textilepay163

pay163 时间:2021-01-18 阅读:()

FinancialdifficultiesandsolutionsforindustrialtransferundertheintegrationofBeijing-Tianjin-HebeiregionDongJianping*DepartmentofFinance,TianjinAgriculturalUniversity,Tianjin300384,Chinae-mailaddress:dongjianping68@163.

com.

*correspondingauthor:DongJianpingKeywords:Beijing-Tianjin-Hebeiregion;Integration;Industrialtransfer;FinancialdifficultiesAbstract:TheintegrationofBeijing-Tianjin-Hebeiregionhasbecomeanationalstrategy,andtheindustrialtransferisimperative.

Itrequirescoordinateddevelopmentofthesethreeregions.

However,thebigdifferenceoffinancialservicelevelamongtheseregionsmakestheindustrialtransferslowdown.

Inthepresentstudy,thefinancialdifficultiesofBeijing-Tianjin-Hebeiregionalintegrationareanalyzed.

Theresultsshowthatthemainobstaclesabouttheregionaleconomicintegrationarethefuzzyorientationoffinancefunction,theunbalancedfinanciallevelandthelackofunifiedindustrystandard.

Threesolutionsofbroadeningthefinancialchannels,speedingupthefinancialinnovationandimprovingthefinancialenvironmentareputforwardbasedontheaboveanalyses.

IntroductionAsthecoreoftheBohaieconomiczone,theBeijing-Tianjin-Hebeiregionhassomecongenitaladvantagesofconnectedregionduetosimilarcultureandthecomplementaryresource[1].

Withtheestablishmentofthethirdeconomicgrowthpole,alargenumberofdomesticandforeignfunds,talentsandtechnologiesflocktoBeijing-Tianjin-Hebeiregion.

Undertheguidanceofnationalpolicyandthepushingofmarketingforces,theregionaleconomicdevelopmenthasbeenaccelerated.

ItisnecessarytorealizetheintegratedcoordinateddevelopmentoftheBeijing–Tianjin-Hebeiregion[2].

However,theregionalbarriershaveformedduetothelongtermadministrativedivision.

Currently,thereisnoreallyeconomicinterdependentrelationshipamongBeijing,TianjinandHebeiregion.

LargepopulationcontinuouslyflockedtoBeijing,thecapitalofChina,resultinginaseriouscitydisease,suchastrafficjams,environmentalpollutionandhazeweather[3].

Althoughasearlyas10yearsagothegovernmentofBeijing,TianjinandHebeipublisheda"Langfangconsensus"relatingtotheregionalintegration[4],thethoughtbarriersofthe"smallpatchoflandjustyourown",theadministrativebarriersof"mysitethatImakedecision",andtheinterestsfetterof"richwatershouldbekeptinone'sownfields",leadingtodifferentunderstandingsforthegovernmentsofthethreeregionstotheregionalintegration[5].

SinceXiJinpingpersonallypromotedthecoordinateddevelopmentofBeijing-Tianjin-Hebeibeforetwosessionsin2014,thecoordinateddevelopmentforthethreeregionshasbecomeanationalstrategy.

TheintegrativedevelopmentoftheBeijing-Tianjin-Hebeiregionhasreceivedhighattentionagain,theindustrialtransferandundertakinghasbeencarryingoutquietly[6].

Industrialtransferreferstoaprocessofcertainindustriestransferfromonecountryorregiontoanothercountryorregion[7],anditisakindofwidespreadeconomicphenomenonintheprocessofeconomicdevelopment.

Beijingislocatedintheupstreamofindustrychainandhasenteredthepost-industrystageofindustrialization,therefore,variousresourcesbecomingsaturated.

Inordertofurtheroptimizetheeconomicstructure,apartoftheindustryneedtotransferoutofBeijing.

Tianjinislocatedinthemiddlestreamofindustrychainandhasenteredtheadvancedstageofindustrialization,itissuitableforundertakingaerospace,newenergyandnewmaterials,biologicalmedicineandnewgenerationofinformationtechnology.

WhileHebeiislocatedinthedownstreamofindustrychainandisintheintermediatestageofindustrialization.

Ithasasolidfoundationintheironandsteel,pharmaceutical,textileandotherindustrieswithlowbusinesscosts,cheaplaborandbasicmanufacturingadvantages[4].

Therefore,throughareasonableindustriallinks,theBeijing-Tianjin-Hebeiregioncancreateacityindustrialchainwithhighcompetitiveadvantage,improvingthelevelofmanufacturingindustry.

