WashingtonRepublic of Congo’s Transparency Scorecard - Global …:刚果共和国的透明度,记分卡-全球…

Republic of Congo’s Transparency Scorecard

1.Unanswered Questions about the Likouala Deal

As we discussed in our last letter (2 December 2004), the Congolese Government’s2003 global settlement with Total included a transaction under which Total’s 65%working interest in the Likouala concession,valued at$160 million,was transferredto ROC and then immediately transferred from ROC to a shell company,Likouala

S.A(itself owned by another shell company registered offshore, in the British VirginIslands, whose owners are unknown). This transaction was described by theEconomist Intelligence Unit as ‘highly prejudicial to the public interest’ (BusinessAfrica, 1 October 2004).

According to the government's press release of 17 November 2004belongs either to Total, the SNPC or ROC,or a combination of these actors, so this isnot in fact an arms-length transaction.However,Total wrote in its 2003 Annual

the ROC government must be the owner.

As part of this transaction,Likouala S.A. obtained an$80 million oil-collateralizedloan- the proceeds of which were transferred to ROC.At the time, the ROC hadcommitted to abstain from contracting any new long-term oil-collateralized debt.Assuming ROC is the owner of Likouala S.A., this would have been a new long-termoil-collateralized debt in direct contravention of the 2003 staff monitored programme

Likouala SA is really a loan to the ROC government comes from a draft of theagreement between Total,ROC and Likouala S.A.obtained by Global Witness.Thisdraft states that ROC’s share of excess oil has been assigned to Likouala S.A.for thepurposes of repaying this loan. .

The ownership of Likouala S.A. is obviously problematic and complicating revenuecollection.Moreover, according to the Q42004 and Q 1 2005 certifications done byKPMG one operator,Operator 6,which is known to be Likouala S.A.,has not been

the company as described by Congolese authorities,why have the authorities not beenable to correct this situation?

Assuming the government is not the owner of Likouala SA, then if it is true thatCongo’s excess oil is used to repay the Likouala SA loan, it implies the governmentreceived much less for the Likouala concession on a net basis than the reported$80million.Whatever the case, the Likouala transaction appears to have removed anentire income stream from oversight.Given that we do not have accurate data onROC’s share of excess oil, it is impossible to calculate how much of ROC’s oilrevenue could have been diverted by this arrangement.

3/23.

2.No Disclosure of the Settlement of Outstanding Disputes with Total

As we pointed out in our last letter, there has to date been no full disclosure of thedetails of ROC’s settlement of disputes with oil company Total (Accord Général deTransaction/AGT of 10 July 2003) with regard to revenues, costs and therescheduling of ROC’s debt to Total.This obviously affects whether the internationalcommunity has a clear picture of ROC’s overall indebtedness and the government’sfiscal position.Does the IMF have full information regarding the conditions of theAGT?

3.No Progress with the Extractive Industries Transparency Initiative(EITI) We welcomed ROC’s formal adhesion to the EITI process in October 2004.According to the minimum criteria of the EITI (March 2005), the government shouldprepare a‘public,financially sustainable work plan[…] including measurable targets,a timetable for implementation, and an assessment of potential capacity constraints’ .

However, the authorities themselves have taken no steps to implement the Initiative.Frustrated by the lack of progress, the Congolese PWYP Coalition and itsinternational partners organized a regional Round Table on the EITI and oil sectortransparency in Pointe Noire,ROC in February 2005 and invited representatives ofCongolese, regional and international civil society, the Congolese government(Ministry of Hydrocarbons and Ministry of Finance), the main private oil companiesoperating in ROC and the World Bank.The final communiqué for the Round Tablecalled on the government to establish as soon as possible a multi-stakeholder workinggroup to discuss implementation. To date there has been no progress on thiscommitment by the government.

4.Lack of Transparency over Government Expenditures

Budgetary transparency remains grossly inadequate given that the government doesnot provide Parliament with information on budget execution, actual revenues andexpenditures,and Parliament is limited in its scrutiny of the budgetary documents thatare supplied to them.Congolese opposition parliamentarians staged a walk-out of thedebate on the 2005 budget due to the fact that they were not given budgetarydocuments on the morning of the debate.

