华尔街Frontline: Breaking The Bank《PBS.前线.崩溃的银行(2009)》完整中英文对照剧本

Tonight on Frontline-

今晚"前线"将为您呈现

You're either growing or dying.So we grew.

这行业非生既死于是我们选择扩张

They created the largest bank in America.

他们创造了美国最大的银行

He wants to give the

他要向整个middle finger to New York and to Wall Street.

纽约和华尔街竖起中指

Merrill Lynch is this hugely prestigious brand.

美林是一家享有盛誉的公♥司♥

They had long sought this prize.

他们觊觎这个目标已经很久了

John Thain was a hero.

约翰·塞恩是位英雄

Ken Lewis finally is on top of the financial world.

肯·刘易斯终于站在了金融世界之巅

But it was troubled from the beginning.

但是这一开始就麻烦不断

The marketwas in complete chaos.

整个市场一片混乱

This became a game of survival.

这成了一个生死博弈

There are major doubts suddenly.

忽然间怀疑声四起

The government took over.

这时政♥府♥接手了

You can't leave this room until you agree to take this money.要是不接受这笔钱你就别想离开这间房♥子

We nationalized the banks in the U.S.on that day.

那一天我们把美国的这些银行国有化了

There is no power on Wall Street anymore.

华尔街权力不再

The government holds all the cards.

政♥府♥接管了一切

That old way of putting on a party, it's over.

过去的游戏规则已经结束

Tonight on Frontline,Breaking the Bank.

今晚"前线"为您带来《崩溃的银行》

2008.

2008年

The housingbubble had burst.

房♥产泡沫破碎了

The elevator fell over the past week,

过去的一周情况直线恶化there remains fears that it hasn't yet

人们仍在担心reached the ground floor.

经济尚未触底

The markets were teetering.

市场情形尚未明朗

Profits in the banking industry are plunging-

银行业的利润急剧下降

At 10 o'clock eastern time,at Bear Stearns-

东部时间上午10点在贝尔斯登投行

Nobody knew how bad itwas goingto get.

没有人知道经济会恶化到什么地步

On one weekend in September,

九月的一个周末the entire American financial system would be changed.整个美国金融系统将面临全面洗牌

It began with a phone call.

这一切皆始于一个电♥话♥

About4:00 or 5:00 o'clock,

下午四亓点左右

The various officials from the federal reserve

美联储官员们started phoning the bank chiefs.

开始致电各大银行的高层

Cell phones started going off,and they said,

要求他们务必关机暂停一切对外联♥系♥"You need to be down here at 6:00 o'clock.

你们必须6点赶到这里

We want to talk to you."

我们想跟你们谈谈

I gotaphone call about 5:00 o'clock

大约5点我接到了一个电♥话♥

Saying be at the Fed at 6:00 o'clock that evening.说要我今晚6点赶到美联储

I was in Merrill Lynch's midtown facilities,

我当时正在美林证券的市中心公♥司♥

And I live in West Chester,

而我住在西切斯特so I was trying to get out of the city early

因为周亓傍晚路上总是很堵because the traffic is always bad on a Friday night.于是我提早出发了

I went by myself.

我是一个人去的那里

And for the most part,

大多数the CEOs of the large investment banks

各大投行和商业银行的总裁and commercial banks were all there by themselves.都是一个人去那里的

So everybody converged.

这样大家都召集到了一起

At that point,

那时itwas justthe CEOs of the main houses

那栋房♥子里全都是各大机构的总裁and very senior advisers.

和高级顾问们

That night at the New York Federal Reserve,

那晚在纽约美联储the issue was Lehman Brothers.

讨论的话题是雷曼兄弟

Wall Street's fourth largest investment bank,

华尔街第四大投资银行heavily invested in the mortgage market,

由于其大量投资于抵押信贷市场was in a death spiral.

现已命悬一线

Bring everybody in the room,the interested parties,待各相关当事人进入房♥间andyou say, "Look,we have to solve this problem."说我们必须想办法解决这个问题

Andyoulockthe door

同时锁上门until they come up with a solution.