Industrytransferhasasignificantroletotheeconomicgrowthintheundertakingregion,correspondingly,givesrisetoalotoffinancialneeds.

Undersuchcircumstances,theindustrytransfersetaseriesofhigherrequirementtotheoptimizationoffinancialresourceallocation,theimprovementofthefinancialorganizationsystemandtheextensionoffinancialservices.

Therefore,thestudyofthefinancialsupportofindustrytransferamongBeijing-Tianjin-Hebeiregionisveryimportantforsolvingregionaleconomicintegration.

Thisresearchisbeneficialtoputforwardsomecountermeasuresforrisksolvingandtorealizeastablegrowthofregionaleconomic,whichhasimportantpracticalsignificanceandtheoreticalvalue.

ProblemsoftheRegionalEconomicIntegrationofBeijing-Tianjin-HebeiThePresentSituationofIndustryTransferamongBeijing-Tianjin-Hebei.

Currently,thereareseveralproblemsholdingbacktheregionaleconomicintegrationofBeijing-Tianjin-Hebei.

TheseproblemsarelistedinTable1.

Table1ProblemsholdingbacktheregionalintegrationofBeijing-Tianjin-HebeiResearchsitesProblemsoftheregionalintegrationBeijingcityLargegapofeconomiclevelamongBeijing-Tianjin-HebeiRegionTianjincityLackofoverallplanningofBeijing-Tianjin-HebeiRegionHebeiprovinceThemarketfunctioncannotdecidetheallocationofresourcesHebeiprovinceNosoundregionalcooperationmechanismamongthethreeregions(1)LackofOverallPlanningofBeijing-Tianjin-HebeiRegion.

Fromtheregionalpointofview,Beijing,TianjinandHebeibelongtooneregion,butactuallytheybelongtothreedifferentadministrativeareas.

Therefore,itisdifficulttocarryoutoneunifiedplanningforeconomicdevelopment.

Duetoseveralreasonssuchashistory,conceptandsystem,threeregionsareusedtodothingsintheirownway,andeagertodevelopindependently.

Thismodelof"largeandcomplete"causestheidenticalindustrystructure,andtherepeatedconstructionresultsinaseriouswasteofresources[8].

(2)LargeGapofEconomicLevelamongBeijing-Tianjin-HebeiRegion.

BeingacapitalofChina,Beijinghasstrongerattractionontalentandresourcesthansurroundingcities.

Duetotheabovereason,threeregionsofBeijing–Tianjin-Hebeicannotdevelopatthesamepace,ararepovertyzonearoundBeijingandTianjinhasoccured[9].

(3)TheMarketFunctionCannotDecidetheAllocationofResources.

Inordertoachievetheregionaleconomicintegration,acompletemarketeconomyshouldbeimplemented.

Undertheconditionofmarket-orientedeconomy,themarketcanplayadecisiveroleintheallocationofresources.

However,theproportionofstate-ownedeconomyinBeijing-Tianjin-Hebeiregionishigh,theindustrialmonopolyisseriousandthemarketawarenessisweak,themarketsegmentationandlocalprotectionhinderthefreeflowofeconomicresourcesaswellasthetransregionaleconomiccooperation[10].

(4)NoSoundRegionalCooperationMechanismamongBeijing-Tianjin-Hebei.

Firstly,theconsultationmechanismforseniorleadersamongBeijing–Tianjin-Hebeihasnotbeenestablished.

Inrecentyears,althoughthebilateralvisitsandmultilateralnegotiationswerecarriedoutbytopleaders,aformalhigh-levelcoordinationmechanismhavenotmadesignificantprogress.

Secondly,thereisnooverallcooperationideasandresultantforceamongBeijing-Tianjin-Hebei.

Foralongtime,thefunctionofBeijingistoservethewholenation,thisideamakesBeijingcannotfocusonregionaldevelopment.

TheFinancialDifficultiesfortheIndustryTransferofBeijing-Tianjin-Hebei.

Financeisthecoreoftheeconomy,sotheeconomicdevelopmentdemandsthefinancetogoaheadfirst.

However,fromthepresentsituationofBeijing-Tianjin-Hebeicollaboration,therearestillmanyproblemsneedtosolve.

(1)TheFuzzyOrientationforRegionalFinanceFunction.

Duetothedividedregionalfinanceandscatteredadministrativemanagement,thefinancialcompetitionisgreaterthanthefinancialcooperationamongBeijing–Tianjin-Hebeiregion.