In discussions with World Bank staff regarding the issue of budgetary transparency,the Congolese PWYP Coalition and its international partners were encouraged byassurances that good governance and oil sector transparency reforms will be at theheart of the Bank's elaboration of its new 2-year country strategy, and furthermorethat civil society would be consulted over the strategy and over the elaboration of thePoverty Strategy Reduction Paper(PRSP) (meetings with World Bank representativesin Washington,April 2005,and World Bank country representative in Brazzaville). ROC’s Letter of Intent and Memorandum of Economic and Financial Policies,(November 17,2004),which form the basis of the PRGF programme, state that ‘themanagement of the capital budget will be improved through better physical andfinancial monitoring of proj ects. In addition, through transparent and properprocedures for public procurement, the government will ensure that project costs arecompetitive.The World Bank has carried out an in-depth review of the investment

5 See http://www.eitransparency.org/docs/statementmarch 172005.pdf,para.7.

management arrangements and plans to assist the government in improving its

The investment budget is critical to the country’s poverty reduction strategy and theCongolese Coalition and its international partners take a keen interest in it.However,they have been unable to obtain information on the review of investment managementarrangements or on how this physical and financial monitoring of projects with theassistance of the Bank is being implemented–indeed, in exchanges with Bankofficials we were informed that it was the role of civil society to monitor governmentexpenditures.

5.No Improvement in Performance by the National Oil Company(SNPC)

(a)The SNPC Audits

In our last letter we highlighted,based on the external audits of SNPC’s 1999-2001and 2002 accounts, the mismanagement and opacity in SNPC had not improved.Partial publication of the 2002 audit revealed the accounts to be ‘uncertifiable’, cited‘major weaknesses in internal controls’(Summary,p.4)and the risk of‘fraud’ (p. 1/7).The audit also stated that SNPC was performing extremely poorly as a fiscal agent forthe government, citing ‘exceptionally large differences’ in the sales prices obtainedfrom different traders (Chapter 5,p. 10) and frequent recourse to oil-collateralizedborrowing, the costs of which are extremely high and about which there is noadequate information in terms of interest,commissions and other expenses (Chapter 5,p. 12).

main source of wealth continues unabated.KMPG cite lack of access to accountinformation(including foreign exchange accounts), and continued poor performanceby SNPC as a fiscal agent for the government in terms of its marketing of oil andcontracting of oil-collateralized debt (see below for further explanation). In summary,the auditors found ‘significant risks of errors and fraud related to weak internalcontrols and current governance’ in the 2003 accounts.Overall, this means there hasbeen no improvement in SNPC’s performance despite the many practicalrecommendations by the auditors and an ambitious Action Plan. In fact, the trend isfor the worse: the auditors conclude that the 2003 parent company and consolidatedfinancial statements are‘not certifiable(as in 2002),not even auditable(sic)’ . SNPC was supposed to implement an Action Plan based on the recommendations inKPMG’s audit of the 1999-2001 accounts, produced in August 2003 -recommendations that were repeated in the 2002 audit.We raised specific concernsregarding the implementation of this Action Plan in our last letter:what substantiveevidence,given the conclusions of the 2003 Audit,do the Fund and the Bank havethat this Action Plan is being implemented?

(b)SNPC’s role as fiscal agent for ROC:oil-collateralized borrowing

ROC is supposed under the terms of the PRGF to desist from contracting oil-collateralized debt except for debt in the form of prepayments (‘pré-paiements’) oradvances from oil traders that are repaid before the end of the year in which they arecontracted.

.

According to the publication of information on financial transactions by the SNPC onbehalf of the government,ROC ceased short-term financing in July 2004 and nofurther prepayments are listed.Nonetheless, according to the certifications of 2004Q3 and Q4 and 2005 Q 1,prepayments are continuing unabatedly(see Statement I andAnnex II Table IV).

According to analysis provided by US creditors of ROC, $115 million (CFA

66.45 billion) in 2003 oil revenue and at least$50 million in 2004 oil revenue wasnot captured by KPMG’s certifications. It is the belief of the creditors that all ofthis unaccounted-for revenue is related to the complex system of oil-collateralizedloans undertaken by SNPC on behalf of ROC.

Comparing data published by the Ministry of Finance (TOFE) to the Certifications,the short-term loans from traders seem to carry an annualized cost of 40%in 2004and a staggering 170%annualized cost in 2003,with an average loan term for bothyears of approximately 27 days.These loans are contracted by SNPC and it is notclear to what extent they are monitored by the Congolese government debt office.(c)SNPC’s Marketing of ROC’s Oil

In addition to the exorbitant costs of these loans, it appears that in both 2003and 2004, there were significant differences between the market sale price or‘prix fiscal’ of oil and the actual sales price obtained by SNPC. Such‘écarts devalorisation’ are captured in the certifications and amounted to $29 million in 2003and$59 million in 2004.According to analysis by US creditors, in 2003,when pre-paid cargos are compared to the cargos that were not pre-paid(only 3 out of 20), theywere sold at an average discount of$3.65 per barrel.

