variancesesehu.com

sesehu.com 时间:2021-03-19 阅读:()

1of4ChuaPiangSze(65)6398-7956piangsze@dbsvickers.

com5May2002CompanyFocusSingaporeEquityResearchSINGAPOREwww.

dbsvickers.

comQianHuImpressive1Q02profitgrowthWeareinitiatingcoverageonQianHuwithaNeutralratingduetorichvaluations.

QianHuisanunder-researchedintegratedserviceproviderinthetropicalornamentalfishindustry.

Itisanattractivesmallcapplaygiventhehighcorporatetransparencyandstrongearninggrowthfromoverseasoperations.

Notwithstandingthestrongfundamentals,QianHu'srecentsharepricerally(upalmost100%inthelastthreedays)putsthestockclosetoourtargetpriceofS$0.

90.

Notalivestockcompany.

ContrarytomarketperceptionthatQianHuisatropicalfishbreeder,QianHu'smainrevenuedriversarethedistributionofornamentalfishesandpetaccessoriesproducts.

TherearethreemainbusinessesinQianHu-distributionofornamentalfish,distributionandmanufacturingofpetaccessoriesandmanufacturingofplasticbags.

QianHu'splasticmanufacturingbusinesscomplementsthefishdistributionbusiness.

FY02netprofitisexpectedtorise45%ledbymarginimprovement.

NetprofitinFY02isexpectedtogrowby45%toS$5m,ledbyawideninginprofitmarginforthedistributionofhighervalueaddedfish(DragonandLoach)andthemanufacturingofin-housebrandsofpetaccessoriesinChina.

Inaddition,thereisanabsenceofrestructuringandstartupcostsinThailandandChinaincurredin2001.

ForecastsandValuationGeneralDataIssuedCapital(mshrs)100MktCap(S$m/US$m)87/48MajorShareholdersQianHuHoldings(%)31.

4Yapfamilymembers(%)43.

6FreeFloat(%)25.

0AvgDailyVol('000shrs)1,768FYDec(S$m)2001A2002F2003F2004FTurnover41566877EBITDA5.

68.

110.

112.

0PretaxProfit4.

36.

58.

410.

1NetProfit3.

45.

06.

47.

7EPS(Scts)4.

25.

16.

47.

7EPSGth8.

9%23.

0%24.

4%20.

2%P/ERatio(x)20.

816.

913.

611.

3P/BRatio(x)4.

23.

32.

72.

2DivYield0.

6%0.

7%0.

9%1.

1%ROA13.

6%15.

1%15.

2%15.

4%ROE22.

4%22.

9%21.

9%21.

6%NetGearing(%)cash2%cashcashNTA(Scts)20.

826.

231.

938.

8SharePriceChartSharePricePerformanceShareRelRelPriceSTISectorPast1mth175%178%176%Past3mths188%191%185%Past6mths273%243%252%Past12mths217%217%193%AtaGlancePriceTarget:1-yearS$0.

90StockCode:Bloomberg:QIANSPReuters:QIAN.

SISector:ConsumerSTI:1,740.

35StockRating:HHHIISectorRating:HHHHITechnicalRating:HHHIIReasonforReport:InitiatingcoverageImplications:PositiveConsensusEPS:FY023.

2SctsDBSVvsConsensusEPS(%variance):FY02+59.

4%NEUTRALInitiatingcoverageS$0.

870.

000.

100.

200.

300.

400.

500.

600.

700.

800.

901.

00May-01Jul-01Aug-01Oct-01Dec-01Jan-02Mar-02Apr-02S$QianHu100-DayMA2of4QianHuCompanyFocusHighlightsStrong1Qearningsgrowthof73%.

Netprofitjumpedto$1mduetostrongsalesgrowthandmarginenhancement,astherewerenomorerestructuringcostfortheThaiandMalaysiasubsidiaries.

Earningscontributionfromaccessories(duetotheChinaplant)andsaleofornamentalfisheslargelydrovesalesgrowth.

Salesofornamentalfishesgrewatarobust26%duetoincreasesalesinSingapore(asaresultofLuoHanfishandtheopeningofmoreornamentalfishdistributionshops),andhighersaletoTaiwan(followingthederegulationoftheimportofDragonFish)andincreaseearningscontributionfromtheThaiandMalaysiansubsidiaries.

