electronicwww

www.e12.com.cn 时间:2021-03-01 阅读:()

www.

pkf-hk.

comNewPoliciesforDeepeningtheValue-addedTax("VAT")ReformPKFHONGKONG|TAXPKFHONGKONG|TAXBackgroundOn5March2019,PremierLiKeqiangproposedinthe"GovernmentWorkReport"thatthePRC'sGovernmentwillimplementlarger-scaletaxreductionpoliciesanddeepentheVATreform.

On20March2019,PremierLiKeqiangchairedtheExecutiveMeetingsoftheStateCouncilandclarifiedthesupportingmeasuresforVATtaxreduction.

On21March2019,theMinistryofFinance,theStateTaxationAdministrationandtheGeneralAdministrationofCustomsjointlyissuedthe"AnnouncementonPoliciesforDeepeningtheVATReform"(Announcement[2019]No.

39oftheMinistryofFinance,theStateTaxationAdministrationandtheGeneralAdministrationofCustoms)("AnnouncementNo.

39")andseveralguidelinesinordertoreducetheVATtaxburden.

AnnouncementNo.

39hascomeintoeffecton1April2019.

WesetoutbelowanoverviewandkeymeasuresofAnnouncementNo.

39.

OverviewofAnnouncementNo.

391.

ReductionofVATratesWhenVATgeneraltaxpayers("thetaxpayers")carryoutVATtaxableactivitiesorimportsgoods,theapplicableVATrateshavebeenreducedasfollows:theoriginalVATrate16%forrelevanttransactionsisadjustedto13%;theoriginalVAT10%forrelevanttransactionsisadjustedto9%;andtheoriginalVATrate6%forrelevanttransactionsremainsunchanged.

Wherethereisaneedtocorrectorissueaninvoiceforthetaxableactivitiesoccurredbefore1April2019,theinvoiceshallbeissuedaccordingtotheoriginalapplicableVATratesanditisprohibitedtoapplythenewVATrates.

2.

ReductionofexportrefundratesInlinewiththereductionofVATrates,thePRCenterpriseexportrefundrateandtheoverseasvisitorspurchaserefundrateupontheirdeparturehavebeenreducedaccordinglyasfollowing:-AdjustedrefundrateExportedgoodsandrelevantservicewhichareoriginallysubjectto16%VATrateand16%exportrefundrateExportrefundrateisadjustedto13%Exportedgoodsandcrossboardertaxableactivitieswhichareoriginallysubjectto10%VATrateand10%exportrefundrateExportrefundrateisadjustedto9%Thegoodspurchasedbyoverseasvisitorswhicharesubjecttoa13%refundrateRefundrateisadjustedto11%Thegoodspurchasedbyoverseasvisitorswhicharesubjecttoa9%refundrateRefundrateisadjustedto8%PleasenotethatifthetaxpayershadpaidtheVATbasedontheoriginalVATratebefore30June2019,theoriginalrefundrateshallapply;ifthetaxpayerspaidtheVATbasedonthenewVATrate,thenewrefundrateshallapply.

PKFHONGKONG|TAXOverviewofAnnouncementNo.

393.

Reductionofagriculturalproducts'deductionrateForagriculturalproductspurchasedbytaxpayers,thenewdeductionrateisadjustedto9%fromtheoriginalrate10%.

ForagriculturalproductspurchasedbytaxpayersforproductionoroutsourcedprocessingwhicharesubjecttoVATat13%,a10%deductionrateshallapplywhencalculatinginputVAT.

4.

One-offdeductionofinputVATarisingfromtheacquisitionofimmovablepropertyorprojectunderconstructionTaxpayersnolongerneedtoclaimtheirinputVATcreditforpurchasingimmovablepropertyorprojectunderconstructionover2years.

AllrelevantinputVATcannowbedeductedintherelevanttaxperiod.

BeforethecommencementofAnnouncementNo.

39,ifthereisanyinputVATnotyetfullydeducted,itcanbeusedtooffsettheoutputVATintherelevanttaxperiodstartingfromApril2019.