The SNPC external audit reports also cover its marketing performance and criticizesthe absence of benchmarking.The 2003 report notes that$20 million was lost on oilsales at below market prices to Sphynx(UK)Ltd.On average,Sphynx paid 9.6%below the official Congolese tax price ($15 million discount). Sphynx also gaveCongo very short term advances on all six cargos. These loans cost Congo almost$5million and carry an annualized cost of 81.32%.At the time of these transactions,Sphynx was managed by Denis Gokana,who held the title of Special Advisor to thePresident and who became President and CEO of the SNPC in January 2005.GlobalWitness has seen evidence that below-market value transactions with Sphynxcontinued into 2004.

Overall,analysis of the certifications and the TOFE show huge discrepancies betweenthe reference price and the sales price obtained by SNPC for cargos. In 2004, SNPCsold Congo’s oil for an average of 6%below market value. 17.5%($173 million)ofCongo’s 2004 oil revenue(marketed by SNPC)has been lost by poor sales termsand costly oil-collateralized loans if the market value of ROC’s oil is compared tothe actual amount transferred to the Treasury, as seen in the certifications andadjusting for the repayment of long-term loan principal.

5.The Certification Process is not Independent Verification

The oil revenue certification system,while useful,does not achieve what its namesuggests. It provides an independent calculation of what is due to ROC in termsof revenue and compares that with the amounts declared by the companies,andit highlights the costs of the SNPC financing and marketing.But it does notcertify that all oil revenue is actually received by the Treasury.KPMG does nothave access to source documents on sales and loans but relies on statements by theSNPC(‘notes de calcul’).At least in 2003 and 2004 KPMG was able to verify

government cash receipts against bank account information, but as of Q 1 2005,KPMG this information is no longer available to them,an extremely worrying trend.Importantly, the certifications only cover current-production-related revenue and notany non-recurrent revenue such as bonuses and dividends.

6.Reconciliation of discrepancies between the certifications and the TOFE

According to information from creditors, the IMF and the World Bank askedthe ROC authorities to instruct KPMG to reconcile the oil revenue data for2003 and 2004 registered in the Treasury accounts and that in the certification

The discrepancies are large and the only legitimate explanation for them is thatthey are due to timing delays resulting from the fact that the accounting basisfor the Treasury accounts is ‘cash’ and for the certifications ‘accruals’ . Sincethe proceeds of oil sales by the SNPC for the government are either transferredin cash to the government (‘encaissements’) or used to make debt or otherpayments for the government (‘prélèvements’),KPMG distinguishes betweendelays in cash transfers and expenditures.

First of all,KPMG was asked to look at the discrepancies in net oil revenuetransferred to the Treasury between the certifications and the TOFE or‘décalages sur encaissements’ . For 2004,KPMG certifications identified$237 million (CFA 124.227 billion) more of oil revenue in thecertifications than in the budget. Furthermore, one would expect non-recurrent revenue to be included in the budget (TOFE).KPMG states that thediscrepancies were reconciled transaction by transaction, it also says that theinformation used to do so was not any primary sources, such as bank accountinformation, but ‘official statements specifically prepared by the CongoleseTreasury’ (‘relevés oficiels du Trésor établis spécifiquement par le TrésorCongolais pour les diligences de KPMG’).KPMG therefore cannot vouch forthe veracity of these statements (‘Nous ne nous prononçons pas sur cetétatémanant de la Direction du Trésor. Cet état est un document interne auMinistère des Finance

Furthermore,KPMG also identified significant discrepancies in the amount ofdebits to the gross oil revenue(‘décalages sur prélèvements’),namely that for2004 the budget accounts for $33 million (CFA 17.631 billion)more indebits to the net oil revenue than the certifications.The only legitimatedebits or expenditures by SNPC are maritime taxes, repayment of oil-backedloans,prepayment fees,bank fees and SNPC commissions.The certificationsalso factor in the various losses in revenue due to ‘écarts de valorisation’ (thedifference between the prix fiscal and the price SNPC obtains), ‘écarts surencaissement SNPC’ (the difference between SNPC should have transferred tothe Treasury and what it did transfer), and ‘écarts sur matière SNPC’ (thedifference between Congo’s actual oil entitlement and the barrels SNPCcredited Congo with), thus they would not be expected to have more debitsthan the TOFE. It is unclear whether the budget figure also takes into account

all the various ‘écarts’,given the lack of supporting data(see below). If it doesnot, then the figure for the discrepancy would have to include these too, andwould rise to$105 million(CFA 54.996 billion).