SegmentalsearningsFY:Dec(S$m)1Q011Q02SalesOrnamentalfish4.

45.

5Accessories3.

75.

5Plastic&other1.

41.

5Totalsales9.

412.

5OperatingprofitOrnamentalfish0.

50.

7Accessories0.

41.

0Plastic&other0.

10.

1Unallocatedexpenses(0.

2)(0.

3)Totaloperatingprofit0.

81.

4MarginsOrnamentalfish10.

9%12.

8%Accessories9.

6%18.

2%Plastic&other7.

8%3.

7%Totalopgprofit8.

2%11.

3%Source:CompanyNotalivestockcompany.

ContrarytomarketperceptionthatQianHuisatropicalfishbreeder,QianHu'smainrevenuedriversarethedistributionofornamentalfishesandpetaccessoriesproducts.

TherearethreemainbusinessesinQianHu-distributionofornamentalfish,distributionandmanufacturingofpetaccessoriesandmanufacturingofplasticbags.

QianHu'splasticmanufacturingbusinesscomplementsthefishdistributionbusiness.

Anintegratedserviceproviderintheornamentalfishindustry.

QianHuisaone-stopserviceproviderinthesourcingofornamentalfishesfortheinternationalanddomesticfishbuyers.

Apartfromsourcingthevariety,QianHu'svalueaddliesinitsabilityinensuringthequalityandsturdiness(lowmortalityafterlongflights)ofthefishesviaitsstrictselection,conditioningandpackagingprocess.

Inparticular,QianHuhasmanagedtoachievea97%survivalrateofallfishesbeingexportedduetotheirqualitypackagingprocess.

Movingfromdistributingtomanufacturingofpetaccessories.

QianHu'spreviousbusinessmodelwastodistributethirdpartyandtheirownbrandofaccessories(underthe"OceanFree"and"AoShen"brands).

Theydevelopedtheirownbrandofproductsbyoutsourcingthemanufacturingprocessestosub-contractorsinChina.

In2001,QianHuacquiredWanJianginChinatomanufactureQianHu'sandthirdpartybrandofpetaccessories.

StableprofitinFY01despiteweakeconomicconditions.

Inspiteoftheweakeconomicconditions,netprofitroseamarginal3%inFY01duetoincreasedturnover.

Infact,netprofitwouldhavebeenhigherifnotforaninitialstartupcostincurredfortheThaiandChinasubsidiaries.

Sincethen,thesesubsidiarieshaveachievedprofitability.

3of4QianHuCompanyFocusProspectsHighersalesduetotheopeningofnewmarketsanddistributioncenters.

Salesareexpectedtogrow37%ledbyincreaserevenuefrombothdomesticandoverseasmarketsledbytheopeningofmorefishretailshopsandnewdistributionoutletsinThailandandMalaysia.

RevenuefromthedistributionofArowanafishisexpectedtoimproveonthebackofimportderegulationmovesinTaiwan.

Inaddition,therewouldbeincreaserevenuecomingfromthenewaccessoriesmanufacturingplantinChina.

FY02netprofitisexpectedtorise45%ledbymarginimprovement.

Netprofitisexpectedtoriseastronger45%,toS$5m,ledbyawideninginprofitmarginforthedistributionofhighervalueaddedfish(DragonandLoach)andthemanufacturingofin-housebrandsofpetaccessoriesinChina.

Inaddition,thereisanabsenceofrestructuringandstartupcostsinThailandandChinaincurredin2001.

ActionWeareinitiatingcoverageonQianHuwithaNeutralratingduetorichvaluations.

QianHuisanunder-researchedintegratedserviceproviderinthetropicalornamentalfishindustry.

Itisanattractivesmallcapplaygiventhehighcorporatetransparencyandstrongearninggrowthfromoverseasoperations.

Notwithstandingthestrongfundamentals,therecentrallyinshareprice(upalmost100%inthelastthreedays)putsthestockclosetoourtargetpriceofS$0.

90.

