numberjquery

jqueryhover 时间:2021-02-27 阅读:()

MSCIResearch2010MSCI.

Allrightsreserved.

1of7Pleaserefertothedisclaimerattheendofthisdocument.

MSCIUSAESGSelectIndexMethodologyJuly2010MSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

2of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV07101.

INTRODUCTIONTheMSCIUSAESGSelectIndexisdesignedtomaximizeexposuretopositiveenvironmental,socialandgovernance(ESG)factorswhileexhibitingriskandreturncharacteristicssimilartothoseoftheMSCIUSAIndex.

TheIndexissector-diversifiedwithhighESGratingsfromeachsector.

RelativetotheMSCIUSAIndex,theMSCIUSAESGSelectIndextendstoover-weightcompanieswithhigherESGratingsandunder-weightcompanieswithlowerratings.

TobaccocompaniesarenoteligiblefortheIndex.

2.

ESGRESEARCHFRAMEWORKMSCI'sESGresearchframeworkgeneratesananalysisandratingofeachcompany'smanagementofitsenvironmental,socialandgovernanceperformance.

Theratingcriteriaaddressacompany'sESGperformanceinthecontextoffivecategories,coveringkeycorporatestakeholders.

Environment–rateacompany'smanagementofitsenvironmentalchallenges,includingitsefforttoreduceoroffsettheimpactsofitsproductsandoperations.

CommunityandSociety–measurehowwellacompanymanagesitsimpactonthecommunitieswhereitoperates,includingitstreatmentoflocalpopulation,itshandlingofhumanrightsissuesanditscommitmenttophilanthropicactivities.

EmployeesandSupplyChain–assessacompany'srecordofmanagingemployees,contractorsandsuppliers.

Issuesofparticularinterestincludelabor-managementrelations,anti-discriminationpoliciesandpractices,employeesafety,andthelaborrightsofworkersthroughoutthecompany'ssupplychain.

Customers–measurethequalityandsafetyrecordofacompany'sproducts,itsmarketingpractices,andanyinvolvementinregulatoryoranti-competitivecontroversies.

GovernanceandEthics–addressacompany'sinvestorrelationsandmanagementpractices,includingcompanysustainabilityreporting,boardaccountabilityandbusinessethicspoliciesandpractices.

MSCIappliesitsproprietaryESGratingframeworktoeachcompanybyselectingtheESGratingcriteriamostrelevanttoeachfirm.

Toevaluateacompany,analystsreviewmorethan500datapointsandscoremorethan100indicators.

MSCIexpressesacompany'sESGperformanceasanumericalscoreandonaletter-basedratingscale.

Theratingsfallonanine-pointscalefromAAAtoC.

Scoresandratingsarenotnormalizedacrossindividualindustriesortheoverallcompanyuniverse.

Thismeansthatoneindustrymayhavenocompaniesthatreceiveany"A"ratings,whileanotherindustrymayhavenocompanieswith"C"ratings.

FormoredetailsonESGscoresandratings,pleaserefertohttp://www.

kld.

com/research/3.

CONSTRUCTINGTHEMSCIUSAESGSELECTINDEXConstructingtheMSCIUSAESGSelectIndexinvolvesthefollowingsteps:Definingtheunderlyinguniverse;Definingtheoptimizationconstraints;andMSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

3of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV0710Determiningtheoptimizedportfolio.

3.

1DefiningtheunderlyinguniverseTheunderlyinguniversefortheMSCIUSAESGSelectIndexistheMSCIUSAIndex,excludinganystockswithTobaccoinvolvement.

3.

2DefiningtheoptimizationconstraintsConstituentsareselectedtomaximizeexposuretocompanybasedESGscores,subjecttomaintainingriskandreturncharacteristicssimilartotheMSCIUSAIndex.

ESGscoresarenormalizedandfactoredintotheoptimizationprocess.

OptimizationisaquantitativeprocessthatconsidersthemarketcapitalizationweightsfromtheMSCIUSAIndex,ESGscoresandadditionaloptimizationconstraintstoselectandweightheconstituentsintheIndex.

NormalizationoftheESGscoresallowstheoptimizationtoassesseachscoreinthecontextoftheoveralldistributionoftheESGscores.