5.

InputVATforpurchaseofdomesticpassengertransportationservicesAnnouncementNo.

39hasrevisedtherelevantprovisionsinthepreviousVATregulationsfor"certaintypesofserviceswhoseinputVATcannotbeclaimed",andstipulatesthatifthetaxpayerspurchase"domesticpassengertransportationservices",theinputVATarisingfromsuchservicescanbeusedtooffsetthetaxpayers'outputVAT.

IfthetaxpayersobtainVATelectronicgeneralinvoicesorVATspecialinvoices,theinputVATshallbetheVATamountindicatedontheinvoices;iftaxpayersobtaindocumentswhichstatethepassenger'sidentityinformationincludingairtransporte-ticket,railwaytickets,roadorwaterwayticketandetc.

,theinputVATshallbecalculatedbytheVATinclusivepriceonsuchdocumentsandapplicableVATrates.

PKFHONGKONG|TAXOverviewofAnnouncementNo.

396.

SuperdeductionofinputVATforseveralindustriesFrom1April2019to31December2021,taxpayersengagedinproductionorlivelihoodrelatedserviceswillbegranteda10%superdeductionofinputVATtooffsettheirVATpayable("SuperDeductionPolicy").

Applicablescope:"taxpayersengagedinproductionorlivelihoodrelatedservices"referstoanytaxpayerswhichearnmorethan50%oftheirtotalsalesrevenuebyprovidingpostalservice,telecommunicationsservice,modernserviceorlifestyleservice.

Thespecificrulesareasfollows:-1.

Forthosetaxpayersincorporatedbefore31March2019,ifthesalesamountfromApril2018toMarch2019meetsrelevantrequirement(iftheoperationperiodislessthan12month,theactualsalesamountisregardedasthesalesamount),theSuperDeductionPolicyshallapplysince1April2019.

2.

Forthosetaxpayersincorporatedafter1April2019,ifthesalesamountsinceincorporationmeetsrelevantrequirement,theSuperDeductionPolicyshallapplyfromthedateofregistrationtobeageneralVATtaxpayer.

3.

Oncethetaxpayersconfirmtoapplythesuperdeduction,noadjustmentshallbemadeinthecurrentyear,andtheireligibilityforthesuperdeductioninthefollowingyearshouldbedeterminedbasedonitssalesamountoftheprecedingyear.

Ataxpayershouldmakethesuperdeductioninthecurrentperiodat10%ofthecurrentperiod'screditableinputVAT.

Nosupperdeductionshallbecalculatedfornon-deductibleinputVATaccordingtotheprevailingregulations.

IftheinputVATistransferredoutasrequired,thesuperdeductionrelatedtosuchamountofinputVATshouldalsobereducedaccordinglyinthecurrentperiod.

Theformulaofcalculatingthesuperdeductionisasbelow:Superdeductionprovisioninthecurrentperiod=creditableinputVATincurrentperiod*10%Superdeductionamountdeductibleinthecurrentperiod=balanceofsuperdeductionattheendofthepreviousperiod+superdeductionprovisioninthecurrentperiod–superdeductionamountreductioninthecurrentperiodPKFHONGKONG|TAXOverviewofAnnouncementNo.

397.

VATrefundsforexcessinputVATThepilotsystemforrefundingtheexcessinputVATcreditshastakeneffecton1April2019.

AtaxpayerwhomeetsallofthefollowingcriteriamayapplyfortherefundofitsincrementalexcessinputVAT:1.

FromthetaxperiodsinceApril2019,theincrementalexcessinputVATforeachofthesixconsecutivemonths(twoconsecutivequartersiftaxedquarterly)isapositiveamount,andtheincrementalexcessinputVATcreditsinthesixthmonthisnotlessthanRMB500,000;2.

Thetaxpayer'staxationcreditrankingisratedasGradeAorGradeB;3.

ThetaxpayerhasnotcommittedfraudforexcessinputVATrefund,exportrefundorfalselyissuedspecialVATinvoicesfor36monthsbeforeitsclaimfortheVATrefund;4.