BothBeijingandTianjinwouldliketobecomethecenterofregionalfinance,thiskindofsituationhasbecomealimitingfactorforthefinancialintegration[11].

(2)TheHinderingforFinancialIntegrationbyLocalInterests.

Thebasicrequirementforfinancialintegrationistheintegrationoffinancialmarket,i.

e.

,theways,meansandenvironmentoffinancialoperationtendtobeuniform.

Moreover,theorientationandregulationoffinancialpolicymustkeeppacewitheachother.

Alloftheserequiretobreaktheregionalsegmentation.

However,accordingtotheappraisalsystemforgovernmentsatalllevelsinChina,thegrowthofregionaleconomicisanimportantindicator.

Asaresult,itisinevitablethatthelocalgovernmentswillmakedecisionsfromtheperspectiveoflocalinterests,hence,theymayinterveneinthebehaviorofcreditdecisionandmanagementoffinancialinstitutionsdirectlyorindirectly,makingthefinancialintegrationtobeholdbackbythelocalprotectionism.

(3)TheEconomicImbalanceRestrictstheFlowofFinancialFactors.

TheresourcedistributionamongBeijing-Tianjin-Hebeiregionisunbalanced,andthedevelopmentlevelisnotconsistent.

ThesocialfinancingscaleofBeijing,TianjinandHebeiwas64.

4%,34.

2%and22.

1%ofGDP(GrossDomesticProduct)respectivelyin2013.

ItisobviousthatthefinanciallevelofBeijingisthehighest,Tianjinishigher,butHebeiisthelowest.

DuetothedistinctgapofthefinancialtotalamountandeconomicsupportcapabilityamongBeijing-Tianjin-Hebeiregion,theinvestmentreturnandthecostofcapitalvarywithdifferentregion,whichreducesthedepthandbreadthoffinancialcooperation[12].

(4)LackofUnifiedStandardinFinancialIndustry.

BecausethefinancialindustryinBeijing,TianjinandHebeiismanagedbydifferentbankdepartments,thefinancialbusinessprocesses,thestandardofserviceandrisk,themechanismofprofitallocationarenotunified,whichleadstoabarrierofmutualexchange,mutualrecognitionandinterconnectionoffinancialproducts.

Thiskindofphenomenonproducestwoconsequences,oneisthatthelong-distancetransactionencountersdifficulties,accordingly,thepayingcostincreases.

Anotheristhattheestablishmentofcreditsystembecomeslaggingbehind,andtheinformationsharingamongthreeregionsisunabletorealize.

MeasuresBroadeningthefinancialchannels.

Inordertoavoidtheproblemsoftheundertakingforindustrialtransferduetothelackofmoney,theessentialthingistobuildamulti-levelfinancingplatformwhichenlargesthefinancialchannels.

Thegovernmentsshouldsupportsmallandmedium-sizedenterprisestobelistedonthestockexchange,increasingtheproportionofdirectfinancing.

Themarketconstructionofstock,fundandbondshouldbeaccelerated.

Theinvestofprivatecapitalshouldbeencouraged,permittingthepeopleofallsocialstratatoinvestandsharethelistedcompaniessoastosolvethefundproblemoftheenterprises.

SpeedingUptheFinancialInnovation.

AccordingtothedemandofenterpriseandmarketduringtheindustrytransferamongBeijing-Tianjin-Hebeiregion,thegovernmentsshouldpromotetheinnovationoffinancialproductsandenlargetheservicemodes.

Therefore,anevaluationmechanismforcomprehensivecustomerserviceandareasonablemechanismforcomplainthandlingareneededsoastoimprovetheconsciousnessoffinancialservice.

Strengtheningtheconstructionoffinancialecologicalenvironment.

Agoodcreditenvironmentandaperfectcreditsystemarethekeysfortheestablishmentoffinancialecologicalenvironment.

Thetheoryofindustryeconomicspointedoutearlierthatonlyagoodeconomicenvironmenthasbeencreated,theoveralldevelopmentofeconomiccanbepromoted.

ThegovernmentofBeijing,TianjinandHebeishouldpayattentiontobuildareasonableandeffectivesocialcreditsystem,andincreasetheincentiveandconstraintactionofthecreditratingsystem,graduallyexpandthecoverageofpersonalcreditinformation.

Inaddition,theconnectionbetweentheprovincesandcitiesshouldbestrengthenedsoastorealizethediversifieddevelopmentoffinancialservicesystem.