Ateachquarterlyindexreview,thefollowingoptimizationconstraintsareusedforreplicabilityandinvestability:Thepredictedtrackingerrorisrestrictedto1.

8%Themaximumweightofanindexconstituentwillbe5%;Theminimumweightofanindexconstituentwillbe0.

1%;Thenumberofindexconstituentsisconstrainedtoamaximumof350;ThesectorweightsoftheMSCIUSAESGSelectIndexwillnotdeviatemorethan+/-3%fromthesectorweightsofMSCIUSA;TheonewayturnoveroftheMSCIUSAESGSelectIndexisconstrainedtoamaximumof15%atSemi-AnnualIndexReviewsand10%atQuarterlyIndexReviews;Onewaytransactioncostissetto0.

5%whichaimstoachieveabalancebetweenturnoverandESGScores;andAnAS/CF(AssetSelection/CommonFactor)RiskAversionRatioof10isapplied.

PleaserefertotheAppendixforthedescriptionofthehandlingofinfeasibleoptimizations.

3.

3DefiningtheoptimizedportfolioTheMSCIUSAESGSelectIndexisconstructedusingthemostrecentreleaseoftheBarraOpenOptimizerincombinationwiththerelevantBarraEquityModel.

TheoptimizationusestheMSCIUSAIndexastheuniverseofeligiblesecuritiesandthespecifiedoptimizationobjectiveandconstraintstodeterminetheoptimalMSCIUSAESGSelectIndex.

MSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

4of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV07104.

MAINTAININGTHEMSCIUSAESGSELECTINDEX4.

1QuarterlyIndexReviewsTheMSCIUSAESGSelectIndexisrebalancedonaquarterlybasistocoincidewiththeregularIndexReviews(Semi-AnnualIndexReviewsinMayandNovemberandQuarterlyIndexReviewsinFebruaryandAugust)oftheMSCIGlobalInvestableMarketIndices.

ThechangesareimplementedattheendofFebruary,May,AugustandNovember.

ESGscoresusedforthequarterlyindexreviewswillbetakenasoftheendofthemonthprecedingtheIndexReview,i.

e.

,January,April,JulyandOctober.

AteachIndexReview,theoptimizationprocessoutlinedinSection3isimplemented.

CompaniescanonlybeaddedtotheMSCIUSAESGSelectIndexatregularIndexReviews.

4.

2OngoingEvent-RelatedMaintenanceIngeneral,theMSCIUSAESGSelectIndexfollowstheeventmaintenanceoftheunderlyingMSCIUSAIndex.

NewadditionstotheunderlyingindexduetocorporateeventsarenotaddedsimultaneouslytotheMSCIUSAESGSelectIndex,butareconsideredforinclusionatthefollowingIndexReview.

CompaniesdeletedfromtheMSCIUSAIndexbetweenIndexReviewsduetocorporateeventsmaintenancearealsodeletedatthesametimefromtheMSCIUSAESGSelectIndex.

ThetechnicaldetailsrelatingtothehandlingofspecificcorporateeventtypescanbefoundintheMSCICorporateEventsMethodologybookavailableat:http://www.

mscibarra.

com/products/indices/international_equity_indices/gimi/stdindex/methodology.

htmlMSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

5of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV0710Appendix:HandlingInfeasibleOptimizationsDuringthequarterlyindexreview,intheeventthatthereisnooptimalsolutionthatsatisfiesalltheoptimizationconstraintsdefinedinSection3.

2,thetrackingerrorwillberelaxedinstepsof0.

2%untilanoptimalsolutionisfound.

MSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

6of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV0710ContactInformationclientservice@msci.

comAmericasAmericasAtlantaBostonChicagoMontrealMonterreyNewYorkSanFranciscoSaoPauloStamfordToronto1.

888.

588.

4567(tollfree)+1.

404.

551.

3212+1.

617.

532.

0920+1.

312.

675.

0545+1.

514.

847.

7506+52.

81.

1253.

4020+1.

212.

804.

3901+1.

415.

836.

8800+55.

11.

3706.

1360+1.

203.

325.

5630+1.

416.

628.

1007Europe,MiddleEast&AfricaAmsterdamCapeTownFrankfurtGenevaLondonMadridMilanParisZurich+31.

20.

462.

1382+27.

21.

673.

0100+49.

69.

133.

859.

