.

239.

2%Lightchemicalfeedstockmilliontonnes27.

375.

8%Lightproductsyield%76.

180.

47ptsRefiningyield%95.

200.

42ptsChemicalEthylene'000tonnes7,35611.

3%9,8508.

7%Syntheticresin'000tonnes10,0675.

6%Syntheticrubber'000tonnes7463.

8%Syntheticfibremonomerandpolymer'000tonnes7,0868.

6%Syntheticfibre'000tonnes1,0441.

4%Urea'000tonnes680-39.

7%MarketingandDistributionTotalsalesvolumeofoilproductsmilliontonnes121.

5810.

3%TotalDomesticSalesofRefinedOilProductsmilliontonnes113.

578.

8%147.

04.

60%Ofwhich:Retailvolumemilliontonnes75.

5517.

8%Directsalesvolumemilliontonnes24.

12-1.

3%Wholesalevolumemilliontonnes13.

9-11.

9%TotalnumberofservicestationsunderSINOPECbrand30,1030.

0%Ofwhich:Company-operated30,0731.

6%Franchised30-94.

2%AverageannualthroughputperpetrolstationTonne/station3,34813.

1%Source:theCompanySinopec1H11SalesVolumeandPricesSalesvolume(000tonne)ChangeyoyAveragerealisedprice(RMB/tonne,RMB/000m3)ChangeyoyCrudeoil2,386-9.

5%4,60034.

2%Naturalgas(millioncubicmeters)5,93643.

5%1,26823.

5%Gasoline23,70511.

7%8,23614.

3%Diesel48,61211.

2%6,99419.

6%Kerosene8,05325.

1%5,92827.

1%Basicchemicalfeedstock9,93720.

4%6,95925.

8%Syntheticfibremonomersandpolymer3,14114.

2%10,37027.

4%Syntheticresin5,1769.

8%10,1349.

8%Syntheticfibre7644.

9%13,99525.

3%Syntheticrubber6314.

1%22,02840.

4%Chemicalfertilizer468-48.

9%2,04924.

3%Source:theCompany19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage6of8Sinopec1-3Q11RevenueBreakdownSinopec1-3Q11OperatingProfitCorporate&Others21.

4%Chemicals15.

0%Marketing&Distribution54.

1%Refining7.

7%Exploration&Production1.

8%-30,000-20,000-10,000010,00020,00030,00040,00050,00060,000Exploration&ProductionRefiningMarketing&DistributionChemicalsCorporate&OthersRMBm20102011Source:theCompanySource:theCompanyDomesticGasoline&DieselRetailPrices203040506070809010011012013014020042005200620072008200920102011US$/bblgasolineretailpricedieselretailpricecrudeoilcostsSource:CEIC,BloombergDomesticPetrochemicals-NaphthaSpreadDomesticPetrochemicalsPrices01,0002,0003,0004,0005,0006,0007,0008,0009,00010,000200620072008200920102011RMB/tonnePropyleneTolueneStyreneHDPE3,0008,00013,00018,00023,00028,00033,00038,00020042005200620072008200920102011RMB/tonneHDPEStyreneSBRAcrylonitrileSource:CEIC、Bloomberg、GuotaiJunanInternationalSource:CEICIncomeStatementYearendDec31(RMBm)200920102011F2012F2013FTurnover1,315,9151,876,7582,285,9802,397,6752,536,281Otheroperatingrevenues29,13736,42432,21632,59233,7441,345,0521,913,1822,318,1962,430,2682,570,025Otherincome00000Purchasedcrudeoil,productsandoperatingsuppliesandexpenses-980,564-1,482,484-1,834,061-1,909,118-2,017,235SG&A&Personnel-69,434-84,720-103,193-108,235-114,492DD&A-54,016-59,223-63,253-68,287-74,509Explorationexpenses-10,545-10,955-13,344-13,996-14,805Taxesotherthanincometax-132,884-157,189-191,465-205,252-217,597Otheroperatingexpenses,net-6,910-13,607-7,848-8,417-8,629Totaloperatingexpenses-1,254,353-1,808,178-2,213,163-2,313,305-2,447,267Operatingprofit90,699105,004105,033116,963122,758Netfinancecosts-7,466-6,974-6,552-5,342-4,597Profitbeforetaxation86,604103,693105,652119,000125,793Taxation-19,599-25,689-24,346-27,759-29,42919December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage7of8Minorityinterests-3,858-6,204-6,467-7,257-7,664ProfitattributabletoequityshareholdersoftheCompany63,14771,80074,83983,98488,700BasicEPS0.

