linesns

sns平台 时间:2021-02-12 阅读:()

>>Employedbyanon-USaffiliateofMLPF&Sandisnotregistered/qualifiedasaresearchanalystundertheFINRArules.

Referto"OtherImportantDisclosures"forinformationoncertainBofAMerrillLynchentitiesthattakeresponsibilityforthisreportinparticularjurisdictions.

BofAMerrillLynchdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.

Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.

Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.

Refertoimportantdisclosuresonpage8to10.

AnalystCertificationonPage6.

PriceObjectiveBasis/Riskonpage6.

LinktoDefinitionsonpage6.

11377586TencentHoldingsLtd.

EstimateChangeBUYHypedeflating;backtofocusonthefundamentalsEquity|HongKong|Internet/e-Commerce15April2014EddieLeung>>+85221617189ResearchAnalystMerrillLynch(HongKong)eddie.

leung@baml.

comBinnieWong>>+85225363458ResearchAnalystMerrillLynch(HongKong)binnie.

wong@baml.

comStockDataPriceHK$526.

00PriceObjectiveHK$687.

00DateEstablished19-Mar-2014InvestmentOpinionB-1-7VolatilityRiskMEDIUM52-WeekRangeHK$243.

00-HK$646.

00MrktVal/SharesOut(mn)US$124,549/1,836.

0MarketValue(mn)HK$965,746AverageDailyVolume7,919,982BofAMLTicker/ExchangeTCTZF/HKGBloomberg/Reuters700HK/0700.

HKROE(2013E)31.

5%NetDbttoEqty(Dec-2012A)-6.

4%Est.

5-YrEPS/DPSGrowth30.

5%/12.

4%FreeFloat37.

0%KeyChanges(CNY)PreviousCurrent2014EEPS10.

8510.

982015EEPS15.

1515.

18Hypedeflating;fundamentalsstillstableAsregulationcoolsdownoncesurgingexuberancesurroundingonlinepayment,whileasectorrotationtotraditionalsectorsalongwithIPOstriggeredastockcorrection,Tencent'sexecutionappearstoremainsoundandstablejudgingfromourrecentdiscussionswithmanagement.

Wenotethat:1)Mobilegames,whichbenefitfromeffectiveuserrecruitmentofitsmobilesocialplatformsandmulti-tiercooperationstructureswithdevelopers,areontracktobeakeyrevenuedriver.

2)ScaleofYixun(eCommerce)willbecontrolledtoeasemarginpressure.

3)O2Owillbeamulti-yearlong-termprojectforTencent,butwon'tbeamaterialrevenuesourceincomingcoupleofyears.

AsthecompanyshiftsawayfromeCtohigher-margingameandsocialbusinesses,welowerour14/15Erevenueforecastsby0.

5%/5.

6%;butraiseEPSupby2%/1%.

In1Q14,investmentgainsshouldoffsettheUS$100m+subsidiesontaxiapps.

Wethinkthestockcancontinuetobevolatileinthenear-termwhileearningsgrowthcatchesupwithanexpandedPE.

WebelievechangesinthediscountrateinarisingrateenvironmentarealsoarisktoDCFvaluation.

Managementreiteratedtheirdeterminationtofocusandsolidifytheiradvantagesinsocialandcommunicationwhilekeepingacloseeyeonupandcomingapplicationsassourcesofdisruption.

Wealsoseedevelopmentinhardware,homeentertainmentandwearabletopotentiallycomplicatethecompetitivelandscape.

Medium-termnoteprogramtoaddfinancialflexibilityTencent'snewlyannouncedmedium-termnoteprogram,whichgivesitflexibilitytoissuenotesuptoUS$5binvariousterms,currencies,anddatestoinvestorswithin12monthsfrom10Apr,mightbepartlydrivenbypositivemarketconditionsafterMoody'supgradetoA3anddoesn'tnecessarilyimplyanyimmediatemulti-billiondollaracquisition.

TheprogramcanalsosupportTencent'sinvestmentstrategyintheShenzhen-basedentitythatseeksabanklicense,whencapitalinjectionisneeded.

Tencentisaminorityshareholderwhichhopestoreduceregulatoryrestrictioninexpandingitspaymentbusinessifthisentityobtainsabanklicense.

Estimates(Dec)(CNY)2011A2012A2013E2014E2015ENetIncome(Adjusted-mn)10,20312,73215,50220,59428,649EPS5.

496.

838.

3010.

9815.

18EPSChange(YoY)26.

8%24.

4%21.

6%32.

2%38.

3%Dividend/Share0.

490.

660.

660.

940.

93FreeCashFlow/Share5.

118.

627.

129.

1814.

45Valuation(Dec)2011A2012A2013E2014E2015EP/E77.

68x61.

92x49.

45x38.

43x27.

79xDividendYield0.

12%0.

16%0.

16%0.

22%0.

22%EV/EBITDA*52.

13x40.

98x31.

84x25.

35x17.

63xFreeCashFlowYield*1.

20%2.

04%1.

69%2.

19%3.

48%*ForfulldefinitionsofiQmethodSMmeasures,seepage7.

CRTencentHoldingsLtd.

15April20142iQprofileSMTencentHoldingsLtd.

KeyIncomeStatementData(Dec)2011A2012A2013E2014E2015E(CNYMillions)Sales28,49643,89460,43778,46097,102GrossProfit18,56825,68632,65944,36062,311SellGeneral&AdminExpense(6,635)(10,511)(15,684)(22,239)(28,727)OperatingProfit11,91415,47919,19423,92135,564NetInterest&OtherIncome185(428)861,702(240)AssociatesNANANANANAPretaxIncome12,09915,05119,28125,62335,324Tax(expense)/Benefit(1,874)(2,266)(3,718)(4,941)(6,812)NetIncome(Adjusted)10,20312,73215,50220,59428,649AverageFullyDilutedSharesOutstanding1,8591,8641,8671,8761,887KeyCashFlowStatementDataNetIncome10,20312,73215,50220,59428,649Depreciation&Amortization2,5082,8684,4155,7327,094ChangeinWorkingCapital1,1771,177(816)141146DeferredTaxationChargeNANANANANAOtherAdjustments,Net(530)2,653(237)(1,791)377CashFlowfromOperations13,35819,42918,86424,67636,267CapitalExpenditure(4,046)(3,657)(5,798)(7,708)(9,326)(Acquisition)/DisposalofInvestments(7,333)(16,277)(2,778)(2,778)(2,778)OtherCashInflow/(Outflow)(3,976)3,664000CashFlowfromInvesting(15,355)(16,270)(8,576)(10,485)(12,104)SharesIssue/(Repurchase)(1,316)119000CostofDividendsPaid(895)(1,225)(1,225)(1,760)(1,760)CashFlowfromFinancing4,373(2,386)29,775(1,760)(1,760)FreeCashFlow9,31215,77313,06616,96926,941NetDebt(879)(2,684)(11,747)(24,177)(46,581)ChangeinNetDebt4,380(1,871)(9,063)(12,431)(22,403)KeyBalanceSheetDataProperty,Plant&Equipment5,8857,4038,78610,76112,993OtherNon-CurrentAssets15,41631,34434,29838,77841,315TradeReceivables2,0212,3544,2865,5646,886Cash&Equivalents12,61213,38353,44665,87788,280OtherCurrentAssets20,87120,77220,20420,20420,204TotalAssets56,80475,256121,019141,183169,678Long-TermDebt3,7339,62240,62240,62240,622OtherNon-CurrentLiabilities2,7992,8202,8202,8202,820Short-TermDebt7,9991,0771,0771,0771,077OtherCurrentLiabilities13,18419,58820,13621,55523,023TotalLiabilities27,71633,10864,65566,07567,543TotalEquity29,08842,14856,36475,109102,135TotalEquity&Liabilities56,80475,256121,019141,183169,678iQmethodSM-BusPerformance*ReturnOnCapitalEmployed29.

8%27.

0%19.

8%17.

5%21.

6%ReturnOnEquity40.

1%35.

7%31.

5%31.

3%32.

3%OperatingMargin41.

8%35.

3%31.

8%30.

5%36.

6%EBITDAMargin50.

6%41.

8%39.

1%37.

8%43.

9%iQmethodSM-QualityofEarnings*CashRealizationRatio1.

3x1.

5x1.

2x1.

2x1.

3xAssetReplacementRatio2.

1x1.

4x1.

3x1.

3x1.

3xTaxRate(Reported)15.

5%15.

1%19.

3%19.

3%19.

3%NetDebt-to-EquityRatio-3.

0%-6.

4%-20.

8%-32.

2%-45.

6%InterestCoverNM44.

5xNMNANAKeyMetrics*ForfulldefinitionsofiQmethodSMmeasures,seepage7.

CompanyDescriptionTencentisaleadingproviderofpremiummessagingservices,InternetVAS,wirelessVASandonlinegamestousers,andadvertisingandecommerceservicestocorporatesinChina.

Theinstantmessenger"QQ"hasthelargestonlinecommunitybasewithover800maccounts.

Otherpopularcommunity-basedproductsincludeWeixin/WeChat,Qzone,Pengyouetc.

InvestmentThesisThestrengthinitsmobileandPCcommunityplatformsofferslong-termgrowthopportunities,whilethecompanyisinvestingforlong-terminitiativeslikesearch,videoandeCommerce.

Weexpectnear-termmarginpressureamidsolidtop-linegrowthasrevenuemixshiftstolower-marginsegments.

Ontheotherhand,thecompanyisstillarmedwiththelargestonlineuserplatforminthecountryandcontributionfrommobileonlinegamescanhelptooffsetmarginpressure.

StockDataPricetoBookValue13.

7xCRTencentHoldingsLtd.

15April20143MoreaboutboringfundamentalsMobilemonetization:gamestoprecedemarketing;paymenttobeamulti-yearprojectAsthecontributionfrommobileO2Opaymentislikelytoremainlessthan5%inthecomingcoupleofyearsduetolowcommissionrates,wethinkthehypesurroundingmobileO2Opaymentshouldbegraduallydeflating.

Despitethebigmarketpotential,itwilltakemultipleyearstodevelopthescaleandbuilduppartnership/merchantnetworks.

Weexpectanadditional1pptofextragrowtheachyearfromthepaymentbusinessandmobilegamestobethekeybusinessmodeltomonetizesmartphoneusersinthecomingtwotothreeyears:PCgamesgenerated~45%ofsalesforTencentin4Q13andweexpectmobilegamestogrowfrom~4%in4Q13to~25%bymid-15.

Mobilegamedailyactiveusersof100m+onTencenthavealreadybeenmorethanPCgamedailyactiveusers.

Conversionratesofmobilegamerstopayingusersareinsingledigit,whichissignificantlylowerthanPCgameindustry'smid-teens.

Weseethisdifferencetobepartlystructuralduetodifferencesingamegenresanduserdemographics.

However,thediscountsinARPU,ofwhichmobilegameswere30-50%in4Q13toPCgames,areexpectedtonarrowdowngoingforwardassomehardcoremobileonlinegamesintheindustryareabletogenerateARPUcomparabletoPCgames.

MobilegameshavebettermarginsthanPCgamesduetoabiggermixofinhousegames,andrecognitionofrevenuesonanetbasisexcludingchannelfeespaidtoAppleAppStore.

Tencentalsosawexamplesoftherepeatcustomerratesofmobilegameslaunchedonsocialplatformstodoublethatofgameslaunchedpurelyviaanappstore.

Forlong-tailgames,Tencentoffersthealternativeofusingitsappstorefordistribution(insteadofitsmobilegamecenteronMobileQQandWeixin).

Wethinkitsappstorewillnotbeathreattothetoptwo,BaiduandQihoo,duetofewerheavyusers,butwillgenerateincrementalprofitsforthecompanyonbackofdecentmargins(35%+).

Tencentplanstooffermorepaidmarketingsolutionsandvalue-addedservicesforWeixinpublicaccountsinthefuture.

Inthemeantime,itcontinuestoseegooddemandfromadvertisers,especiallyeCommerceandonlineservices,foritsperformance-basedadinventoryonapplicationsotherthanWeixin.

ThecompanyisaddingmoremobileadinventoryincludingMobileQzoneandMobileQQandistestingadsonpublicaccounts.