00+41.

22.

817.

9777+44.

20.

7618.

2222+34.

91.

700.

7275+39.

02.

5849.

04150800.

91.

59.

17(tollfree)+41.

44.

220.

9300AsiaPacificChinaNorthChinaSouthHongKongSeoulSingaporeSydneyTokyo10800.

852.

1032(tollfree)10800.

152.

1032(tollfree)+852.

2844.

9333+827.

0768.

88984800.

852.

3749(tollfree)+61.

2.

9033.

9333+81.

3.

5226.

8222www.

mscibarra.

com|www.

riskmetrics.

comMSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

7of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV0710NoticeandDisclaimerThisdocumentandalloftheinformationcontainedinit,includingwithoutlimitationalltext,data,graphs,charts(collectively,the"Information")isthepropertyofMSClInc.

,itssubsidiaries(includingwithoutlimitationBarra,Inc.

andRiskMetricsGroup,Inc.

)and/ortheirsubsidiaries(includingwithoutlimitationtheFEA,ISS,KLDandCFRAcompanies)(aloneorwithoneormoreofthem,"MSCI"),ortheirdirectorindirectsuppliersoranythirdpartyinvolvedinthemakingorcompilingoftheInformation(collectively(includingMSCI),the"MSCIParties"orindividually,an"MSCIParty"),asapplicable,andisprovidedforinformationalpurposesonly.

TheInformationmaynotbereproducedorredisseminatedinwholeorinpartwithoutpriorwrittenpermissionfromtheapplicableMSCIParty.

TheInformationmaynotbeusedtoverifyorcorrectotherdata,tocreateindices,riskmodelsoranalytics,orinconnectionwithissuing,offering,sponsoring,managingormarketinganysecurities,portfolios,financialproductsorotherinvestmentvehiclesbasedon,linkedto,trackingorotherwisederivedfromanyMSCIproductsordata.

Historicaldataandanalysisshouldnotbetakenasanindicationorguaranteeofanyfutureperformance,analysis,forecastorprediction.

NoneoftheInformationconstitutesanoffertosell(orasolicitationofanoffertobuy),orapromotionorrecommendationof,anysecurity,financialproductorotherinvestmentvehicleoranytradingstrategy,andnoneoftheMSCIPartiesendorses,approvesorotherwiseexpressesanyopinionregardinganyissuer,securities,financialproductsorinstrumentsortradingstrategies.

NoneoftheInformation,MSCIindices,modelsorotherproductsorservicesisintendedtoconstituteinvestmentadviceorarecommendationtomake(orrefrainfrommaking)anykindofinvestmentdecisionandmaynotbereliedonassuch.

TheuseroftheInformationassumestheentireriskofanyuseitmaymakeorpermittobemadeoftheInformation.

NONEOFTHEMSCIPARTIESMAKESANYEXPRESSORIMPLIEDWARRANTIESORREPRESENTATIONSWITHRESPECTTOTHEINFORMATION(ORTHERESULTSTOBEOBTAINEDBYTHEUSETHEREOF),ANDTOTHEMAXIMUMEXTENTPERMITTEDBYLAW,MSCI,ONITSBEHALFANDONTHEBEHALFOFEACHMSCIPARTY,HEREBYEXPRESSLYDISCLAIMSALLIMPLIEDWARRANTIES(INCLUDING,WITHOUTLIMITATION,ANYIMPLIEDWARRANTIESOFORIGINALITY,ACCURACY,TIMELINESS,NON-INFRINGEMENT,COMPLETENESS,MERCHANTABILITYANDFITNESSFORAPARTICULARPURPOSE)WITHRESPECTTOANYOFTHEINFORMATION.

Withoutlimitinganyoftheforegoingandtothemaximumextentpermittedbylaw,innoeventshallanyoftheMSCIPartieshaveanyliabilityregardinganyoftheInformationforanydirect,indirect,special,punitive,consequential(includinglostprofits)oranyotherdamagesevenifnotifiedofthepossibilityofsuchdamages.

Theforegoingshallnotexcludeorlimitanyliabilitythatmaynotbyapplicablelawbeexcludedorlimited,includingwithoutlimitation(asapplicable),anyliabilityfordeathorpersonalinjurytotheextentthatsuchinjuryresultsfromthenegligenceorwilfuldefaultofitself,itsservants,agentsorsub-contractors.