PeercomparisonShareMktCapEPSPE(x)EV/EBITDAOpgEBITDAP/SalesP/BVprice(S$)(S$m)0101(x)marginmargin(x)(x)OSIMSPOSIMIntl0.

801850.

0613.

812.

59.

0%11.

0%1.

44.

4AUSSPAussino.

com0.

46870.

0314.

210.

018.

9%20.

4%2.

33.

8TTISPTTIntl0.

451350.

0315.

010.

74.

5%5.

4%0.

31.

7XLHMKXianLeng1.

26610.

1111.

910.

150.

8%50.

8%5.

01.

7LACLNLawrencePLC10.

98940.

6716.

39.

613.

9%14.

8%1.

33.

3QIANSPQianHu0.

87870.

0420.

815.

210.

5%13.

7%2.

13.

3Fisheriesandwholesaleindustryaverage64915.

511.

17.

8%9.

0%0.

82.

8IncomeStatementSegmentalSource:Company,DBSVickersFY:Dec(S$m)200020012002F2003F2004FSales33.

941.

256.

367.

677.

1EBITDA5.

25.

68.

110.

112.

0OperatingProfit4.

34.

36.

68.

510.

2Assosciates0.

00.

00.

00.

00.

0Intr/InvsmtInc-0.

2-0.

1-0.

1-0.

1-0.

1PftBeforeTax4.

14.

36.

58.

410.

1Tax-1.

0-0.

9-1.

6-2.

1-2.

5MI0.

00.

00.

00.

00.

0Netprofit3.

23.

45.

06.

47.

7Depn/Amortn0.

91.

31.

51.

61.

8CashFlow4.

14.

86.

58.

09.

5X-ordItems2.

00.

00.

00.

00.

0Growthrates:SalesGrowth28.

2%21.

7%36.

6%20.

0%14.

0%OpgProfit119.

6%0.

7%52.

7%28.

3%20.

2%PBT130.

1%2.

9%53.

6%28.

6%20.

4%PAT141.

2%8.

9%44.

8%28.

3%20.

2%FY:Dec(S$m)200020012002F2003F2004FSalesOrnamentalfish16.

518.

324.

727.

730.

5Accessories12.

016.

625.

331.

638.

0Plastic&other5.

46.

36.

48.

38.

6Totalsales33.

941.

256.

367.

677.

1OperatingprofitOrnamentalfish2.

12.

13.

23.

64.

0Accessories2.

12.

64.

65.

76.

8Plastic&other0.

40.

40.

30.

50.

7Inallocatedexp-0.

4-0.

8-1.

4-1.

4-1.

4Totalopgprofit4.

24.

36.

68.

510.

2MarginOrnamentalfish12.

7%11.

4%12.

8%13.

0%13.

2%Accessories17.

2%15.

7%18.

0%18.

0%18.

0%Plastic&other8.

1%6.

5%4.

0%6.

5%8.

0%Totalopgprofit12.

5%10.

4%11.

7%12.

5%13.

2%4of4QianHuCompanyFocusDBSVickersResearchStarRatingSystemHHHHH-StrongBuy(>20%relativetomarketoverthenext12months)HHHHI-Outperform(>10%relativetomarketoverthenext12months)HHHII-Neutral(performinlinewithmarket+/-10%overthenext12months)HHIII-Underperform(<10%relativetomarketoverthenext12months)HIIII-Sell(<20%relativetomarketoverthenext12months)ThisdocumentispublishedbyDBSVickersResearch(Singapore)PteLtd(DBSVR),adirectwholly-ownedsubsidiaryofDBSVickersSecurities(Singapore)PteLtdandanindirectwholly-ownedsubsidiaryofDBSVickersSecuritiesHoldingsPteLtd.

Theresearchisbasedoninformationobtainedfromsourcesbelievedtobereliable,butwedonotmakeanyrepresentationorwarrantyastoitsaccuracy,completenessorcorrectness.

Opinionsexpressedaresubjecttochangewithoutnotice.

Thisdocumentispreparedforgeneralcirculation.

Anyrecommendationcontainedinthisdocumentdoesnothaveregardtothespecificinvestmentobjectives,financialsituationandtheparticularneedsofanyspecificaddressee.