Weforecastperformance-basedadvertisingtogrowto55%ofitsadsalesin15E,upfrom40%in13,andtheoveralladsalestogrowat13-15ECAGRof59%toaccountfor13%oftotalsales,upfrom8%in13.

AlthoughsocialmediahasbecomeanimportantonlinechannelforadvertisersinUS,reaching11-13%ofonlineadsin13accordingtoeMarketerandourUSInternetteam,thereisstillalackofsocialplatformswithbothreachandaccuracyinChina.

Weestimateonly~5%ofonlineadsrelatedtosocialads.

TencentandSinaWeiboareprobablytheonlytwowithenoughreachtoservetherequirementofmostlargeadvertisers.

CRTencentHoldingsLtd.

15April20144RiskofrisinginterestrateenvironmenttovaluationAspointedoutbyourequitystrategyteam,thereisarisktovaluationofgrowthstocksamidtighteningliquidityandrisinginterestratesasgrowthstocksdependonfutureearningsandcashflowsandwouldbesensitivetochangesindiscountrates(seethesensitivityanalysistablebelow).

WealsonotethatChineseInternetstocksperformedwellin2013,butafteraperiodofsignificantdepressionduring2011and12.

Table1:RisktoDCFvaluationfromchangesininterestrateenvironmentChangeinWACCWACCPriceobjective(HK$)-3%6%2565-2%7%1292-1%8%868BaseWACC9%6871%10%5292%11%4443%12%384Source:BofAMerrillLynchResearchChart1:PerformanceofbasketsofselectInternetcompaniesindifferentcountriesSource:Companydata,Bloomberg,BofAMerrillLynchResearchChina:Baidu,Tencent,Sina,Sohu,Netease,Ctrip,Giant;US:eBay,Google,Yahoo,Amazon,InteractiveCorp,Expedia,Priceline,Activision;Korea:NcSoft,Naver,Daum,CJShopping,Neowiz;Japan:YahooJapan,Rakuten,GREE,DeNA,StartToday,Mixi,Kakaku,CyberAgent,Cookpad0501001502002503003501/1/20102/1/20103/1/20104/1/20105/1/20106/1/20107/1/20108/1/20109/1/201010/1/201011/1/201012/1/20101/1/20112/1/20113/1/20114/1/20115/1/20116/1/20117/1/20118/1/20119/1/201110/1/201111/1/201112/1/20111/1/20122/1/20123/1/20124/1/20125/1/20126/1/20127/1/20128/1/20129/1/201210/1/201211/1/201212/1/20121/1/20132/1/20133/1/20134/1/20135/1/20136/1/20137/1/20138/1/20139/1/201310/1/201311/1/201312/1/20131/1/20142/1/20143/1/20144/1/2014ChinaUSKoreaJapanMSCIChinaCRTencentHoldingsLtd.

15April20145MixshifttounexcitingbutprofitablebusinessesAfterrestructuringofthesearchandeCommercesegments,TencentshouldseesomecushiononitsmarginsasrevenuemixcomesmorefromprofitablebusinesseslikePCgames,mobilegames,socialnetworkplatformandadvertising.

WebelieveWeixinhaspassedtheinitialfastrampstageandwillgrowsteadilyalongwith3G/4GuserbaseinChina.

TencenthasindicateditsfocusonoverseasmarketswhicharestillevolvingwithoutastrongincumbentinmobilecommunicationtoolssuchasMalaysia,IndiaandIndonesia.

Chart2:RevenuemixshiftingtounexcitingbutprofitablebusinessesSource:Companydata,BofAMerrillLynchChart3:UsergrowthmomentuminlinewithmostotherleadingsocialplatformsSource:Companydata,BofAMerrillLynch05,00010,00015,00020,00025,00030,00035,00040,00045,00050,000FY11FY12FY13EFY14EFY15EOnlinegamesNon-gameIVASMobileservicesAdvertisingEcommerceOthersRMBmn-10%-5%0%5%10%15%20%25%30%35%40%QoQRenren(MAU)Facebook(MAU)TencentWeixin+QQ(MAU)Twitter(MAU)YY(MAU)SinaWeibo(MAU)CRTencentHoldingsLtd.

15April20146Priceobjectivebasis&riskTencentHoldings(TCTZF)OurPOofHK$687isbasedon1)DCFvaluationofHK$683with9%discountrate,mid-term15-18EFCFCAGRof20%and5%terminalgrowth,2)HK$4fromitsstakeinSogou,valuedat5x14ESales(50%discounttotheaverageP/Salesof9.

5xoflargerpeers).

RiskstoourPOare1)DisruptionofgrowthofWeixinbytelcos,2)Competitiononpaymentbusiness,3)Competitiontolimitoverseasgrowth,4)Regulationononlinefinance,onlinegames,instantmessaging,wirelessservices,aswellaswebsitecontent,particularlyvideoandblog,wouldhurtusageand,therefore,reducemonetization,5)FasterthanexpecteddeteriorationinPCgamessuchasDNF,6)Destructiveapplications.

NewtechnologydevelopmentsmayreduceusageofTencentusersorresultinuserchurn,7)Expensesfordevelopinginitiativesincludingecommercebuthighmarketexpectationonmargins,8)Consolegames,9)RisinginterestratesonDCFvaluation,10)ChinaopeningupmarkettooverseasSNSsitesLinktoDefinitionsTechnologyClickherefordefinitionsofcommonlyusedterms.

AnalystCertificationI,EddieLeung,herebycertifythattheviewsexpressedinthisresearchreportaccuratelyreflectmypersonalviewsaboutthesubjectsecuritiesandissuers.

Ialsocertifythatnopartofmycompensationwas,is,orwillbe,directlyorindirectly,relatedtothespecificrecommendationsorviewexpressedinthisresearchreport.

APR-OnlinemediaCoverageClusterInvestmentratingCompanyBofAMerrillLynchtickerBloombergsymbolAnalystBUYBaidu.

comBIDUBIDUUSEddieLeungBonaFilmGroupLimitedBONABONAUSAngelineOoiCtrip.

Com-ADRCTRPCTRPUSEddieLeungDaumCommunicationsCorp.

DAUCF035720KSSeanOhE-CommerceChinaDangdangDANGDANGUSBinnieWongNaverCorporationXNHNF035420KSSeanOhNCSOFTNCSCF036570KSSeanOhNetease,IncNTESNTESUSEddieLeungPerfectWorldCoLtd-ADRPWRDPWRDUSEddieLeungQihooQIHUQIHUUSEddieLeungSinaCorpSINASINAUSEddieLeungSohu.

comIncSOHUSOHUUSEddieLeungSoufunSFUNSFUNUSEddieLeungTencentHoldingsTCTZF700HKEddieLeungVipshopHoldingsVIPSVIPSUSBinnieWongNEUTRALChangyou.

comLimitedCYOUCYOUUSEddieLeungNetdragonWebsoftNDWTF777HKEddieLeungRenrenInc.

RENNRENNUSEddieLeungYoukuTudouYOKUYOKUUSEddieLeungUNDERPERFORMTelevisionBroadcastsLtdTVBCF511HKAngelineOoiThe9LtdNCTYNCTYUSEddieLeungCRTencentHoldingsLtd.

15April20147APR-OnlinemediaCoverageClusterInvestmentratingCompanyBofAMerrillLynchtickerBloombergsymbolAnalystRVWJiayuan.

comDATEDATEUSEddieLeungTALEducation/XueersiXRSXRSUSEddieLeungXuedaEducationXUEXUEUSEddieLeungiQmethodSMMeasuresDefinitionsBusinessPerformanceNumeratorDenominatorReturnOnCapitalEmployedNOPAT=(EBIT+InterestIncome)*(1-TaxRate)+GoodwillAmortizationTotalAssets–CurrentLiabilities+STDebt+AccumulatedGoodwillAmortizationReturnOnEquityNetIncomeShareholders'EquityOperatingMarginOperatingProfitSalesEarningsGrowthExpected5-YearCAGRFromLatestActualN/AFreeCashFlowCashFlowFromOperations–TotalCapexN/AQualityofEarningsCashRealizationRatioCashFlowFromOperationsNetIncomeAssetReplacementRatioCapexDepreciationTaxRateTaxChargePre-TaxIncomeNetDebt-To-EquityRatioNetDebt=TotalDebt,LessCash&EquivalentsTotalEquityInterestCoverEBITInterestExpenseValuationToolkitPrice/EarningsRatioCurrentSharePriceDilutedEarningsPerShare(BasisAsSpecified)Price/BookValueCurrentSharePriceShareholders'Equity/CurrentBasicSharesDividendYieldAnnualisedDeclaredCashDividendCurrentSharePriceFreeCashFlowYieldCashFlowFromOperations–TotalCapexMarketCap.

=CurrentSharePrice*CurrentBasicSharesEnterpriseValue/SalesEV=CurrentSharePrice*CurrentShares+MinorityEquity+NetDebt+OtherLTLiabilitiesSalesEV/EBITDAEnterpriseValueBasicEBIT+Depreciation+AmortizationiQmethodSMisthesetofBofAMerrillLynchstandardmeasuresthatservetomaintainglobalconsistencyunderthreebroadheadings:BusinessPerformance,QualityofEarnings,andvalidations.

ThekeyfeaturesofiQmethodare:Aconsistentlystructured,detailed,andtransparentmethodology.

Guidelinestomaximizetheeffectivenessofthecomparativevaluationprocess,andtoidentifysomecommonpitfalls.

iQdatabaseisourreal-timeglobalresearchdatabasethatissourceddirectlyfromourequityanalysts'earningsmodelsandincludesforecastedaswellashistoricaldataforincomestatements,balancesheets,andcashflowstatementsforcompaniescoveredbyBofAMerrillLynch.

iQprofileSM,iQmethodSMareservicemarksofMerrillLynch&Co.

,Inc.

iQdatabaseisaregisteredservicemarkofMerrillLynch&Co.

,Inc.

CRTencentHoldingsLtd.

15April20148ImportantDisclosuresTCTZFPriceChart01002003004005006007001-Jan-121-Jan-131-Jan-14B:Buy,N:Neutral,U:Underperform,PO:PriceObjective,NA:Nolongervalid,NR:NoRatingTCTZF1-AprBLeungPO:HK$22011-MayPO:HK$23516-MayPO:HK$24210-AugPO:HK$2409-NovPO:HK$21814-MarPO:HK$23829-AprPO:HK$27315-AugPO:HK$2692-OctPO:HK$29214-NovPO:HK$30218-MarPO:HK$30020-MarPO:HK$29115-MayPO:HK$3163-JulPO:HK$33814-AugPO:HK$40216-SepPO:HK$46413-NovPO:HK$4751-DecPO:HK$49526-JanPO:HK$55417-FebPO:HK$63810-MarPO:HK$67519-MarPO:HK$687TheInvestmentOpinionSystemiscontainedattheendofthereportundertheheading"FundamentalEquityOpinionKey".

Darkgreyshadingindicatesthesecurityisrestrictedwiththeopinionsuspended.

Mediumgreyshadingindicatesthesecurityisunderreviewwiththeopinionwithdrawn.

Lightgreyshadingindicatesthesecurityisnotcovered.

ChartiscurrentasofMarch31,2014orsuchlaterdateasindicated.

InvestmentRatingDistribution:TechnologyGroup(asof31Mar2014)CoverageUniverseCountPercentInv.

BankingRelationships*CountPercentBuy12456.

88%Buy9475.

81%Neutral4721.

56%Neutral3472.

34%Sell4721.

56%Sell3472.

34%InvestmentRatingDistribution:GlobalGroup(asof31Mar2014)CoverageUniverseCountPercentInv.

BankingRelationships*CountPercentBuy170250.

59%Buy125473.

68%Neutral84425.

09%Neutral61372.

63%Sell81824.

32%Sell53064.

79%*CompaniesthatwereinvestmentbankingclientsofBofAMerrillLynchoroneofitsaffiliateswithinthepast12months.

Forpurposesofthisdistribution,astockratedUnderperformisincludedasaSell.

FUNDAMENTALEQUITYOPINIONKEY:OpinionsincludeaVolatilityRiskRating,anInvestmentRatingandanIncomeRating.

VOLATILITYRISKRATINGS,indicatorsofpotentialpricefluctuation,are:A-Low,B-MediumandC-High.