Thus,thesupportroleofthefinancialmarkettotheundertakingofindustrytransferwillbecomestrong.

AcknowledgementsTheresearchwasfundedbythekeyaccountingresearchprojectfrom2015to2016ofFinancialBureauofTianjinandtheAccountingSocietyofTianjin,China(No.

kjkyxm150902).

References[1]S.

Zhang.

BasedoncooperativegameofBeijing-Tianjin-Hebeiregionaleconomiccooperation.

JournalofHebeiNormalUniversity(PhilosophyandSocialSciencesEdition),34(2011)30-34.

[2]M.

Zhang.

Beijing-Tianjin-HebeiintegrationacceleratesthetransformationofBeijingindustry.

Chinaeconomictimes,June19,2014,version007.

[3]S.

Yan.

IntegrationoftheBeijing-Tianjin-Hebei:howtooverallplanningforenterprises.

Chinabusinesstimes,March20,2014,version004.

[4]J.

Zhang.

InvestmentopportunitiesundertheintegrationoftheBeijing-Tianjin-Hebeiregion.

ForeignInvestmentinChina,5(2014)18-20.

[5]Z.

Liu.

Beijing-Tianjin-Hebeiintegrationneedtobreakthreebigbarriers.

People'sBBS,4(2014)52-55.

[6]H.

Tao.

AcceleratedtheintegrationoftheBeijing-Tianjin-Hebeiregion,thegameofindustryundertakingiscarryingoutquietly.

Chinatradenews,April1,2014,version003.

[7]G.

Zhang,S.

Wang,S.

liuandS.

Jia.

ResearchofthecoordinateddevelopmentofBeijing-Tianjin-Hebeibasedontheindustrialdockingandtransfe.

Economyandmanagement,28(2014)14-20.

[8]X.

Liang,J.

Xie.

Theevolution,presentsituationanddevelopmentofBeijing-Tianjin-Hebeiregionaleconomicintegration.

JournalofHebeiUniversityofEconomyandTrade,30(2009)66-69.

[9]J.

Sun.

ConfirmingthenewpositionofthecoordinateddevelopmentofBeijing-Tianjin-Hebei.

ThePeople'sDaily,October16,2014,version020.

[10]Y.

Zhang.

DiscussiononpathchoiceofintegrationoftheBeijing-Tianjin-Hebeiregioncoordinateddevelopment.

Moderneconomicmanagement.

36(2014)50-53.

[11]Z.

Cai.

FinancepromotestheintegrationoftheBeijing-Tianjin-Hebeiregion.

FinancialEconomy,6(2014)14-16.

[12]J.

Chen.

Beijing-Tianjin-Hebeiintegrationandfinancialcooperation.

Chinesefinance,3(2014)58-59.

com.

*correspondingauthor:DongJianpingKeywords:Beijing-Tianjin-Hebeiregion;Integration;Industrialtransfer;FinancialdifficultiesAbstract:TheintegrationofBeijing-Tianjin-Hebeiregionhasbecomeanationalstrategy,andtheindustrialtransferisimperative.

Itrequirescoordinateddevelopmentofthesethreeregions.

However,thebigdifferenceoffinancialservicelevelamongtheseregionsmakestheindustrialtransferslowdown.

Inthepresentstudy,thefinancialdifficultiesofBeijing-Tianjin-Hebeiregionalintegrationareanalyzed.

Theresultsshowthatthemainobstaclesabouttheregionaleconomicintegrationarethefuzzyorientationoffinancefunction,theunbalancedfinanciallevelandthelackofunifiedindustrystandard.

Threesolutionsofbroadeningthefinancialchannels,speedingupthefinancialinnovationandimprovingthefinancialenvironmentareputforwardbasedontheaboveanalyses.

IntroductionAsthecoreoftheBohaieconomiczone,theBeijing-Tianjin-Hebeiregionhassomecongenitaladvantagesofconnectedregionduetosimilarcultureandthecomplementaryresource[1].

Withtheestablishmentofthethirdeconomicgrowthpole,alargenumberofdomesticandforeignfunds,talentsandtechnologiesflocktoBeijing-Tianjin-Hebeiregion.

Undertheguidanceofnationalpolicyandthepushingofmarketingforces,theregionaleconomicdevelopmenthasbeenaccelerated.

ItisnecessarytorealizetheintegratedcoordinateddevelopmentoftheBeijing–Tianjin-Hebeiregion[2].

However,theregionalbarriershaveformedduetothelongtermadministrativedivision.