Thetaxpayerhasnotbeenpenalizedbytaxauthoritiesfortaxevasionmattersfortwoormoretimeswithin36monthsbeforeitsclaimfortheVATrefund;and5.

IthasnotenjoyedthepolicyofVATrefundundertherefund-upon-levyorrefund-after-levysince1April2019.

TheformulaoftherefundableamountregardingincrementalexcessinputVATinthecurrentperiodisasfollows:RefundableincrementalexcessinputVAT=incrementalexcessinputVAT*theproportionofinputVAT*60%ProportionofinputVATreferstotheproportionofVATindicatedinthespecialVATinvoices(includingthemachine-printeduniforminvoicesformotorvehiclesales)thathavebeencredited,specialVATpaymentformsissuedbyCustomsforimportandtaxpaymentreceiptsfromApril2019untiltheprecedingtaxperiodoftheclaimforVATrefund,overallinputVATthathasbeencreditedinthesameperiods.

Fortheexportofgoodsandlaborservicesorcross-bordertaxableactivitiescarriedoutbyataxpayer,towhichthemeasuresforVAT"exemption,creditandrefund"areapplicable,thetaxpayercouldapplyfortherefundoftheexcessinputVATcreditsgiventhatitstillmeetsthecriteriaspecifiedinAnnouncementNo.

39aftercompletingtheformalitiesforVAT"exemption,creditorrefund";ifthemeasuresforVAT"exemptionandrefund"areapplicable,therelevantinputVATshouldnotbeusedfortherefundofexcessinputVAT.

PKFHONGKONG|TAXPKFCommentsTaxreductionisthekeyreformdirectionofthePRC'sfinancialdepartmentinrecentyears.

ThedeepeningVATreformpolicythistimefocusesonreducingtheVATratesofcertainindustriessuchasmanufacturing,transportation,constructionandbasictelecommunicationsservices,butitdoesnotreducethe6%VATrateapplicabletotheserviceindustry.

WeviewthatitispossibleforthePRCgovernmenttosimplifythethree-levelVATratesinthefutureinordertoachievethesimplificationoftaxationsystem.

Itisunlikelythatthe6%VATratewillbereducedinthefollowingyears,butthereisstillroomforsimplificationofthethree-levelVATratesafterthisreform.

Thereductionofthetaxratewouldsignificantlyreducethetaxburdenofintermediateflowsofgoodsorservices,andwouldlaythefoundationforthegovernment'smacroscopicpolicyofreducingtaxburden.

TaxpayersshouldfocusontheeffectivedateoftheVATreformpolicy.

SincethetimingwhentheVATobligationarisesmaynotbeconsistentwiththetimingofrevenuerecognition,ifthetaxpayerscandeterminethetimingofVATobligationandtheapplicableVATratesmoreaccuratelyinadvance,theyshouldbeabletomitigaterelevanttaxrisksinareasonablemanner.

TheVATreductionpolicies(includingthepilotsystemofVATrefundsforexcessinputVAT)underAnnouncementNo.

39caneffectivelyincreasetaxpayers'cashflow,reducetaxpayers'operatingcostsandcreatelargerprofitmarginsfortaxpayers.

Taxpayersshouldmakeproperpreparationsfortheabovepreferentialpoliciestoensurethattheycanfullyenjoythepreferentialtaxpoliciesbyevaluatingtheirsituation,improvingtheinternalcontrolsystemandperformingreasonabletaxplanning.

Moreover,theVATreductionpoliciesthistimearealsoinlinewiththeinternaltrendofreducingtaxburden.

Fromthedomesticperspective,weviewthatthetaxreductionpolicieswouldbebeneficialtothedevelopmentofPRC'seconomyandcross-bordertrading,andwouldbeabletoattractmoreforeigninvestmentinthePRC.