Anyuseoforaccesstoproducts,servicesorinformationofMSCIrequiresalicensefromMSCI.

MSCI,Barra,RiskMetrics,ISS,KLD,CFRA,FEA,EAFE,Aegis,Cosmos,BarraOne,andallotherMSCIproductnamesarethetrademarks,registeredtrademarks,orservicemarksofMSCIintheUnitedStatesandotherjurisdictions.

TheGlobalIndustryClassificationStandard(GICS)wasdevelopedbyandistheexclusivepropertyofMSCIandStandard&Poor's.

"GlobalIndustryClassificationStandard(GICS)"isaservicemarkofMSCIandStandard&Poor's.

FTSEisatrademarkoftheLondonStockExchangeandTheFinancialTimesandisusedbyFTSEInternationalLimitedandothersunderlicense.

AboutMSCIMSCIInc.

isaleadingproviderofinvestmentdecisionsupporttoolstoinvestorsglobally,includingassetmanagers,banks,hedgefundsandpensionfunds.

MSCIproductsandservicesincludeindices,portfolioriskandperformanceanalytics,andgovernancetools.

Thecompany'sflagshipproductofferingsare:theMSCIindiceswhichincludeover120,000dailyindicescoveringmorethan70countries;Barraportfolioriskandperformanceanalyticscoveringglobalequityandfixedincomemarkets;RiskMetricsmarketandcreditriskanalytics;ISSgovernanceresearchandoutsourcedproxyvotingandreportingservices;FEAvaluationmodelsandriskmanagementsoftwarefortheenergyandcommoditiesmarkets;andCFRAforensicaccountingriskresearch,legal/regulatoryriskassessment,anddue-diligence.

MSCIisheadquarteredinNewYork,withresearchandcommercialofficesaroundtheworld.

Allrightsreserved.

1of7Pleaserefertothedisclaimerattheendofthisdocument.

MSCIUSAESGSelectIndexMethodologyJuly2010MSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

2of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV07101.

INTRODUCTIONTheMSCIUSAESGSelectIndexisdesignedtomaximizeexposuretopositiveenvironmental,socialandgovernance(ESG)factorswhileexhibitingriskandreturncharacteristicssimilartothoseoftheMSCIUSAIndex.

TheIndexissector-diversifiedwithhighESGratingsfromeachsector.

RelativetotheMSCIUSAIndex,theMSCIUSAESGSelectIndextendstoover-weightcompanieswithhigherESGratingsandunder-weightcompanieswithlowerratings.

TobaccocompaniesarenoteligiblefortheIndex.

2.

ESGRESEARCHFRAMEWORKMSCI'sESGresearchframeworkgeneratesananalysisandratingofeachcompany'smanagementofitsenvironmental,socialandgovernanceperformance.

Theratingcriteriaaddressacompany'sESGperformanceinthecontextoffivecategories,coveringkeycorporatestakeholders.

Environment–rateacompany'smanagementofitsenvironmentalchallenges,includingitsefforttoreduceoroffsettheimpactsofitsproductsandoperations.

CommunityandSociety–measurehowwellacompanymanagesitsimpactonthecommunitieswhereitoperates,includingitstreatmentoflocalpopulation,itshandlingofhumanrightsissuesanditscommitmenttophilanthropicactivities.

EmployeesandSupplyChain–assessacompany'srecordofmanagingemployees,contractorsandsuppliers.

Issuesofparticularinterestincludelabor-managementrelations,anti-discriminationpoliciesandpractices,employeesafety,andthelaborrightsofworkersthroughoutthecompany'ssupplychain.

Customers–measurethequalityandsafetyrecordofacompany'sproducts,itsmarketingpractices,andanyinvolvementinregulatoryoranti-competitivecontroversies.

GovernanceandEthics–addressacompany'sinvestorrelationsandmanagementpractices,includingcompanysustainabilityreporting,boardaccountabilityandbusinessethicspoliciesandpractices.

MSCIappliesitsproprietaryESGratingframeworktoeachcompanybyselectingtheESGratingcriteriamostrelevanttoeachfirm.

Toevaluateacompany,analystsreviewmorethan500datapointsandscoremorethan100indicators.

