sharesTerms Conditions - FreeQuote 123.com

Terms&Conditions

PLEASE READ THE FOLLOWING TERMS OF SERVICES&LEGAL NOTICES('THISAGREEMENT')CAREFULLY BEFORE USING THE FREEQUOTE123.COMWEBSITE(the'Site'or'FREEQUOTE123.COM').These terms explain your (and our) rights under thisAgreement,and make certain disclosures required by the law.By using the Site,you give yourassent to the terms ofthis Agreement. If you do not agree to these terms,you may not use theSite.FREEQUO TE123.COM, Inc. ('FREEQUOTE123.COM',' 'We'or'Our')has the right, in oursole discretion, to modify,add,or remove any terms or conditions of this Agreement withoutgiving individual notice to you,by posting the changes on the Site.Your continuing use of theSite signifies your acceptance of any such changes.

DISCLOSURES REQUIRED UNDER SECTION 527 AND 342 OF THE BANKRUPTCY

ABUSE PREVENTION AND CONSUMER PROTECTION ACT OF 2005.

NOTICE NO. 1 Notice Mandated By Section 342(b)(1)and 527(a)(1)Of The Bankruptcy

C o de

PURPOSES,BENEFITS AND COSTS OF BANKRUPTCYThe United S tate s Constitution provides a method whereby individuals,burdened by exce ssivedebt,can obtain a'fresh start'and pursue productive lives unimpaired by past financial problems.It is an important alternative for persons strapped with more debt and stress than they can handle.The federal bankruptcy laws were enacted to provide good,honest,hard-working debtors with afresh start and to establish a ranking and equity among all the creditors clamoring for the debtor'slimited reso urc es.

Bankruptcy helps people avoid the kind ofpermanent discouragement that canprevent themfrom ever re-establishing themselves as hard-working members of society.

To the extent that there may be money or property available for distribution to creditors,creditors are ranked to make sure that money or property is fairly distributed according toestablished rules as to which creditors get what.

This discussion is intended only as a briefoverview ofthe types of bankruptcy filings and ofwhat a bankruptcy filing can and cannot do.No one should base their decision as to whether ornot to file bankruptcy solely on this information.Bankruptcy law is complex,and there are manyconsiderations that must be taken into account in making the determination whether or not to file.Anyone considering bankruptcy is encouraged to make no decision about bankruptcy withoutseeking the advice and assistance of an experienced attorney who practices nothing butb ankrup tc y law.

Types of Bankruptcy

The Bankruptcy Code is divided into chapters.The chapters which almost always apply toconsumer debtors are chapter 7,known as a'straight bankruptcy',and chapter 13,which involvesan affordable plan o f repayment.

An important feature applicable to all types of bankruptcy filings is the automatic stay.Theautomatic stay means that the mere request for bankruptcy protection automatically stops andbrings to a grinding halt mo st lawsuits, reposse ssions, foreclosures,evictions,garnishments,attachments,utility shut-o ffs,and debt co lle ction harassment. It o ffers debtors a breathing sp e llby giving the debtor and the trustee assigned to the case time to review the situation and developan appropriate p lan. In mo st circumstance s,creditors cannot take any further action against thedebtor or the property without permis sion from the bankruptcy court.

Chapter 7

In a chapter 7 case, the bankruptcy court appoints a trustee to examine the debtor's assets todetermine if there are any assets not protected by available'exemptions' .Exemptions are lawsthat allow a debtor to keep,and not part with,certain types and amounts of money and property.For example, exemption laws allows a debtor to protect a certain amount of equity in the debtor'sresidence,motor vehicle,household goods, life insurance,health aids,retirement plans, specifiedfuture earnings such as social security benefits,child support,and alimony,and certain othertypes ofpersonal property. If there is any non-exempt property, it is the Trustee's job to sell itand to distribute the proceeds among the unsecured creditors.Although a liquidation case canrarely help with secured debt(the secured creditor still has the right to repo ssess the collateral ifthe debtor falls behind in the monthly payments), the debtor will be discharged from the legalobligation to pay unsecured debts such as credit card debts,medical bills and utility arrearages.However,certain types of unsecured debt are allowed special treatment and cannot be discharged.These include some student loans,alimony,child support,criminal fines,and some taxes.Additional information about chapter 7 is available at the Site.