PKFHONGKONG|TAX2019PKFHongKongLimited|AllRightsReservedPKFHongKongLimitedisamemberfirmofthePKFInternationalLimitedfamilyoflegallyindependentfirmsanddoesnotacceptanyresponsibilityorliabilityfortheactionsorinactionsofanyindividualmemberorcorrespondentfirmorfirms.

JeffreyLauTaxManagerjeffreylau@pkf-hk.

comHenryFungTaxPartnerhenryfung@pkf-hk.

comlinkedin.

com/company/pkf-hong-kong/https://www.

facebook.

com/PKFhkIMPORTANTNOTE:Theinformationcontainedinthisdocumentisonlyforgeneralinformationandisnotintendedtoaddressthecircumstancesofanyparticularentitiesorindividuals.

Accordingly,thisdocumentdoesnotconstituteaccounting,tax,legal,investment,consulting,orotherprofessionaladviceorservices.

Noactionshouldbetakensolelyonthebasisofthecontentsofthisdocumentwhichonlycontainabriefoutlineoftherelevantlaws.

Beforetakinganyaction,pleaseensurethatyouobtainadvicespecifictoyourcircumstancesfromyourusualPKFtaxpartnersorothertaxadvisersorliaisewiththerelevanttaxauthorities.

Weacceptnoresponsibilityorliabilitytoanypersonschoosingtotakeactionorimplementbusinessplansoractivitiessolelyorpartiallybasedonthisdocument.

PKFHongKongLimited26/F,CiticorpCentre,18WhitfieldRoad,CausewayBay,HongKongPKFconsistsofover400offices,operatingin150countriesacrossfiveregions.

Wespecialiseinprovidinghighqualityaudit,accounting,tax,andbusinessadvisorysolutionstointernationalanddomesticorganisationsinallourmarkets.

PKFTaxandBusinessAdvisoryprovidescomprehensivetaxandbusinessadvisoryservicesinrespectoftheInternational,HongKongandChinataxmatters.

OurprofessionalteamatPKFHongKongisexperiencedinprovidingcross-borderindividualincometaxadviceinvolvingHongKongandChina.

Ifyourequireassistanceinthisregard,pleasefeelfreetocontactus.

Contactus:FollowusonWeChatScantheQRcodeandgetthelatestPKFHongTel:+85228063822Email:enquiry@pkf-hk.

comWebsite:www.

pkf-hk.

com

pkf-hk.

comNewPoliciesforDeepeningtheValue-addedTax("VAT")ReformPKFHONGKONG|TAXPKFHONGKONG|TAXBackgroundOn5March2019,PremierLiKeqiangproposedinthe"GovernmentWorkReport"thatthePRC'sGovernmentwillimplementlarger-scaletaxreductionpoliciesanddeepentheVATreform.

On20March2019,PremierLiKeqiangchairedtheExecutiveMeetingsoftheStateCouncilandclarifiedthesupportingmeasuresforVATtaxreduction.

On21March2019,theMinistryofFinance,theStateTaxationAdministrationandtheGeneralAdministrationofCustomsjointlyissuedthe"AnnouncementonPoliciesforDeepeningtheVATReform"(Announcement[2019]No.

39oftheMinistryofFinance,theStateTaxationAdministrationandtheGeneralAdministrationofCustoms)("AnnouncementNo.

39")andseveralguidelinesinordertoreducetheVATtaxburden.

AnnouncementNo.

39hascomeintoeffecton1April2019.

WesetoutbelowanoverviewandkeymeasuresofAnnouncementNo.

39.

OverviewofAnnouncementNo.

391.

ReductionofVATratesWhenVATgeneraltaxpayers("thetaxpayers")carryoutVATtaxableactivitiesorimportsgoods,theapplicableVATrateshavebeenreducedasfollows:theoriginalVATrate16%forrelevanttransactionsisadjustedto13%;theoriginalVAT10%forrelevanttransactionsisadjustedto9%;andtheoriginalVATrate6%forrelevanttransactionsremainsunchanged.

