Turnoverjquery

jqueryhover 时间:2021-02-27 阅读:()

MSCIUSAESGSelectIndex(USD)MSCIUSAESGSelectIndex(USD)|msci.

comTheMSCIUSAESGSelectIndexisdesignedtomaximizeexposuretopositiveenvironmental,socialandgovernance(ESG)factorswhileexhibitingriskandreturncharacteristicssimilartothoseoftheMSCIUSAIndex.

TheIndexisoptimizedtobesectordiversied,targetingcompanieswithhighESGratingsineachsector.

RelativetotheMSCIUSAIndex,theMSCIUSAESGSelectIndextendstoover-weightcompanieswithhighESGratingsandunder-weightcompanieswithlowratings.

TheIndexisabenchmarkforinvestorswhoseekaninvestmentopportunitysetwithaveryhighESGscoreandcontrolledrisk.

ConstituentselectionisbasedondatafromMSCIESGResearch.

CUMULATIVEINDEXPERFORMANCE—NETRETURNS(USD)(AUG2010–JAN2021)Aug10Jul11May12Apr13Feb14Jan15Nov15Sep16Aug17Jun18May19Mar20Jan2150100200300400MSCIUSAESGSelectMSCIUSA421.

95415.

35ANNUALPERFORMANCE(%)YearMSCIUSAESGSelectMSCIUSA202024.

1820.

73201931.

9030.

882018-5.

81-5.

04201722.

4221.

19201612.

1310.

892015-2.

000.

69201413.

4912.

69201330.

7931.

79201210.

0315.

3320111.

441.

36INDEXPERFORMANCE—NETRETURNS(%)(JAN29,2021)ANNUALIZED1Mo3Mo1YrYTD3Yr5Yr10YrSinceAug31,2010MSCIUSAESGSelect-0.

4313.

8523.

45-0.

4313.

3117.

4312.

9214.

64MSCIUSA-0.

9614.

9619.

38-0.

9612.

0216.

1113.

0514.

81FUNDAMENTALS(JAN29,2021)DivYld(%)P/EP/EFwdP/BV1.

5130.

2423.

214.

901.

4831.

7722.

664.

33INDEXRISKANDRETURNCHARACTERISTICS(AUG31,2010–JAN29,2021)ANNUALIZEDSTDDEV(%)2SHARPERATIO2,3MAXIMUMDRAWDOWNBetaTrackingError(%)Turnover(%)13Yr5Yr10Yr3Yr5Yr10YrSinceAug31,2010(%)PeriodYYYY-MM-DDMSCIUSAESGSelect0.

982.

1528.

3118.

4515.

0113.

700.

681.

060.

901.

0132.

842020-02-19—2020-03-23MSCIUSA1.

000.

003.

1319.

0315.

3013.

750.

610.

970.

911.

0234.

162020-02-19—2020-03-231Last12months2Basedonmonthlynetreturnsdata3BasedonICELIBOR1MOnSeptember1,2010theFTSEKLDindexestransitionedtotheMSCIESGIndexes.

TheformerKLDindexeshadmultiplethirdpartyindexcalculatorsovertime.

ConsequentlytheMSCIESGindexhistorieshavebeenaggregatedandcompiledtocreateacontinuoustimeseriesfromavarietyofsources—sourceswhichmayhavefolloweddifferentindexcalculationmethodologiesinsomeinstances.

TheMSCIESGIndexesuseratingsandotherdatasuppliedbyMSCIESGResearchInc,asubsidiaryofMSCIInc.

TheMSCIUSAESGSelectIndexwaslaunchedonSep01,2010.

Datapriortothelaunchdateisback-testeddata(i.

e.

calculationsofhowtheindexmighthaveperformedoverthattimeperiodhadtheindexexisted).

Therearefrequentlymaterialdifferencesbetweenback-testedperformanceandactualresults.

Pastperformance--whetheractualorback-tested--isnoindicationorguaranteeoffutureperformance.

JAN29,2021MSCIUSAESGSelectIndex(USD)|msci.

comINDEXCHARACTERISTICSMSCIUSAESGSelectMSCIUSANumberofConstituents198620Weight(%)Largest5.

366.

72Smallest0.

090.

01Average0.

510.

16Median0.

300.

06TOP10CONSTITUENTSIndexWt.

(%)ParentIndexWt.

(%)SectorAPPLE5.

366.

72InfoTechMICROSOFTCORP5.

274.

96InfoTechALPHABETA2.

961.

63CommSrvcsTESLA2.

071.

76ConsDiscrACCENTUREA1.