INVESTMENTRATINGSreflecttheanalyst'sassessmentofastock's:(i)absolutetotalreturnpotentialand(ii)attractivenessforinvestmentrelativetootherstockswithinitsCoverageCluster(definedbelow).

Therearethreeinvestmentratings:1-Buystocksareexpectedtohaveatotalreturnofatleast10%andarethemostattractivestocksinthecoveragecluster;2-NeutralstocksareexpectedtoremainflatorincreaseinvalueandarelessattractivethanBuyratedstocksand3-Underperformstocksaretheleastattractivestocksinacoveragecluster.

Analystsassigninvestmentratingsconsidering,amongotherthings,the0-12monthtotalreturnexpectationforastockandthefirm'sguidelinesforratingsdispersions(showninthetablebelow).

Thecurrentpriceobjectiveforastockshouldbereferencedtobetterunderstandthetotalreturnexpectationatanygiventime.

Thepriceobjectivereflectstheanalyst'sviewofthepotentialpriceappreciation(depreciation).

InvestmentratingTotalreturnexpectation(within12-monthperiodofdateofinitialrating)Ratingsdispersionguidelinesforcoveragecluster*Buy≥10%≤70%Neutral≥0%≤30%UnderperformN/A≥20%*RatingsdispersionsmayvaryfromtimetotimewhereBofAMerrillLynchResearchbelievesitbetterreflectstheinvestmentprospectsofstocksinaCoverageCluster.

INCOMERATINGS,indicatorsofpotentialcashdividends,are:7-same/higher(dividendconsideredtobesecure),8-same/lower(dividendnotconsideredtobesecure)and9-paysnocashdividend.

CoverageClusteriscomprisedofstockscoveredbyasingleanalystortwoormoreanalystssharingacommonindustry,sector,regionorotherclassification(s).

Astock'scoverageclusterisincludedinthemostrecentBofAMerrillLynchCommentreferencingthestock.

Pricechartsforthesecuritiesreferencedinthisresearchreportareavailableathttp://pricecharts.

ml.

com,orcall1-800-MERRILLtohavethemmailed.

Thecompanyisorwas,withinthelast12months,aninvestmentbankingclientofMLPF&Sand/oroneormoreofitsaffiliates:TencentHoldings.

IntheUS,retailsalesand/ordistributionofthisreportmaybemadeonlyinstateswherethesesecuritiesareexemptfromregistrationorhavebeenqualifiedforsale:TencentHoldings.

MLPF&Soranaffiliateexpectstoreceiveorintendstoseekcompensationforinvestmentbankingservicesfromthiscompanyoranaffiliateofthecompanywithinthenextthreemonths:TencentHoldings.

BofAMerrillLynchResearchpersonnel(includingtheanalyst(s)responsibleforthisreport)receivecompensationbasedupon,amongotherfactors,theoverallprofitabilityofBankofAmericaCorporation,includingprofitsderivedfrominvestmentbankingrevenues.

CRTencentHoldingsLtd.

15April20149OtherImportantDisclosuresOfficersofMLPF&Soroneormoreofitsaffiliates(otherthanresearchanalysts)mayhaveafinancialinterestinsecuritiesoftheissuer(s)orinrelatedinvestments.

Fromtimetotimeresearchanalystsconductsitevisitsofcoveredcompanies.

BofAMerrillLynchpoliciesprohibitresearchanalystsfromacceptingpaymentorreimbursementfortravelexpensesfromthecompanyforsuchvisits.

BofAMerrillLynchGlobalResearchpoliciesrelatingtoconflictsofinterestaredescribedathttp://www.

ml.

com/media/43347.

pdf.

"BofAMerrillLynch"includesMerrillLynch,Pierce,Fenner&SmithIncorporated("MLPF&S")anditsaffiliates.

InvestorsshouldcontacttheirBofAMerrillLynchrepresentativeorMerrillLynchGlobalWealthManagementfinancialadvisoriftheyhavequestionsconcerningthisreport.

"BofAMerrillLynch"and"MerrillLynch"areeachglobalbrandsforBofAMerrillLynchGlobalResearch.

InformationrelatingtoNon-USaffiliatesofBofAMerrillLynchandDistributionofAffiliateResearchReports:MLPF&Sdistributes,ormayinthefuturedistribute,researchreportsofthefollowingnon-USaffiliatesintheUS(shortname:legalname):MerrillLynch(France):MerrillLynchCapitalMarkets(France)SAS;MerrillLynch(Frankfurt):MerrillLynchInternationalBankLtd.

,FrankfurtBranch;MerrillLynch(SouthAfrica):MerrillLynchSouthAfrica(Pty)Ltd.

;MerrillLynch(Milan):MerrillLynchInternationalBankLimited;MLI(UK):MerrillLynchInternational;MerrillLynch(Australia):MerrillLynchEquities(Australia)Limited;MerrillLynch(HongKong):MerrillLynch(AsiaPacific)Limited;MerrillLynch(Singapore):MerrillLynch(Singapore)PteLtd.

;MerrillLynch(Canada):MerrillLynchCanadaInc;MerrillLynch(Mexico):MerrillLynchMexico,SAdeCV,CasadeBolsa;MerrillLynch(Argentina):MerrillLynchArgentinaSA;MerrillLynch(Japan):MerrillLynchJapanSecuritiesCo.

,Ltd.

;MerrillLynch(Seoul):MerrillLynchInternationalIncorporated(SeoulBranch);MerrillLynch(Taiwan):MerrillLynchSecurities(Taiwan)Ltd.

;DSPMerrillLynch(India):DSPMerrillLynchLimited;PTMerrillLynch(Indonesia):PTMerrillLynchIndonesia;MerrillLynch(Israel):MerrillLynchIsraelLimited;MerrillLynch(Russia):OOOMerrillLynchSecurities,Moscow;MerrillLynch(TurkeyI.

B.

):MerrillLynchYatirimBankA.

S.

;MerrillLynch(TurkeyBroker):MerrillLynchMenkulDeerlerA.

.

;MerrillLynch(Dubai):MerrillLynchInternational,DubaiBranch;MLPF&S(Zurichrep.

office):MLPF&SIncorporatedZurichrepresentativeoffice;MerrillLynch(Spain):MerrillLynchCapitalMarketsEspana,S.

A.

S.

V.

;MerrillLynch(Brazil):BankofAmericaMerrillLynchBancoMultiploS.

A.

;MerrillLynchKSACompany,MerrillLynchKingdomofSaudiArabiaCompany.

ThisresearchreporthasbeenapprovedforpublicationandisdistributedintheUnitedKingdomtoprofessionalclientsandeligiblecounterparties(aseachisdefinedintherulesoftheFinancialConductAuthorityandthePrudentialRegulationAuthority)byMerrillLynchInternationalandBankofAmericaMerrillLynchInternationalLimited,whichareauthorizedbythePrudentialRegulationAuthorityandregulatedbytheFinancialConductAuthorityandthePrudentialRegulationAuthority,andisdistributedintheUnitedKingdomtoretailclients(asdefinedintherulesoftheFinancialConductAuthorityandthePrudentialRegulationAuthority)byMerrillLynchInternationalBankLimited,LondonBranch,whichisauthorisedbytheCentralBankofIrelandandsubjecttolimitedregulationbytheFinancialConductAuthorityandPrudentialRegulationAuthority-detailsabouttheextentofourregulationbytheFinancialConductAuthorityandPrudentialRegulationAuthorityareavailablefromusonrequest;hasbeenconsideredanddistributedinJapanbyMerrillLynchJapanSecuritiesCo.

,Ltd.

,aregisteredsecuritiesdealerundertheFinancialInstrumentsandExchangeActinJapan;isdistributedinHongKongbyMerrillLynch(AsiaPacific)Limited,whichisregulatedbytheHongKongSFCandtheHongKongMonetaryAuthority(notethatHongKongrecipientsofthisresearchreportshouldcontactMerrillLynch(AsiaPacific)Limitedinrespectofanymattersrelatingtodealinginsecuritiesorprovisionofspecificadviceonsecurities);isissuedanddistributedinTaiwanbyMerrillLynchSecurities(Taiwan)Ltd.

;isissuedanddistributedinIndiabyDSPMerrillLynchLimited;andisissuedanddistributedinSingaporetoinstitutionalinvestorsand/oraccreditedinvestors(eachasdefinedundertheFinancialAdvisersRegulations)byMerrillLynchInternationalBankLimited(MerchantBank)andMerrillLynch(Singapore)PteLtd.

(CompanyRegistrationNo.

'sF06872Eand198602883Drespectively).

MerrillLynchInternationalBankLimited(MerchantBank)andMerrillLynch(Singapore)PteLtd.

areregulatedbytheMonetaryAuthorityofSingapore.

BankofAmericaN.

A.

,AustralianBranch(ARBN064874531),AFSLicense412901(BANAAustralia)andMerrillLynchEquities(Australia)Limited(ABN65006276795),AFSLicense235132(MLEA)distributesthisreportinAustraliaonlyto'Wholesale'clientsasdefinedbys.

761GoftheCorporationsAct2001.

WiththeexceptionofBANAAustralia,neitherMLEAnoranyofitsaffiliatesinvolvedinpreparingthisresearchreportisanAuthorisedDeposit-TakingInstitutionundertheBankingAct1959norregulatedbytheAustralianPrudentialRegulationAuthority.

NoapprovalisrequiredforpublicationordistributionofthisreportinBrazilanditslocaldistributionismadebyBankofAmericaMerrillLynchBancoMúltiploS.

A.

inaccordancewithapplicableregulations.

MerrillLynch(Dubai)isauthorizedandregulatedbytheDubaiFinancialServicesAuthority(DFSA).

ResearchreportspreparedandissuedbyMerrillLynch(Dubai)arepreparedandissuedinaccordancewiththerequirementsoftheDFSAconductofbusinessrules.

MerrillLynch(Frankfurt)distributesthisreportinGermany.

MerrillLynch(Frankfurt)isregulatedbyBaFin.

ThisresearchreporthasbeenpreparedandissuedbyMLPF&Sand/oroneormoreofitsnon-USaffiliates.

MLPF&SisthedistributorofthisresearchreportintheUSandacceptsfullresponsibilityforresearchreportsofitsnon-USaffiliatesdistributedtoMLPF&SclientsintheUS.

AnyUSpersonreceivingthisresearchreportandwishingtoeffectanytransactioninanysecuritydiscussedinthereportshoulddosothroughMLPF&Sandnotsuchforeignaffiliates.

GeneralInvestmentRelatedDisclosures:TaiwanReaders:Neithertheinformationnoranyopinionexpressedhereinconstitutesanofferorasolicitationofanoffertotransactinanysecuritiesorotherfinancialinstrument.

NopartofthisreportmaybeusedorreproducedorquotedinanymannerwhatsoeverinTaiwanbythepressoranyotherpersonwithouttheexpresswrittenconsentofBofAMerrillLynch.

Thisresearchreportprovidesgeneralinformationonly.

Neithertheinformationnoranyopinionexpressedconstitutesanofferoraninvitationtomakeanoffer,tobuyorsellanysecuritiesorotherfinancialinstrumentoranyderivativerelatedtosuchsecuritiesorinstruments(e.

g.

,options,futures,warrants,andcontractsfordifferences).

Thisreportisnotintendedtoprovidepersonalinvestmentadviceanditdoesnottakeintoaccountthespecificinvestmentobjectives,financialsituationandtheparticularneedsofanyspecificperson.

Investorsshouldseekfinancialadviceregardingtheappropriatenessofinvestinginfinancialinstrumentsandimplementinginvestmentstrategiesdiscussedorrecommendedinthisreportandshouldunderstandthatstatementsregardingfutureprospectsmaynotberealized.

Anydecisiontopurchaseorsubscribeforsecuritiesinanyofferingmustbebasedsolelyonexistingpublicinformationonsuchsecurityortheinformationintheprospectusorotherofferingdocumentissuedinconnectionwithsuchoffering,andnotonthisreport.

Securitiesandotherfinancialinstrumentsdiscussedinthisreport,orrecommended,offeredorsoldbyMerrillLynch,arenotinsuredbytheFederalDepositInsuranceCorporationandarenotdepositsorotherobligationsofanyinsureddepositoryinstitution(including,BankofAmerica,N.

A.

).

Investmentsingeneraland,derivatives,inparticular,involvenumerousrisks,including,amongothers,marketrisk,counterpartydefaultriskandliquidityrisk.