With regard to the delays in expenditures (“décalages sur prélèvements’),herethe auditors were not able to reconcile transaction by transaction,not even onthe basis of specially offered prepared statements by the Treasury. In fact, theywere expressly told by the Ministry of Finance that the expenditures did notfall within the scope of their mission and thus no justification whatsoever wasoffered (‘Nous rappelons que les Décalages sur Prélèvements, qui sontidentifiés dans le Statement 2, sont obtenus par diférence, et n'ontfait l'objet

The large discrepancies (attributed to timing delays) between the incomereceived according to the certifications and to the budget are extremelytroubling.They cannot be explained by cut-off dates and the reconciliations donot clarify them because KPMG did not have access to primary sourcessuch as bank account information. It is therefore our belief that the exerciseundertaken falls far short of a true reconciliation,and thus it is not possible tostate that the oil revenue information as registered in the Treasury accounts arein any way independently certified.Clearly there is an urgent need for astricter certification system and other measures designed to ensure genuinetransparency in the revenue collection and budgetary system.

5.No clear picture of ROC’s debt position going forward to HIPC

oil-collateralized borrowing,often through third party shell companies, together withdiscrepancies identified in the certifications and other published data discussed abovesuggest that ROC continues to be secretive about its indebtedness and even to bewithholding information regarding this position from the international community.

$38 million(CFA 19.1 billion) is clearly of macroeconomic significance and shouldhave a major impact on ROC’s budgetary outlook for 2005.Has the governmentprovided full information on this?

The prime concern of the Congolese PWYP Coalition and its international partners isthat ROC’s oil revenues be mobilized for poverty reduction and to ensure thecountry’s sustainable development and it is not our concern per se to defend theinterests of private creditors.Nevertheless,with regard to its substantial arrears to theLondon Club,ROC is currently spending millions of dollars on resisting courtjudgements. These charges are presumably being borne by the budget and thusultimately by Congolese citizens.

Three-Year Arrangement Under the Poverty Reduction and Growth Facility—StafReport,January

comment 3.

According to creditors,ROC is refusing to enter into good faith negotiations.Onecreditor has even launched a legal action under the RICO anti-racketeering and anti-money laundering statutes in the USA, alleging that the ‘defendants conspired todivert oil revenues from the Republic of Congo into the pockets of powerful

seems to be in direct contradiction to the IMF’s requirements that,where the Fundlends into arrears,a‘debtor engage its creditors in an early and constructive dialogue’

Discusses the Good-Faith Criterion under the Fund Policy on Lending into Arrears to Private Creditors,September 24,2002.

- WashingtonRepublic of Congo’s Transparency Scorecard - Global …:刚果共和国的透明度,记分卡-全球…相关文档