Wherethereisaneedtocorrectorissueaninvoiceforthetaxableactivitiesoccurredbefore1April2019,theinvoiceshallbeissuedaccordingtotheoriginalapplicableVATratesanditisprohibitedtoapplythenewVATrates.

2.

ReductionofexportrefundratesInlinewiththereductionofVATrates,thePRCenterpriseexportrefundrateandtheoverseasvisitorspurchaserefundrateupontheirdeparturehavebeenreducedaccordinglyasfollowing:-AdjustedrefundrateExportedgoodsandrelevantservicewhichareoriginallysubjectto16%VATrateand16%exportrefundrateExportrefundrateisadjustedto13%Exportedgoodsandcrossboardertaxableactivitieswhichareoriginallysubjectto10%VATrateand10%exportrefundrateExportrefundrateisadjustedto9%Thegoodspurchasedbyoverseasvisitorswhicharesubjecttoa13%refundrateRefundrateisadjustedto11%Thegoodspurchasedbyoverseasvisitorswhicharesubjecttoa9%refundrateRefundrateisadjustedto8%PleasenotethatifthetaxpayershadpaidtheVATbasedontheoriginalVATratebefore30June2019,theoriginalrefundrateshallapply;ifthetaxpayerspaidtheVATbasedonthenewVATrate,thenewrefundrateshallapply.

PKFHONGKONG|TAXOverviewofAnnouncementNo.

393.

Reductionofagriculturalproducts'deductionrateForagriculturalproductspurchasedbytaxpayers,thenewdeductionrateisadjustedto9%fromtheoriginalrate10%.

ForagriculturalproductspurchasedbytaxpayersforproductionoroutsourcedprocessingwhicharesubjecttoVATat13%,a10%deductionrateshallapplywhencalculatinginputVAT.

4.

One-offdeductionofinputVATarisingfromtheacquisitionofimmovablepropertyorprojectunderconstructionTaxpayersnolongerneedtoclaimtheirinputVATcreditforpurchasingimmovablepropertyorprojectunderconstructionover2years.

AllrelevantinputVATcannowbedeductedintherelevanttaxperiod.

BeforethecommencementofAnnouncementNo.

39,ifthereisanyinputVATnotyetfullydeducted,itcanbeusedtooffsettheoutputVATintherelevanttaxperiodstartingfromApril2019.

5.

InputVATforpurchaseofdomesticpassengertransportationservicesAnnouncementNo.

39hasrevisedtherelevantprovisionsinthepreviousVATregulationsfor"certaintypesofserviceswhoseinputVATcannotbeclaimed",andstipulatesthatifthetaxpayerspurchase"domesticpassengertransportationservices",theinputVATarisingfromsuchservicescanbeusedtooffsetthetaxpayers'outputVAT.

IfthetaxpayersobtainVATelectronicgeneralinvoicesorVATspecialinvoices,theinputVATshallbetheVATamountindicatedontheinvoices;iftaxpayersobtaindocumentswhichstatethepassenger'sidentityinformationincludingairtransporte-ticket,railwaytickets,roadorwaterwayticketandetc.

,theinputVATshallbecalculatedbytheVATinclusivepriceonsuchdocumentsandapplicableVATrates.

PKFHONGKONG|TAXOverviewofAnnouncementNo.

396.

SuperdeductionofinputVATforseveralindustriesFrom1April2019to31December2021,taxpayersengagedinproductionorlivelihoodrelatedserviceswillbegranteda10%superdeductionofinputVATtooffsettheirVATpayable("SuperDeductionPolicy").

Applicablescope:"taxpayersengagedinproductionorlivelihoodrelatedservices"referstoanytaxpayerswhichearnmorethan50%oftheirtotalsalesrevenuebyprovidingpostalservice,telecommunicationsservice,modernserviceorlifestyleservice.

Thespecificrulesareasfollows:-1.

Forthosetaxpayersincorporatedbefore31March2019,ifthesalesamountfromApril2018toMarch2019meetsrelevantrequirement(iftheoperationperiodislessthan12month,theactualsalesamountisregardedasthesalesamount),theSuperDeductionPolicyshallapplysince1April2019.