Nosecurity,financialinstrumentorderivativeissuitableforallinvestors.

Insomecases,securitiesandotherfinancialinstrumentsmaybedifficulttovalueorsellandreliableinformationaboutthevalueorrisksrelatedtothesecurityorfinancialinstrumentmaybedifficulttoobtain.

Investorsshouldnotethatincomefromsuchsecuritiesandotherfinancialinstruments,ifany,mayfluctuateandthatpriceorvalueofsuchsecuritiesandinstrumentsmayriseorfalland,insomecases,investorsmaylosetheirentireprincipalinvestment.

Pastperformanceisnotnecessarilyaguidetofutureperformance.

Levelsandbasisfortaxationmaychange.

Thisreportmaycontainashort-termtradingideaorrecommendation,whichhighlightsaspecificnear-termcatalystoreventimpactingthecompanyorthemarketthatisanticipatedtohaveashort-termpriceimpactontheequitysecuritiesofthecompany.

Short-termtradingideasandrecommendationsaredifferentfromanddonotaffectastock'sfundamentalequityrating,whichreflectsbothalongertermtotalreturnexpectationandattractivenessforinvestmentrelativetootherstockswithinitsCoverageCluster.

Short-termtradingideasandrecommendationsmaybemoreorlesspositivethanastock'sfundamentalequityrating.

CRTencentHoldingsLtd.

15April201410BofAMerrillLynchisawarethattheimplementationoftheideasexpressedinthisreportmaydependuponaninvestor'sabilityto"short"securitiesorotherfinancialinstrumentsandthatsuchactionmaybelimitedbyregulationsprohibitingorrestricting"shortselling"inmanyjurisdictions.

Investorsareurgedtoseekadviceregardingtheapplicabilityofsuchregulationspriortoexecutinganyshortideacontainedinthisreport.

Foreigncurrencyratesofexchangemayadverselyaffectthevalue,priceorincomeofanysecurityorfinancialinstrumentmentionedinthisreport.

Investorsinsuchsecuritiesandinstruments,includingADRs,effectivelyassumecurrencyrisk.

UKReaders:TheprotectionsprovidedbytheU.

K.

regulatoryregime,includingtheFinancialServicesScheme,donotapplyingeneraltobusinesscoordinatedbyBofAMerrillLynchentitieslocatedoutsideoftheUnitedKingdom.

BofAMerrillLynchGlobalResearchpoliciesrelatingtoconflictsofinterestaredescribedathttp://www.

ml.

com/media/43347.

pdf.

OfficersofMLPF&Soroneormoreofitsaffiliates(otherthanresearchanalysts)mayhaveafinancialinterestinsecuritiesoftheissuer(s)orinrelatedinvestments.

MLPF&Soroneofitsaffiliatesisaregularissueroftradedfinancialinstrumentslinkedtosecuritiesthatmayhavebeenrecommendedinthisreport.

MLPF&Soroneofitsaffiliatesmay,atanytime,holdatradingposition(longorshort)inthesecuritiesandfinancialinstrumentsdiscussedinthisreport.

BofAMerrillLynch,throughbusinessunitsotherthanBofAMerrillLynchGlobalResearch,mayhaveissuedandmayinthefutureissuetradingideasorrecommendationsthatareinconsistentwith,andreachdifferentconclusionsfrom,theinformationpresentedinthisreport.

Suchideasorrecommendationsreflectthedifferenttimeframes,assumptions,viewsandanalyticalmethodsofthepersonswhopreparedthem,andBofAMerrillLynchisundernoobligationtoensurethatsuchothertradingideasorrecommendationsarebroughttotheattentionofanyrecipientofthisreport.

IntheeventthattherecipientreceivedthisreportpursuanttoacontractbetweentherecipientandMLPF&Sfortheprovisionofresearchservicesforaseparatefee,andinconnectiontherewithMLPF&Smaybedeemedtobeactingasaninvestmentadviser,suchstatusrelates,ifatall,solelytothepersonwithwhomMLPF&Shascontracteddirectlyanddoesnotextendbeyondthedeliveryofthisreport(unlessotherwiseagreedspecificallyinwritingbyMLPF&S).

MLPF&Sisandcontinuestoactsolelyasabroker-dealerinconnectionwiththeexecutionofanytransactions,includingtransactionsinanysecuritiesmentionedinthisreport.

CopyrightandGeneralInformationregardingResearchReports:Copyright2014MerrillLynch,Pierce,Fenner&SmithIncorporated.

Allrightsreserved.

iQmethod,iQmethod2.

0,iQprofile,iQtoolkit,iQworksareservicemarksofBankofAmericaCorporation.

iQanalytics,iQcustom,iQdatabaseareregisteredservicemarksofBankofAmericaCorporation.

ThisresearchreportispreparedfortheuseofBofAMerrillLynchclientsandmaynotberedistributed,retransmittedordisclosed,inwholeorinpart,orinanyformormanner,withouttheexpresswrittenconsentofBofAMerrillLynch.

BofAMerrillLynchGlobalResearchreportsaredistributedsimultaneouslytointernalandclientwebsitesandotherportalsbyBofAMerrillLynchandarenotpublicly-availablematerials.

Anyunauthorizeduseordisclosureisprohibited.

Receiptandreviewofthisresearchreportconstitutesyouragreementnottoredistribute,retransmit,ordisclosetoothersthecontents,opinions,conclusion,orinformationcontainedinthisreport(includinganyinvestmentrecommendations,estimatesorpricetargets)withoutfirstobtainingexpressedpermissionfromanauthorizedofficerofBofAMerrillLynch.

MaterialspreparedbyBofAMerrillLynchGlobalResearchpersonnelarebasedonpublicinformation.

Factsandviewspresentedinthismaterialhavenotbeenreviewedby,andmaynotreflectinformationknownto,professionalsinotherbusinessareasofBofAMerrillLynch,includinginvestmentbankingpersonnel.

BofAMerrillLynchhasestablishedinformationbarriersbetweenBofAMerrillLynchGlobalResearchandcertainbusinessgroups.

Asaresult,BofAMerrillLynchdoesnotdisclosecertainclientrelationshipswith,orcompensationreceivedfrom,suchcompaniesinresearchreports.

Totheextentthisreportdiscussesanylegalproceedingorissues,ithasnotbeenpreparedasnorisitintendedtoexpressanylegalconclusion,opinionoradvice.

Investorsshouldconsulttheirownlegaladvisersastoissuesoflawrelatingtothesubjectmatterofthisreport.

BofAMerrillLynchGlobalResearchpersonnel'sknowledgeoflegalproceedingsinwhichanyBofAMerrillLynchentityand/oritsdirectors,officersandemployeesmaybeplaintiffs,defendants,co-defendantsorco-plaintiffswithorinvolvingcompaniesmentionedinthisreportisbasedonpublicinformation.

Factsandviewspresentedinthismaterialthatrelatetoanysuchproceedingshavenotbeenreviewedby,discussedwith,andmaynotreflectinformationknownto,professionalsinotherbusinessareasofBofAMerrillLynchinconnectionwiththelegalproceedingsormattersrelevanttosuchproceedings.

Thisreporthasbeenpreparedindependentlyofanyissuerofsecuritiesmentionedhereinandnotinconnectionwithanyproposedofferingofsecuritiesorasagentofanyissuerofanysecurities.

NoneofMLPF&S,anyofitsaffiliatesortheirresearchanalystshasanyauthoritywhatsoevertomakeanyrepresentationorwarrantyonbehalfoftheissuer(s).

BofAMerrillLynchGlobalResearchpolicyprohibitsresearchpersonnelfromdisclosingarecommendation,investmentrating,orinvestmentthesisforreviewbyanissuerpriortothepublicationofaresearchreportcontainingsuchrating,recommendationorinvestmentthesis.

Anyinformationrelatingtothetaxstatusoffinancialinstrumentsdiscussedhereinisnotintendedtoprovidetaxadviceortobeusedbyanyonetoprovidetaxadvice.

Investorsareurgedtoseektaxadvicebasedontheirparticularcircumstancesfromanindependenttaxprofessional.

Theinformationherein(otherthandisclosureinformationrelatingtoBofAMerrillLynchanditsaffiliates)wasobtainedfromvarioussourcesandwedonotguaranteeitsaccuracy.

Thisreportmaycontainlinkstothird-partywebsites.

BofAMerrillLynchisnotresponsibleforthecontentofanythird-partywebsiteoranylinkedcontentcontainedinathird-partywebsite.

Contentcontainedonsuchthird-partywebsitesisnotpartofthisreportandisnotincorporatedbyreferenceintothisreport.

TheinclusionofalinkinthisreportdoesnotimplyanyendorsementbyoranyaffiliationwithBofAMerrillLynch.

Accesstoanythird-partywebsiteisatyourownrisk,andyoushouldalwaysreviewthetermsandprivacypoliciesatthird-partywebsitesbeforesubmittinganypersonalinformationtothem.

BofAMerrillLynchisnotresponsibleforsuchtermsandprivacypoliciesandexpresslydisclaimsanyliabilityforthem.

SubjecttothequietperiodapplicableunderlawsofthevariousjurisdictionsinwhichwedistributeresearchreportsandotherlegalandBofAMerrillLynchpolicy-relatedrestrictionsonthepublicationofresearchreports,fundamentalequityreportsareproducedonaregularbasisasnecessarytokeeptheinvestmentrecommendationcurrent.

Certainoutstandingreportsmaycontaindiscussionsand/orinvestmentopinionsrelatingtosecurities,financialinstrumentsand/orissuersthatarenolongercurrent.

Alwaysrefertothemostrecentresearchreportrelatingtoacompanyorissuerpriortomakinganinvestmentdecision.

Insomecases,acompanyorissuermaybeclassifiedasRestrictedormaybeUnderRevieworExtendedReview.

Ineachcase,investorsshouldconsideranyinvestmentopinionrelatingtosuchcompanyorissuer(oritssecurityand/orfinancialinstruments)tobesuspendedorwithdrawnandshouldnotrelyontheanalysesandinvestmentopinion(s)pertainingtosuchissuer(oritssecuritiesand/orfinancialinstruments)norshouldtheanalysesoropinion(s)beconsideredasolicitationofanykind.

SalespersonsandfinancialadvisorsaffiliatedwithMLPF&SoranyofitsaffiliatesmaynotsolicitpurchasesofsecuritiesorfinancialinstrumentsthatareRestrictedorUnderReviewandmayonlysolicitsecuritiesunderExtendedReviewinaccordancewithfirmpolicies.

NeitherBofAMerrillLynchnoranyofficeroremployeeofBofAMerrillLynchacceptsanyliabilitywhatsoeverforanydirect,indirectorconsequentialdamagesorlossesarisingfromanyuseofthisreportoritscontents.

CR

Referto"OtherImportantDisclosures"forinformationoncertainBofAMerrillLynchentitiesthattakeresponsibilityforthisreportinparticularjurisdictions.

BofAMerrillLynchdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.

Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.

Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.

Refertoimportantdisclosuresonpage8to10.

AnalystCertificationonPage6.

PriceObjectiveBasis/Riskonpage6.

LinktoDefinitionsonpage6.

11377586TencentHoldingsLtd.

EstimateChangeBUYHypedeflating;backtofocusonthefundamentalsEquity|HongKong|Internet/e-Commerce15April2014EddieLeung>>+85221617189ResearchAnalystMerrillLynch(HongKong)eddie.

leung@baml.

comBinnieWong>>+85225363458ResearchAnalystMerrillLynch(HongKong)binnie.

wong@baml.

comStockDataPriceHK$526.

00PriceObjectiveHK$687.

00DateEstablished19-Mar-2014InvestmentOpinionB-1-7VolatilityRiskMEDIUM52-WeekRangeHK$243.

00-HK$646.

00MrktVal/SharesOut(mn)US$124,549/1,836.

0MarketValue(mn)HK$965,746AverageDailyVolume7,919,982BofAMLTicker/ExchangeTCTZF/HKGBloomberg/Reuters700HK/0700.

HKROE(2013E)31.

5%NetDbttoEqty(Dec-2012A)-6.

4%Est.

5-YrEPS/DPSGrowth30.

5%/12.

4%FreeFloat37.

0%KeyChanges(CNY)PreviousCurrent2014EEPS10.