Thisdocumentisfortheinformationofaddresseesonlyandisnottobetakeninsubstitutionfortheexerciseofjudgementbyaddressees,whoshouldobtainseparatelegalorfinancialadvice.

DBSVRacceptsnoliabilitywhatsoeverforanydirectorconsequentiallossarisingfromanyuseofthisdocumentorfurthercommunicationgiveninrelationtothisdocument.

Thisdocumentisnottobeconstruedasanofferorasolicitationofanoffertobuyorsellanysecurities.

TheDevelopmentBankofSingaporeLtdandSingaporeTechnologiesPteLtdaresubstantialshareholdersofDBSVickersSecuritiesHoldingsPteLtd,andalongwiththeiraffiliatesand/orpersonsassociatedwithanyofthemmayfromtimetotimehaveinterestsinthesecuritiesmentionedinthisdocument.

DBSVR,DBSVickersSecurities(Singapore)PteLtd,TheDevelopmentBankofSingaporeLtdandtheirassociates,theirdirectors,and/oremployeesmayhavepositionsin,andmayeffecttransactionsinsecuritiesmentionedhereinandmayalsoperformorseektoperformbroking,investmentbankingandotherbankingservicesforthesecompanies.

AnyUSpersonswishingtoobtainfurtherinformationortoeffectatransactioninanysecuritydiscussedinthisdocumentshouldcontactDBSVickersSecurities(USA)Inc.

exclusively.

DBSVickersSecurities(UK)LtdisanauthorisedpersoninthemeaningoftheFinancialServicesActandisregulatedbyTheSecuritiesandFuturesAuthorityLimited.

ResearchdistributedintheUKisintendedonlyforinstitutionalclients.

TimothyWongDirectorofResearchDBSVickersResearch(Singapore)PteLtd–8CrossStreet,#02-01PWCBuilding,Singapore048424Tel.

65-5339688,Fax:65-2268048

com5May2002CompanyFocusSingaporeEquityResearchSINGAPOREwww.

dbsvickers.

comQianHuImpressive1Q02profitgrowthWeareinitiatingcoverageonQianHuwithaNeutralratingduetorichvaluations.

QianHuisanunder-researchedintegratedserviceproviderinthetropicalornamentalfishindustry.

Itisanattractivesmallcapplaygiventhehighcorporatetransparencyandstrongearninggrowthfromoverseasoperations.

Notwithstandingthestrongfundamentals,QianHu'srecentsharepricerally(upalmost100%inthelastthreedays)putsthestockclosetoourtargetpriceofS$0.

90.

Notalivestockcompany.

ContrarytomarketperceptionthatQianHuisatropicalfishbreeder,QianHu'smainrevenuedriversarethedistributionofornamentalfishesandpetaccessoriesproducts.

TherearethreemainbusinessesinQianHu-distributionofornamentalfish,distributionandmanufacturingofpetaccessoriesandmanufacturingofplasticbags.

QianHu'splasticmanufacturingbusinesscomplementsthefishdistributionbusiness.

FY02netprofitisexpectedtorise45%ledbymarginimprovement.

NetprofitinFY02isexpectedtogrowby45%toS$5m,ledbyawideninginprofitmarginforthedistributionofhighervalueaddedfish(DragonandLoach)andthemanufacturingofin-housebrandsofpetaccessoriesinChina.

Inaddition,thereisanabsenceofrestructuringandstartupcostsinThailandandChinaincurredin2001.

ForecastsandValuationGeneralDataIssuedCapital(mshrs)100MktCap(S$m/US$m)87/48MajorShareholdersQianHuHoldings(%)31.

4Yapfamilymembers(%)43.

6FreeFloat(%)25.

0AvgDailyVol('000shrs)1,768FYDec(S$m)2001A2002F2003F2004FTurnover41566877EBITDA5.

68.

110.

112.

0PretaxProfit4.

36.

58.

410.

1NetProfit3.

45.

06.

47.

7EPS(Scts)4.

25.

16.

47.

7EPSGth8.

9%23.

0%24.

4%20.

2%P/ERatio(x)20.

816.

913.

611.

3P/BRatio(x)4.

23.

32.

72.

2DivYield0.

6%0.

7%0.

9%1.