2.

Forthosetaxpayersincorporatedafter1April2019,ifthesalesamountsinceincorporationmeetsrelevantrequirement,theSuperDeductionPolicyshallapplyfromthedateofregistrationtobeageneralVATtaxpayer.

3.

Oncethetaxpayersconfirmtoapplythesuperdeduction,noadjustmentshallbemadeinthecurrentyear,andtheireligibilityforthesuperdeductioninthefollowingyearshouldbedeterminedbasedonitssalesamountoftheprecedingyear.

Ataxpayershouldmakethesuperdeductioninthecurrentperiodat10%ofthecurrentperiod'screditableinputVAT.

Nosupperdeductionshallbecalculatedfornon-deductibleinputVATaccordingtotheprevailingregulations.

IftheinputVATistransferredoutasrequired,thesuperdeductionrelatedtosuchamountofinputVATshouldalsobereducedaccordinglyinthecurrentperiod.

Theformulaofcalculatingthesuperdeductionisasbelow:Superdeductionprovisioninthecurrentperiod=creditableinputVATincurrentperiod*10%Superdeductionamountdeductibleinthecurrentperiod=balanceofsuperdeductionattheendofthepreviousperiod+superdeductionprovisioninthecurrentperiod–superdeductionamountreductioninthecurrentperiodPKFHONGKONG|TAXOverviewofAnnouncementNo.

397.

VATrefundsforexcessinputVATThepilotsystemforrefundingtheexcessinputVATcreditshastakeneffecton1April2019.

AtaxpayerwhomeetsallofthefollowingcriteriamayapplyfortherefundofitsincrementalexcessinputVAT:1.

FromthetaxperiodsinceApril2019,theincrementalexcessinputVATforeachofthesixconsecutivemonths(twoconsecutivequartersiftaxedquarterly)isapositiveamount,andtheincrementalexcessinputVATcreditsinthesixthmonthisnotlessthanRMB500,000;2.

Thetaxpayer'staxationcreditrankingisratedasGradeAorGradeB;3.

ThetaxpayerhasnotcommittedfraudforexcessinputVATrefund,exportrefundorfalselyissuedspecialVATinvoicesfor36monthsbeforeitsclaimfortheVATrefund;4.

Thetaxpayerhasnotbeenpenalizedbytaxauthoritiesfortaxevasionmattersfortwoormoretimeswithin36monthsbeforeitsclaimfortheVATrefund;and5.

IthasnotenjoyedthepolicyofVATrefundundertherefund-upon-levyorrefund-after-levysince1April2019.

TheformulaoftherefundableamountregardingincrementalexcessinputVATinthecurrentperiodisasfollows:RefundableincrementalexcessinputVAT=incrementalexcessinputVAT*theproportionofinputVAT*60%ProportionofinputVATreferstotheproportionofVATindicatedinthespecialVATinvoices(includingthemachine-printeduniforminvoicesformotorvehiclesales)thathavebeencredited,specialVATpaymentformsissuedbyCustomsforimportandtaxpaymentreceiptsfromApril2019untiltheprecedingtaxperiodoftheclaimforVATrefund,overallinputVATthathasbeencreditedinthesameperiods.

Fortheexportofgoodsandlaborservicesorcross-bordertaxableactivitiescarriedoutbyataxpayer,towhichthemeasuresforVAT"exemption,creditandrefund"areapplicable,thetaxpayercouldapplyfortherefundoftheexcessinputVATcreditsgiventhatitstillmeetsthecriteriaspecifiedinAnnouncementNo.

39aftercompletingtheformalitiesforVAT"exemption,creditorrefund";ifthemeasuresforVAT"exemptionandrefund"areapplicable,therelevantinputVATshouldnotbeusedfortherefundofexcessinputVAT.

PKFHONGKONG|TAXPKFCommentsTaxreductionisthekeyreformdirectionofthePRC'sfinancialdepartmentinrecentyears.

