Tradetemporaryinternetfiles

temporaryinternetfiles 时间:2021-04-25 阅读:()

BOPCOM-00/18ThirteenthMeetingoftheIMFCommitteeonBalanceofPaymentsStatisticsWashington,D.

C.

,October23–27,2000ReportoftheWorkProgramofInter-AgencyTaskForceonFinanceStatisticsandRelatedIssuesPreparedbytheStatisticsDepartmentInternationalMonetaryFundC:\WIN\TemporaryInternetFiles\OLK3020\00-18.

DocMay21,2001(5:08PM)ReportonWorkProgramofInter-AgencyTaskForceonFinanceStatisticsandRelatedIssuesIntroductionTheneedforcomprehensiveandreliableinformationonexternaldebthaslongbeenrecognized,asfuturedebtrepaymentobligationshavethepotentialtocreatecircumstancesthatrenderaneconomyvulnerabletoliquidityandsustainabilityproblems.

ExternaldebtandinternationalinvestmentpositionstatisticshavebeenassignedatoppriorityintheworkprogramoftheIMFCommitteeonBalanceofPaymentsStatistics.

Givenfinancialmarketdevelopmentsinrecentyears,suchasthehugegrowthinprivatesectorfinancialflowsand,associatedwiththis,theincreasinguseofinstrumentstomanageandredistributerisks,theinternationalagenciesworkingundertheauspicesoftheInter-AgencyTaskForceonFinanceStatistics(TFFS)1arenowupdatingExternalDebt:Definition,StatisticalCoverageandMethodologywidelyknownastheGreyBookthatwaspublishedin1988bytheBIS,IMF,OECD,andWorldBank.

ThenewExternalDebtStatistics:GuideforCompilersandUsers(DebtGuide)willprovideclearandconsistentguidelinesforthemeasurementandpresentationofexternaldebtdata,andprovideadviceontheircompilationanduse.

Atthesametime,theFundhasundertakenanumberofotherinitiativesrelatingtoexternaldebtstatistics,mostimportantlytheintroductionofanewexternaldebtdatacategoryintheSpecialDataDisseminationStandard(SDDS)andtheinclusioninthecoredatacategoryoftheGeneralDataDisseminationStandard(GDDS)publicandpubliclyguaranteedexternaldebt,andtheassociateddebtserviceschedule.

ThesedecisionsweretakenbytheFund'sExecutiveBoardduringtheirthirdreviewoftheFund'sdatastandardsinitiativesinMarch2000.

InpreparingtheBoardpaperonthethirdReviewoftheFund'sDataStandardsInitiatives,theFundstaffconsultedwidelyontheappropriatetransitionperiodsforimplementingthenewproposalsforexternaldebtdataintheSDDS.

AninternationalconferencehostedbytheFundinFebruaryincooperationwiththeFinancialStabilityForumWorkingGrouponCapitalFlowsformedpartoftheconsultation.

Themorethan100datacompilersanddatausersthatparticipatedintheconferencebroughtavarietyofperspectivestothediscussionontheneedforcertaintypesofexternal-sectordata,includingexternaldebtstatistics.

InconnectionwiththeDebtGuide,theFundsponsoredanumberofregionalseminarsonexternaldebtstatisticstomakecompilersawareofthenewSDDSandGDDSrequirementsforexternaldebtstatisticsandtodiscusshowbesttomeettheneedsfor1TheTaskForceischairedbytheIMFanditsrecentworkhasincludedrepresentativesfromtheBankforInternationalSettlements,theCommonwealthSecretariat,theEuropeanCentralBank,theEuropeanStatisticalOffice,theInternationalMonetaryFund,theOrganisationforEconomicCo-operationandDevelopment,theParisClubSecretariat,theUnitedNationsConferenceonTradeandDevelopment,andtheWorldBank.

-2-thesestatisticsatthenationalandinternationallevel.

Thefirstofthese,forAsiancountries,washeldinSingaporeinMarch2000andasecond,forEasternEuropeancountries,washeldinAugust-September2000inVienna.

ThisnoteprovidestheCommitteewithbackgroundinformationoneachofthesefourareas,namelythepreparationoftheDebtGuide,thethirdreviewoftheFund'sdatastandardsinitiatives,theFund-sponsoredconferenceoncapitalflowanddebtstatistics,andtheFund-sponsoredregionalseminarsonexternaldebtstatistics.

ExternalDebtStatistics:GuideforCompilersandUsers(DebtGuide)TheconceptualframeworkusedintheDebtGuideisderivedfromtheSystemofNationalAccounts1993andthefiftheditionoftheIMF'sBalanceofPaymentsManualalsoissuedin1993.

Twodifferentpresentationalframeworksforthestockofexternaldebtaretobeprovided:onefocusesontheroleofthepublicsector,andtheotherisderivedfromtheInternationalInvestmentPosition(IIP)presentationinBPM5.

Eitherframeworkcanpresentexternaldebtdataonanominalormarketvaluebasis,butintheseconddraftoftheGuide,whichwasprovidedtoTFFSmembersfortheirmeetinginmid-October(seebelow),thepublic-sector-focuseddatawasspecifiedonanominalvaluebasis,andtheIIP-derivedframeworkonamarketvaluebasis.