In addition to attorney fees, there is a filing fee that must be paid to the Bankruptcy Court.Chapter 13

In a chapter 13 case, the debtor puts forward a plan, following the rules set forth in thebankruptcy laws, to repay certain creditors over a p eriod o f time,usually from future income.Achapter 13 case may be advantageous in that the debtor is allowed to get caught up on mortgagesor car loans without the threat of foreclosure or repossession,and is allowed to keep both exemptand nonexempt property.The debtor's plan is a document outlining to the bankruptcy court howthe debtor proposes to dispose of the claims ofthe debtor's creditors.The debtor's property isprotected from seizure from creditors, including mortgage and other lien holders,as long as theproposed payments are made and necessary insurance coverages remain in place.The plangenerally requires monthly payments to the bankruptcy trustee over a period of three to fiveyears.Arrangements can be made to have these payments made automatically through payrolldeductions.

Additional information about chapter 13 is available at the Site.

In addition to attorney fees, there is a filing fee that must be paid to the Bankruptcy Court.Chapter 11

By and large,chapter 11 is a type of bankruptcy reserved for large corporate reorganizations.Chapter 11 shares many of the qualities of a chapter 13,but tends to involve much morecomplexity on a much larger scale.

However, since chapter 11 does not usually pertain to individuals whose debts are primarilyconsumer debts, further information about chapter 11 will be provided by reference to thefollowing resource:The A Bankruptcy Basics@brochure prepared b y the Administrative O fficeof the United States Courts,dated June 2000,and which can be accessed over the internet byvisiting the fo llowing webs ite:http://www.uscourts.gov/bankruptcycourts.html

Chapter 12

Chapter 12 ofthe Bankruptcy Code was enacted by Congress in 1986, specifically to meet theneeds of financially distressed family farmers.The primary purpose of this legislation was tog iv efamily farmers facing bankruptcy a chance to reorganize their debts and keep their farms.However,as with chapter 11, since chapter 12 does not usually pertain to individuals whosedebts are primarily consumer debts, further information about chapter 12 will be provided byreference to the same'Bankruptcy Basics'brochure referred to above,which can be accessedover the internet at the same said website as mentioned for chapter 11.

What Bankruptcy Can and Cannot Do

Bankruptcy may make it possible for financially distressed individuals to:

1.Discharge liability for most or all of their debts and get a fresh start.When the debt isdischarged, the debtor has no further legal obligation to pay the debt.

2.Stop foreclosure actions on their home and allow them an opportunity to catch up on mis sedp ayme nts.

3.Prevent repossession of a car or other property,or force the creditor to return property evenafter it has been repossessed.

4.Stop wage garnishment and other debt collection harassment,and give the individual somebreathing roo m.

5.Restore or prevent termination of certain types of utility service.

6.Lower the monthly payments and interest rates on debts, including secured debts such as carloans.

7.Allow debtors an opportunity to challenge the claims of certain creditors who have co mmittedfraud or who are otherwise seeking to collect more than they are legally entitled to.

Bankruptcy,however,cannot cure every financial problem. It is usually not possible to:

1.Eliminate certain rights o f secured creditors.Although a debtor can force secured creditors totake payments over time in the bankruptcy process,a debtor generally cannot keep the collateralunless the debtor continues to pay the debt.

2.Discharge types of debts singled out by the federal bankruptcy statutes for special treatment,such as child support,alimony, student loans,certain court ordered payments,criminal fines,andsome taxes.

3.Protect all co signers on their debts. If relative or friend co-signed a loan which the debtordischarged in bankruptcy, the cosigner may still be obligated to repay whatever part of the loannot paid during the pendency ofthe bankruptcy case.

4.Discharge debts that are incurred after bankruptcy has been filed.

Bankruptcy's Effect on Your Credit

By federal law,a bankruptcy can remain part of a debtor's credit history for 10 years.Whether ornot the debtor will be granted credit in the future is unpredictable,and probably depends, to acertain extent,on what good things the debtor does in the nature ofkeeping a job, saving money,making timely payments on secured debts,etc.