8510.

982015EEPS15.

1515.

18Hypedeflating;fundamentalsstillstableAsregulationcoolsdownoncesurgingexuberancesurroundingonlinepayment,whileasectorrotationtotraditionalsectorsalongwithIPOstriggeredastockcorrection,Tencent'sexecutionappearstoremainsoundandstablejudgingfromourrecentdiscussionswithmanagement.

Wenotethat:1)Mobilegames,whichbenefitfromeffectiveuserrecruitmentofitsmobilesocialplatformsandmulti-tiercooperationstructureswithdevelopers,areontracktobeakeyrevenuedriver.

2)ScaleofYixun(eCommerce)willbecontrolledtoeasemarginpressure.

3)O2Owillbeamulti-yearlong-termprojectforTencent,butwon'tbeamaterialrevenuesourceincomingcoupleofyears.

AsthecompanyshiftsawayfromeCtohigher-margingameandsocialbusinesses,welowerour14/15Erevenueforecastsby0.

5%/5.

6%;butraiseEPSupby2%/1%.

In1Q14,investmentgainsshouldoffsettheUS$100m+subsidiesontaxiapps.

Wethinkthestockcancontinuetobevolatileinthenear-termwhileearningsgrowthcatchesupwithanexpandedPE.

WebelievechangesinthediscountrateinarisingrateenvironmentarealsoarisktoDCFvaluation.

Managementreiteratedtheirdeterminationtofocusandsolidifytheiradvantagesinsocialandcommunicationwhilekeepingacloseeyeonupandcomingapplicationsassourcesofdisruption.

Wealsoseedevelopmentinhardware,homeentertainmentandwearabletopotentiallycomplicatethecompetitivelandscape.

Medium-termnoteprogramtoaddfinancialflexibilityTencent'snewlyannouncedmedium-termnoteprogram,whichgivesitflexibilitytoissuenotesuptoUS$5binvariousterms,currencies,anddatestoinvestorswithin12monthsfrom10Apr,mightbepartlydrivenbypositivemarketconditionsafterMoody'supgradetoA3anddoesn'tnecessarilyimplyanyimmediatemulti-billiondollaracquisition.

TheprogramcanalsosupportTencent'sinvestmentstrategyintheShenzhen-basedentitythatseeksabanklicense,whencapitalinjectionisneeded.

Tencentisaminorityshareholderwhichhopestoreduceregulatoryrestrictioninexpandingitspaymentbusinessifthisentityobtainsabanklicense.

Estimates(Dec)(CNY)2011A2012A2013E2014E2015ENetIncome(Adjusted-mn)10,20312,73215,50220,59428,649EPS5.

496.

838.

3010.

9815.

18EPSChange(YoY)26.

8%24.

4%21.

6%32.

2%38.

3%Dividend/Share0.

490.

660.

660.

940.

93FreeCashFlow/Share5.

118.

627.

129.

1814.

45Valuation(Dec)2011A2012A2013E2014E2015EP/E77.

68x61.

92x49.

45x38.

43x27.

79xDividendYield0.

12%0.

16%0.

16%0.

22%0.

22%EV/EBITDA*52.

13x40.

98x31.

84x25.

35x17.

63xFreeCashFlowYield*1.

20%2.

04%1.

69%2.

19%3.

48%*ForfulldefinitionsofiQmethodSMmeasures,seepage7.

CRTencentHoldingsLtd.

15April20142iQprofileSMTencentHoldingsLtd.

KeyIncomeStatementData(Dec)2011A2012A2013E2014E2015E(CNYMillions)Sales28,49643,89460,43778,46097,102GrossProfit18,56825,68632,65944,36062,311SellGeneral&AdminExpense(6,635)(10,511)(15,684)(22,239)(28,727)OperatingProfit11,91415,47919,19423,92135,564NetInterest&OtherIncome185(428)861,702(240)AssociatesNANANANANAPretaxIncome12,09915,05119,28125,62335,324Tax(expense)/Benefit(1,874)(2,266)(3,718)(4,941)(6,812)NetIncome(Adjusted)10,20312,73215,50220,59428,649AverageFullyDilutedSharesOutstanding1,8591,8641,8671,8761,887KeyCashFlowStatementDataNetIncome10,20312,73215,50220,59428,649Depreciation&Amortization2,5082,8684,4155,7327,094ChangeinWorkingCapital1,1771,177(816)141146DeferredTaxationChargeNANANANANAOtherAdjustments,Net(530)2,653(237)(1,791)377CashFlowfromOperations13,35819,42918,86424,67636,267CapitalExpenditure(4,046)(3,657)(5,798)(7,708)(9,326)(Acquisition)/DisposalofInvestments(7,333)(16,277)(2,778)(2,778)(2,778)OtherCashInflow/(Outflow)(3,976)3,664000CashFlowfromInvesting(15,355)(16,270)(8,576)(10,485)(12,104)SharesIssue/(Repurchase)(1,316)119000CostofDividendsPaid(895)(1,225)(1,225)(1,760)(1,760)CashFlowfromFinancing4,373(2,386)29,775(1,760)(1,760)FreeCashFlow9,31215,77313,06616,96926,941NetDebt(879)(2,684)(11,747)(24,177)(46,581)ChangeinNetDebt4,380(1,871)(9,063)(12,431)(22,403)KeyBalanceSheetDataProperty,Plant&Equipment5,8857,4038,78610,76112,993OtherNon-CurrentAssets15,41631,34434,29838,77841,315TradeReceivables2,0212,3544,2865,5646,886Cash&Equivalents12,61213,38353,44665,87788,280OtherCurrentAssets20,87120,77220,20420,20420,204TotalAssets56,80475,256121,019141,183169,678Long-TermDebt3,7339,62240,62240,62240,622OtherNon-CurrentLiabilities2,7992,8202,8202,8202,820Short-TermDebt7,9991,0771,0771,0771,077OtherCurrentLiabilities13,18419,58820,13621,55523,023TotalLiabilities27,71633,10864,65566,07567,543TotalEquity29,08842,14856,36475,109102,135TotalEquity&Liabilities56,80475,256121,019141,183169,678iQmethodSM-BusPerformance*ReturnOnCapitalEmployed29.

8%27.

0%19.

8%17.

5%21.

6%ReturnOnEquity40.

1%35.

7%31.

5%31.

3%32.

3%OperatingMargin41.

8%35.

3%31.

8%30.

5%36.

6%EBITDAMargin50.

6%41.

8%39.

1%37.

8%43.

9%iQmethodSM-QualityofEarnings*CashRealizationRatio1.

3x1.

5x1.

2x1.

2x1.

3xAssetReplacementRatio2.

1x1.

4x1.

3x1.

3x1.

3xTaxRate(Reported)15.

5%15.

1%19.

3%19.

3%19.

3%NetDebt-to-EquityRatio-3.

0%-6.

4%-20.

8%-32.

2%-45.

6%InterestCoverNM44.

5xNMNANAKeyMetrics*ForfulldefinitionsofiQmethodSMmeasures,seepage7.

CompanyDescriptionTencentisaleadingproviderofpremiummessagingservices,InternetVAS,wirelessVASandonlinegamestousers,andadvertisingandecommerceservicestocorporatesinChina.

Theinstantmessenger"QQ"hasthelargestonlinecommunitybasewithover800maccounts.

Otherpopularcommunity-basedproductsincludeWeixin/WeChat,Qzone,Pengyouetc.

InvestmentThesisThestrengthinitsmobileandPCcommunityplatformsofferslong-termgrowthopportunities,whilethecompanyisinvestingforlong-terminitiativeslikesearch,videoandeCommerce.

Weexpectnear-termmarginpressureamidsolidtop-linegrowthasrevenuemixshiftstolower-marginsegments.

Ontheotherhand,thecompanyisstillarmedwiththelargestonlineuserplatforminthecountryandcontributionfrommobileonlinegamescanhelptooffsetmarginpressure.

StockDataPricetoBookValue13.

7xCRTencentHoldingsLtd.

15April20143MoreaboutboringfundamentalsMobilemonetization:gamestoprecedemarketing;paymenttobeamulti-yearprojectAsthecontributionfrommobileO2Opaymentislikelytoremainlessthan5%inthecomingcoupleofyearsduetolowcommissionrates,wethinkthehypesurroundingmobileO2Opaymentshouldbegraduallydeflating.

Despitethebigmarketpotential,itwilltakemultipleyearstodevelopthescaleandbuilduppartnership/merchantnetworks.

Weexpectanadditional1pptofextragrowtheachyearfromthepaymentbusinessandmobilegamestobethekeybusinessmodeltomonetizesmartphoneusersinthecomingtwotothreeyears:PCgamesgenerated~45%ofsalesforTencentin4Q13andweexpectmobilegamestogrowfrom~4%in4Q13to~25%bymid-15.

Mobilegamedailyactiveusersof100m+onTencenthavealreadybeenmorethanPCgamedailyactiveusers.

Conversionratesofmobilegamerstopayingusersareinsingledigit,whichissignificantlylowerthanPCgameindustry'smid-teens.

Weseethisdifferencetobepartlystructuralduetodifferencesingamegenresanduserdemographics.

However,thediscountsinARPU,ofwhichmobilegameswere30-50%in4Q13toPCgames,areexpectedtonarrowdowngoingforwardassomehardcoremobileonlinegamesintheindustryareabletogenerateARPUcomparabletoPCgames.

MobilegameshavebettermarginsthanPCgamesduetoabiggermixofinhousegames,andrecognitionofrevenuesonanetbasisexcludingchannelfeespaidtoAppleAppStore.

Tencentalsosawexamplesoftherepeatcustomerratesofmobilegameslaunchedonsocialplatformstodoublethatofgameslaunchedpurelyviaanappstore.

Forlong-tailgames,Tencentoffersthealternativeofusingitsappstorefordistribution(insteadofitsmobilegamecenteronMobileQQandWeixin).

Wethinkitsappstorewillnotbeathreattothetoptwo,BaiduandQihoo,duetofewerheavyusers,butwillgenerateincrementalprofitsforthecompanyonbackofdecentmargins(35%+).

Tencentplanstooffermorepaidmarketingsolutionsandvalue-addedservicesforWeixinpublicaccountsinthefuture.

Inthemeantime,itcontinuestoseegooddemandfromadvertisers,especiallyeCommerceandonlineservices,foritsperformance-basedadinventoryonapplicationsotherthanWeixin.

ThecompanyisaddingmoremobileadinventoryincludingMobileQzoneandMobileQQandistestingadsonpublicaccounts.

Weforecastperformance-basedadvertisingtogrowto55%ofitsadsalesin15E,upfrom40%in13,andtheoveralladsalestogrowat13-15ECAGRof59%toaccountfor13%oftotalsales,upfrom8%in13.

AlthoughsocialmediahasbecomeanimportantonlinechannelforadvertisersinUS,reaching11-13%ofonlineadsin13accordingtoeMarketerandourUSInternetteam,thereisstillalackofsocialplatformswithbothreachandaccuracyinChina.

Weestimateonly~5%ofonlineadsrelatedtosocialads.

TencentandSinaWeiboareprobablytheonlytwowithenoughreachtoservetherequirementofmostlargeadvertisers.

CRTencentHoldingsLtd.

15April20144RiskofrisinginterestrateenvironmenttovaluationAspointedoutbyourequitystrategyteam,thereisarisktovaluationofgrowthstocksamidtighteningliquidityandrisinginterestratesasgrowthstocksdependonfutureearningsandcashflowsandwouldbesensitivetochangesindiscountrates(seethesensitivityanalysistablebelow).

WealsonotethatChineseInternetstocksperformedwellin2013,butafteraperiodofsignificantdepressionduring2011and12.