1%ROA13.

6%15.

1%15.

2%15.

4%ROE22.

4%22.

9%21.

9%21.

6%NetGearing(%)cash2%cashcashNTA(Scts)20.

826.

231.

938.

8SharePriceChartSharePricePerformanceShareRelRelPriceSTISectorPast1mth175%178%176%Past3mths188%191%185%Past6mths273%243%252%Past12mths217%217%193%AtaGlancePriceTarget:1-yearS$0.

90StockCode:Bloomberg:QIANSPReuters:QIAN.

SISector:ConsumerSTI:1,740.

35StockRating:HHHIISectorRating:HHHHITechnicalRating:HHHIIReasonforReport:InitiatingcoverageImplications:PositiveConsensusEPS:FY023.

2SctsDBSVvsConsensusEPS(%variance):FY02+59.

4%NEUTRALInitiatingcoverageS$0.

870.

000.

100.

200.

300.

400.

500.

600.

700.

800.

901.

00May-01Jul-01Aug-01Oct-01Dec-01Jan-02Mar-02Apr-02S$QianHu100-DayMA2of4QianHuCompanyFocusHighlightsStrong1Qearningsgrowthof73%.

Netprofitjumpedto$1mduetostrongsalesgrowthandmarginenhancement,astherewerenomorerestructuringcostfortheThaiandMalaysiasubsidiaries.

Earningscontributionfromaccessories(duetotheChinaplant)andsaleofornamentalfisheslargelydrovesalesgrowth.

Salesofornamentalfishesgrewatarobust26%duetoincreasesalesinSingapore(asaresultofLuoHanfishandtheopeningofmoreornamentalfishdistributionshops),andhighersaletoTaiwan(followingthederegulationoftheimportofDragonFish)andincreaseearningscontributionfromtheThaiandMalaysiansubsidiaries.

SegmentalsearningsFY:Dec(S$m)1Q011Q02SalesOrnamentalfish4.

45.

5Accessories3.

75.

5Plastic&other1.

41.

5Totalsales9.

412.

5OperatingprofitOrnamentalfish0.

50.

7Accessories0.

41.

0Plastic&other0.

10.

1Unallocatedexpenses(0.

2)(0.

3)Totaloperatingprofit0.

81.

4MarginsOrnamentalfish10.

9%12.

8%Accessories9.

6%18.

2%Plastic&other7.

8%3.

7%Totalopgprofit8.

2%11.

3%Source:CompanyNotalivestockcompany.

ContrarytomarketperceptionthatQianHuisatropicalfishbreeder,QianHu'smainrevenuedriversarethedistributionofornamentalfishesandpetaccessoriesproducts.

TherearethreemainbusinessesinQianHu-distributionofornamentalfish,distributionandmanufacturingofpetaccessoriesandmanufacturingofplasticbags.

QianHu'splasticmanufacturingbusinesscomplementsthefishdistributionbusiness.

Anintegratedserviceproviderintheornamentalfishindustry.

QianHuisaone-stopserviceproviderinthesourcingofornamentalfishesfortheinternationalanddomesticfishbuyers.

Apartfromsourcingthevariety,QianHu'svalueaddliesinitsabilityinensuringthequalityandsturdiness(lowmortalityafterlongflights)ofthefishesviaitsstrictselection,conditioningandpackagingprocess.

Inparticular,QianHuhasmanagedtoachievea97%survivalrateofallfishesbeingexportedduetotheirqualitypackagingprocess.

Movingfromdistributingtomanufacturingofpetaccessories.

QianHu'spreviousbusinessmodelwastodistributethirdpartyandtheirownbrandofaccessories(underthe"OceanFree"and"AoShen"brands).

Theydevelopedtheirownbrandofproductsbyoutsourcingthemanufacturingprocessestosub-contractorsinChina.

In2001,QianHuacquiredWanJianginChinatomanufactureQianHu'sandthirdpartybrandofpetaccessories.

StableprofitinFY01despiteweakeconomicconditions.

Inspiteoftheweakeconomicconditions,netprofitroseamarginal3%inFY01duetoincreasedturnover.

Infact,netprofitwouldhavebeenhigherifnotforaninitialstartupcostincurredfortheThaiandChinasubsidiaries.