Services Available From Credit Counseling Agencies

With limited exceptions,Section 109(h)ofthe Bankruptcy Code requires that all individuals whofile for bankruptcy relief on or after October 17,2005 receive a briefing that outlines allavailable opportunities for credit counseling and provides assistance in performing a budgetanalysis.The briefing must be given within 180 days prior to the bankruptcy filing.The briefingmay be provided individually or in a group(including briefings conducted over the Internet orover the telephone)and must be provided by a non-profit budget and credit counseling agencyapproved by the United States Trustee or bankruptcy administrator.The clerk o f the b ankruptcycourt has a list that you may consult of the approved budget and credit counseling agencies. Inaddition,after filing a bankruptcy case,an individual debtor generally must complete a financialmanagement instructional course before he or she can receive a discharge.The clerk also has alist of approved financial management instructional courses.

If you're not disciplined enough to create a workable budget and stick to it, can't work out arepayment plan with your creditors,can't keep track of mounting bills,or need more help withyour debts than can be achieved by merely having a few of your unsecured creditors lower yourintere st rates somewhat, it prob ably makes little sense to consider contacting a credit counselingorganization.

If,on the other hand,you meet all or most of those criteria, there are many non-profit creditcounseling organizations that will work with you to solve your financial problems.

But be aware that, just because an organization says it's 'nonprofit,' there's no guarantee that itsservice s are free,affordab le or even le gitimate.

Most credit counselors offer services through local offices, the Internet,or on the telephone. Ifpossible, it probably best to find an organization that offers in-person counseling.Manyuniversities,military b ases,credit unions,housing authoritie s,and branche s o f the U.S.Cooperative Extension Service operate nonpro fit credit counseling programs.Your financialinstitution, local consumer protection agency,and friends and family also maybe good sourcesof information and referrals.

Reputable credit counseling organizations can advise you on managing your money and debts,help you develop a budget,and offer free educational materials and workshops.Their counselorsare certified and trained in the areas of consumer credit,money and debt management,andbudgeting.Legitimate counselors will discuss your entire financial situation with you,and helpyou develop a personalized plan to solve your money problems.An initial counseling sessiontypically lasts an hour,with an offer of follow-up sessions.

If your financial problems stem from too much debt or your inability to repay your debts,a creditcounseling agency may recommend that you enroll in what is knows as a'debt management plan'or'DMP' .A DMP alone is not credit counseling,and DMPs are not for everyone.You shouldsign up for one of these plans only after a certified credit counselor has spent time thoroughlyreviewing your financial situation,has offered you customized advice on managing your money,and has analyzed your budget to make sure that the proposed DMP is one you can afford.However,remember that all organizations that promote DMP's fund themselves in part througharrangements with the creditors involved,which are called'fair share', so you have to be wary asto whose best interest the counselor has in mind.Even if a DMP is not appropriate for you,areputable credit counseling organization still can help you create a budget and teach you moneymanagement skills.

In a DMP,you deposit money each month with the credit counseling organization,which usesyour depo sits to pay your unsecured debts, like your credit card b ills and medical b ills,accordingto a payment schedule the counselor develops with your creditors.Your creditors may agree tolower your interest rates or waive certain fees,but it's always best to check with all yourcreditors,just to make sure they offer the concessions that a credit counseling organization ispromising you.A succes s ful DMP require s you to make re gular, timely payments,and couldtake 48 months or more to complete.Ask the credit counselor to estimate how long it will takefor youto complete the plan.You may have to agree not to apply for C or use C any additional

credit while you're participating in the plan,and a DMP is likely of little value if your problemsstem from or involve your secured creditors holding your car, truck or home as collateral.DMP'sare also likely of little value if your problems stem from alimony,child support or overdue taxes.The bottom line is this: If all you need is a little lowering of your interest rates on someunsecured debts,a DMP might be the answer.However, if what you really need is to reduce theamount of your debt,bankruptcy may be the solution.