Currently,thereisnoreallyeconomicinterdependentrelationshipamongBeijing,TianjinandHebeiregion.

LargepopulationcontinuouslyflockedtoBeijing,thecapitalofChina,resultinginaseriouscitydisease,suchastrafficjams,environmentalpollutionandhazeweather[3].

Althoughasearlyas10yearsagothegovernmentofBeijing,TianjinandHebeipublisheda"Langfangconsensus"relatingtotheregionalintegration[4],thethoughtbarriersofthe"smallpatchoflandjustyourown",theadministrativebarriersof"mysitethatImakedecision",andtheinterestsfetterof"richwatershouldbekeptinone'sownfields",leadingtodifferentunderstandingsforthegovernmentsofthethreeregionstotheregionalintegration[5].

SinceXiJinpingpersonallypromotedthecoordinateddevelopmentofBeijing-Tianjin-Hebeibeforetwosessionsin2014,thecoordinateddevelopmentforthethreeregionshasbecomeanationalstrategy.

TheintegrativedevelopmentoftheBeijing-Tianjin-Hebeiregionhasreceivedhighattentionagain,theindustrialtransferandundertakinghasbeencarryingoutquietly[6].

Industrialtransferreferstoaprocessofcertainindustriestransferfromonecountryorregiontoanothercountryorregion[7],anditisakindofwidespreadeconomicphenomenonintheprocessofeconomicdevelopment.

Beijingislocatedintheupstreamofindustrychainandhasenteredthepost-industrystageofindustrialization,therefore,variousresourcesbecomingsaturated.

Inordertofurtheroptimizetheeconomicstructure,apartoftheindustryneedtotransferoutofBeijing.

Tianjinislocatedinthemiddlestreamofindustrychainandhasenteredtheadvancedstageofindustrialization,itissuitableforundertakingaerospace,newenergyandnewmaterials,biologicalmedicineandnewgenerationofinformationtechnology.

WhileHebeiislocatedinthedownstreamofindustrychainandisintheintermediatestageofindustrialization.

Ithasasolidfoundationintheironandsteel,pharmaceutical,textileandotherindustrieswithlowbusinesscosts,cheaplaborandbasicmanufacturingadvantages[4].

Therefore,throughareasonableindustriallinks,theBeijing-Tianjin-Hebeiregioncancreateacityindustrialchainwithhighcompetitiveadvantage,improvingthelevelofmanufacturingindustry.

Industrytransferhasasignificantroletotheeconomicgrowthintheundertakingregion,correspondingly,givesrisetoalotoffinancialneeds.

Undersuchcircumstances,theindustrytransfersetaseriesofhigherrequirementtotheoptimizationoffinancialresourceallocation,theimprovementofthefinancialorganizationsystemandtheextensionoffinancialservices.

Therefore,thestudyofthefinancialsupportofindustrytransferamongBeijing-Tianjin-Hebeiregionisveryimportantforsolvingregionaleconomicintegration.

Thisresearchisbeneficialtoputforwardsomecountermeasuresforrisksolvingandtorealizeastablegrowthofregionaleconomic,whichhasimportantpracticalsignificanceandtheoreticalvalue.

ProblemsoftheRegionalEconomicIntegrationofBeijing-Tianjin-HebeiThePresentSituationofIndustryTransferamongBeijing-Tianjin-Hebei.

Currently,thereareseveralproblemsholdingbacktheregionaleconomicintegrationofBeijing-Tianjin-Hebei.

TheseproblemsarelistedinTable1.

Table1ProblemsholdingbacktheregionalintegrationofBeijing-Tianjin-HebeiResearchsitesProblemsoftheregionalintegrationBeijingcityLargegapofeconomiclevelamongBeijing-Tianjin-HebeiRegionTianjincityLackofoverallplanningofBeijing-Tianjin-HebeiRegionHebeiprovinceThemarketfunctioncannotdecidetheallocationofresourcesHebeiprovinceNosoundregionalcooperationmechanismamongthethreeregions(1)LackofOverallPlanningofBeijing-Tianjin-HebeiRegion.

Fromtheregionalpointofview,Beijing,TianjinandHebeibelongtooneregion,butactuallytheybelongtothreedifferentadministrativeareas.

Therefore,itisdifficulttocarryoutoneunifiedplanningforeconomicdevelopment.

Duetoseveralreasonssuchashistory,conceptandsystem,threeregionsareusedtodothingsintheirownway,andeagertodevelopindependently.