730.

830.

860.

971.

02DilutedEPS0.

720.

820.

790.

890.

94Source:theCompany,GuotaiJunanInternational.

BalanceSheetYearendDec31(RMBm)200920102011F2012F2013FProperty,plantandequipment484,815540,700556,428602,148649,440Constructioninprogress120,37589,599119,980124,089130,446Others91,594104,62698,175106,767115,192Non-currentassets696,784734,925774,583833,005895,077Cashandcashequivalents8,78217,00821,40224,84226,797Inventories141,727156,546190,680199,997211,559Billsreceivable28,70259,04371,91775,43179,792Others22,26827,63233,46735,10337,123Currentassets201,479260,229317,467335,374355,270Short-termdebts59,35017,01915,62411,5928,400Billspayable119,873136,346166,076174,191184,260Accruedexpensesandotherpayables117,798153,478186,943196,078207,413Others18,90029,56328,09228,82728,459Currentliabilities315,921336,406396,735410,688428,532Netcurrentliabilities-114,442-76,177-79,268-75,314-73,263Totalassetslesscurrentliabilities582,342658,748695,315757,691821,815Long-termdebts152,725174,075160,149144,134126,838Others24,80134,30523,43429,00535,813Non-currentliabilities177,526208,380183,583173,139162,651404,816450,368511,732584,552659,164EquitySharecapital86,70286,70286,70386,70386,703Reserves292,238332,345387,242452,805519,752378,940419,047473,945539,508606,455Minorityinterests25,87631,32137,78845,04452,709Totalequity404,816450,368511,732584,552659,164Source:theCompany,GuotaiJunanInternational.

CashFlowStatementYearendDec31(RMBm)200920102011F2012F2013FPBT86,604103,693105,652119,000125,793DD&A54,01659,22363,25368,28774,509Netinterest7,3327,3127,2215,6604,847Changeinworkingcapital14,5021,1748,6191,1411,689Others9,10413,08910,91613,25414,841Cashgeneratedfromoperations171,558184,491195,661207,342221,680Incometaxpaid-6,045-14,158-24,330-27,644-28,696Netcashgeneratedfromoperatingactivities165,513170,333171,331179,698192,985InvestingactivitiesCapitalexpenditure-107,487-106,371-124,100-134,028-144,750Interestincome2776601,0841,1871,349Others-10,145-772,7432,8963,031Netcashusedininvestingactivities-117,355-105,788-120,273-129,945-140,371FinancingactivitiesLoanschange-23,471-19,311-16,792-19,311-20,856Dividendpaid-13,559-16,391-19,942-18,421-21,753Interestpaid-7,762-6,739-9,929-8,581-8,050Others-1,619-13,853000Netcash(usedin)/generatedfromfinancingactivities-46,411-56,294-46,663-46,314-50,659Netincrease/(decrease)incashandcashequivalents1,7478,2514,3943,4391,955Cashandcashequivalentsat1January7,0408,78217,00821,40224,842Cashandcashequivalentsat31December8,78217,00821,40224,84226,797Source:theCompany,GuotaiJunanInternational.

19December2011Sinopec中国石化(00386HK)CompanyReportSeethelastpagefordisclaimerPage8of8CompanyRatingDefinitionTheBenchmark:HongKongHangSengIndexTimeHorizon:6to18monthsRatingDefinitionBuyRelativePerformance>15%;orthefundamentaloutlookofthecompanyorsectorisfavorable.