ThedeepeningVATreformpolicythistimefocusesonreducingtheVATratesofcertainindustriessuchasmanufacturing,transportation,constructionandbasictelecommunicationsservices,butitdoesnotreducethe6%VATrateapplicabletotheserviceindustry.

WeviewthatitispossibleforthePRCgovernmenttosimplifythethree-levelVATratesinthefutureinordertoachievethesimplificationoftaxationsystem.

Itisunlikelythatthe6%VATratewillbereducedinthefollowingyears,butthereisstillroomforsimplificationofthethree-levelVATratesafterthisreform.

Thereductionofthetaxratewouldsignificantlyreducethetaxburdenofintermediateflowsofgoodsorservices,andwouldlaythefoundationforthegovernment'smacroscopicpolicyofreducingtaxburden.

TaxpayersshouldfocusontheeffectivedateoftheVATreformpolicy.

SincethetimingwhentheVATobligationarisesmaynotbeconsistentwiththetimingofrevenuerecognition,ifthetaxpayerscandeterminethetimingofVATobligationandtheapplicableVATratesmoreaccuratelyinadvance,theyshouldbeabletomitigaterelevanttaxrisksinareasonablemanner.

TheVATreductionpolicies(includingthepilotsystemofVATrefundsforexcessinputVAT)underAnnouncementNo.

39caneffectivelyincreasetaxpayers'cashflow,reducetaxpayers'operatingcostsandcreatelargerprofitmarginsfortaxpayers.

Taxpayersshouldmakeproperpreparationsfortheabovepreferentialpoliciestoensurethattheycanfullyenjoythepreferentialtaxpoliciesbyevaluatingtheirsituation,improvingtheinternalcontrolsystemandperformingreasonabletaxplanning.

Moreover,theVATreductionpoliciesthistimearealsoinlinewiththeinternaltrendofreducingtaxburden.

Fromthedomesticperspective,weviewthatthetaxreductionpolicieswouldbebeneficialtothedevelopmentofPRC'seconomyandcross-bordertrading,andwouldbeabletoattractmoreforeigninvestmentinthePRC.

PKFHONGKONG|TAX2019PKFHongKongLimited|AllRightsReservedPKFHongKongLimitedisamemberfirmofthePKFInternationalLimitedfamilyoflegallyindependentfirmsanddoesnotacceptanyresponsibilityorliabilityfortheactionsorinactionsofanyindividualmemberorcorrespondentfirmorfirms.

JeffreyLauTaxManagerjeffreylau@pkf-hk.

comHenryFungTaxPartnerhenryfung@pkf-hk.

comlinkedin.

com/company/pkf-hong-kong/https://www.

facebook.

com/PKFhkIMPORTANTNOTE:Theinformationcontainedinthisdocumentisonlyforgeneralinformationandisnotintendedtoaddressthecircumstancesofanyparticularentitiesorindividuals.

Accordingly,thisdocumentdoesnotconstituteaccounting,tax,legal,investment,consulting,orotherprofessionaladviceorservices.

Noactionshouldbetakensolelyonthebasisofthecontentsofthisdocumentwhichonlycontainabriefoutlineoftherelevantlaws.

Beforetakinganyaction,pleaseensurethatyouobtainadvicespecifictoyourcircumstancesfromyourusualPKFtaxpartnersorothertaxadvisersorliaisewiththerelevanttaxauthorities.

Weacceptnoresponsibilityorliabilitytoanypersonschoosingtotakeactionorimplementbusinessplansoractivitiessolelyorpartiallybasedonthisdocument.

PKFHongKongLimited26/F,CiticorpCentre,18WhitfieldRoad,CausewayBay,HongKongPKFconsistsofover400offices,operatingin150countriesacrossfiveregions.

Wespecialiseinprovidinghighqualityaudit,accounting,tax,andbusinessadvisorysolutionstointernationalanddomesticorganisationsinallourmarkets.

PKFTaxandBusinessAdvisoryprovidescomprehensivetaxandbusinessadvisoryservicesinrespectoftheInternational,HongKongandChinataxmatters.