880.

46InfoTechHOMEDEPOT1.

820.

87ConsDiscrFACEBOOKA1.

721.

85CommSrvcsBLACKROCKA1.

600.

32FinancialsNVIDIA1.

530.

95InfoTechSALESFORCE.

COM1.

490.

61InfoTechTotal25.

6820.

14FACTORS-KEYEXPOSURESTHATDRIVERISKANDRETURNMSCIFACTORBOXMSCIUSAESGSelectMSCIUSAUNDERWEIGHTNEUTRALOVERWEIGHTSelectIndex(USD)|msci.

comINDEXMETHODOLOGYMSCIUSAESGSelectIndexconstituentsareselectedfromtheMSCIUSAIndex,whichismadeupofsecuritiesoflargeandmidcapU.

S.

companies.

CompanieswithTobaccoinvolvementareexcludedfromtheIndex.

CompanieswithMSCIESGControversiesscorebelow3arenoteligiblefortheIndex.

Theuniverseofeligiblecompaniesareoptimizedusingparametersforpredictedtrackingerror(1.

8%),maximum(5%)andminimum(0.

1%)constituentweight,sectorvariationfromtheparentindex(+/-3%),turnoverandotherfactors.

Sinceconstituentselectionandweightsaredeterminedusingoptimization,theIndexisnotcapitalizationweighted.

AttheQuarterlyIndexReviews,companieswithMSCIESGControversiesscorebelow2areremoved.

TheIndexisoptimizedonaquarterlybasiscoincidingwiththeregularIndexReviewsoftheMSCIGlobalInvestableMarketIndexes.

ChangesareeffectiveatthebeginningofMarch,June,SeptemberandDecember.

FACTORBOXANDFaCSMETHODOLOGYMSCIFaCSisastandardmethod(MSCIFaCSMethodology)forevaluatingandreportingtheFactorcharacteristicsofequityportfolios.

MSCIFaCSconsistsofFactorGroups(e.

g.

Value,Size,Momentum,Quality,Yield,andVolatility)thathavebeenextensivelydocumentedinacademicliteratureandvalidatedbyMSCIResearchaskeydriversofriskandreturninequityportfolios.

TheseFactorGroupsareconstructedbyaggregating16factors(e.

g.

Book-to-Price,Earnings/DividendYields,LTReversal,Leverage,EarningsVariability/Quality,Beta)fromthelatestBarraglobalequityfactorriskmodel,GEMLT,designedtomakefundcomparisonstransparentandintuitiveforuse.

TheMSCIFactorBox,whichispoweredbyMSCIFaCS,providesavisualizationdesignedtoeasilycompareabsoluteexposuresoffunds/indexesandtheirbenchmarksalong6FactorGroupsthathavehistoricallydemonstratedexcessmarketreturnsoverthelongrun.

comTheMSCIUSAESGSelectIndexisdesignedtomaximizeexposuretopositiveenvironmental,socialandgovernance(ESG)factorswhileexhibitingriskandreturncharacteristicssimilartothoseoftheMSCIUSAIndex.

TheIndexisoptimizedtobesectordiversied,targetingcompanieswithhighESGratingsineachsector.

RelativetotheMSCIUSAIndex,theMSCIUSAESGSelectIndextendstoover-weightcompanieswithhighESGratingsandunder-weightcompanieswithlowratings.

TheIndexisabenchmarkforinvestorswhoseekaninvestmentopportunitysetwithaveryhighESGscoreandcontrolledrisk.

ConstituentselectionisbasedondatafromMSCIESGResearch.

CUMULATIVEINDEXPERFORMANCE—NETRETURNS(USD)(AUG2010–JAN2021)Aug10Jul11May12Apr13Feb14Jan15Nov15Sep16Aug17Jun18May19Mar20Jan2150100200300400MSCIUSAESGSelectMSCIUSA421.

95415.

35ANNUALPERFORMANCE(%)YearMSCIUSAESGSelectMSCIUSA202024.

1820.

73201931.

9030.

882018-5.

81-5.

04201722.

4221.

19201612.

1310.

892015-2.

000.

69201413.

4912.

69201330.

7931.

79201210.

0315.

3320111.

441.

36INDEXPERFORMANCE—NETRETURNS(%)(JAN29,2021)ANNUALIZED1Mo3Mo1YrYTD3Yr5Yr10YrSinceAug31,2010MSCIUSAESGSelect-0.

4313.

8523.

45-0.

4313.

3117.

4312.

9214.

64MSCIUSA-0.

9614.