AccumulateRelativePerformanceis5%to15%;orthefundamentaloutlookofthecompanyorsectorisfavorable.

NeutralRelativePerformanceis-5%to5%;orthefundamentaloutlookofthecompanyorsectorisneutral.

ReduceRelativePerformanceis-5%to-15%;orthefundamentaloutlookofthecompanyorsectorisunfavorable.

SellRelativePerformance5%;orthefundamentaloutlookofthesectorisfavorable.

NeutralRelativePerformanceis-5%to5%;orthefundamentaloutlookofthesectorisneutral.

UnderperformRelativePerformance<-5%;orthefundamentaloutlookofthesectorisunfavorable.

DISCLOSUREOFINTERESTS(1)TheAnalystsandtheirassociatesdonotserveasanofficeroftheissuermentionedinthisResearchReport.

(2)TheAnalystsandtheirassociatesdonothaveanyfinancialinterestsinrelationtotheissuermentionedinthisResearchReport.

(3)ExceptforShandongChenming(01812),GuotaiJunananditsgroupcompaniesdonotholdequaltoormorethan1%ofthemarketcapitalizationoftheissuermentionedinthisResearchReport.

(4)GuotaiJunananditsgroupcompanieshavenothadinvestmentbankingrelationshipswiththeissuermentionedinthisResearchReportwithinthepreceding12months.

DISCLAIMERThisResearchReportdoesnotconstituteaninvitationoroffertoacquire,purchaseorsubscribeforsecuritiesbyGuotaiJunanSecurities(HongKong)Limited("GuotaiJunan").

GuotaiJunananditsgroupcompaniesmaydobusinessthatrelatestocompaniescoveredinresearchreports,includinginvestmentbanking,investmentservicesandetc.

(forexample,theplacingagent,leadmanager,sponsor,underwriterorinvestproprietarily).

Anyopinionsexpressedinthisreportmaydifferorbecontrarytoopinionsorinvestmentstrategiesexpressedorallyorinwrittenformbysalespersons,dealersandotherprofessionalexecutivesofGuotaiJunangroupofcompanies.

AnyopinionsexpressedinthisreportmaydifferorbecontrarytoopinionsorinvestmentdecisionsmadebytheassetmanagementandinvestmentbankinggroupsofGuotaiJunan.

ThoughbestefforthasbeenmadetoensuretheaccuracyoftheinformationanddatacontainedinthisResearchReport,GuotaiJunandoesnotguaranteetheaccuracyandcompletenessoftheinformationanddataherein.

ThisResearchReportmaycontainsomeforward-lookingestimatesandforecastsderivedfromtheassumptionsofthefuturepoliticalandeconomicconditionswithinherentlyunpredictableandmutablesituation,souncertaintymaycontain.

Investorsshouldunderstandandcomprehendtheinvestmentobjectivesanditsrelatedrisks,andwherenecessaryconsulttheirownfinancialadviserspriortoanyinvestmentdecision.

ThisResearchReportisnotdirectedat,orintendedfordistributiontooruseby,anypersonorentitywhoisacitizenorresidentoforlocatedinanyjurisdictionwheresuchdistribution,publication,availabilityorusewouldbecontrarytoapplicablelaworregulationorwhichwouldsubjectGuotaiJunananditsgroupcompaniestoanyregistrationorlicensingrequirementwithinsuchjurisdiction.

2011GuotaiJunanSecurities(HongKong)Limited.

AllRightsReserved.

27/F.

,LowBlock,GrandMillenniumPlaza,181Queens'RoadCentral,HongKong.

Tel.