OurprofessionalteamatPKFHongKongisexperiencedinprovidingcross-borderindividualincometaxadviceinvolvingHongKongandChina.

Ifyourequireassistanceinthisregard,pleasefeelfreetocontactus.

Contactus:FollowusonWeChatScantheQRcodeandgetthelatestPKFHongTel:+85228063822Email:enquiry@pkf-hk.

comWebsite:www.

pkf-hk.

com

- electronicwww相关文档

- 发行人www.e12.com.cn

- 发行人www.e12.com.cn

- 意见书www.e12.com.cn

- http://www.zhnet.com.cn

- 转换器www

- www.e12.com.cn上海高中除了四大名校,接下来哪所高中最好?顺便讲下它的各方面情况

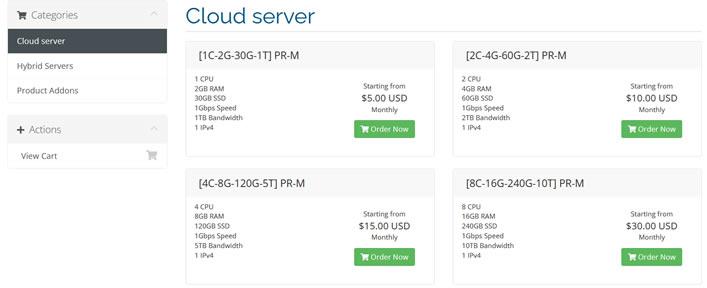

PacificRack 下架旧款方案 续费涨价 谨慎自动续费

前几天看到网友反馈到PacificRack商家关于处理问题的工单速度慢,于是也有后台提交个工单问问,没有得到答复导致工单自动停止,不清楚商家最近在调整什么。而且看到有网友反馈到,PacificRack 商家的之前年付低价套餐全部下架,而且如果到期续费的话账单中的产品价格会涨价不少。所以,如果我们有需要续费产品的话,谨慎选择。1、特价产品下架我们看到他们的所有原来发布的特价方案均已下架。如果我们已有...

Vinahost - 越南VPS主机商月6美元 季付以上赠送时长最多半年

Vinahost,这个主机商还是第一次介绍到,翻看商家的介绍信息,是一家成立于2008年的老牌越南主机商,业务涵盖网站设计、域名、SSL证书、电子邮箱、虚拟主机、越南VPS、云计算、越南服务器出租以及设备托管等,机房主要在越南胡志明市的Viettle和VNPT数据中心,其中VNPT数据中心对于国内是三网直连,速度优。类似很多海外主机商一样,希望拓展自己的业务,必须要降价优惠或者增加机房迎合需求用户...

Linode 18周年庆典活动 不断改进产品结构和体验

今天早上相比很多网友和一样收到来自Linode的庆祝18周年的邮件信息。和往年一样,他们会回顾在过去一年中的成绩,以及在未来准备改进的地方。虽然目前Linode商家没有提供以前JP1优化线路的机房,但是人家一直跟随自己的脚步在走,确实在云服务器市场上有自己的立足之地。我们看看过去一年中Linode的成就:第一、承诺投入 100,000 美元来帮助具有社会意识的非营利组织,促进有价值的革新。第二、发...

www.e12.com.cn为你推荐

-

摩根币摩根币到底是什么是不是骗局对对塔101,简单学习网,对对塔三个哪个好同ip网站一个域名能对应多个IP吗haole018.com为啥进WWWhaole001)COM怎么提示域名出错?囡道是haole001换地了吗www.toutoulu.com外链方案到底应该怎么弄呢机器蜘蛛有谁知道猎人的机械蜘蛛在哪捉的机器蜘蛛挑战或是生存Boss是一只巨型机器蜘蛛的第一人称射击游戏叫什么www.1100.com诺亚洲1100怎么下电影www.28.cnXX小说网站谁有啊?云鹏清维生素C、维生素E……是含片好还是胶囊好?