9619.

38-0.

9612.

0216.

1113.

0514.

81FUNDAMENTALS(JAN29,2021)DivYld(%)P/EP/EFwdP/BV1.

5130.

2423.

214.

901.

4831.

7722.

664.

33INDEXRISKANDRETURNCHARACTERISTICS(AUG31,2010–JAN29,2021)ANNUALIZEDSTDDEV(%)2SHARPERATIO2,3MAXIMUMDRAWDOWNBetaTrackingError(%)Turnover(%)13Yr5Yr10Yr3Yr5Yr10YrSinceAug31,2010(%)PeriodYYYY-MM-DDMSCIUSAESGSelect0.

982.

1528.

3118.

4515.

0113.

700.

681.

060.

901.

0132.

842020-02-19—2020-03-23MSCIUSA1.

000.

003.

1319.

0315.

3013.

750.

610.

970.

911.

0234.

162020-02-19—2020-03-231Last12months2Basedonmonthlynetreturnsdata3BasedonICELIBOR1MOnSeptember1,2010theFTSEKLDindexestransitionedtotheMSCIESGIndexes.

TheformerKLDindexeshadmultiplethirdpartyindexcalculatorsovertime.

ConsequentlytheMSCIESGindexhistorieshavebeenaggregatedandcompiledtocreateacontinuoustimeseriesfromavarietyofsources—sourceswhichmayhavefolloweddifferentindexcalculationmethodologiesinsomeinstances.

TheMSCIESGIndexesuseratingsandotherdatasuppliedbyMSCIESGResearchInc,asubsidiaryofMSCIInc.

TheMSCIUSAESGSelectIndexwaslaunchedonSep01,2010.

Datapriortothelaunchdateisback-testeddata(i.

e.

calculationsofhowtheindexmighthaveperformedoverthattimeperiodhadtheindexexisted).

Therearefrequentlymaterialdifferencesbetweenback-testedperformanceandactualresults.

Pastperformance--whetheractualorback-tested--isnoindicationorguaranteeoffutureperformance.

JAN29,2021MSCIUSAESGSelectIndex(USD)|msci.

comINDEXCHARACTERISTICSMSCIUSAESGSelectMSCIUSANumberofConstituents198620Weight(%)Largest5.

366.

72Smallest0.

090.

01Average0.

510.

16Median0.

300.

06TOP10CONSTITUENTSIndexWt.

(%)ParentIndexWt.

(%)SectorAPPLE5.

366.

72InfoTechMICROSOFTCORP5.

274.

96InfoTechALPHABETA2.

961.

63CommSrvcsTESLA2.

071.

76ConsDiscrACCENTUREA1.

880.

46InfoTechHOMEDEPOT1.

820.

87ConsDiscrFACEBOOKA1.

721.

85CommSrvcsBLACKROCKA1.

600.

32FinancialsNVIDIA1.

530.

95InfoTechSALESFORCE.

COM1.

490.

61InfoTechTotal25.

6820.

14FACTORS-KEYEXPOSURESTHATDRIVERISKANDRETURNMSCIFACTORBOXMSCIUSAESGSelectMSCIUSAUNDERWEIGHTNEUTRALOVERWEIGHTSelectIndex(USD)|msci.

comINDEXMETHODOLOGYMSCIUSAESGSelectIndexconstituentsareselectedfromtheMSCIUSAIndex,whichismadeupofsecuritiesoflargeandmidcapU.

S.

companies.

CompanieswithTobaccoinvolvementareexcludedfromtheIndex.

CompanieswithMSCIESGControversiesscorebelow3arenoteligiblefortheIndex.

Theuniverseofeligiblecompaniesareoptimizedusingparametersforpredictedtrackingerror(1.

8%),maximum(5%)andminimum(0.

1%)constituentweight,sectorvariationfromtheparentindex(+/-3%),turnoverandotherfactors.

Sinceconstituentselectionandweightsaredeterminedusingoptimization,theIndexisnotcapitalizationweighted.

AttheQuarterlyIndexReviews,companieswithMSCIESGControversiesscorebelow2areremoved.

TheIndexisoptimizedonaquarterlybasiscoincidingwiththeregularIndexReviewsoftheMSCIGlobalInvestableMarketIndexes.

ChangesareeffectiveatthebeginningofMarch,June,SeptemberandDecember.

FACTORBOXANDFaCSMETHODOLOGYMSCIFaCSisastandardmethod(MSCIFaCSMethodology)forevaluatingandreportingtheFactorcharacteristicsofequityportfolios.