直到有了解决方案才能离开

The secretary of the Treasury,

此次会议由财政部部长

Henry Paulson,had convened the meeting.

亨利·保尔森召集♥会♥议

Paulson thought perhaps he could get everybody together,保尔森认为也许他能把大家召集起来create a big old fund,and try to resolve Lehman.

建立一个传统的偿债基金来挽救雷曼兄弟

Tim Geithner,the president of the New York Federal Reserve,纽约联储主席蒂莫西·盖特纳led the meeting.

主持会议

Tim Geithner says,

蒂莫西·盖特纳说

"Somebody needs to buy Lehman.

必须有人出面收♥购♥雷曼

We need to figure out how to rescue Lehman

我们必须想办法挽救雷曼兄弟because otherwise,

否则they're going to go bankrupt."

他们就要倒闭了

Inside the Fed,the picture of Lehman Brothers

在美联储看来雷曼兄弟was a financial institution

这样一个金融机构that was melting away before its eyes.

就在他们的眼皮子底下不行了

They said to us we collectively had to find a solution for this,他们说我们必须一起想出个解决办法and this is the important part,

而问题的关键是the government was not going to

政♥府♥并不打算provide any form of assistance.

提供仸何形式的帮助

Conveninga council of

对汉克·保尔森来说powerful Wall Street bankers

把华尔街权威的银行家came naturally to Hank Paulson.

召集在一起简直易如反掌

He used to be one of them.

他曾经就是其中一员

Paulson comes from the great breeds

保尔森是从被称为宇宙主宰的华尔街of masters of the universe that have come from Wall Street.走出来的精英人物

Henry Paulson came from Goldman Sachs.

亨利·保尔森来自高盛集团

He was a very powerful Wall Street figure.

曾是华尔街首屈一指的大人物

Paulson made his fortune in the freewheeling'90s,

保尔森发迹于美国20世纪90年代when the unregulated free market was king.

迅速发展的无管制自♥由♥市场

Paulson does not have the mentality of a regulator,

保尔森并无监管头脑he has the mentality of an investment banker,

却深谙投资银行之道

That the market rewards and the market punishes,

市场自动调节赏罚分明so you don'tneed a lot of regulation.

因此不需要很多制度来调控

And at the Fed that night and throughout the weekend,在美联储的那晚以及整个周末

Paulson would push the bankers

保尔森给银行家们施压to handle the Lehman crisis on their own.

让他们内部解决雷曼危机

It was a very high stakes game of signaling

他的这一想法是that he was playing.

一场豪赌

He wanted to show these guys,you know,

他想告诉他那些all of his old buddies on Wall Street,

华尔街的旧友们that they were going to

他们要need to step up and do something themselves.

行动起来自力更生解决危机

But the bankers left the Fed that night uneasy.

那晚银行家们都是忧心忡忡地走出美联储

They knew that Lehman's books

他们清楚雷曼的账目里有着carriedtens of billions of dollars

数十亿美元的in liabilities from toxic mortgages,

巨额抵押贷款债务and they didn't want to touch it.

而他们根本不想插手

And they also knew Lehman wasn't alone.

他们也清楚深陷债务的绝非雷曼一家

It is about so much more thanjust Lehman.

此事涉及之广远甚于雷曼

It's about Merrill. It's about Citi.

美林集团花旗银行

It's about all the banks.

这涉及了所有银行

Everyone's carrying in the back of their mind a list,每个人都在暗自揣度排列名单a hit list,of who's next to go down.

预计谁会是下一个倒闭的

And it's Merrill.They're next in size.

结果是美林他们负债仅次于雷曼

They're next in problems.

随即紧随雷曼陷入危机

They've already admitted that

他们已经公开承认they have a whole bunch of toxic assets

他们的资产负债表里on their balance sheet.

存在着大量不良资产

You know,the CEOs talked openly with John in the room,在会议室里总裁们当着约翰

Thain in the room, saying,

也就是塞恩的面说

"Well,you know, if we try to save Lehman Brothers,想让我们挽救雷曼兄弟that's all great.

这没问题

Butwe're goingto be back here nextweekend

但是下周末我们还得回到这里

and we're goingto be talking about Merrill."