Table1:RisktoDCFvaluationfromchangesininterestrateenvironmentChangeinWACCWACCPriceobjective(HK$)-3%6%2565-2%7%1292-1%8%868BaseWACC9%6871%10%5292%11%4443%12%384Source:BofAMerrillLynchResearchChart1:PerformanceofbasketsofselectInternetcompaniesindifferentcountriesSource:Companydata,Bloomberg,BofAMerrillLynchResearchChina:Baidu,Tencent,Sina,Sohu,Netease,Ctrip,Giant;US:eBay,Google,Yahoo,Amazon,InteractiveCorp,Expedia,Priceline,Activision;Korea:NcSoft,Naver,Daum,CJShopping,Neowiz;Japan:YahooJapan,Rakuten,GREE,DeNA,StartToday,Mixi,Kakaku,CyberAgent,Cookpad0501001502002503003501/1/20102/1/20103/1/20104/1/20105/1/20106/1/20107/1/20108/1/20109/1/201010/1/201011/1/201012/1/20101/1/20112/1/20113/1/20114/1/20115/1/20116/1/20117/1/20118/1/20119/1/201110/1/201111/1/201112/1/20111/1/20122/1/20123/1/20124/1/20125/1/20126/1/20127/1/20128/1/20129/1/201210/1/201211/1/201212/1/20121/1/20132/1/20133/1/20134/1/20135/1/20136/1/20137/1/20138/1/20139/1/201310/1/201311/1/201312/1/20131/1/20142/1/20143/1/20144/1/2014ChinaUSKoreaJapanMSCIChinaCRTencentHoldingsLtd.

15April20145MixshifttounexcitingbutprofitablebusinessesAfterrestructuringofthesearchandeCommercesegments,TencentshouldseesomecushiononitsmarginsasrevenuemixcomesmorefromprofitablebusinesseslikePCgames,mobilegames,socialnetworkplatformandadvertising.

WebelieveWeixinhaspassedtheinitialfastrampstageandwillgrowsteadilyalongwith3G/4GuserbaseinChina.

TencenthasindicateditsfocusonoverseasmarketswhicharestillevolvingwithoutastrongincumbentinmobilecommunicationtoolssuchasMalaysia,IndiaandIndonesia.

Chart2:RevenuemixshiftingtounexcitingbutprofitablebusinessesSource:Companydata,BofAMerrillLynchChart3:UsergrowthmomentuminlinewithmostotherleadingsocialplatformsSource:Companydata,BofAMerrillLynch05,00010,00015,00020,00025,00030,00035,00040,00045,00050,000FY11FY12FY13EFY14EFY15EOnlinegamesNon-gameIVASMobileservicesAdvertisingEcommerceOthersRMBmn-10%-5%0%5%10%15%20%25%30%35%40%QoQRenren(MAU)Facebook(MAU)TencentWeixin+QQ(MAU)Twitter(MAU)YY(MAU)SinaWeibo(MAU)CRTencentHoldingsLtd.

15April20146Priceobjectivebasis&riskTencentHoldings(TCTZF)OurPOofHK$687isbasedon1)DCFvaluationofHK$683with9%discountrate,mid-term15-18EFCFCAGRof20%and5%terminalgrowth,2)HK$4fromitsstakeinSogou,valuedat5x14ESales(50%discounttotheaverageP/Salesof9.

5xoflargerpeers).

RiskstoourPOare1)DisruptionofgrowthofWeixinbytelcos,2)Competitiononpaymentbusiness,3)Competitiontolimitoverseasgrowth,4)Regulationononlinefinance,onlinegames,instantmessaging,wirelessservices,aswellaswebsitecontent,particularlyvideoandblog,wouldhurtusageand,therefore,reducemonetization,5)FasterthanexpecteddeteriorationinPCgamessuchasDNF,6)Destructiveapplications.

NewtechnologydevelopmentsmayreduceusageofTencentusersorresultinuserchurn,7)Expensesfordevelopinginitiativesincludingecommercebuthighmarketexpectationonmargins,8)Consolegames,9)RisinginterestratesonDCFvaluation,10)ChinaopeningupmarkettooverseasSNSsitesLinktoDefinitionsTechnologyClickherefordefinitionsofcommonlyusedterms.

AnalystCertificationI,EddieLeung,herebycertifythattheviewsexpressedinthisresearchreportaccuratelyreflectmypersonalviewsaboutthesubjectsecuritiesandissuers.

Ialsocertifythatnopartofmycompensationwas,is,orwillbe,directlyorindirectly,relatedtothespecificrecommendationsorviewexpressedinthisresearchreport.

APR-OnlinemediaCoverageClusterInvestmentratingCompanyBofAMerrillLynchtickerBloombergsymbolAnalystBUYBaidu.

comBIDUBIDUUSEddieLeungBonaFilmGroupLimitedBONABONAUSAngelineOoiCtrip.

Com-ADRCTRPCTRPUSEddieLeungDaumCommunicationsCorp.

DAUCF035720KSSeanOhE-CommerceChinaDangdangDANGDANGUSBinnieWongNaverCorporationXNHNF035420KSSeanOhNCSOFTNCSCF036570KSSeanOhNetease,IncNTESNTESUSEddieLeungPerfectWorldCoLtd-ADRPWRDPWRDUSEddieLeungQihooQIHUQIHUUSEddieLeungSinaCorpSINASINAUSEddieLeungSohu.

comIncSOHUSOHUUSEddieLeungSoufunSFUNSFUNUSEddieLeungTencentHoldingsTCTZF700HKEddieLeungVipshopHoldingsVIPSVIPSUSBinnieWongNEUTRALChangyou.

comLimitedCYOUCYOUUSEddieLeungNetdragonWebsoftNDWTF777HKEddieLeungRenrenInc.

RENNRENNUSEddieLeungYoukuTudouYOKUYOKUUSEddieLeungUNDERPERFORMTelevisionBroadcastsLtdTVBCF511HKAngelineOoiThe9LtdNCTYNCTYUSEddieLeungCRTencentHoldingsLtd.

15April20147APR-OnlinemediaCoverageClusterInvestmentratingCompanyBofAMerrillLynchtickerBloombergsymbolAnalystRVWJiayuan.

comDATEDATEUSEddieLeungTALEducation/XueersiXRSXRSUSEddieLeungXuedaEducationXUEXUEUSEddieLeungiQmethodSMMeasuresDefinitionsBusinessPerformanceNumeratorDenominatorReturnOnCapitalEmployedNOPAT=(EBIT+InterestIncome)*(1-TaxRate)+GoodwillAmortizationTotalAssets–CurrentLiabilities+STDebt+AccumulatedGoodwillAmortizationReturnOnEquityNetIncomeShareholders'EquityOperatingMarginOperatingProfitSalesEarningsGrowthExpected5-YearCAGRFromLatestActualN/AFreeCashFlowCashFlowFromOperations–TotalCapexN/AQualityofEarningsCashRealizationRatioCashFlowFromOperationsNetIncomeAssetReplacementRatioCapexDepreciationTaxRateTaxChargePre-TaxIncomeNetDebt-To-EquityRatioNetDebt=TotalDebt,LessCash&EquivalentsTotalEquityInterestCoverEBITInterestExpenseValuationToolkitPrice/EarningsRatioCurrentSharePriceDilutedEarningsPerShare(BasisAsSpecified)Price/BookValueCurrentSharePriceShareholders'Equity/CurrentBasicSharesDividendYieldAnnualisedDeclaredCashDividendCurrentSharePriceFreeCashFlowYieldCashFlowFromOperations–TotalCapexMarketCap.

=CurrentSharePrice*CurrentBasicSharesEnterpriseValue/SalesEV=CurrentSharePrice*CurrentShares+MinorityEquity+NetDebt+OtherLTLiabilitiesSalesEV/EBITDAEnterpriseValueBasicEBIT+Depreciation+AmortizationiQmethodSMisthesetofBofAMerrillLynchstandardmeasuresthatservetomaintainglobalconsistencyunderthreebroadheadings:BusinessPerformance,QualityofEarnings,andvalidations.

ThekeyfeaturesofiQmethodare:Aconsistentlystructured,detailed,andtransparentmethodology.

Guidelinestomaximizetheeffectivenessofthecomparativevaluationprocess,andtoidentifysomecommonpitfalls.

iQdatabaseisourreal-timeglobalresearchdatabasethatissourceddirectlyfromourequityanalysts'earningsmodelsandincludesforecastedaswellashistoricaldataforincomestatements,balancesheets,andcashflowstatementsforcompaniescoveredbyBofAMerrillLynch.

iQprofileSM,iQmethodSMareservicemarksofMerrillLynch&Co.

,Inc.

iQdatabaseisaregisteredservicemarkofMerrillLynch&Co.

,Inc.

CRTencentHoldingsLtd.

15April20148ImportantDisclosuresTCTZFPriceChart01002003004005006007001-Jan-121-Jan-131-Jan-14B:Buy,N:Neutral,U:Underperform,PO:PriceObjective,NA:Nolongervalid,NR:NoRatingTCTZF1-AprBLeungPO:HK$22011-MayPO:HK$23516-MayPO:HK$24210-AugPO:HK$2409-NovPO:HK$21814-MarPO:HK$23829-AprPO:HK$27315-AugPO:HK$2692-OctPO:HK$29214-NovPO:HK$30218-MarPO:HK$30020-MarPO:HK$29115-MayPO:HK$3163-JulPO:HK$33814-AugPO:HK$40216-SepPO:HK$46413-NovPO:HK$4751-DecPO:HK$49526-JanPO:HK$55417-FebPO:HK$63810-MarPO:HK$67519-MarPO:HK$687TheInvestmentOpinionSystemiscontainedattheendofthereportundertheheading"FundamentalEquityOpinionKey".

Darkgreyshadingindicatesthesecurityisrestrictedwiththeopinionsuspended.

Mediumgreyshadingindicatesthesecurityisunderreviewwiththeopinionwithdrawn.

Lightgreyshadingindicatesthesecurityisnotcovered.

ChartiscurrentasofMarch31,2014orsuchlaterdateasindicated.

InvestmentRatingDistribution:TechnologyGroup(asof31Mar2014)CoverageUniverseCountPercentInv.

BankingRelationships*CountPercentBuy12456.

88%Buy9475.

81%Neutral4721.

56%Neutral3472.

34%Sell4721.

56%Sell3472.

34%InvestmentRatingDistribution:GlobalGroup(asof31Mar2014)CoverageUniverseCountPercentInv.

BankingRelationships*CountPercentBuy170250.

59%Buy125473.

68%Neutral84425.

09%Neutral61372.

63%Sell81824.

32%Sell53064.

79%*CompaniesthatwereinvestmentbankingclientsofBofAMerrillLynchoroneofitsaffiliateswithinthepast12months.

Forpurposesofthisdistribution,astockratedUnderperformisincludedasaSell.

FUNDAMENTALEQUITYOPINIONKEY:OpinionsincludeaVolatilityRiskRating,anInvestmentRatingandanIncomeRating.

VOLATILITYRISKRATINGS,indicatorsofpotentialpricefluctuation,are:A-Low,B-MediumandC-High.

INVESTMENTRATINGSreflecttheanalyst'sassessmentofastock's:(i)absolutetotalreturnpotentialand(ii)attractivenessforinvestmentrelativetootherstockswithinitsCoverageCluster(definedbelow).

Therearethreeinvestmentratings:1-Buystocksareexpectedtohaveatotalreturnofatleast10%andarethemostattractivestocksinthecoveragecluster;2-NeutralstocksareexpectedtoremainflatorincreaseinvalueandarelessattractivethanBuyratedstocksand3-Underperformstocksaretheleastattractivestocksinacoveragecluster.

Analystsassigninvestmentratingsconsidering,amongotherthings,the0-12monthtotalreturnexpectationforastockandthefirm'sguidelinesforratingsdispersions(showninthetablebelow).

Thecurrentpriceobjectiveforastockshouldbereferencedtobetterunderstandthetotalreturnexpectationatanygiventime.

Thepriceobjectivereflectstheanalyst'sviewofthepotentialpriceappreciation(depreciation).

InvestmentratingTotalreturnexpectation(within12-monthperiodofdateofinitialrating)Ratingsdispersionguidelinesforcoveragecluster*Buy≥10%≤70%Neutral≥0%≤30%UnderperformN/A≥20%*RatingsdispersionsmayvaryfromtimetotimewhereBofAMerrillLynchResearchbelievesitbetterreflectstheinvestmentprospectsofstocksinaCoverageCluster.

INCOMERATINGS,indicatorsofpotentialcashdividends,are:7-same/higher(dividendconsideredtobesecure),8-same/lower(dividendnotconsideredtobesecure)and9-paysnocashdividend.

CoverageClusteriscomprisedofstockscoveredbyasingleanalystortwoormoreanalystssharingacommonindustry,sector,regionorotherclassification(s).