NOTICE NO.2

Notice Mandated By Section 527(a)(2)Of The Bankruptcy Code

NOTICE OF MANDATORYDISCLOSURE

TO CONSUMERS WHO CONTEMPLATE FILING BANKRUPTCY

You are notified as follows:

1.All information that you are required to provide with the filing of your case and thereafter,while your case is pending,must be complete,accurate and truthful.

2.All your assets and all your liabilities must be completely and accurately disclosed in thedocuments filed to commence your case,and the replacement value of each asset(as defined inSection 506 of the Bankruptcy Code)must be stated in those documents where requested afterreasonable inquiry to establish such value.

3.Some sections of the Bankruptcy Code require you to determine and list the replacement valueof an asset such as a car or furniture.When replacement value is required, it means thereplacement value,established after reasonable inquiry,as of the date of the filing of yourbankruptcy case,without deduction for co sts of sales or marketing.With respect to propertyacquired for personal, family or household purposes,replacement value means the price a retailmerchant would charge for'used'property of that kind considering the age and condition of theproperty.Again, replacement value is defined in the Bankruptcy Code as the price that a retailmerchant would charge for property of the same kind,considering the age and condition of theproperty at the time its value is determined.This is not the cost to replace the item with a newone or what you could sell the item for; it is the cost at which a retail merchant would sell theused item in its current condition. In many cases (particularly used clothing, furniture, computers,etc.), this would be'yard sale'value,or what the item might sell for on eBay. In other cases, suchas jewelry,antiques or collectables, it may be retail value.For motor vehicles, it would be thethird party purchase value.For real property, it is what the real property would sell for,at currentMarket value.For cash and bank accounts, it is the actual amount on deposit.For stocks andbonds, it is their market value as ofthe date your case is filed.You must make a reasonableinquiry to determine the replacement value of your assets.

4.Before your case can be filed, it is subject to what is called'Means Testing' .The Means Testwas designed to determine whether or not you qualify to file a case under chapter 7 of the

Bankruptcy Code,and if not,how much you need to pay your unsecured creditors in a chapter 13case.For purposes of means test,you must state,after reasonable inquiry,your total currentmonthly income, the amount of all expenses as specified and allowed pursuant to section707(b)(2)of the bankruptcy code,and if the plan is to file in a Chapter 13 case,you must state,again after reasonable inquiry,your disposable income,as that term is defined.

5. Information that you provide during your case may be audited pursuant to the provisions ofthe Bankruptcy Code.Your failure to provide complete,accurate and truthful information mayresult inthe dismissal of your case or other sanctions, including criminal sanctions.

NOTICE NO.3

Notice Mandated By Section 527(b)Of The BankruptcyCode

IMPORTANT INFORMATION ABOUT BANKRUPTCYASSISTANCE SERVICES

If you decide to seek bankruptcy relief,you can represent yourself,you can hire an attorney torepresent you,or you can get help in some localities from a bankruptcy petition preparer who isnot an attorney.THE LAW REQUIRES AN ATTORNEY OR BANKRUPTCY PETITIONPREPARER TO GIVE YOU A WRITTEN CONTRACT SPECIFYING WHAT THEATTORNEY OR BANKRUPTCY PETITION PREPARER WILL DO FOR YOU AND HOWMUCH IT WILL COST.Ask to see the contract before you hire anyone.

The following information helps you understand what must be done in a routine bankruptcy caseto help you evaluate how much service you need.Although bankruptcy can be complex,manycases are routine.

Before filing a bankruptcy case,either you or your attorney should analyze your eligibility fordifferent forms of debt relief available under the Bankruptcy Code and which form ofrelief ismost likely to be beneficial for you.Be sure you understand the relief you can obtain and itslimitations.To file a bankruptcy case,documents called a Petition,Schedules and Statement ofFinancial Affairs,as well as in some cases a Statement of Intention need to be prepared correctlyand filed with the bankruptcy court.You will have to pay a filing fee to the bankruptcy court.Once your case starts,you will have to attend the required first meeting of creditors where youmay be questioned by a court official called a>trustee=and by creditors.