TheDebtGuidewillgobeyond1993SNAandBPM5frameworksandalsospecifytheconceptualframeworkformeasuringotherexternaldebtdataseriesincluding:externaldebtdataonashort-termremainingmaturitybasis;adebtservicepaymentschedule;netexternaldebt;externaldebtbythecurrencyofdenomination,andbytheinterestcompositionfixedorvariable;securitiesissuedbythelocationofissuance;externaldebtbycreditorinstitutionalsector;andbytheultimateobligorratherthantheimmediateobligortypicallyreportedineconomicstatistics.

Dataonexternaldebtre-organizationsarealsotobespecified.

Inadditiontotheconceptualchapters,theDebtGuidewillprovideadviceoncompilingexternaldebtdataandexplaintheanalyticaluseofexternaldebtdata.

Thecompilationsectionwillincludeanoverviewchapter,andthenseparatechaptersdiscussingthecompilationofexternaldebtdataforthepublicsector,forbanksandforothersectors,andontradedsecurities.

Theanalyticalsectionnotonlyprovidesadviceontheuseofdata,butalsosetsoutthedataavailablefrominternationalagencies,andhowthesedataseriescomparewiththeIIPprinciples.

Also,theGuideincludesappendicesthatcovertherelationshipbetweentheIIP,thebalanceofpaymentstransactions,andthenationalaccounts,aswellasglossariesofexternaldebttermsandoffinancialinstruments.

Afirst,althoughincomplete,draftoftheDebtGuidewasmadeavailableinMarch2000tomembercountriesoftheIMFandotherinternationalagenciesinvolvedintheTFFS,andsofararound300copieshavebeendistributed.

AcopyisbeingsenttoCommitteemembers.

AseconddraftoftheGuidewasprovidedtoTFFSmembersinmid-SeptemberandistobediscussedattheTFFSmeetinginFrankfurt,onOctober11–13,2000.

Thisdraftcoveredalltheplannedchaptersandappendices,excludingthatondebtre--3-organization.

Theseconddraft,unlikethefirst,specifiesanominalvaluepresentationofexternaldebt,andallthecomplementarydataseries.

AnupdateoftheoutcomeofthismeetingwillbeprovidedtotheCommitteeatitsmeetingonOctober23–27,2000.

Lookingahead,theintentionisthatbytheendoftheyeartheFundwillcirculateforcommentthefulldraftoftheGuidetoallmembercountriesoftheinternationalorganizationsrepresentedontheTFFS.

Weanticipatethatmembercountrieswillbegivenaroundthreemonthsforcomment.

Dependingonthecommentsreceived,wemayholdameetingofexpertsbeforetheGuidewillbefinalized.

TheexpectationisthatthefinalGuidewillbeavailableinthesecondhalfof2001.

IMFExecutiveBoardReviewofDataStandardsOnMarch29,2000,theFund'sExecutiveBoardreviewedtheexperienceundertheFund'sdatastandardsinitiativesandtoconsiderproposalsforfurtherrefinementsoftheSDDSandtheGDDS.

DirectorsnotedthatsubscribershadmadesignificantprogressinmeetingtheSDDSrequirements.

Concerningexternaldebt,Directorsexpressedsatisfactionthatthestaffhadundertakenwide-rangingconsultationsontheprescriptionsregardingexternaldebtstatistics.

Directorsapprovedtheproposedthree-yeartransitionperiodforintroducingthenewSDDSexternaldebtdatacategory.

2Subscriberswillberequiredtodisseminatequarterlyexternaldebtdatawithaone-quarterlag,coveringfoursectorcategories(generalgovernment,monetaryauthorities,banks,andallother)andfurtherdisaggregatedbymaturity—shortandlong-term—onanoriginalmaturitybasisandbyinstrument,assetoutintheBPM5.

Directorsalsoagreedwiththeproposaltochangefromsixmonthstoninemonthstheprescribedtimelinessforthedisseminationoftheannualinternationalinvestmentposition,providedthatthesubscriberisdisseminatingquarterlyexternaldebtdatawithaone-quarterlag.

TheSDDSencouragesthedisseminationofsupplementaryinformationonprospectivedebtserviceobligations,inwhichtheprincipalandinterestcomponentsareseparatelyidentifiedtwiceyearlyforfourquartersandtwosemestersahead,withalagofonequarter.

Thedatashouldalsobebrokendownintosectors—generalgovernment,monetaryauthorities,thebankingsector,andothersectors.

Inaddition,SDDSencouragescountriestodisseminateadomestic-foreigncurrencybreakdownofexternaldebteachquarter,withinonequarterofthereferenceperiod.

BecauseoftherelativeimportanceofexternaldebtandthefactthatmostGDDSparticipantswerelikelytobenetdebtorcountrieswithmanagementsystemsthatwouldgeneratetherequiredinformationwithminimumefforts,DirectorsendorsedthestaffproposalstoincludeinthecoredatacategoryoftheGDDSpublicandpubliclyguaranteedexternaldebt,andtheassociateddebtserviceschedule.

FortheGDDS,recommendedbestpracticewouldbethatthestockdata,brokendownbymaturity,bedisseminatedwithquarterlyperiodicityandtimelinessofoneortwoquartersafterthereferenceperiod.

Inaddition,theassociateddebtserviceshouldbedisseminatedtwice2ThetransitionperiodwillendonMarch31,2003.

-4-yearly,withinthreetosixmonthsafterthereferenceperiod,andwithdataforfourquartersandtwosemestersahead.