Astock'scoverageclusterisincludedinthemostrecentBofAMerrillLynchCommentreferencingthestock.

Pricechartsforthesecuritiesreferencedinthisresearchreportareavailableathttp://pricecharts.

ml.

com,orcall1-800-MERRILLtohavethemmailed.

Thecompanyisorwas,withinthelast12months,aninvestmentbankingclientofMLPF&Sand/oroneormoreofitsaffiliates:TencentHoldings.

IntheUS,retailsalesand/ordistributionofthisreportmaybemadeonlyinstateswherethesesecuritiesareexemptfromregistrationorhavebeenqualifiedforsale:TencentHoldings.

MLPF&Soranaffiliateexpectstoreceiveorintendstoseekcompensationforinvestmentbankingservicesfromthiscompanyoranaffiliateofthecompanywithinthenextthreemonths:TencentHoldings.

BofAMerrillLynchResearchpersonnel(includingtheanalyst(s)responsibleforthisreport)receivecompensationbasedupon,amongotherfactors,theoverallprofitabilityofBankofAmericaCorporation,includingprofitsderivedfrominvestmentbankingrevenues.

CRTencentHoldingsLtd.

15April20149OtherImportantDisclosuresOfficersofMLPF&Soroneormoreofitsaffiliates(otherthanresearchanalysts)mayhaveafinancialinterestinsecuritiesoftheissuer(s)orinrelatedinvestments.

Fromtimetotimeresearchanalystsconductsitevisitsofcoveredcompanies.

BofAMerrillLynchpoliciesprohibitresearchanalystsfromacceptingpaymentorreimbursementfortravelexpensesfromthecompanyforsuchvisits.

BofAMerrillLynchGlobalResearchpoliciesrelatingtoconflictsofinterestaredescribedathttp://www.

ml.

com/media/43347.

pdf.

"BofAMerrillLynch"includesMerrillLynch,Pierce,Fenner&SmithIncorporated("MLPF&S")anditsaffiliates.

InvestorsshouldcontacttheirBofAMerrillLynchrepresentativeorMerrillLynchGlobalWealthManagementfinancialadvisoriftheyhavequestionsconcerningthisreport.

"BofAMerrillLynch"and"MerrillLynch"areeachglobalbrandsforBofAMerrillLynchGlobalResearch.

InformationrelatingtoNon-USaffiliatesofBofAMerrillLynchandDistributionofAffiliateResearchReports:MLPF&Sdistributes,ormayinthefuturedistribute,researchreportsofthefollowingnon-USaffiliatesintheUS(shortname:legalname):MerrillLynch(France):MerrillLynchCapitalMarkets(France)SAS;MerrillLynch(Frankfurt):MerrillLynchInternationalBankLtd.

,FrankfurtBranch;MerrillLynch(SouthAfrica):MerrillLynchSouthAfrica(Pty)Ltd.

;MerrillLynch(Milan):MerrillLynchInternationalBankLimited;MLI(UK):MerrillLynchInternational;MerrillLynch(Australia):MerrillLynchEquities(Australia)Limited;MerrillLynch(HongKong):MerrillLynch(AsiaPacific)Limited;MerrillLynch(Singapore):MerrillLynch(Singapore)PteLtd.

;MerrillLynch(Canada):MerrillLynchCanadaInc;MerrillLynch(Mexico):MerrillLynchMexico,SAdeCV,CasadeBolsa;MerrillLynch(Argentina):MerrillLynchArgentinaSA;MerrillLynch(Japan):MerrillLynchJapanSecuritiesCo.

,Ltd.

;MerrillLynch(Seoul):MerrillLynchInternationalIncorporated(SeoulBranch);MerrillLynch(Taiwan):MerrillLynchSecurities(Taiwan)Ltd.

;DSPMerrillLynch(India):DSPMerrillLynchLimited;PTMerrillLynch(Indonesia):PTMerrillLynchIndonesia;MerrillLynch(Israel):MerrillLynchIsraelLimited;MerrillLynch(Russia):OOOMerrillLynchSecurities,Moscow;MerrillLynch(TurkeyI.

B.

):MerrillLynchYatirimBankA.

S.

;MerrillLynch(TurkeyBroker):MerrillLynchMenkulDeerlerA.

.

;MerrillLynch(Dubai):MerrillLynchInternational,DubaiBranch;MLPF&S(Zurichrep.

office):MLPF&SIncorporatedZurichrepresentativeoffice;MerrillLynch(Spain):MerrillLynchCapitalMarketsEspana,S.

A.

S.

V.

;MerrillLynch(Brazil):BankofAmericaMerrillLynchBancoMultiploS.

A.

;MerrillLynchKSACompany,MerrillLynchKingdomofSaudiArabiaCompany.

ThisresearchreporthasbeenapprovedforpublicationandisdistributedintheUnitedKingdomtoprofessionalclientsandeligiblecounterparties(aseachisdefinedintherulesoftheFinancialConductAuthorityandthePrudentialRegulationAuthority)byMerrillLynchInternationalandBankofAmericaMerrillLynchInternationalLimited,whichareauthorizedbythePrudentialRegulationAuthorityandregulatedbytheFinancialConductAuthorityandthePrudentialRegulationAuthority,andisdistributedintheUnitedKingdomtoretailclients(asdefinedintherulesoftheFinancialConductAuthorityandthePrudentialRegulationAuthority)byMerrillLynchInternationalBankLimited,LondonBranch,whichisauthorisedbytheCentralBankofIrelandandsubjecttolimitedregulationbytheFinancialConductAuthorityandPrudentialRegulationAuthority-detailsabouttheextentofourregulationbytheFinancialConductAuthorityandPrudentialRegulationAuthorityareavailablefromusonrequest;hasbeenconsideredanddistributedinJapanbyMerrillLynchJapanSecuritiesCo.

,Ltd.

,aregisteredsecuritiesdealerundertheFinancialInstrumentsandExchangeActinJapan;isdistributedinHongKongbyMerrillLynch(AsiaPacific)Limited,whichisregulatedbytheHongKongSFCandtheHongKongMonetaryAuthority(notethatHongKongrecipientsofthisresearchreportshouldcontactMerrillLynch(AsiaPacific)Limitedinrespectofanymattersrelatingtodealinginsecuritiesorprovisionofspecificadviceonsecurities);isissuedanddistributedinTaiwanbyMerrillLynchSecurities(Taiwan)Ltd.

;isissuedanddistributedinIndiabyDSPMerrillLynchLimited;andisissuedanddistributedinSingaporetoinstitutionalinvestorsand/oraccreditedinvestors(eachasdefinedundertheFinancialAdvisersRegulations)byMerrillLynchInternationalBankLimited(MerchantBank)andMerrillLynch(Singapore)PteLtd.

(CompanyRegistrationNo.

'sF06872Eand198602883Drespectively).

MerrillLynchInternationalBankLimited(MerchantBank)andMerrillLynch(Singapore)PteLtd.

areregulatedbytheMonetaryAuthorityofSingapore.

BankofAmericaN.

A.

,AustralianBranch(ARBN064874531),AFSLicense412901(BANAAustralia)andMerrillLynchEquities(Australia)Limited(ABN65006276795),AFSLicense235132(MLEA)distributesthisreportinAustraliaonlyto'Wholesale'clientsasdefinedbys.

761GoftheCorporationsAct2001.

WiththeexceptionofBANAAustralia,neitherMLEAnoranyofitsaffiliatesinvolvedinpreparingthisresearchreportisanAuthorisedDeposit-TakingInstitutionundertheBankingAct1959norregulatedbytheAustralianPrudentialRegulationAuthority.

NoapprovalisrequiredforpublicationordistributionofthisreportinBrazilanditslocaldistributionismadebyBankofAmericaMerrillLynchBancoMúltiploS.

A.

inaccordancewithapplicableregulations.

MerrillLynch(Dubai)isauthorizedandregulatedbytheDubaiFinancialServicesAuthority(DFSA).

ResearchreportspreparedandissuedbyMerrillLynch(Dubai)arepreparedandissuedinaccordancewiththerequirementsoftheDFSAconductofbusinessrules.

MerrillLynch(Frankfurt)distributesthisreportinGermany.

MerrillLynch(Frankfurt)isregulatedbyBaFin.

ThisresearchreporthasbeenpreparedandissuedbyMLPF&Sand/oroneormoreofitsnon-USaffiliates.

MLPF&SisthedistributorofthisresearchreportintheUSandacceptsfullresponsibilityforresearchreportsofitsnon-USaffiliatesdistributedtoMLPF&SclientsintheUS.

AnyUSpersonreceivingthisresearchreportandwishingtoeffectanytransactioninanysecuritydiscussedinthereportshoulddosothroughMLPF&Sandnotsuchforeignaffiliates.

GeneralInvestmentRelatedDisclosures:TaiwanReaders:Neithertheinformationnoranyopinionexpressedhereinconstitutesanofferorasolicitationofanoffertotransactinanysecuritiesorotherfinancialinstrument.

NopartofthisreportmaybeusedorreproducedorquotedinanymannerwhatsoeverinTaiwanbythepressoranyotherpersonwithouttheexpresswrittenconsentofBofAMerrillLynch.

Thisresearchreportprovidesgeneralinformationonly.

Neithertheinformationnoranyopinionexpressedconstitutesanofferoraninvitationtomakeanoffer,tobuyorsellanysecuritiesorotherfinancialinstrumentoranyderivativerelatedtosuchsecuritiesorinstruments(e.

g.

,options,futures,warrants,andcontractsfordifferences).

Thisreportisnotintendedtoprovidepersonalinvestmentadviceanditdoesnottakeintoaccountthespecificinvestmentobjectives,financialsituationandtheparticularneedsofanyspecificperson.

Investorsshouldseekfinancialadviceregardingtheappropriatenessofinvestinginfinancialinstrumentsandimplementinginvestmentstrategiesdiscussedorrecommendedinthisreportandshouldunderstandthatstatementsregardingfutureprospectsmaynotberealized.

Anydecisiontopurchaseorsubscribeforsecuritiesinanyofferingmustbebasedsolelyonexistingpublicinformationonsuchsecurityortheinformationintheprospectusorotherofferingdocumentissuedinconnectionwithsuchoffering,andnotonthisreport.

Securitiesandotherfinancialinstrumentsdiscussedinthisreport,orrecommended,offeredorsoldbyMerrillLynch,arenotinsuredbytheFederalDepositInsuranceCorporationandarenotdepositsorotherobligationsofanyinsureddepositoryinstitution(including,BankofAmerica,N.

A.

).

Investmentsingeneraland,derivatives,inparticular,involvenumerousrisks,including,amongothers,marketrisk,counterpartydefaultriskandliquidityrisk.

Nosecurity,financialinstrumentorderivativeissuitableforallinvestors.

Insomecases,securitiesandotherfinancialinstrumentsmaybedifficulttovalueorsellandreliableinformationaboutthevalueorrisksrelatedtothesecurityorfinancialinstrumentmaybedifficulttoobtain.

Investorsshouldnotethatincomefromsuchsecuritiesandotherfinancialinstruments,ifany,mayfluctuateandthatpriceorvalueofsuchsecuritiesandinstrumentsmayriseorfalland,insomecases,investorsmaylosetheirentireprincipalinvestment.

Pastperformanceisnotnecessarilyaguidetofutureperformance.

Levelsandbasisfortaxationmaychange.

Thisreportmaycontainashort-termtradingideaorrecommendation,whichhighlightsaspecificnear-termcatalystoreventimpactingthecompanyorthemarketthatisanticipatedtohaveashort-termpriceimpactontheequitysecuritiesofthecompany.

Short-termtradingideasandrecommendationsaredifferentfromanddonotaffectastock'sfundamentalequityrating,whichreflectsbothalongertermtotalreturnexpectationandattractivenessforinvestmentrelativetootherstockswithinitsCoverageCluster.

Short-termtradingideasandrecommendationsmaybemoreorlesspositivethanastock'sfundamentalequityrating.

CRTencentHoldingsLtd.

15April201410BofAMerrillLynchisawarethattheimplementationoftheideasexpressedinthisreportmaydependuponaninvestor'sabilityto"short"securitiesorotherfinancialinstrumentsandthatsuchactionmaybelimitedbyregulationsprohibitingorrestricting"shortselling"inmanyjurisdictions.