:(852)2509-9118Fax:(852)2509-7793Website:www.

gtja.

com.

hk

- 中国mmbb.com相关文档

- neilmmbb.com

- 41.58mmbb.com

- tecturammbb.com

- thermicmmbb.com

- 15.5mmbb.com

- Literaturverzeichnis

HostYun 新增美国三网CN2 GIA VPS主机 采用美国原生IP低至月15元

在之前几个月中也有陆续提到两次HostYun主机商,这个商家前身是我们可能有些网友熟悉的主机分享团队的,后来改名称的。目前这个品牌主营低价便宜VPS主机,这次有可以看到推出廉价版本的美国CN2 GIA VPS主机,月费地址15元,适合有需要入门级且需要便宜的用户。第一、廉价版美国CN2 GIA VPS主机方案我们可看到这个类型的VPS目前三网都走CN2 GIA网络,而且是原生IP。根据信息可能后续...

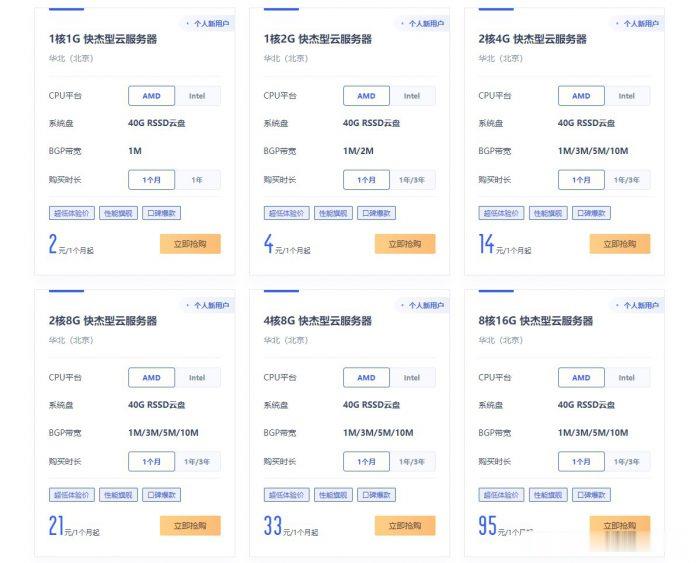

ucloud国内云服务器2元/月起;香港云服务器4元/首月;台湾云服务器3元/首月

ucloud云服务器怎么样?ucloud为了扩大云服务器市场份额,给出了超低价云服务器的促销活动,活动仍然是此前的Ucloud全球大促活动页面。目前,ucloud国内云服务器2元/月起;香港云服务器4元/首月;台湾云服务器3元/首月。相当于2-4元就可以试用国内、中国香港、中国台湾这三个地域的云服务器1个月了。ucloud全球大促仅限新用户,国内云服务器个人用户低至56元/年起,香港云服务器也仅8...

Friendhosting全场VDS主机45折,虚拟主机4折,老用户续费9折

Friendhosting发布了今年黑色星期五促销活动,针对全场VDS主机提供45折优惠码,虚拟主机4折,老用户续费可获9折加送1个月使用时长,优惠后VDS最低仅€14.53/年起,商家支持PayPal、信用卡、支付宝等付款方式。这是一家成立于2009年的老牌保加利亚主机商,提供的产品包括虚拟主机、VPS/VDS和独立服务器租用等,数据中心可选美国、保加利亚、乌克兰、荷兰、拉脱维亚、捷克、瑞士和波...

mmbb.com为你推荐

-

中老铁路老挝磨丁经济特区的前景如何?mathplayer西南交大网页上的 Mathplayer 安装了为什么还是用不了?haole018.comhttp://www.haoledy.com/view/32092.html 轩辕剑天之痕11、12集在线观看sss17.com一玩棋牌吧(www.17wqp.com)怎么样?baqizi.cc讲讲曾子杀猪的主要内容!yinrentangWeichentang正品怎么样,谁知道?www.15job.com南方人才市场有官方网站是什么?59ddd.com网站找不到了怎么办啊干支论坛2018天干地支数值是多少?www.stockstar.com股票分析软件哪个好用?用过的介绍一些