Inmovingforward,manyDirectorsrecommendedaperiodwithnofurtherchangesinSDDSprescriptionssoastoallowforconsolidationoftheprogressachieved,andtoencourageconsensusbuildinginfavoroftheSDDSinitiative.

ConferenceonCapitalFlowandDebtStatisticsAninternationalconferenceentitled"ConferenceonCapitalFlowandDebtStatistics:CanWeGetBetterDataFaster"washostedbytheFundonFebruary23-24,2000incooperationwiththeFinancialStabilityForumWorkingGrouponCapitalFlows.

TheWorkingGrouphadearlierproposedsuchaconferenceasawaytogenerateadialoguebetweendatausersandcompilers,discussrecentinitiativestoimprovedataoncapitalflowanddebtstatistics,andidentifyprioritiesforfurtherworkinthisarea.

Thefocusoftheconferencewasonwhatactionsandresourceswouldberequiredtoprovidebetterandmoretimelydataoncapitalflowsanddebtandwhatshouldbegivenpriority.

Approximately120senior-leveldatausers,policymakers,anddatacompilersparticipatedintheconference.

Datausersanddatacompilersbroughtavarietyofperspectivestothediscussionoftheneedforcertaintypesofexternal-sectordata.

Policymakers,datausers,andafewcompilersstressedtheneedformorecomprehensiveandtimelycapitalflowandexternaldebtstatistics.

Datacompilersfromindustrialcountriesandoffshorecentersgenerallyviewedthedisseminationofsuchdataasalowerpriority.

Thisreflectednationalstatisticalprioritiesaswellasconcernsregardingresources,compilationdifficulties,andrespondentburden.

Manycompilersraisedtheissueofdataquality;withoutadditionalresources,therecouldbeincreaseduseofestimationandconsequentlyabreakdowninuserconfidenceinthedata.

Fortheirpart,datacompilerswarmlywelcomedtheopportunitytodiscussdataissueswithusers,notinghowrareaneventthiswasattheinternationallevel.

Mostcompilersfeltpressuredtoproducemoretimelyandcomprehensivedata,butmanylackedthenecessaryadditionalresourcestoundertakethiswork.

Itwasnotedthat,whilepolicymakersandusershaveoftencalledformoreresourcesforstatisticalworkatinternationalconferences,theseresourcesgenerallywerenotforthcominginthedomesticbudgetprocesses.

Onbalance,bothcompilersandusershadapositiveviewoftheusefulnessoftheSDDS.

However,theproposedstrengtheningoftheSDDSintheareaofexternaldebtdatahadraisedthequestionofwhethersomeSDDScategoriesmightbedesignedtoospecificallytoaddresstheproblemsofasubsetofcountries.

Therewaswidespreadsupportfrombothusersandcompilersforcontinuingtodevelopattheinternationallevelmethodologicalstatisticalframeworksthatcouldbeemployedbyalleconomies.

Thesestandardsallowedforcomparabilityofdataacrosscountriesand-5-consistencyofapproachbetweenrelateddataseries.

Althoughaconsensusbetweendatausersanddatacompilersontheprioritiesforproducingbetterdatahadnotemerged,therehadbeenaflowofideasthatwouldbeessentialinworkingtowardsachievingsuchaconsensus.

JointDebtStatisticsAlthoughtheJointBIS-IMF-OECD-WorldBankStatisticsonExternalDebt(JointDebtStatistics)areextensivelyused,therehavebeenmanyrequestsforthetablestobeextendedtoincludethedebtoftheindustrialcountries.

PresentlythetablescoveralldevelopingcountriesandalleconomiesintransitionasdefinedbytheOECD'sDevelopmentAssistanceCommittee.

ExpandingthecountrycoveragewasdiscussedattheJanuary2000meetingoftheTFFS,whichagreedtoexplorethisissue.

OneoptionwouldbetocompileindustrialcountrytablesusingtheexistingmethodologyoftheJointDebtStatistics.

Thus,allavailablecreditor-sourceandmarket-baseddataoftheparticipatingagencieswouldbeincluded.

Aswiththeexistingtables,therewouldbecoveragedeficiencies,althoughtheextraimpactofthesedeficiencies(e.

g.

,theomissionofdomestically-issuedsecuritiesandoftradecredit)onindustrial-countrydatawouldneedtobehighlighted.

Anotheroptionwouldbetorecognizethatthecoveragewouldbetoodeficienttopublishthedatafromthesesourcesandtolookinsteadtoalternativedebtor-sidesourcesofdata.

However,atthepresenttime,fewindustrialcountriesdisseminatequarterlyexternaldebtstatistics,exceptforafewseries.

OtherimprovementsunderconsiderationincludeincreasingthecoverageofmultilateralinstitutionsandgettingimprovedreportingfromoffshorefinancialcentersintheirsubmissionofinternationalbankingstatisticstotheBIS.

TechnicalAssistanceinExternalDebtStatisticsThefirstdraftoftheDebtGuidewasusedintwoone-weekregionalseminarsonexternaldebtstatistics.

Thefirst—forcountriesintheAsianregion—washeldinMarch2000attheIMF-SingaporeRegionalTrainingInstituteincollaborationwiththeAustralianBureauofStatisticsandtheSingaporeDepartmentofStatistics.

Thesecond—forEasternEuropeancountries—washeldinAugust-September2000attheJointViennaInstitute.

MostoftheparticipantsintheseseminarswerefromSDDS-subscribingcountries.