Sincethen,thesesubsidiarieshaveachievedprofitability.

3of4QianHuCompanyFocusProspectsHighersalesduetotheopeningofnewmarketsanddistributioncenters.

Salesareexpectedtogrow37%ledbyincreaserevenuefrombothdomesticandoverseasmarketsledbytheopeningofmorefishretailshopsandnewdistributionoutletsinThailandandMalaysia.

RevenuefromthedistributionofArowanafishisexpectedtoimproveonthebackofimportderegulationmovesinTaiwan.

Inaddition,therewouldbeincreaserevenuecomingfromthenewaccessoriesmanufacturingplantinChina.

FY02netprofitisexpectedtorise45%ledbymarginimprovement.

Netprofitisexpectedtoriseastronger45%,toS$5m,ledbyawideninginprofitmarginforthedistributionofhighervalueaddedfish(DragonandLoach)andthemanufacturingofin-housebrandsofpetaccessoriesinChina.

Inaddition,thereisanabsenceofrestructuringandstartupcostsinThailandandChinaincurredin2001.

ActionWeareinitiatingcoverageonQianHuwithaNeutralratingduetorichvaluations.

QianHuisanunder-researchedintegratedserviceproviderinthetropicalornamentalfishindustry.

Itisanattractivesmallcapplaygiventhehighcorporatetransparencyandstrongearninggrowthfromoverseasoperations.

Notwithstandingthestrongfundamentals,therecentrallyinshareprice(upalmost100%inthelastthreedays)putsthestockclosetoourtargetpriceofS$0.

90.

PeercomparisonShareMktCapEPSPE(x)EV/EBITDAOpgEBITDAP/SalesP/BVprice(S$)(S$m)0101(x)marginmargin(x)(x)OSIMSPOSIMIntl0.

801850.

0613.

812.

59.

0%11.

0%1.

44.

4AUSSPAussino.

com0.

46870.

0314.

210.

018.

9%20.

4%2.

33.

8TTISPTTIntl0.

451350.

0315.

010.

74.

5%5.

4%0.

31.

7XLHMKXianLeng1.

26610.

1111.

910.

150.

8%50.

8%5.

01.

7LACLNLawrencePLC10.

98940.

6716.

39.

613.

9%14.

8%1.

33.

3QIANSPQianHu0.

87870.

0420.

815.

210.

5%13.

7%2.

13.

3Fisheriesandwholesaleindustryaverage64915.

511.

17.

8%9.

0%0.

82.

8IncomeStatementSegmentalSource:Company,DBSVickersFY:Dec(S$m)200020012002F2003F2004FSales33.

941.

256.

367.

677.

1EBITDA5.

25.

68.

110.

112.

0OperatingProfit4.

34.

36.

68.

510.

2Assosciates0.

00.

00.

00.

00.

0Intr/InvsmtInc-0.

2-0.

1-0.

1-0.

1-0.

1PftBeforeTax4.

14.

36.

58.

410.

1Tax-1.

0-0.

9-1.

6-2.

1-2.

5MI0.

00.

00.

00.

00.

0Netprofit3.

23.

45.

06.

47.

7Depn/Amortn0.

91.

31.

51.

61.

8CashFlow4.

14.

86.

58.

09.

5X-ordItems2.

00.

00.

00.

00.

0Growthrates:SalesGrowth28.

2%21.

7%36.

6%20.

0%14.

0%OpgProfit119.

6%0.

7%52.

7%28.

3%20.

2%PBT130.

1%2.

9%53.

6%28.

6%20.

4%PAT141.

2%8.

9%44.

8%28.

3%20.

2%FY:Dec(S$m)200020012002F2003F2004FSalesOrnamentalfish16.

518.

324.

727.

730.

5Accessories12.

016.

625.

331.

638.

0Plastic&other5.

46.

36.

48.

38.

6Totalsales33.

941.

256.

367.

677.

1OperatingprofitOrnamentalfish2.

12.

13.

23.

64.

0Accessories2.

12.

64.

65.

76.

8Plastic&other0.

40.

40.

30.

50.

7Inallocatedexp-0.

4-0.

8-1.