- 刚果刚果共和国的森林采伐管理制度

- 路基刚果共和国砂性土路基雨季施工问题与处理

- 刚果刚果共和国(刚果布)市场调研项目报告

- 刚果刚果共和国:刚果共和国-历史沿革,刚果共和国-概述 刚果盆地

- 刚果刚果共和国经贸,文化调查报告

- 非洲刚果共和国中非国际物流工业园区

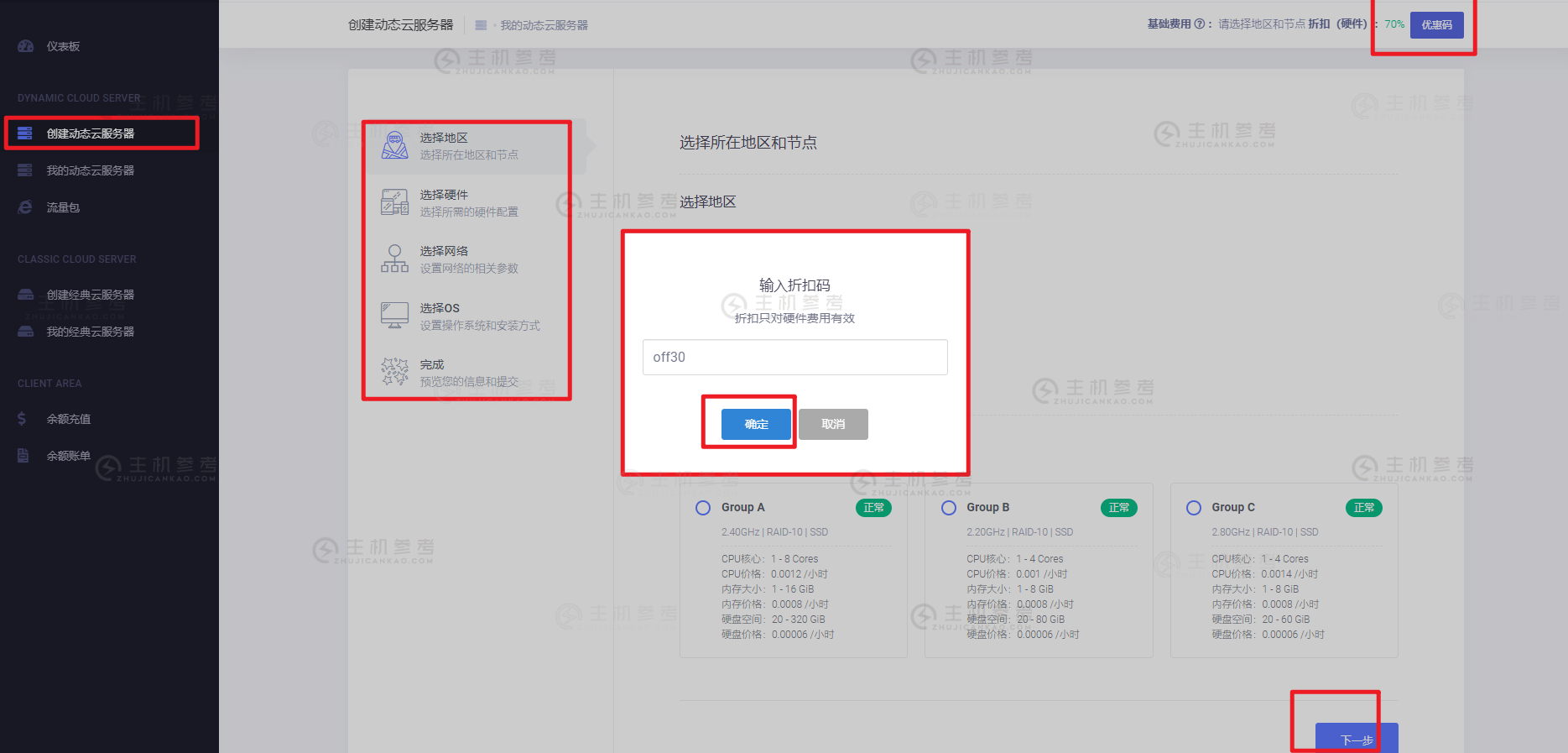

HostMem,最新优惠促销,全场75折优惠,大硬盘VPS特价优惠,美国洛杉矶QuadraNet机房,KVM虚拟架构,KVM虚拟架构,2核2G内存240GB SSD,100Mbps带宽,27美元/年

HostMem近日发布了最新的优惠消息,全场云服务器产品一律75折优惠,美国洛杉矶QuadraNet机房,基于KVM虚拟架构,2核心2G内存240G SSD固态硬盘100Mbps带宽4TB流量,27美元/年,线路方面电信CN2 GT,联通CU移动CM,有需要美国大硬盘VPS云服务器的朋友可以关注一下。HostMem怎么样?HostMem服务器好不好?HostMem值不值得购买?HostMem是一家...