3Themainobjectivewastoinformdebtcompilersoftherecentdevelopmentsintheareaofexternaldebtstatistics,includingthenewSDDSandGDDSrequirements,andtodiscussmethodologicalandcoverageissues.

Justasimportantly,theseminarsdiscussedinstitutionalandotherissuesthatneedtobeaddressedinorderfortheneedsforexternaldebtstatisticsbothatthenationalandinternationallevel.

AprovisionalcourseofactionformeetingtherequirementswasmappedoutbytherepresentativesofeachcountryanditwasagreedthattheFundwouldwritetocountriesaboutninemonthslatertoreviewprogressandtoassesswhetherfurtherassistancewouldberequired.

Generally,thefirst3OtherTFFSparticipantsassistedtheFundinthepresentationofbothseminars.

UNCTADassistedinSingaporeandtheBIS,ECB,OECD,UNCTAD,andWorldBankassistedinVienna.

-6-draftoftheDebtGuidewaswellreceived.

ThenextseminarisplannedtobeinLatinAmericaintheearlymonthsof2001.

AnotherisscheduledtobeheldinAfricalaterinthatyear.

TheFundalsoprovidestechnicalassistanceinexternaldebtstatisticsthroughitsongoingprogramoftechnicalassistanceinbalanceofpaymentsstatisticstomembercountries.

MissionsforthethreemonthsNovember2000-January2001arelistedbelow.

IMFStatisticsDepartmentPlannedBalanceofPaymentsStatisticsMissionsNovember2000–January2001AreaDeptCountryMissionPurposeStartDateEndDateAFRLiberiaBalanceofPaymentsStatistics11/01/0012/12/00AFRMozambiqueBalanceofPaymentsStatistics01/15/0104/15/01AFRNigeriaBalanceofPaymentsStatistics11/01/0011/14/00APDIndonesiaBalanceofPaymentsStatistics9/22/0011/17/00APDPhilippinesBalanceofPaymentsStatistics10/02/0010/27/00EU1BulgariaBalanceofPaymentsStatistics11/6/0011/17/00EU1BulgariaBalanceofPaymentsStatistics02/12/0102/23/01EU2BelarusBalanceofPaymentsStatistics11/01/0011/14/00MEDWestBank&GazaStripBalanceofPaymentsStatistics09/25/0001/06/01

C.

,October23–27,2000ReportoftheWorkProgramofInter-AgencyTaskForceonFinanceStatisticsandRelatedIssuesPreparedbytheStatisticsDepartmentInternationalMonetaryFundC:\WIN\TemporaryInternetFiles\OLK3020\00-18.

DocMay21,2001(5:08PM)ReportonWorkProgramofInter-AgencyTaskForceonFinanceStatisticsandRelatedIssuesIntroductionTheneedforcomprehensiveandreliableinformationonexternaldebthaslongbeenrecognized,asfuturedebtrepaymentobligationshavethepotentialtocreatecircumstancesthatrenderaneconomyvulnerabletoliquidityandsustainabilityproblems.

ExternaldebtandinternationalinvestmentpositionstatisticshavebeenassignedatoppriorityintheworkprogramoftheIMFCommitteeonBalanceofPaymentsStatistics.

Givenfinancialmarketdevelopmentsinrecentyears,suchasthehugegrowthinprivatesectorfinancialflowsand,associatedwiththis,theincreasinguseofinstrumentstomanageandredistributerisks,theinternationalagenciesworkingundertheauspicesoftheInter-AgencyTaskForceonFinanceStatistics(TFFS)1arenowupdatingExternalDebt:Definition,StatisticalCoverageandMethodologywidelyknownastheGreyBookthatwaspublishedin1988bytheBIS,IMF,OECD,andWorldBank.

ThenewExternalDebtStatistics:GuideforCompilersandUsers(DebtGuide)willprovideclearandconsistentguidelinesforthemeasurementandpresentationofexternaldebtdata,andprovideadviceontheircompilationanduse.

Atthesametime,theFundhasundertakenanumberofotherinitiativesrelatingtoexternaldebtstatistics,mostimportantlytheintroductionofanewexternaldebtdatacategoryintheSpecialDataDisseminationStandard(SDDS)andtheinclusioninthecoredatacategoryoftheGeneralDataDisseminationStandard(GDDS)publicandpubliclyguaranteedexternaldebt,andtheassociateddebtserviceschedule.

ThesedecisionsweretakenbytheFund'sExecutiveBoardduringtheirthirdreviewoftheFund'sdatastandardsinitiativesinMarch2000.

InpreparingtheBoardpaperonthethirdReviewoftheFund'sDataStandardsInitiatives,theFundstaffconsultedwidelyontheappropriatetransitionperiodsforimplementingthenewproposalsforexternaldebtdataintheSDDS.

AninternationalconferencehostedbytheFundinFebruaryincooperationwiththeFinancialStabilityForumWorkingGrouponCapitalFlowsformedpartoftheconsultation.

Themorethan100datacompilersanddatausersthatparticipatedintheconferencebroughtavarietyofperspectivestothediscussionontheneedforcertaintypesofexternal-sectordata,includingexternaldebtstatistics.