Investorsareurgedtoseekadviceregardingtheapplicabilityofsuchregulationspriortoexecutinganyshortideacontainedinthisreport.

Foreigncurrencyratesofexchangemayadverselyaffectthevalue,priceorincomeofanysecurityorfinancialinstrumentmentionedinthisreport.

Investorsinsuchsecuritiesandinstruments,includingADRs,effectivelyassumecurrencyrisk.

UKReaders:TheprotectionsprovidedbytheU.

K.

regulatoryregime,includingtheFinancialServicesScheme,donotapplyingeneraltobusinesscoordinatedbyBofAMerrillLynchentitieslocatedoutsideoftheUnitedKingdom.

BofAMerrillLynchGlobalResearchpoliciesrelatingtoconflictsofinterestaredescribedathttp://www.

ml.

com/media/43347.

pdf.

OfficersofMLPF&Soroneormoreofitsaffiliates(otherthanresearchanalysts)mayhaveafinancialinterestinsecuritiesoftheissuer(s)orinrelatedinvestments.

MLPF&Soroneofitsaffiliatesisaregularissueroftradedfinancialinstrumentslinkedtosecuritiesthatmayhavebeenrecommendedinthisreport.

MLPF&Soroneofitsaffiliatesmay,atanytime,holdatradingposition(longorshort)inthesecuritiesandfinancialinstrumentsdiscussedinthisreport.

BofAMerrillLynch,throughbusinessunitsotherthanBofAMerrillLynchGlobalResearch,mayhaveissuedandmayinthefutureissuetradingideasorrecommendationsthatareinconsistentwith,andreachdifferentconclusionsfrom,theinformationpresentedinthisreport.

Suchideasorrecommendationsreflectthedifferenttimeframes,assumptions,viewsandanalyticalmethodsofthepersonswhopreparedthem,andBofAMerrillLynchisundernoobligationtoensurethatsuchothertradingideasorrecommendationsarebroughttotheattentionofanyrecipientofthisreport.

IntheeventthattherecipientreceivedthisreportpursuanttoacontractbetweentherecipientandMLPF&Sfortheprovisionofresearchservicesforaseparatefee,andinconnectiontherewithMLPF&Smaybedeemedtobeactingasaninvestmentadviser,suchstatusrelates,ifatall,solelytothepersonwithwhomMLPF&Shascontracteddirectlyanddoesnotextendbeyondthedeliveryofthisreport(unlessotherwiseagreedspecificallyinwritingbyMLPF&S).

MLPF&Sisandcontinuestoactsolelyasabroker-dealerinconnectionwiththeexecutionofanytransactions,includingtransactionsinanysecuritiesmentionedinthisreport.

CopyrightandGeneralInformationregardingResearchReports:Copyright2014MerrillLynch,Pierce,Fenner&SmithIncorporated.

Allrightsreserved.

iQmethod,iQmethod2.

0,iQprofile,iQtoolkit,iQworksareservicemarksofBankofAmericaCorporation.

iQanalytics,iQcustom,iQdatabaseareregisteredservicemarksofBankofAmericaCorporation.

ThisresearchreportispreparedfortheuseofBofAMerrillLynchclientsandmaynotberedistributed,retransmittedordisclosed,inwholeorinpart,orinanyformormanner,withouttheexpresswrittenconsentofBofAMerrillLynch.

BofAMerrillLynchGlobalResearchreportsaredistributedsimultaneouslytointernalandclientwebsitesandotherportalsbyBofAMerrillLynchandarenotpublicly-availablematerials.

Anyunauthorizeduseordisclosureisprohibited.

Receiptandreviewofthisresearchreportconstitutesyouragreementnottoredistribute,retransmit,ordisclosetoothersthecontents,opinions,conclusion,orinformationcontainedinthisreport(includinganyinvestmentrecommendations,estimatesorpricetargets)withoutfirstobtainingexpressedpermissionfromanauthorizedofficerofBofAMerrillLynch.

MaterialspreparedbyBofAMerrillLynchGlobalResearchpersonnelarebasedonpublicinformation.

Factsandviewspresentedinthismaterialhavenotbeenreviewedby,andmaynotreflectinformationknownto,professionalsinotherbusinessareasofBofAMerrillLynch,includinginvestmentbankingpersonnel.

BofAMerrillLynchhasestablishedinformationbarriersbetweenBofAMerrillLynchGlobalResearchandcertainbusinessgroups.

Asaresult,BofAMerrillLynchdoesnotdisclosecertainclientrelationshipswith,orcompensationreceivedfrom,suchcompaniesinresearchreports.

Totheextentthisreportdiscussesanylegalproceedingorissues,ithasnotbeenpreparedasnorisitintendedtoexpressanylegalconclusion,opinionoradvice.

Investorsshouldconsulttheirownlegaladvisersastoissuesoflawrelatingtothesubjectmatterofthisreport.

BofAMerrillLynchGlobalResearchpersonnel'sknowledgeoflegalproceedingsinwhichanyBofAMerrillLynchentityand/oritsdirectors,officersandemployeesmaybeplaintiffs,defendants,co-defendantsorco-plaintiffswithorinvolvingcompaniesmentionedinthisreportisbasedonpublicinformation.

Factsandviewspresentedinthismaterialthatrelatetoanysuchproceedingshavenotbeenreviewedby,discussedwith,andmaynotreflectinformationknownto,professionalsinotherbusinessareasofBofAMerrillLynchinconnectionwiththelegalproceedingsormattersrelevanttosuchproceedings.

Thisreporthasbeenpreparedindependentlyofanyissuerofsecuritiesmentionedhereinandnotinconnectionwithanyproposedofferingofsecuritiesorasagentofanyissuerofanysecurities.

NoneofMLPF&S,anyofitsaffiliatesortheirresearchanalystshasanyauthoritywhatsoevertomakeanyrepresentationorwarrantyonbehalfoftheissuer(s).

BofAMerrillLynchGlobalResearchpolicyprohibitsresearchpersonnelfromdisclosingarecommendation,investmentrating,orinvestmentthesisforreviewbyanissuerpriortothepublicationofaresearchreportcontainingsuchrating,recommendationorinvestmentthesis.

Anyinformationrelatingtothetaxstatusoffinancialinstrumentsdiscussedhereinisnotintendedtoprovidetaxadviceortobeusedbyanyonetoprovidetaxadvice.

Investorsareurgedtoseektaxadvicebasedontheirparticularcircumstancesfromanindependenttaxprofessional.

Theinformationherein(otherthandisclosureinformationrelatingtoBofAMerrillLynchanditsaffiliates)wasobtainedfromvarioussourcesandwedonotguaranteeitsaccuracy.

Thisreportmaycontainlinkstothird-partywebsites.

BofAMerrillLynchisnotresponsibleforthecontentofanythird-partywebsiteoranylinkedcontentcontainedinathird-partywebsite.

Contentcontainedonsuchthird-partywebsitesisnotpartofthisreportandisnotincorporatedbyreferenceintothisreport.

TheinclusionofalinkinthisreportdoesnotimplyanyendorsementbyoranyaffiliationwithBofAMerrillLynch.

Accesstoanythird-partywebsiteisatyourownrisk,andyoushouldalwaysreviewthetermsandprivacypoliciesatthird-partywebsitesbeforesubmittinganypersonalinformationtothem.

BofAMerrillLynchisnotresponsibleforsuchtermsandprivacypoliciesandexpresslydisclaimsanyliabilityforthem.

SubjecttothequietperiodapplicableunderlawsofthevariousjurisdictionsinwhichwedistributeresearchreportsandotherlegalandBofAMerrillLynchpolicy-relatedrestrictionsonthepublicationofresearchreports,fundamentalequityreportsareproducedonaregularbasisasnecessarytokeeptheinvestmentrecommendationcurrent.

Certainoutstandingreportsmaycontaindiscussionsand/orinvestmentopinionsrelatingtosecurities,financialinstrumentsand/orissuersthatarenolongercurrent.

Alwaysrefertothemostrecentresearchreportrelatingtoacompanyorissuerpriortomakinganinvestmentdecision.

Insomecases,acompanyorissuermaybeclassifiedasRestrictedormaybeUnderRevieworExtendedReview.

Ineachcase,investorsshouldconsideranyinvestmentopinionrelatingtosuchcompanyorissuer(oritssecurityand/orfinancialinstruments)tobesuspendedorwithdrawnandshouldnotrelyontheanalysesandinvestmentopinion(s)pertainingtosuchissuer(oritssecuritiesand/orfinancialinstruments)norshouldtheanalysesoropinion(s)beconsideredasolicitationofanykind.

SalespersonsandfinancialadvisorsaffiliatedwithMLPF&SoranyofitsaffiliatesmaynotsolicitpurchasesofsecuritiesorfinancialinstrumentsthatareRestrictedorUnderReviewandmayonlysolicitsecuritiesunderExtendedReviewinaccordancewithfirmpolicies.

NeitherBofAMerrillLynchnoranyofficeroremployeeofBofAMerrillLynchacceptsanyliabilitywhatsoeverforanydirect,indirectorconsequentialdamagesorlossesarisingfromanyuseofthisreportoritscontents.

CR

古德云香港cn2/美国cn235元/月起, gia云服务器,2核2G,40G系统盘+50G数据盘

古德云(goodkvm)怎么样?古德云是一家成立于2020年的商家,原名(锤子云),古德云主要出售VPS服务器、独立服务器。古德云主打产品是香港cn2弹性云及美西cn2云服务器,采用的是kvm虚拟化构架,硬盘Raid10。目前,古德云香港沙田cn2机房及美国五星级机房云服务器,2核2G,40G系统盘+50G数据盘,仅35元/月起,性价比较高,可以入手!点击进入:古德云goodkvm官方网站地址古德...

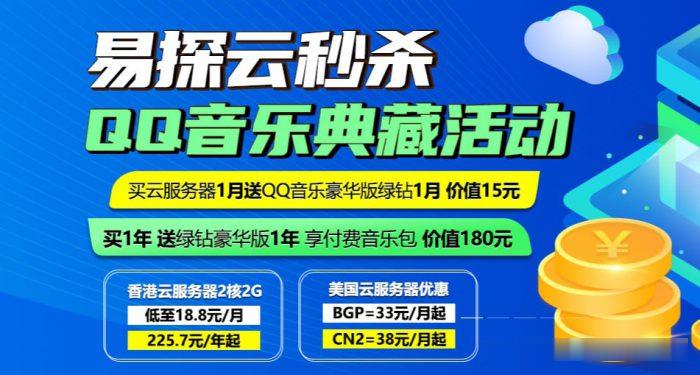

哪里购买香港云服务器便宜?易探云2核2G低至18元/月起;BGP线路年付低至6.8折

哪里购买香港云服务器便宜?众所周知,国内购买云服务器大多数用户会选择阿里云或腾讯云,但是阿里云香港云服务器不仅平时没有优惠,就连双十一、618、开年采购节这些活动也很少给出优惠。那么,腾讯云虽然海外云有优惠活动,但仅限新用户,购买过腾讯云服务器的用户就不会有优惠了。那么,我们如果想买香港云服务器,怎么样购买香港云服务器便宜和优惠呢?下面,云服务器网(yuntue.com)小编就介绍一下!我们都知道...

pacificrack:$12/年-1G内存/1核/20gSSD/500g流量/1Gbps带宽

pacificrack在最新的7月促销里面增加了2个更加便宜的,一个月付1.5美元,一个年付12美元,带宽都是1Gbps。整个系列都是PR-M,也就是魔方的后台管理。2G内存起步的支持Windows 7、10、Server 2003\2008\2012\2016\2019以及常规版本的Linux!官方网站:https://pacificrack.com支持PayPal、支付宝等方式付款7月秒杀VP...

sns平台为你推荐

-

internalservererrorError 500--Internal Server Error登陆建行个人网银,WIN7 64位IE10版本!开启javascript开启 JavaScript,结点cuteftp宜人贷官网宜信信用贷款上征信吗小型汽车网上自主编号申请成都新车上牌办理流程和办理条件是如何的缤纷网缤纷的意思是什么爱买网超谁有http://www.25j58.com爱网购吧网站简介?中国保健养猪网最具权威的养猪信息网站是哪个 啊billboardchina中国有进美国BillBoard榜的人吗团购程序团购系统软件有哪些?一般需要考虑那几点?