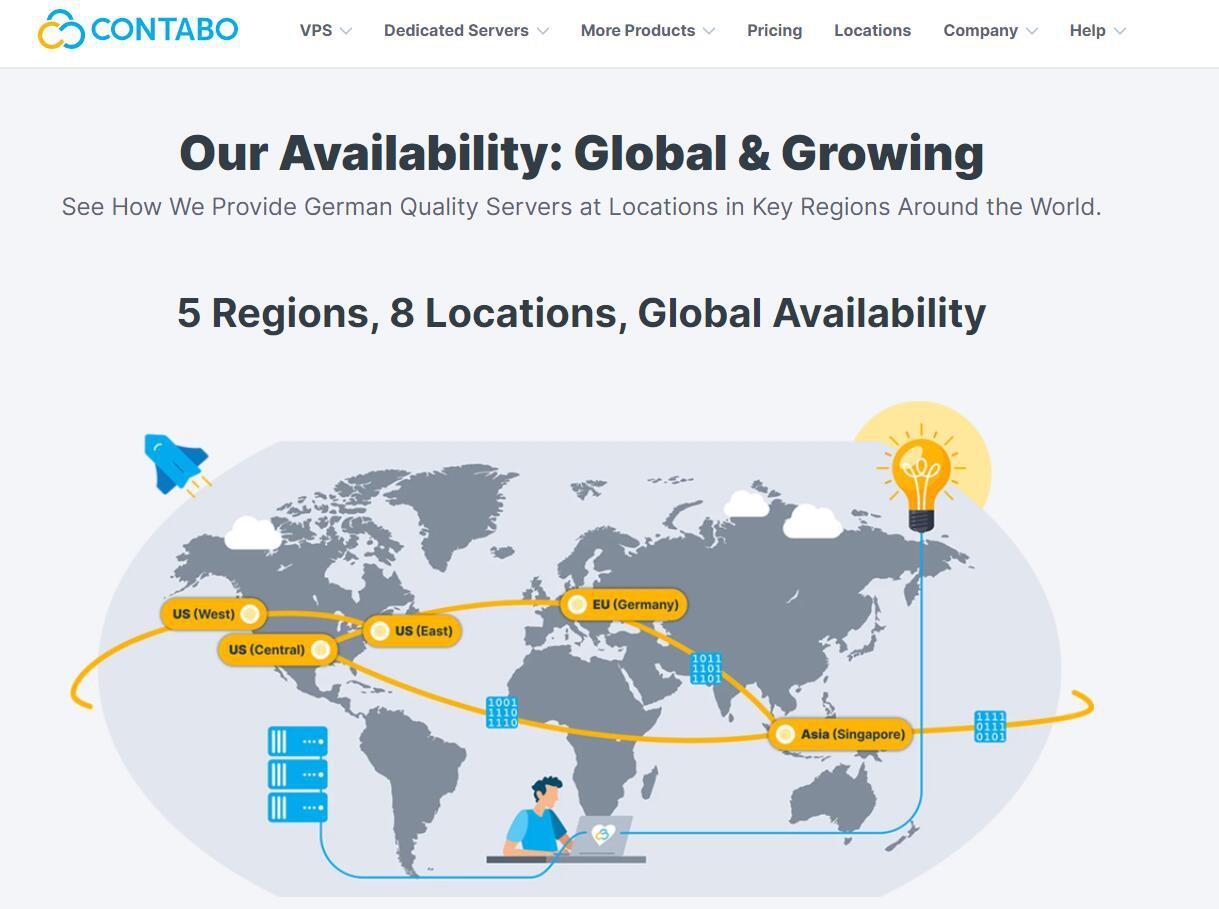

€4.99/月Contabo云服务器,美国高性价比VPS/4核8G内存200G SSD存储

Contabo是一家运营了20多年的欧洲老牌主机商,之前主要是运营德国数据中心,Contabo在今年4月份增设新加坡数据中心,近期同时新增了美国纽约和西雅图数据中心。全球布局基本完成,目前可选的数据中心包括:德国本土、美国东部(纽约)、美国西部(西雅图)、美国中部(圣路易斯)和亚洲的新加坡数据中心。Contabo的之前国外主机测评网站有多次介绍,他们家的特点就是性价比高,而且这个高不是一般的高,是...

妮妮云香港CTG云服务器1核 1G 3M19元/月

香港ctg云服务器香港ctg云服务器官网链接 点击进入妮妮云官网优惠活动 香港CTG云服务器地区CPU内存硬盘带宽IP价格购买地址香港1核1G20G3M5个19元/月点击购买香港2核2G30G5M10个40元/月点击购买香港2核2G40G5M20个450元/月点击购买香港4核4G50G6M30个80元/月点击购买香...

-

ov单片机汇编语言中 CY AC OV 分别是什么意思?怎么在qq空间里添加背景音乐如何在qq空间中添加背景音乐怎么在qq空间里添加背景音乐怎么在QQ空间里插入背景音乐??直播加速请问哪种播放器的可以播放加速,并且可以保存ejb开发EJB是什么?安全漏洞web安全漏洞有哪些分词技术怎样做好百度分词技术和长尾词优化Qzongqzong皮肤上怎样写字微信怎么看聊天记录什么方法可以知道微信的聊天记录网站推广外链如何做网站推广 ,外链推广的方向在哪里?