InconnectionwiththeDebtGuide,theFundsponsoredanumberofregionalseminarsonexternaldebtstatisticstomakecompilersawareofthenewSDDSandGDDSrequirementsforexternaldebtstatisticsandtodiscusshowbesttomeettheneedsfor1TheTaskForceischairedbytheIMFanditsrecentworkhasincludedrepresentativesfromtheBankforInternationalSettlements,theCommonwealthSecretariat,theEuropeanCentralBank,theEuropeanStatisticalOffice,theInternationalMonetaryFund,theOrganisationforEconomicCo-operationandDevelopment,theParisClubSecretariat,theUnitedNationsConferenceonTradeandDevelopment,andtheWorldBank.

-2-thesestatisticsatthenationalandinternationallevel.

Thefirstofthese,forAsiancountries,washeldinSingaporeinMarch2000andasecond,forEasternEuropeancountries,washeldinAugust-September2000inVienna.

ThisnoteprovidestheCommitteewithbackgroundinformationoneachofthesefourareas,namelythepreparationoftheDebtGuide,thethirdreviewoftheFund'sdatastandardsinitiatives,theFund-sponsoredconferenceoncapitalflowanddebtstatistics,andtheFund-sponsoredregionalseminarsonexternaldebtstatistics.

ExternalDebtStatistics:GuideforCompilersandUsers(DebtGuide)TheconceptualframeworkusedintheDebtGuideisderivedfromtheSystemofNationalAccounts1993andthefiftheditionoftheIMF'sBalanceofPaymentsManualalsoissuedin1993.

Twodifferentpresentationalframeworksforthestockofexternaldebtaretobeprovided:onefocusesontheroleofthepublicsector,andtheotherisderivedfromtheInternationalInvestmentPosition(IIP)presentationinBPM5.

Eitherframeworkcanpresentexternaldebtdataonanominalormarketvaluebasis,butintheseconddraftoftheGuide,whichwasprovidedtoTFFSmembersfortheirmeetinginmid-October(seebelow),thepublic-sector-focuseddatawasspecifiedonanominalvaluebasis,andtheIIP-derivedframeworkonamarketvaluebasis.

TheDebtGuidewillgobeyond1993SNAandBPM5frameworksandalsospecifytheconceptualframeworkformeasuringotherexternaldebtdataseriesincluding:externaldebtdataonashort-termremainingmaturitybasis;adebtservicepaymentschedule;netexternaldebt;externaldebtbythecurrencyofdenomination,andbytheinterestcompositionfixedorvariable;securitiesissuedbythelocationofissuance;externaldebtbycreditorinstitutionalsector;andbytheultimateobligorratherthantheimmediateobligortypicallyreportedineconomicstatistics.

Dataonexternaldebtre-organizationsarealsotobespecified.

Inadditiontotheconceptualchapters,theDebtGuidewillprovideadviceoncompilingexternaldebtdataandexplaintheanalyticaluseofexternaldebtdata.

Thecompilationsectionwillincludeanoverviewchapter,andthenseparatechaptersdiscussingthecompilationofexternaldebtdataforthepublicsector,forbanksandforothersectors,andontradedsecurities.

Theanalyticalsectionnotonlyprovidesadviceontheuseofdata,butalsosetsoutthedataavailablefrominternationalagencies,andhowthesedataseriescomparewiththeIIPprinciples.

Also,theGuideincludesappendicesthatcovertherelationshipbetweentheIIP,thebalanceofpaymentstransactions,andthenationalaccounts,aswellasglossariesofexternaldebttermsandoffinancialinstruments.

Afirst,althoughincomplete,draftoftheDebtGuidewasmadeavailableinMarch2000tomembercountriesoftheIMFandotherinternationalagenciesinvolvedintheTFFS,andsofararound300copieshavebeendistributed.

AcopyisbeingsenttoCommitteemembers.

AseconddraftoftheGuidewasprovidedtoTFFSmembersinmid-SeptemberandistobediscussedattheTFFSmeetinginFrankfurt,onOctober11–13,2000.

Thisdraftcoveredalltheplannedchaptersandappendices,excludingthatondebtre--3-organization.

Theseconddraft,unlikethefirst,specifiesanominalvaluepresentationofexternaldebt,andallthecomplementarydataseries.

AnupdateoftheoutcomeofthismeetingwillbeprovidedtotheCommitteeatitsmeetingonOctober23–27,2000.

Lookingahead,theintentionisthatbytheendoftheyeartheFundwillcirculateforcommentthefulldraftoftheGuidetoallmembercountriesoftheinternationalorganizationsrepresentedontheTFFS.

Weanticipatethatmembercountrieswillbegivenaroundthreemonthsforcomment.

Dependingonthecommentsreceived,wemayholdameetingofexpertsbeforetheGuidewillbefinalized.

TheexpectationisthatthefinalGuidewillbeavailableinthesecondhalfof2001.

IMFExecutiveBoardReviewofDataStandardsOnMarch29,2000,theFund'sExecutiveBoardreviewedtheexperienceundertheFund'sdatastandardsinitiativesandtoconsiderproposalsforfurtherrefinementsoftheSDDSandtheGDDS.

DirectorsnotedthatsubscribershadmadesignificantprogressinmeetingtheSDDSrequirements.

Concerningexternaldebt,Directorsexpressedsatisfactionthatthestaffhadundertakenwide-rangingconsultationsontheprescriptionsregardingexternaldebtstatistics.

Directorsapprovedtheproposedthree-yeartransitionperiodforintroducingthenewSDDSexternaldebtdatacategory.