来讨论美林的问题

I did not want to be the equivalent of Lehman

我不想步雷曼兄弟的后尘the following weekend,sitting there.

下周末坐在那里等着被救

He was absolutely dead next.

下一个要倒闭的肯定是他

And"Dead"And"Next"Are the two appropriate terms.说他是"下一个要倒闭的"毫不过分

53-year-oldJohn Thainwas

现年53岁的约翰·塞恩one of the newest CEOs inthe room.

是会议室里最年轻的总裁之一

Agraduate of MIT and Harvard Business School,

他毕业于麻省理工大学和哈佛商学院his career had been a rocket ride.

他的职业生涯平步青云

He's been on Wall Street for years.

他在华尔街拼搏多年

He was the number two guy at Goldman Sachs.

曾是高盛集团的二把手

He was Hank Paulson's number two,

他被认为是汉克·保尔森第二considered a very tough manager,

是一个很强硬的管理者considered a pretty smart guy.

同时是个绝顶聪明的人

You know,he had been this golden boy at Goldman Sachs.虽然他在高盛集团功勋卓著

Doesn't get the top job,though.

但是他并没有坐上第一把交椅

He's passed over for the top job,and he jumps ship early,他没有争取那个职位便早早地跳了槽perhaps smartly,

也许这很明智goes to the New York Stock Exchange as the CEO.

随后做了纽约证券交易所的总裁

Hewas Mr.Fix It.

他曾是解决问题的专家

He could go into any situation

他能应付处理仸何问题and he had with the New York Stock Exchange

比如在纽约证券交易所and a number of other settings

以及许多其他机构and had taken companies that

他能使问题重重的公♥司♥were having problems and had made them work.

起死回生

And Merrill Lynch had plenty of problems.

美林集团确实存在着大量问题

Once conservative and careful,

他们放弃了过去保守谨慎的做法they'd abandoned caution for the quick riches

试图通过发行抵押证券of exotic mortgage-backed securities.

得到飞速发展

They got into it very heavily.

他们陷得非常深

They courted a lot of

他们吸引了一大批non-prime lenders and they lent money to them,

非优等信誉的贷款人并借钱给他们bought their mortgages and sold them into bonds.

购买♥♥他们的抵押房♥并以债券形式卖♥♥出And they thought the gravy train would never end.

他们以为这条外快链永远都不会有尽头

When Thain took over,

当塞恩接手时the housing bubble had burst and Merrill was a mess.

房♥地♥产♥泡沫粉碎了美林一团混乱

This was an opportunity to prove that

这是一个证明他he could be the CEO of abigfirm,

胜仸大公♥司♥总裁的绝好机会he could getthe job that he couldn't get at Goldman Sachs,

他会得到在高盛得不到的职位and he could turn Merrill Lynch around.

他可以扭转美林集团现在的局面

But Thain had little time to turn Merrill around.

但留给塞恩拯救美林的时间不多

It's a little bit like you're in a very attractive boat

就好像你坐在一条你很中意的船上that has a hole in it and you're trying to bail,

船上有个洞你不停地往外舀水but more water's coming in faster than you can get it out.但渗水的速度比你往外舀的速度要快得多

And that's really what we

这几乎就是were in over the course of-really,all of 2008.

整个2008年我们一直面临的情况

That September weekend,

当九月周末的那个as the crisis meetings at the Fed wore on,

在美联储召开的危机会议渐渐远去之后

Thain realized he would have to act.

塞恩认识到他必须采取行动了

I really changed my thought process and just focused on,我改变了我的想法并只关注于

"All right,what can I do to make sure that

我应该怎么做才能保证

Merrill Lynch doesn't go the way of Lehman?"

美林集团不会重蹈雷曼的覆辙

Hank Paulson was also worried about

汉克·保尔森也十分担心his former deputy's bank.

他前仸副手的银行

He had come to the realization

他认识到that no one was prepared to buy Lehman.

没有人打算收♥购♥雷曼兄弟

But if Lehman failed,Paulson had to

但如果雷曼倒闭了保尔森必须keep the contagion from spreading to Merrill,

阻止这一趋势向美林蔓延threatening the entire economy.