MSCIexpressesacompany'sESGperformanceasanumericalscoreandonaletter-basedratingscale.

Theratingsfallonanine-pointscalefromAAAtoC.

Scoresandratingsarenotnormalizedacrossindividualindustriesortheoverallcompanyuniverse.

Thismeansthatoneindustrymayhavenocompaniesthatreceiveany"A"ratings,whileanotherindustrymayhavenocompanieswith"C"ratings.

FormoredetailsonESGscoresandratings,pleaserefertohttp://www.

kld.

com/research/3.

CONSTRUCTINGTHEMSCIUSAESGSELECTINDEXConstructingtheMSCIUSAESGSelectIndexinvolvesthefollowingsteps:Definingtheunderlyinguniverse;Definingtheoptimizationconstraints;andMSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

3of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV0710Determiningtheoptimizedportfolio.

3.

1DefiningtheunderlyinguniverseTheunderlyinguniversefortheMSCIUSAESGSelectIndexistheMSCIUSAIndex,excludinganystockswithTobaccoinvolvement.

3.

2DefiningtheoptimizationconstraintsConstituentsareselectedtomaximizeexposuretocompanybasedESGscores,subjecttomaintainingriskandreturncharacteristicssimilartotheMSCIUSAIndex.

ESGscoresarenormalizedandfactoredintotheoptimizationprocess.

OptimizationisaquantitativeprocessthatconsidersthemarketcapitalizationweightsfromtheMSCIUSAIndex,ESGscoresandadditionaloptimizationconstraintstoselectandweightheconstituentsintheIndex.

NormalizationoftheESGscoresallowstheoptimizationtoassesseachscoreinthecontextoftheoveralldistributionoftheESGscores.

Ateachquarterlyindexreview,thefollowingoptimizationconstraintsareusedforreplicabilityandinvestability:Thepredictedtrackingerrorisrestrictedto1.

8%Themaximumweightofanindexconstituentwillbe5%;Theminimumweightofanindexconstituentwillbe0.

1%;Thenumberofindexconstituentsisconstrainedtoamaximumof350;ThesectorweightsoftheMSCIUSAESGSelectIndexwillnotdeviatemorethan+/-3%fromthesectorweightsofMSCIUSA;TheonewayturnoveroftheMSCIUSAESGSelectIndexisconstrainedtoamaximumof15%atSemi-AnnualIndexReviewsand10%atQuarterlyIndexReviews;Onewaytransactioncostissetto0.

5%whichaimstoachieveabalancebetweenturnoverandESGScores;andAnAS/CF(AssetSelection/CommonFactor)RiskAversionRatioof10isapplied.

PleaserefertotheAppendixforthedescriptionofthehandlingofinfeasibleoptimizations.

3.

3DefiningtheoptimizedportfolioTheMSCIUSAESGSelectIndexisconstructedusingthemostrecentreleaseoftheBarraOpenOptimizerincombinationwiththerelevantBarraEquityModel.

TheoptimizationusestheMSCIUSAIndexastheuniverseofeligiblesecuritiesandthespecifiedoptimizationobjectiveandconstraintstodeterminetheoptimalMSCIUSAESGSelectIndex.

MSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

4of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV07104.

MAINTAININGTHEMSCIUSAESGSELECTINDEX4.

1QuarterlyIndexReviewsTheMSCIUSAESGSelectIndexisrebalancedonaquarterlybasistocoincidewiththeregularIndexReviews(Semi-AnnualIndexReviewsinMayandNovemberandQuarterlyIndexReviewsinFebruaryandAugust)oftheMSCIGlobalInvestableMarketIndices.

ThechangesareimplementedattheendofFebruary,May,AugustandNovember.

ESGscoresusedforthequarterlyindexreviewswillbetakenasoftheendofthemonthprecedingtheIndexReview,i.

e.

,January,April,JulyandOctober.

AteachIndexReview,theoptimizationprocessoutlinedinSection3isimplemented.

CompaniescanonlybeaddedtotheMSCIUSAESGSelectIndexatregularIndexReviews.

4.

2OngoingEvent-RelatedMaintenanceIngeneral,theMSCIUSAESGSelectIndexfollowstheeventmaintenanceoftheunderlyingMSCIUSAIndex.