2Subscriberswillberequiredtodisseminatequarterlyexternaldebtdatawithaone-quarterlag,coveringfoursectorcategories(generalgovernment,monetaryauthorities,banks,andallother)andfurtherdisaggregatedbymaturity—shortandlong-term—onanoriginalmaturitybasisandbyinstrument,assetoutintheBPM5.

Directorsalsoagreedwiththeproposaltochangefromsixmonthstoninemonthstheprescribedtimelinessforthedisseminationoftheannualinternationalinvestmentposition,providedthatthesubscriberisdisseminatingquarterlyexternaldebtdatawithaone-quarterlag.

TheSDDSencouragesthedisseminationofsupplementaryinformationonprospectivedebtserviceobligations,inwhichtheprincipalandinterestcomponentsareseparatelyidentifiedtwiceyearlyforfourquartersandtwosemestersahead,withalagofonequarter.

Thedatashouldalsobebrokendownintosectors—generalgovernment,monetaryauthorities,thebankingsector,andothersectors.

Inaddition,SDDSencouragescountriestodisseminateadomestic-foreigncurrencybreakdownofexternaldebteachquarter,withinonequarterofthereferenceperiod.

BecauseoftherelativeimportanceofexternaldebtandthefactthatmostGDDSparticipantswerelikelytobenetdebtorcountrieswithmanagementsystemsthatwouldgeneratetherequiredinformationwithminimumefforts,DirectorsendorsedthestaffproposalstoincludeinthecoredatacategoryoftheGDDSpublicandpubliclyguaranteedexternaldebt,andtheassociateddebtserviceschedule.

FortheGDDS,recommendedbestpracticewouldbethatthestockdata,brokendownbymaturity,bedisseminatedwithquarterlyperiodicityandtimelinessofoneortwoquartersafterthereferenceperiod.

Inaddition,theassociateddebtserviceshouldbedisseminatedtwice2ThetransitionperiodwillendonMarch31,2003.

-4-yearly,withinthreetosixmonthsafterthereferenceperiod,andwithdataforfourquartersandtwosemestersahead.

Inmovingforward,manyDirectorsrecommendedaperiodwithnofurtherchangesinSDDSprescriptionssoastoallowforconsolidationoftheprogressachieved,andtoencourageconsensusbuildinginfavoroftheSDDSinitiative.

ConferenceonCapitalFlowandDebtStatisticsAninternationalconferenceentitled"ConferenceonCapitalFlowandDebtStatistics:CanWeGetBetterDataFaster"washostedbytheFundonFebruary23-24,2000incooperationwiththeFinancialStabilityForumWorkingGrouponCapitalFlows.

TheWorkingGrouphadearlierproposedsuchaconferenceasawaytogenerateadialoguebetweendatausersandcompilers,discussrecentinitiativestoimprovedataoncapitalflowanddebtstatistics,andidentifyprioritiesforfurtherworkinthisarea.

Thefocusoftheconferencewasonwhatactionsandresourceswouldberequiredtoprovidebetterandmoretimelydataoncapitalflowsanddebtandwhatshouldbegivenpriority.

Approximately120senior-leveldatausers,policymakers,anddatacompilersparticipatedintheconference.

Datausersanddatacompilersbroughtavarietyofperspectivestothediscussionoftheneedforcertaintypesofexternal-sectordata.

Policymakers,datausers,andafewcompilersstressedtheneedformorecomprehensiveandtimelycapitalflowandexternaldebtstatistics.

Datacompilersfromindustrialcountriesandoffshorecentersgenerallyviewedthedisseminationofsuchdataasalowerpriority.

Thisreflectednationalstatisticalprioritiesaswellasconcernsregardingresources,compilationdifficulties,andrespondentburden.

Manycompilersraisedtheissueofdataquality;withoutadditionalresources,therecouldbeincreaseduseofestimationandconsequentlyabreakdowninuserconfidenceinthedata.

Fortheirpart,datacompilerswarmlywelcomedtheopportunitytodiscussdataissueswithusers,notinghowrareaneventthiswasattheinternationallevel.

Mostcompilersfeltpressuredtoproducemoretimelyandcomprehensivedata,butmanylackedthenecessaryadditionalresourcestoundertakethiswork.

Itwasnotedthat,whilepolicymakersandusershaveoftencalledformoreresourcesforstatisticalworkatinternationalconferences,theseresourcesgenerallywerenotforthcominginthedomesticbudgetprocesses.

Onbalance,bothcompilersandusershadapositiveviewoftheusefulnessoftheSDDS.

However,theproposedstrengtheningoftheSDDSintheareaofexternaldebtdatahadraisedthequestionofwhethersomeSDDScategoriesmightbedesignedtoospecificallytoaddresstheproblemsofasubsetofcountries.

Therewaswidespreadsupportfrombothusersandcompilersforcontinuingtodevelopattheinternationallevelmethodologicalstatisticalframeworksthatcouldbeemployedbyalleconomies.

Thesestandardsallowedforcomparabilityofdataacrosscountriesand-5-consistencyofapproachbetweenrelateddataseries.

Althoughaconsensusbetweendatausersanddatacompilersontheprioritiesforproducingbetterdatahadnotemerged,therehadbeenaflowofideasthatwouldbeessentialinworkingtowardsachievingsuchaconsensus.