MSCIFaCSconsistsofFactorGroups(e.

g.

Value,Size,Momentum,Quality,Yield,andVolatility)thathavebeenextensivelydocumentedinacademicliteratureandvalidatedbyMSCIResearchaskeydriversofriskandreturninequityportfolios.

TheseFactorGroupsareconstructedbyaggregating16factors(e.

g.

Book-to-Price,Earnings/DividendYields,LTReversal,Leverage,EarningsVariability/Quality,Beta)fromthelatestBarraglobalequityfactorriskmodel,GEMLT,designedtomakefundcomparisonstransparentandintuitiveforuse.

TheMSCIFactorBox,whichispoweredbyMSCIFaCS,providesavisualizationdesignedtoeasilycompareabsoluteexposuresoffunds/indexesandtheirbenchmarksalong6FactorGroupsthathavehistoricallydemonstratedexcessmarketreturnsoverthelongrun.

- Turnoverjquery相关文档

- 框架jquery

- 河南经贸职业学院关于河南经贸职业学院"三元制"智慧商业实训

- keyboardjquery

- numberjquery

- PHPjquery

- derivativejqueryhover

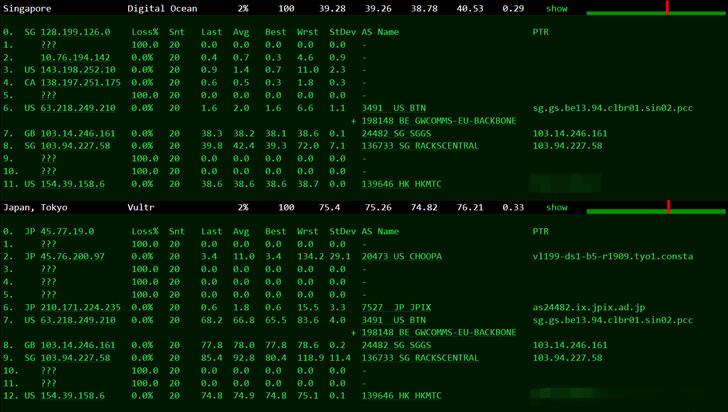

Megalayer新加坡服务器国际带宽线路测评

前几天有关注到Megalayer云服务器提供商有打算在月底的时候新增新加坡机房,这个是继美国、中国香港、菲律宾之外的第四个机房。也有工单询问到官方,新加坡机房有包括CN2国内优化线路和国际带宽,CN2优化线路应该是和菲律宾差不多的。如果我们追求速度和稳定性的中文业务,建议还是选择CN2优化带宽的香港服务器。这里有要到Megalayer新加坡服务器国际带宽的测试服务器,E3-1230配置20M国际带...

易探云美国云服务器评测,主机低至33元/月,336元/年

美国服务器哪家平台好?美国服务器无需备案,即开即用,上线快。美国服务器多数带防御,且有时候项目运营的时候,防御能力是用户考虑的重点,特别是网站容易受到攻击的行业。现在有那么多美国一年服务器,哪家的美国云服务器好呢?美国服务器用哪家好?这里推荐易探云,有美国BGP、美国CN2、美国高防、美国GIA等云服务器,线路优化的不错。易探云刚好就是做香港及美国云服务器的主要商家之一,我们来看一下易探云美国云服...

ZJI:台湾CN2/香港高主频服务器7折每月595元起,其他全场8折

ZJI原名维翔主机,是原来Wordpress圈知名主机商家,成立于2011年,2018年9月更名为ZJI,提供香港、日本、美国独立服务器(自营/数据中心直营)租用及VDS、虚拟主机空间、域名注册业务。ZJI今年全新上架了台湾CN2线路服务器,本月针对香港高主频服务器和台湾CN2服务器提供7折优惠码,其他机房及产品提供8折优惠码,优惠后台湾CN2线路E5服务器月付595元起。台湾一型CPU:Inte...

jqueryhover为你推荐

-

spgnux怎么安装思普操作系统打开网页出现错误网页上有错误怎么解决?bluestacksBlueStacks安卓模拟器官方版怎么用?淘宝店推广如何推广淘宝店安卓应用平台安卓系统支持的软件并不是那么多,为什么这么多人推崇?安卓应用平台安卓手机下软件哪个网站好ios7固件下载ios 7及以上固件请在设备上点“信任”在哪点?2012年正月十五2012年正月十五上午9点27分出生的女孩儿五行缺什么,命怎么样ios系统ios系统的手机有哪些?如何清理ie缓存怎么清除IE缓存.