NewadditionstotheunderlyingindexduetocorporateeventsarenotaddedsimultaneouslytotheMSCIUSAESGSelectIndex,butareconsideredforinclusionatthefollowingIndexReview.

CompaniesdeletedfromtheMSCIUSAIndexbetweenIndexReviewsduetocorporateeventsmaintenancearealsodeletedatthesametimefromtheMSCIUSAESGSelectIndex.

ThetechnicaldetailsrelatingtothehandlingofspecificcorporateeventtypescanbefoundintheMSCICorporateEventsMethodologybookavailableat:http://www.

mscibarra.

com/products/indices/international_equity_indices/gimi/stdindex/methodology.

htmlMSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

5of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV0710Appendix:HandlingInfeasibleOptimizationsDuringthequarterlyindexreview,intheeventthatthereisnooptimalsolutionthatsatisfiesalltheoptimizationconstraintsdefinedinSection3.

2,thetrackingerrorwillberelaxedinstepsof0.

2%untilanoptimalsolutionisfound.

MSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

6of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV0710ContactInformationclientservice@msci.

comAmericasAmericasAtlantaBostonChicagoMontrealMonterreyNewYorkSanFranciscoSaoPauloStamfordToronto1.

888.

588.

4567(tollfree)+1.

404.

551.

3212+1.

617.

532.

0920+1.

312.

675.

0545+1.

514.

847.

7506+52.

81.

1253.

4020+1.

212.

804.

3901+1.

415.

836.

8800+55.

11.

3706.

1360+1.

203.

325.

5630+1.

416.

628.

1007Europe,MiddleEast&AfricaAmsterdamCapeTownFrankfurtGenevaLondonMadridMilanParisZurich+31.

20.

462.

1382+27.

21.

673.

0100+49.

69.

133.

859.

00+41.

22.

817.

9777+44.

20.

7618.

2222+34.

91.

700.

7275+39.

02.

5849.

04150800.

91.

59.

17(tollfree)+41.

44.

220.

9300AsiaPacificChinaNorthChinaSouthHongKongSeoulSingaporeSydneyTokyo10800.

852.

1032(tollfree)10800.

152.

1032(tollfree)+852.

2844.

9333+827.

0768.

88984800.

852.

3749(tollfree)+61.

2.

9033.

9333+81.

3.

5226.

8222www.

mscibarra.

com|www.

riskmetrics.

comMSCIUSAESGSelectIndex|July2010MSCIResearch2010MSCI.

Allrightsreserved.

7of7Pleaserefertothedisclaimerattheendofthisdocument.

.

RV0710NoticeandDisclaimerThisdocumentandalloftheinformationcontainedinit,includingwithoutlimitationalltext,data,graphs,charts(collectively,the"Information")isthepropertyofMSClInc.

,itssubsidiaries(includingwithoutlimitationBarra,Inc.

andRiskMetricsGroup,Inc.

)and/ortheirsubsidiaries(includingwithoutlimitationtheFEA,ISS,KLDandCFRAcompanies)(aloneorwithoneormoreofthem,"MSCI"),ortheirdirectorindirectsuppliersoranythirdpartyinvolvedinthemakingorcompilingoftheInformation(collectively(includingMSCI),the"MSCIParties"orindividually,an"MSCIParty"),asapplicable,andisprovidedforinformationalpurposesonly.

TheInformationmaynotbereproducedorredisseminatedinwholeorinpartwithoutpriorwrittenpermissionfromtheapplicableMSCIParty.

TheInformationmaynotbeusedtoverifyorcorrectotherdata,tocreateindices,riskmodelsoranalytics,orinconnectionwithissuing,offering,sponsoring,managingormarketinganysecurities,portfolios,financialproductsorotherinvestmentvehiclesbasedon,linkedto,trackingorotherwisederivedfromanyMSCIproductsordata.

Historicaldataandanalysisshouldnotbetakenasanindicationorguaranteeofanyfutureperformance,analysis,forecastorprediction.

NoneoftheInformationconstitutesanoffertosell(orasolicitationofanoffertobuy),orapromotionorrecommendationof,anysecurity,financialproductorotherinvestmentvehicleoranytradingstrategy,andnoneoftheMSCIPartiesendorses,approvesorotherwiseexpressesanyopinionregardinganyissuer,securities,financialproductsorinstrumentsortradingstrategies.