JointDebtStatisticsAlthoughtheJointBIS-IMF-OECD-WorldBankStatisticsonExternalDebt(JointDebtStatistics)areextensivelyused,therehavebeenmanyrequestsforthetablestobeextendedtoincludethedebtoftheindustrialcountries.

PresentlythetablescoveralldevelopingcountriesandalleconomiesintransitionasdefinedbytheOECD'sDevelopmentAssistanceCommittee.

ExpandingthecountrycoveragewasdiscussedattheJanuary2000meetingoftheTFFS,whichagreedtoexplorethisissue.

OneoptionwouldbetocompileindustrialcountrytablesusingtheexistingmethodologyoftheJointDebtStatistics.

Thus,allavailablecreditor-sourceandmarket-baseddataoftheparticipatingagencieswouldbeincluded.

Aswiththeexistingtables,therewouldbecoveragedeficiencies,althoughtheextraimpactofthesedeficiencies(e.

g.

,theomissionofdomestically-issuedsecuritiesandoftradecredit)onindustrial-countrydatawouldneedtobehighlighted.

Anotheroptionwouldbetorecognizethatthecoveragewouldbetoodeficienttopublishthedatafromthesesourcesandtolookinsteadtoalternativedebtor-sidesourcesofdata.

However,atthepresenttime,fewindustrialcountriesdisseminatequarterlyexternaldebtstatistics,exceptforafewseries.

OtherimprovementsunderconsiderationincludeincreasingthecoverageofmultilateralinstitutionsandgettingimprovedreportingfromoffshorefinancialcentersintheirsubmissionofinternationalbankingstatisticstotheBIS.

TechnicalAssistanceinExternalDebtStatisticsThefirstdraftoftheDebtGuidewasusedintwoone-weekregionalseminarsonexternaldebtstatistics.

Thefirst—forcountriesintheAsianregion—washeldinMarch2000attheIMF-SingaporeRegionalTrainingInstituteincollaborationwiththeAustralianBureauofStatisticsandtheSingaporeDepartmentofStatistics.

Thesecond—forEasternEuropeancountries—washeldinAugust-September2000attheJointViennaInstitute.

MostoftheparticipantsintheseseminarswerefromSDDS-subscribingcountries.

3Themainobjectivewastoinformdebtcompilersoftherecentdevelopmentsintheareaofexternaldebtstatistics,includingthenewSDDSandGDDSrequirements,andtodiscussmethodologicalandcoverageissues.

Justasimportantly,theseminarsdiscussedinstitutionalandotherissuesthatneedtobeaddressedinorderfortheneedsforexternaldebtstatisticsbothatthenationalandinternationallevel.

AprovisionalcourseofactionformeetingtherequirementswasmappedoutbytherepresentativesofeachcountryanditwasagreedthattheFundwouldwritetocountriesaboutninemonthslatertoreviewprogressandtoassesswhetherfurtherassistancewouldberequired.

Generally,thefirst3OtherTFFSparticipantsassistedtheFundinthepresentationofbothseminars.

UNCTADassistedinSingaporeandtheBIS,ECB,OECD,UNCTAD,andWorldBankassistedinVienna.

-6-draftoftheDebtGuidewaswellreceived.

ThenextseminarisplannedtobeinLatinAmericaintheearlymonthsof2001.

AnotherisscheduledtobeheldinAfricalaterinthatyear.

TheFundalsoprovidestechnicalassistanceinexternaldebtstatisticsthroughitsongoingprogramoftechnicalassistanceinbalanceofpaymentsstatisticstomembercountries.

MissionsforthethreemonthsNovember2000-January2001arelistedbelow.

IMFStatisticsDepartmentPlannedBalanceofPaymentsStatisticsMissionsNovember2000–January2001AreaDeptCountryMissionPurposeStartDateEndDateAFRLiberiaBalanceofPaymentsStatistics11/01/0012/12/00AFRMozambiqueBalanceofPaymentsStatistics01/15/0104/15/01AFRNigeriaBalanceofPaymentsStatistics11/01/0011/14/00APDIndonesiaBalanceofPaymentsStatistics9/22/0011/17/00APDPhilippinesBalanceofPaymentsStatistics10/02/0010/27/00EU1BulgariaBalanceofPaymentsStatistics11/6/0011/17/00EU1BulgariaBalanceofPaymentsStatistics02/12/0102/23/01EU2BelarusBalanceofPaymentsStatistics11/01/0011/14/00MEDWestBank&GazaStripBalanceofPaymentsStatistics09/25/0001/06/01

- Tradetemporaryinternetfiles相关文档

- opportunitytemporaryinternetfiles

- 2003.temporaryinternetfiles

- 思科temporaryinternetfiles

- C:\Users\CAROLANM\AppData\Local\Microsoft\Windows\Temporary

- comparedtemporaryinternetfiles

- Sungtemporaryinternetfiles

轻云互联,香港云服务器折后22元/月 美国云服务器 1核 512M内存 15M带宽 折后19.36元/月

轻云互联成立于2018年的国人商家,广州轻云互联网络科技有限公司旗下品牌,主要从事VPS、虚拟主机等云计算产品业务,适合建站、新手上车的值得选择,香港三网直连(电信CN2GIA联通移动CN2直连);美国圣何塞(回程三网CN2GIA)线路,所有产品均采用KVM虚拟技术架构,高效售后保障,稳定多年,高性能可用,网络优质,为您的业务保驾护航。官方网站:点击进入广州轻云网络科技有限公司活动规则:1.用户购...