Thismodelof"largeandcomplete"causestheidenticalindustrystructure,andtherepeatedconstructionresultsinaseriouswasteofresources[8].

(2)LargeGapofEconomicLevelamongBeijing-Tianjin-HebeiRegion.

BeingacapitalofChina,Beijinghasstrongerattractionontalentandresourcesthansurroundingcities.

Duetotheabovereason,threeregionsofBeijing–Tianjin-Hebeicannotdevelopatthesamepace,ararepovertyzonearoundBeijingandTianjinhasoccured[9].

(3)TheMarketFunctionCannotDecidetheAllocationofResources.

Inordertoachievetheregionaleconomicintegration,acompletemarketeconomyshouldbeimplemented.

Undertheconditionofmarket-orientedeconomy,themarketcanplayadecisiveroleintheallocationofresources.

However,theproportionofstate-ownedeconomyinBeijing-Tianjin-Hebeiregionishigh,theindustrialmonopolyisseriousandthemarketawarenessisweak,themarketsegmentationandlocalprotectionhinderthefreeflowofeconomicresourcesaswellasthetransregionaleconomiccooperation[10].

(4)NoSoundRegionalCooperationMechanismamongBeijing-Tianjin-Hebei.

Firstly,theconsultationmechanismforseniorleadersamongBeijing–Tianjin-Hebeihasnotbeenestablished.

Inrecentyears,althoughthebilateralvisitsandmultilateralnegotiationswerecarriedoutbytopleaders,aformalhigh-levelcoordinationmechanismhavenotmadesignificantprogress.

Secondly,thereisnooverallcooperationideasandresultantforceamongBeijing-Tianjin-Hebei.

Foralongtime,thefunctionofBeijingistoservethewholenation,thisideamakesBeijingcannotfocusonregionaldevelopment.

TheFinancialDifficultiesfortheIndustryTransferofBeijing-Tianjin-Hebei.

Financeisthecoreoftheeconomy,sotheeconomicdevelopmentdemandsthefinancetogoaheadfirst.

However,fromthepresentsituationofBeijing-Tianjin-Hebeicollaboration,therearestillmanyproblemsneedtosolve.

(1)TheFuzzyOrientationforRegionalFinanceFunction.

Duetothedividedregionalfinanceandscatteredadministrativemanagement,thefinancialcompetitionisgreaterthanthefinancialcooperationamongBeijing–Tianjin-Hebeiregion.

BothBeijingandTianjinwouldliketobecomethecenterofregionalfinance,thiskindofsituationhasbecomealimitingfactorforthefinancialintegration[11].

(2)TheHinderingforFinancialIntegrationbyLocalInterests.

Thebasicrequirementforfinancialintegrationistheintegrationoffinancialmarket,i.

e.

,theways,meansandenvironmentoffinancialoperationtendtobeuniform.

Moreover,theorientationandregulationoffinancialpolicymustkeeppacewitheachother.

Alloftheserequiretobreaktheregionalsegmentation.

However,accordingtotheappraisalsystemforgovernmentsatalllevelsinChina,thegrowthofregionaleconomicisanimportantindicator.

Asaresult,itisinevitablethatthelocalgovernmentswillmakedecisionsfromtheperspectiveoflocalinterests,hence,theymayinterveneinthebehaviorofcreditdecisionandmanagementoffinancialinstitutionsdirectlyorindirectly,makingthefinancialintegrationtobeholdbackbythelocalprotectionism.

(3)TheEconomicImbalanceRestrictstheFlowofFinancialFactors.

TheresourcedistributionamongBeijing-Tianjin-Hebeiregionisunbalanced,andthedevelopmentlevelisnotconsistent.

ThesocialfinancingscaleofBeijing,TianjinandHebeiwas64.

4%,34.

2%and22.

1%ofGDP(GrossDomesticProduct)respectivelyin2013.

ItisobviousthatthefinanciallevelofBeijingisthehighest,Tianjinishigher,butHebeiisthelowest.

DuetothedistinctgapofthefinancialtotalamountandeconomicsupportcapabilityamongBeijing-Tianjin-Hebeiregion,theinvestmentreturnandthecostofcapitalvarywithdifferentregion,whichreducesthedepthandbreadthoffinancialcooperation[12].

(4)LackofUnifiedStandardinFinancialIndustry.

BecausethefinancialindustryinBeijing,TianjinandHebeiismanagedbydifferentbankdepartments,thefinancialbusinessprocesses,thestandardofserviceandrisk,themechanismofprofitallocationarenotunified,whichleadstoabarrierofmutualexchange,mutualrecognitionandinterconnectionoffinancialproducts.