NoneoftheInformation,MSCIindices,modelsorotherproductsorservicesisintendedtoconstituteinvestmentadviceorarecommendationtomake(orrefrainfrommaking)anykindofinvestmentdecisionandmaynotbereliedonassuch.

TheuseroftheInformationassumestheentireriskofanyuseitmaymakeorpermittobemadeoftheInformation.

NONEOFTHEMSCIPARTIESMAKESANYEXPRESSORIMPLIEDWARRANTIESORREPRESENTATIONSWITHRESPECTTOTHEINFORMATION(ORTHERESULTSTOBEOBTAINEDBYTHEUSETHEREOF),ANDTOTHEMAXIMUMEXTENTPERMITTEDBYLAW,MSCI,ONITSBEHALFANDONTHEBEHALFOFEACHMSCIPARTY,HEREBYEXPRESSLYDISCLAIMSALLIMPLIEDWARRANTIES(INCLUDING,WITHOUTLIMITATION,ANYIMPLIEDWARRANTIESOFORIGINALITY,ACCURACY,TIMELINESS,NON-INFRINGEMENT,COMPLETENESS,MERCHANTABILITYANDFITNESSFORAPARTICULARPURPOSE)WITHRESPECTTOANYOFTHEINFORMATION.

Withoutlimitinganyoftheforegoingandtothemaximumextentpermittedbylaw,innoeventshallanyoftheMSCIPartieshaveanyliabilityregardinganyoftheInformationforanydirect,indirect,special,punitive,consequential(includinglostprofits)oranyotherdamagesevenifnotifiedofthepossibilityofsuchdamages.

Theforegoingshallnotexcludeorlimitanyliabilitythatmaynotbyapplicablelawbeexcludedorlimited,includingwithoutlimitation(asapplicable),anyliabilityfordeathorpersonalinjurytotheextentthatsuchinjuryresultsfromthenegligenceorwilfuldefaultofitself,itsservants,agentsorsub-contractors.

Anyuseoforaccesstoproducts,servicesorinformationofMSCIrequiresalicensefromMSCI.

MSCI,Barra,RiskMetrics,ISS,KLD,CFRA,FEA,EAFE,Aegis,Cosmos,BarraOne,andallotherMSCIproductnamesarethetrademarks,registeredtrademarks,orservicemarksofMSCIintheUnitedStatesandotherjurisdictions.

TheGlobalIndustryClassificationStandard(GICS)wasdevelopedbyandistheexclusivepropertyofMSCIandStandard&Poor's.

"GlobalIndustryClassificationStandard(GICS)"isaservicemarkofMSCIandStandard&Poor's.

FTSEisatrademarkoftheLondonStockExchangeandTheFinancialTimesandisusedbyFTSEInternationalLimitedandothersunderlicense.

AboutMSCIMSCIInc.

isaleadingproviderofinvestmentdecisionsupporttoolstoinvestorsglobally,includingassetmanagers,banks,hedgefundsandpensionfunds.

MSCIproductsandservicesincludeindices,portfolioriskandperformanceanalytics,andgovernancetools.

Thecompany'sflagshipproductofferingsare:theMSCIindiceswhichincludeover120,000dailyindicescoveringmorethan70countries;Barraportfolioriskandperformanceanalyticscoveringglobalequityandfixedincomemarkets;RiskMetricsmarketandcreditriskanalytics;ISSgovernanceresearchandoutsourcedproxyvotingandreportingservices;FEAvaluationmodelsandriskmanagementsoftwarefortheenergyandcommoditiesmarkets;andCFRAforensicaccountingriskresearch,legal/regulatoryriskassessment,anddue-diligence.

MSCIisheadquarteredinNewYork,withresearchandcommercialofficesaroundtheworld.