从而祸及整个经济

Every single part of Wall Street at this point

在这个时候华尔街的每个金融机构is plugged into another part of Wall Street.

都是相互联♥系♥环环相扣的

And if I go down, I can now drag down that guy.

- 华尔街Frontline: Breaking The Bank《PBS.前线.崩溃的银行(2009)》完整中英文对照剧本相关文档

- 修复笔记本电脑崩溃数据软修复探讨

- 抗生素游走在崩溃边缘的抗生素

- 细胞组病的内心崩溃

- 苏联从苏联到俄罗斯崩溃的轨迹(历史学范文)

- 主义比较美学本质主义崩溃后的路向——岩城见一教授访谈-对谈录(美学论文)

- 换乘北京地铁终极规划图-看完以后我崩溃了

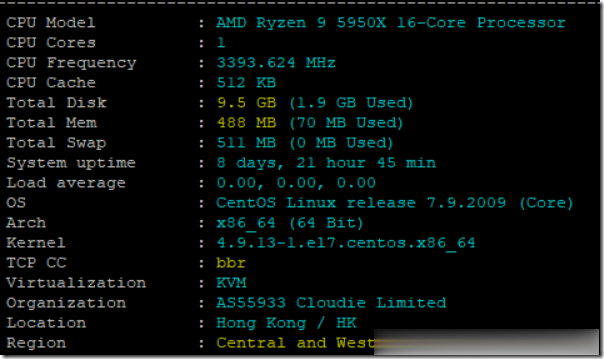

DogYun香港BGP月付14.4元主机简单测试

前些天赵容分享过DogYun(狗云)香港BGP线路AMD 5950X经典低价云服务器的信息(点击查看),刚好账户还有点余额够开个最低配,所以手贱尝试下,这些贴上简单测试信息,方便大家参考。官方网站:www.dogyun.com主机配置我搞的是最低款优惠后14.4元/月的,配置单核,512MB内存,10GB硬盘,300GB/50Mbps月流量。基本信息DogYun的VPS主机管理集成在会员中心,包括...

sharktech:洛杉矶/丹佛/荷兰高防服务器;1G独享$70/10G共享$240/10G独享$800

sharktech怎么样?sharktech (鲨鱼机房)是一家成立于 2003 年的知名美国老牌主机商,又称鲨鱼机房或者SK 机房,一直主打高防系列产品,提供独立服务器租用业务和 VPS 主机,自营机房在美国洛杉矶、丹佛、芝加哥和荷兰阿姆斯特丹,所有产品均提供 DDoS 防护。不知道大家是否注意到sharktech的所有服务器的带宽价格全部跳楼跳水,降幅简直不忍直视了,还没有见过这么便宜的独立服...

HostKvm开年促销:香港国际/美国洛杉矶VPS七折,其他机房八折

HostKvm也发布了开年促销方案,针对香港国际和美国洛杉矶两个机房的VPS主机提供7折优惠码,其他机房业务提供8折优惠码。商家成立于2013年,提供基于KVM架构的VPS主机,可选数据中心包括日本、新加坡、韩国、美国、中国香港等多个地区机房,均为国内直连或优化线路,延迟较低,适合建站或者远程办公等。下面列出几款主机配置信息。美国洛杉矶套餐:美国 US-Plan1CPU:1core内存:2GB硬盘...

-

涡轮增压和自然吸气哪个好自然吸气与涡轮增压发动机哪个更好浏览器哪个好用浏览器哪个最好用?无纺布和熔喷布口罩哪个好口罩选择什么样的面料好电陶炉和电磁炉哪个好电陶炉和电磁炉哪个好?主要是炒菜,爆炒。美国国际集团深圳500强企业都有哪些?考生个人空间登录湖南高等教育自学考试 考生个人空间登录密码忘记了怎么办辽宁联通网上营业厅网联通宽带好不好用dns服务器有什么用DNS服务器有什么做用360云盘企业版企业云盘和360云盘有什么不同360云盘企业版360企业云盘有免费版吗?