Thiskindofphenomenonproducestwoconsequences,oneisthatthelong-distancetransactionencountersdifficulties,accordingly,thepayingcostincreases.

Anotheristhattheestablishmentofcreditsystembecomeslaggingbehind,andtheinformationsharingamongthreeregionsisunabletorealize.

MeasuresBroadeningthefinancialchannels.

Inordertoavoidtheproblemsoftheundertakingforindustrialtransferduetothelackofmoney,theessentialthingistobuildamulti-levelfinancingplatformwhichenlargesthefinancialchannels.

Thegovernmentsshouldsupportsmallandmedium-sizedenterprisestobelistedonthestockexchange,increasingtheproportionofdirectfinancing.

Themarketconstructionofstock,fundandbondshouldbeaccelerated.

Theinvestofprivatecapitalshouldbeencouraged,permittingthepeopleofallsocialstratatoinvestandsharethelistedcompaniessoastosolvethefundproblemoftheenterprises.

SpeedingUptheFinancialInnovation.

AccordingtothedemandofenterpriseandmarketduringtheindustrytransferamongBeijing-Tianjin-Hebeiregion,thegovernmentsshouldpromotetheinnovationoffinancialproductsandenlargetheservicemodes.

Therefore,anevaluationmechanismforcomprehensivecustomerserviceandareasonablemechanismforcomplainthandlingareneededsoastoimprovetheconsciousnessoffinancialservice.

Strengtheningtheconstructionoffinancialecologicalenvironment.

Agoodcreditenvironmentandaperfectcreditsystemarethekeysfortheestablishmentoffinancialecologicalenvironment.

Thetheoryofindustryeconomicspointedoutearlierthatonlyagoodeconomicenvironmenthasbeencreated,theoveralldevelopmentofeconomiccanbepromoted.

ThegovernmentofBeijing,TianjinandHebeishouldpayattentiontobuildareasonableandeffectivesocialcreditsystem,andincreasetheincentiveandconstraintactionofthecreditratingsystem,graduallyexpandthecoverageofpersonalcreditinformation.

Inaddition,theconnectionbetweentheprovincesandcitiesshouldbestrengthenedsoastorealizethediversifieddevelopmentoffinancialservicesystem.

Thus,thesupportroleofthefinancialmarkettotheundertakingofindustrytransferwillbecomestrong.

AcknowledgementsTheresearchwasfundedbythekeyaccountingresearchprojectfrom2015to2016ofFinancialBureauofTianjinandtheAccountingSocietyofTianjin,China(No.

kjkyxm150902).

References[1]S.

Zhang.

BasedoncooperativegameofBeijing-Tianjin-Hebeiregionaleconomiccooperation.

JournalofHebeiNormalUniversity(PhilosophyandSocialSciencesEdition),34(2011)30-34.

[2]M.

Zhang.

Beijing-Tianjin-HebeiintegrationacceleratesthetransformationofBeijingindustry.

Chinaeconomictimes,June19,2014,version007.

[3]S.

Yan.

IntegrationoftheBeijing-Tianjin-Hebei:howtooverallplanningforenterprises.

Chinabusinesstimes,March20,2014,version004.

[4]J.

Zhang.

InvestmentopportunitiesundertheintegrationoftheBeijing-Tianjin-Hebeiregion.

ForeignInvestmentinChina,5(2014)18-20.

[5]Z.

Liu.

Beijing-Tianjin-Hebeiintegrationneedtobreakthreebigbarriers.

People'sBBS,4(2014)52-55.

[6]H.

Tao.

AcceleratedtheintegrationoftheBeijing-Tianjin-Hebeiregion,thegameofindustryundertakingiscarryingoutquietly.

Chinatradenews,April1,2014,version003.

[7]G.

Zhang,S.

Wang,S.

liuandS.

Jia.

ResearchofthecoordinateddevelopmentofBeijing-Tianjin-Hebeibasedontheindustrialdockingandtransfe.

Economyandmanagement,28(2014)14-20.

[8]X.

Liang,J.

Xie.

Theevolution,presentsituationanddevelopmentofBeijing-Tianjin-Hebeiregionaleconomicintegration.

JournalofHebeiUniversityofEconomyandTrade,30(2009)66-69.

[9]J.

Sun.

ConfirmingthenewpositionofthecoordinateddevelopmentofBeijing-Tianjin-Hebei.