4-1.

4-1.

4Totalopgprofit4.

24.

36.

68.

510.

2MarginOrnamentalfish12.

7%11.

4%12.

8%13.

0%13.

2%Accessories17.

2%15.

7%18.

0%18.

0%18.

0%Plastic&other8.

1%6.

5%4.

0%6.

5%8.

0%Totalopgprofit12.

5%10.

4%11.

7%12.

5%13.

2%4of4QianHuCompanyFocusDBSVickersResearchStarRatingSystemHHHHH-StrongBuy(>20%relativetomarketoverthenext12months)HHHHI-Outperform(>10%relativetomarketoverthenext12months)HHHII-Neutral(performinlinewithmarket+/-10%overthenext12months)HHIII-Underperform(<10%relativetomarketoverthenext12months)HIIII-Sell(<20%relativetomarketoverthenext12months)ThisdocumentispublishedbyDBSVickersResearch(Singapore)PteLtd(DBSVR),adirectwholly-ownedsubsidiaryofDBSVickersSecurities(Singapore)PteLtdandanindirectwholly-ownedsubsidiaryofDBSVickersSecuritiesHoldingsPteLtd.

Theresearchisbasedoninformationobtainedfromsourcesbelievedtobereliable,butwedonotmakeanyrepresentationorwarrantyastoitsaccuracy,completenessorcorrectness.

Opinionsexpressedaresubjecttochangewithoutnotice.

Thisdocumentispreparedforgeneralcirculation.

Anyrecommendationcontainedinthisdocumentdoesnothaveregardtothespecificinvestmentobjectives,financialsituationandtheparticularneedsofanyspecificaddressee.

Thisdocumentisfortheinformationofaddresseesonlyandisnottobetakeninsubstitutionfortheexerciseofjudgementbyaddressees,whoshouldobtainseparatelegalorfinancialadvice.

DBSVRacceptsnoliabilitywhatsoeverforanydirectorconsequentiallossarisingfromanyuseofthisdocumentorfurthercommunicationgiveninrelationtothisdocument.

Thisdocumentisnottobeconstruedasanofferorasolicitationofanoffertobuyorsellanysecurities.

TheDevelopmentBankofSingaporeLtdandSingaporeTechnologiesPteLtdaresubstantialshareholdersofDBSVickersSecuritiesHoldingsPteLtd,andalongwiththeiraffiliatesand/orpersonsassociatedwithanyofthemmayfromtimetotimehaveinterestsinthesecuritiesmentionedinthisdocument.

DBSVR,DBSVickersSecurities(Singapore)PteLtd,TheDevelopmentBankofSingaporeLtdandtheirassociates,theirdirectors,and/oremployeesmayhavepositionsin,andmayeffecttransactionsinsecuritiesmentionedhereinandmayalsoperformorseektoperformbroking,investmentbankingandotherbankingservicesforthesecompanies.

AnyUSpersonswishingtoobtainfurtherinformationortoeffectatransactioninanysecuritydiscussedinthisdocumentshouldcontactDBSVickersSecurities(USA)Inc.

exclusively.

DBSVickersSecurities(UK)LtdisanauthorisedpersoninthemeaningoftheFinancialServicesActandisregulatedbyTheSecuritiesandFuturesAuthorityLimited.

ResearchdistributedintheUKisintendedonlyforinstitutionalclients.

TimothyWongDirectorofResearchDBSVickersResearch(Singapore)PteLtd–8CrossStreet,#02-01PWCBuilding,Singapore048424Tel.

65-5339688,Fax:65-2268048

- variancesesehu.com相关文档

- jvksesehu.com

- t19sesehu.com

- bersesehu.com

- htmsesehu.com

- Freesesehu.com

- Selbersesehu.com

火数云-618限时活动,国内云服务器大连3折,限量50台,九江7折 限量30台!

官方网站:点击访问火数云活动官网活动方案:CPU内存硬盘带宽流量架构IP机房价格购买地址4核4G50G 高效云盘20Mbps独享不限openstack1个九江287元/月立即抢购4核8G50G 高效云盘20Mbps独享不限openstack1个九江329元/月立即抢购2核2G50G 高效云盘5Mbps独享不限openstack1个大连15.9元/月立即抢购2核4G50G 高效云盘5Mbps独享不限...