If you choose to file a chapter 7 case,you maybe asked by a creditor to reaffirm a debt.Youmay want help deciding whether to do so.A creditor is not permitted to coerce you intoreaffirming your debts. It may not be in your best interest to reaffirm a debt.

If you choose to file a chapter 13 case in which you repay your creditors what you can affordover 3 to 5 years,you may also want help with preparing your chapter 13 plan and with theconfirmation hearing on your plan which, if held,will be before a bankruptcy judge.

If you select another type ofrelief under the Bankruptcy Code other than chapter 7 or chapter 13,you will want to find out what should be done from someone familiar with that type ofrelief.However,please be advised that in most cases,you will onlybe concerned with chapter 7 andchap ter 13.

Your bankruptcy case may also invo lve litigation.You are generally permitted to representyourself in litigation in bankruptcy court,but only attorneys,not bankruptcy petition prep arers,can give you legal advice.

NOTICE NO.4

Notice Mandated By Section 342(b)(2)Of The Bankruptcy Co de

FRAUD&CONCEALMENT PROHIBITED

If you decide to file bankruptcy, it is important that you understand the following:

1.Some or all of the information youprovide in connection with your bankruptcywill be filedwith the bankruptcy court on forms or documents that you will be required to sign and declare astrue under penalty of perjury.

2.A person who knowingly and fraudulently conceals assets or makes a false oath or statementunder penalty ofperjury in connection with a bankruptcy case shall be subject to fine,imprisonment,or both.

3.All information you provide in connection with your bankruptcy case is subject toexamination by the Attorney General.

ACKNOWLEDGMENT OF RECEIPT

By using the Site and/or otherwise accepting this Agreement,you acknowledge that you havereceived a copy of or been provided with access to all of the following notices:

1.Notice Mandated By Section 342(b)(1)and 527(a)(1)Of The Bankruptcy Code

2.Notice Mandated By Section 527(a)(2)Of The Bankruptcy Code

3.Notice Mandated By Section 527(b)Of The Bankruptcy Code

AGREEMEN T

1.Background

Use o f this S ite is licensed to various law firms acro ss the United States (the "law firms"or "LawFirms") to(i)allow e ach such Law F irm to promote its own web s ite and practice, (ii)fac ilitatethe pub lic's ab ility to learn about bankruptcy law and(iii) interact with bankruptcy attorneys (itbeing understood that not all area codes will include a licensing law firm at all times). In additionto educating the general public about bankruptcy law,each Law Firm provides users with theability to submit information about their specific bankruptcy case,and to request to be contactedby such Law Firm to discuss their case and to possibly hire it to represent them.You understandthat FREEQUOTE123.COM does not refer attorneys or law firms,and does not endorse any ofthe law firms which license use of the Site. It is your decision alone whether or not to work witha licensing law firm.

FREEQUO TE123.COM itself is not a law firm but rather a web site owned(or,as applicable,licensed)and operated by FREEQUOTE123.COM, Inc.FREEQUOTE123.COM does notreceive any portion of any lawyer's or law firm's fees and any arrangements subsequently madeby you and any lawyer or law firm are strictly between you and such party and do not involveFREEQUO TE123.COM in any way.You understand that FREEQUO TE123.COM,and, to theextent applicable, its licensors,does nothing more than license the use o f this S ite to Law F irmsto allow such Law Firms to better market their respective web sites,and, in certain instances,provide various ancillary services related to such licensed use of this S ite.

2.Purpose

THIS WEBSITE IS AN ADVERTISEMENT OF LEGAL SERVICES,and all of the materialsand information on the Site are provided for informational purposes only,and may not reflectcurrent legal developments or variances in the law of differentjurisdictions.Nothing on the Siteshould be construed as legal advice or used as a substitute for legal advice.Neither