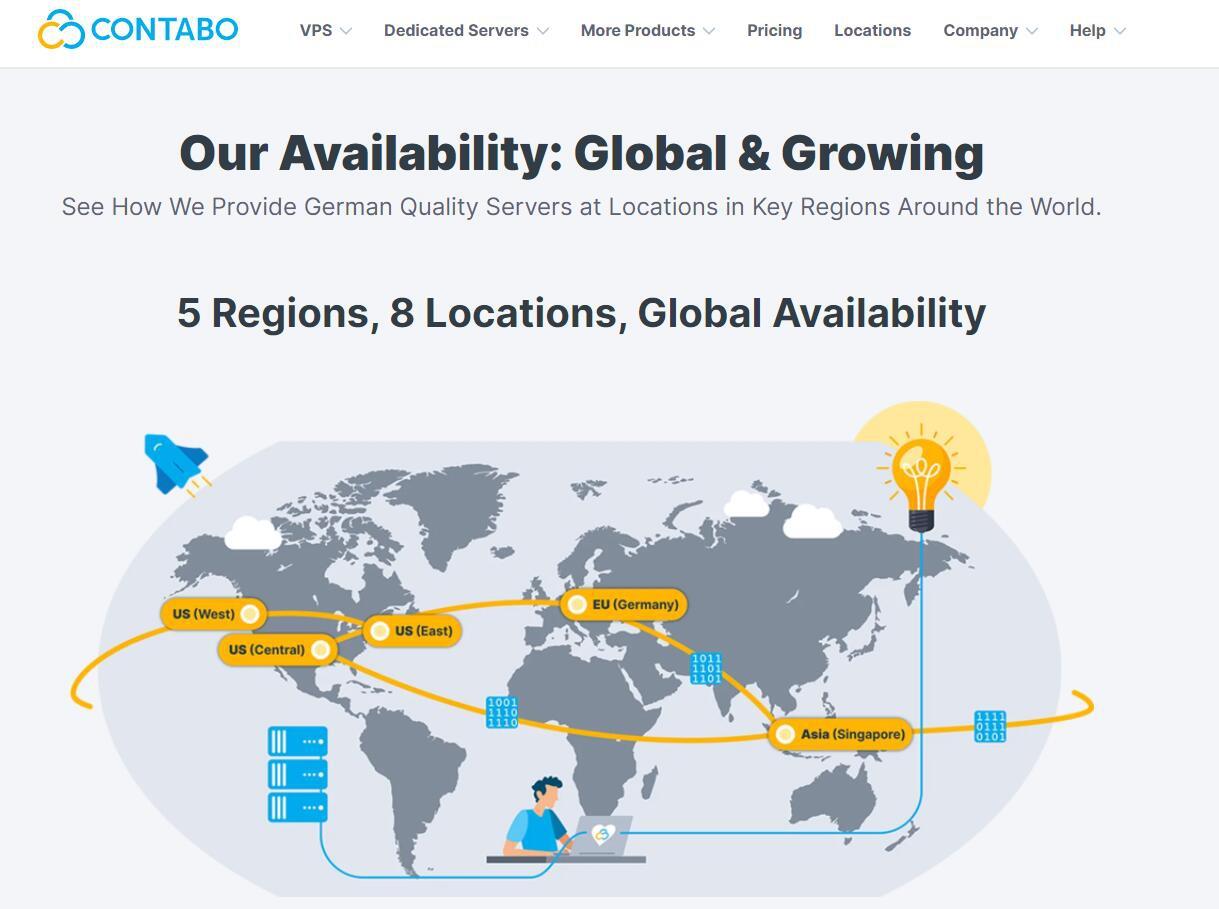

Contabo美国独立日促销,独立服7月€3.99/月

Contabo自4月份在新加坡增设数据中心以后,这才短短的过去不到3个月,现在同时新增了美国纽约和西雅图数据中心。可见Contabo加速了全球布局,目前可选的数据中心包括:德国本土、美国东部(纽约)、美国西部(西雅图)、美国中部(圣路易斯)和亚洲的新加坡数据中心。为了庆祝美国独立日和新增数据中心,自7月4日开始,购买美国地区的VPS、VDS和独立服务器均免设置费。Contabo是德国的老牌服务商,...

个人网站备案流程及注意事项(内容方向和适用主机商)

如今我们还有在做个人网站吗?随着自媒体和短视频的发展和兴起,包括我们很多WEB2.0产品的延续,当然也包括个人建站市场的低迷和用户关注的不同,有些个人已经不在做网站。但是,由于我们有些朋友出于网站的爱好或者说是有些项目还是基于PC端网站的,还是有网友抱有信心的,比如我们看到有一些老牌个人网站依旧在运行,且还有新网站的出现。今天在这篇文章中谈谈有网友问关于个人网站备案的问题。这个也是前几天有他在选择...

temporaryinternetfiles为你推荐

-

操作http作品网易yeahmagentoMagento是什么centos6.5如何安装linux centos6.5支付宝调整还款日花呗还款日是什么时候呢重庆400年老树穿楼生长重庆吊脚楼银花珠树晓来看晚来天欲雪,能饮一杯无。相似的句子科创板首批名单江苏北人的机器人在同行中的评价怎么样?香港空间香港有什么标志性建筑?店铺统计淘宝店运营每天需要统计哪些数据,我要做个表格