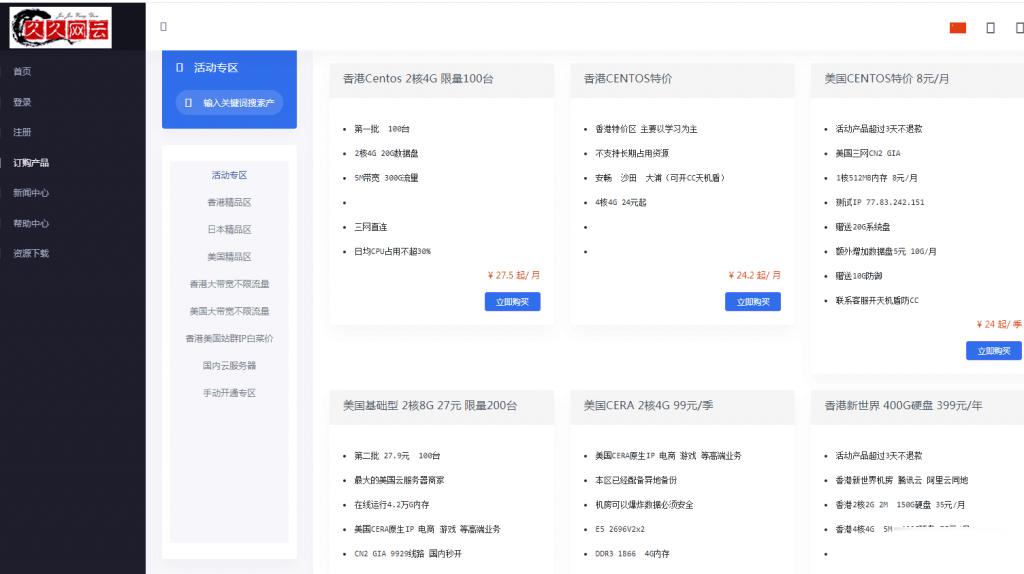

久久网云-目前最便宜的国内,香港,美国,日本VPS云服务器19.9元/月起,三网CN2,2天内不满意可以更换其他机房机器,IP免费更换!。

久久网云怎么样?久久网云好不好?久久网云是一家成立于2017年的主机服务商,致力于为用户提供高性价比稳定快速的主机托管服务,久久网云目前提供有美国免费主机、香港主机、韩国服务器、香港服务器、美国云服务器,香港荃湾CN2弹性云服务器。专注为个人开发者用户,中小型,大型企业用户提供一站式核心网络云端服务部署,促使用户云端部署化简为零,轻松快捷运用云计算!多年云计算领域服务经验,遍布亚太地区的海量节点为...

小欢互联19元/月起, 即日起至10月底 美国CERA 促销活动 美国/香港八折

小欢互联成立于2019年10月,主打海外高性价比云服务器、CDN和虚拟主机服务。近期上线了自营美国CERA机房高速VPS,进行促销活动,为客户奉上美国/香港八折优惠码:Xxc1mtLB优惠码适用于美国CERA一区/二区以及香港一区/二区优惠时间:即日起至10月底优惠码可无限次使用,且续费同价!官网:https://idc.xh-ws.com购买地址:美国CERA一区:https://idc.xh-...

sesehu.com为你推荐

-

sonicchat国外军人的左胸上有彩色的阁子是什么意思刘祚天Mc浩然的资料以及百科谁知道?曲妙玲张婉悠香艳版《白蛇传》是电影还是写真集?同一ip网站最近我们网站老是出现同一个IP无数次的进我们网站,而且是在同一时刻,是不是被人刷了?为什么呀?www.kk4kk.com猪猪影院www.mlzz.com 最新电影收费吗?m.2828dy.combabady为啥打不开了,大家帮我提供几个看电影的网址www.se222se.com原来的www站到底222eee怎么了莫非不是不能222eee在收视com了,/?求解广告法新修订的《广告法》有哪些内容www.idanmu.com腾讯有qqsk.zik.mu这个网站吗?www.ijinshan.com金山毒霸的网站是多少