FREEQUOTE123.COM nor any of its licensors provides legal advice(although a licensor mayprovide legal advice to you in the event you engage such licensor to serve as your legal counsel).The materials and information on the Site do not necessarily reflect the opinions of the attorneysof the Law Firms, their partners,clients or affiliates.The information in the Site is notguaranteed to be correct,complete or up to date.The S ite is not intended to,and does not,constitute or create an attorney-client relationship between you and the attorneys of any of theLaw F irms, their partners,employees,agents or affiliates,or any other attorney associated withthe S ite.Additionally, the mere receipt of an e-mail from or a'post'on the S ite does not create anattorney-client relationship.The applicable Law Firm is solely responsible for providing itsservices to you,and you agree that FREEQUOTE123.COM shall not be liable for any damagesor costs of any type arising out of or in any way connected with your use of such services(including,without limitation,claims based on malpractice).You agree that any claim arising outof your relationship with a Law Firm or attorney shall be brought solely against such Law Firmor attorney,and,as FREEQUO TE123.COM is doing nothing more than assisting the Law Firmsto market their respective practices,neither FREEQUOTE123.COM nor any of its licensors oraffiliates shall be included within any such claim.

- sharesTerms Conditions - FreeQuote 123.com相关文档

- 123.com好123网址之家首页

- 123.com123网站是什么

提速啦:美国多IP站群云服务器 8核8G 10M带宽 7IP 88元/月

提速啦(www.tisula.com)是赣州王成璟网络科技有限公司旗下云服务器品牌,目前拥有在籍员工40人左右,社保在籍员工30人+,是正规的国内拥有IDC ICP ISP CDN 云牌照资质商家,2018-2021年连续4年获得CTG机房顶级金牌代理商荣誉 2021年赣州市于都县创业大赛三等奖,2020年于都电子商务示范企业,2021年于都县电子商务融合推广大使。资源优势介绍:Ceranetwo...

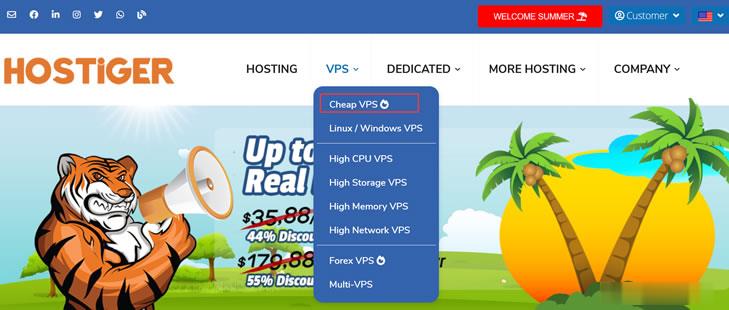

Hostigger不限流量VPS年20美元

Hostigger 主机商在前面的文章中也有介绍过几次,这个商家运营时间是有一些年份,只不过在我们圈内好像之前出现的次数不多。最近这段时间商家有提供不限流量的VPS主机,逐渐的慢慢被人认识到。在前面的介绍到他们提供的机房还是比较多的,比如土耳其、美国等。今天看到Hostigger 商家居然改动挺大的,原来蛮好的域名居然这次连带官方域名都更换掉去掉一个G(Hostiger )。估摸着这个域名也是之前...

天上云:香港大带宽物理机服务器572元;20Mbps带宽!三网CN2线路

天上云服务器怎么样?天上云是国人商家,成都天上云网络科技有限公司,专注于香港、美国海外云服务器的产品,有多年的运维维护经验。世界这么大 靠谱最重,我们7*24H为您提供服务,贴心售后服务,安心、省事儿、稳定、靠谱。目前,天上云香港大带宽物理机服务器572元;20Mbps带宽!三网CN2线路,香港沙田数据中心!点击进入:天上云官方网站地址香港沙田数据中心!线路说明 :去程中国电信CN2 +中国联通+...

-

照片转手绘美图秀秀可以照片转手绘吗?是手机版的ps抠图技巧如何使用PS抠图ps抠图技巧ps抠图多种技巧,越详细越好,急~~~~~~~ps抠图技巧ps抠图多种技巧,越详细越好,急~~~~~~~不兼容软件和电脑不兼容会怎样?中小企业信息化小企业需要信息化吗?需要的话要怎么实现信息化呢?怎么升级ios6iPad怎么升级到iOS6正式版?免费免费建站电脑上有真正免费的网站吗??mate8价格华为mate8 128g售价多少钱bluestackbluestacks下载的东西在哪