- numberjquery相关文档

- Turnoverjquery

- 框架jquery

- 河南经贸职业学院关于河南经贸职业学院"三元制"智慧商业实训

- keyboardjquery

- PHPjquery

- derivativejqueryhover

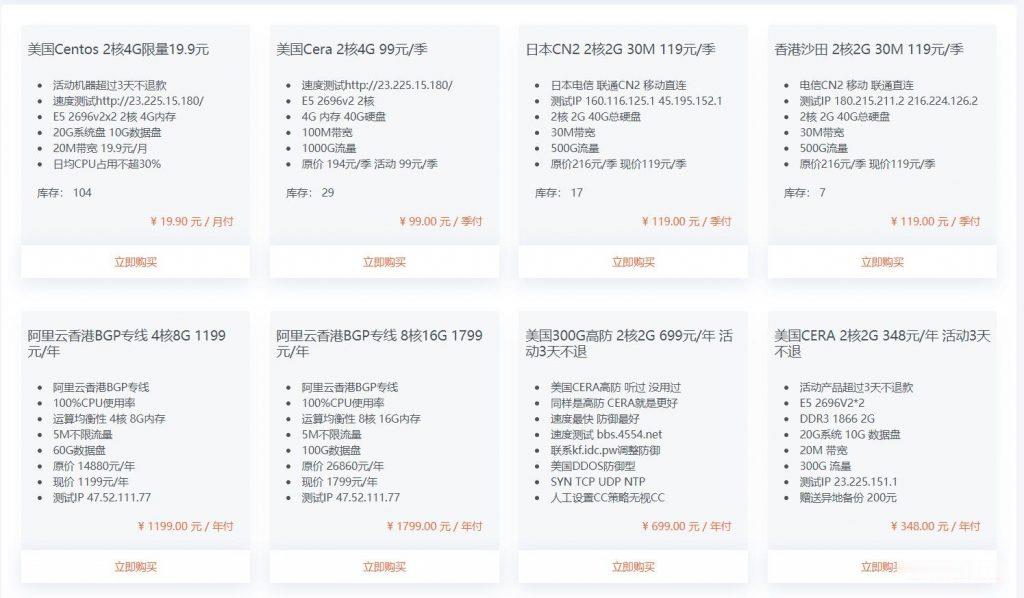

HostYun:联通AS9929线路,最低月付18元起,最高500Mbps带宽,洛杉矶机房

最近AS9929线路比较火,联通A网,对标电信CN2,HostYun也推出了走联通AS9929线路的VPS主机,基于KVM架构,开设在洛杉矶机房,采用SSD硬盘,分为入门和高带宽型,最高提供500Mbps带宽,可使用9折优惠码,最低每月仅18元起。这是一家成立于2008年的VPS主机品牌,原主机分享组织(hostshare.cn),商家以提供低端廉价VPS产品而广为人知,是小成本投入学习练手首选。...

美国cera机房 2核4G 19.9元/月 宿主机 E5 2696v2x2 512G

美国特价云服务器 2核4G 19.9元杭州王小玉网络科技有限公司成立于2020是拥有IDC ISP资质的正规公司,这次推荐的美国云服务器也是商家主打产品,有点在于稳定 速度 数据安全。企业级数据安全保障,支持异地灾备,数据安全系数达到了100%安全级别,是国内唯一一家美国云服务器拥有这个安全级别的商家。E5 2696v2x2 2核 4G内存 20G系统盘 10G数据盘 20M带宽 100G流量 1...

OneTechCloud香港/日本/美国CN2 GIA月付9折季付8折,可选原生IP或高防VPS

OneTechCloud(易科云)是一家主打CN2等高端线路的VPS主机商家,成立于2019年,提供的产品包括VPS主机和独立服务器租用等,数据中心可选美国洛杉矶、中国香港、日本等,有CN2 GIA线路、AS9929、高防、原生IP等。目前商家针对全场VPS主机提供月付9折,季付8折优惠码,优惠后香港VPS最低季付64元起(≈21.3元/月),美国洛杉矶CN2 GIA线路+20Gbps防御型VPS...

jqueryhover为你推荐

-

authorware素材如何用Authorware制作试题arm开发板想购买一个ARM开发板,选什么类型的好保护气球抖音里面看的,这是什么游戏xp系统停止服务XP系统停止服务后怎么办?安装迅雷看看播放器如何用手机安装迅雷看看播放器免费免费建站我想建一个自己的免费网站,但不知道那里有..mate8价格华为mate8手机参数配置如何,多少元网页打开很慢如何解决网速正常 网页打开很慢问题电子商务网站模板电子商务网站模板哪个好?电子商务网站模板免费建站怎么样?虚拟机软件下载谁有好的虚拟机软件?