ThePeople'sDaily,October16,2014,version020.

[10]Y.

Zhang.

DiscussiononpathchoiceofintegrationoftheBeijing-Tianjin-Hebeiregioncoordinateddevelopment.

Moderneconomicmanagement.

36(2014)50-53.

[11]Z.

Cai.

FinancepromotestheintegrationoftheBeijing-Tianjin-Hebeiregion.

FinancialEconomy,6(2014)14-16.

[12]J.

Chen.

Beijing-Tianjin-Hebeiintegrationandfinancialcooperation.

Chinesefinance,3(2014)58-59.

- textilepay163相关文档

- 东信和平配股说明书摘要

- 中信pay163

- 尊敬的各位读者:

- 重庆建设摩托车股份有限公司

- owedpay163

- 支付pay163

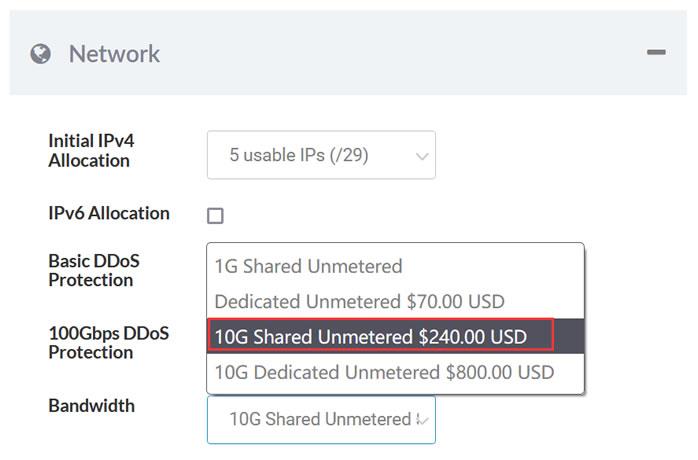

Sharktech10Gbps带宽,不限制流量,自带5个IPv4,100G防御

Sharktech荷兰10G带宽的独立服务器月付319美元起,10Gbps共享带宽,不限制流量,自带5个IPv4,免费60Gbps的 DDoS防御,可加到100G防御。CPU内存HDD价格购买地址E3-1270v216G2T$319/月链接E3-1270v516G2T$329/月链接2*E5-2670v232G2T$389/月链接2*E5-2678v364G2T$409/月链接这里我们需要注意,默...

青云互联19元/月,美国洛杉矶CN2GIA/香港安畅CN2云服务器低至;日本云主机

青云互联怎么样?青云互联美国洛杉矶cn2GIA云服务器低至19元/月起;香港安畅cn2云服务器低至19元/月起;日本cn2云主机低至35元/月起!青云互联是一家成立于2020年的主机服务商,致力于为用户提供高性价比稳定快速的主机托管服务。青云互联本站之前已经更新过很多相关文章介绍了,青云互联的机房有香港和洛杉矶,都有CN2 GIA线路、洛杉矶带高防,商家承诺试用7天,打死全额退款点击进入:青云互联...

HostYun 新增美国三网CN2 GIA VPS主机 采用美国原生IP低至月15元

在之前几个月中也有陆续提到两次HostYun主机商,这个商家前身是我们可能有些网友熟悉的主机分享团队的,后来改名称的。目前这个品牌主营低价便宜VPS主机,这次有可以看到推出廉价版本的美国CN2 GIA VPS主机,月费地址15元,适合有需要入门级且需要便宜的用户。第一、廉价版美国CN2 GIA VPS主机方案我们可看到这个类型的VPS目前三网都走CN2 GIA网络,而且是原生IP。根据信息可能后续...

pay163为你推荐

-

免费美国主机谁有免费空间?给我提供一个,主机屋的就不要了,美国主机也行,但是必须得稳定,谢谢国外虚拟空间哪里买的100m海外虚拟空间便宜稳定?英文域名中文域名和英文域名有什么区别,越具体越好免费网站域名申请怎么免费上传我的网站呀和免费申请域名手机网站空间QQ空间技巧的手机网站啊?100m虚拟主机100元虚拟主机1g虚拟主机网站空间1G是多少M,网站空间用1G虚拟主机够吗。价格多少,数据库和网站有什么关系1g虚拟主机1G虚拟空间大约多少钱?虚拟主机系统什么是虚拟主机?上海虚拟主机上海哪个域名注册和虚拟主机IDC稳定可靠,价格合适?