Redsuning

suning.com 时间:2021-02-15 阅读:()

1KeyhighlightsOn9May2019,theChinaChainStoreandFranchiseAssociation(CCFA)releaseditsannuallistof"theTop100RetailChainOperatorsinChina"(theTop100s).

TotalsalesoftheTop100sin2018were2.

4trillionyuan,up7.

7%year-on-year(yoy),accountingfor6.

3%ofthetotalretailsalesofconsumergoods.

Suning.

comGroupCo.

,Ltd.

,GomeRetailHoldingsLtd.

andChinaResourcesVanguardCo.

,Ltd.

remainedthetopthreeretailchainoperatorsbyretailsales,withnochangeintherankingsoverthepreviousyear.

Byretailformat,conveniencestoresrecordedthehighestyoysalesgrowthof21.

1%yoyin2018.

Top100scontinuedtoseerobustonlinesalesgrowthof55.

5%yoy.

AsiaDistributionandRetailMay2019Top100retailchainoperatorsinChina,2018-KeyfindingsandtakeawaysChinaRetail2Exhibit1:TheTop100s'shareinnationalretailsales,2008-2018Source:ChinaChainStoreandFranchiseAssociation,compiledbyFungBusinessIntelligenceMajorfindingsGrowthpaceoftheTop100sremainssteadyin2018TotalsalesoftheTop100sin2018amountedto2.

4trillionyuan,up7.

7%yoy.

Thegrowthratewasslightlyslowerthanthatof8.

0%yoyin2017,andalsoslowerthanforthenationaltotalretailsalesofconsumergoodsof9.

0%yoy.

TotalnumberofstoresoftheTop100sreachedaround138,000,up16.

0%yoy.

Thegrowthofnumberofstoreswas9.

1%yoyaftertakingouttheeffectoftherapidincreaseinthenumberofconveniencestores(includingSuningXiaodian),similartothegrowthratein2017.

AsshowninExhibit1,theTop100smadeuponly6.

3%ofthetotalretailsalesofconsumergoods,downfrom11.

1%in2008,indicatingtheincreasinglyfragmentednatureofChina'sretailmarket.

Exhibit2showstheTop10retailchainoperatorsbyretailsalesin2018.

Suning.

comGroupCo.

,Ltd.

rankedthetopwithtotalsalesof336.

8billionyuan,followedbyGomeRetailHoldingsLtd.

andChinaResourcesVanguardCo.

,Ltd.

Therankingsforthetop5enterprisesarethesameasthepreviousyear.

AveragegrossprofitmarginoftheTop100swas18.

3%in2018,upfrom17.

9%in2017.

3Source:ChinaChainStoreandFranchiseAssociation,compiledbyFungBusinessIntelligence#SalesofChinaResourcesVanguardCo.

Ltd.

includedsalesofSuguoSupermarket.

Thepre-taxsalesforSuguoSupermarketwere27,550millionyuanin2018.

*EstimatesRankin2018Rankin2017EnterpriseSales,pre-tax(millionyuan)yoygrowth(%)Numberofstoresyoygrowth(%)11Suning.

comGroupCo.

,Ltd.

336,75738.

4%11,064183.

3%22GomeRetailHoldingsLtd.

138,184-10.

1%2,12232.

3%33ChinaResourcesVanguardCo.

,Ltd.

#101,254-2.

3%3,1920.

9%44SunArtRetailGroupLtd.

95,9000.

5%4076.

3%55Walmart(China)InvestmentCo.

,Ltd.

80,490*0.

3%4410.

0%66YonghuiSuperstoresCo.

,Ltd.

76,768*17.

4%1,27558.

2%7N/ABeijingEasyhomeNewRetailDevelopmentCo.

,Ltd.

71,00013.

1%30335.

9%87ChongqingGeneralTrading(Group)Co.

,Ltd.

67,48913.

3%413-2.

4%99SinopecGroup62,00019.

0%27,2595.

8%108LianhuaSupermarketHoldingsCo.

,Ltd.

49,229-2.

9%3,371-1.

5%Exhibit2:Top10chainretailers,2018(Rankedbyretailsales)422enterprisesoutoftheTop100srecordednegativesalesgrowthin2018,comparedwith21enterprisesin2017.

30enterprisesrecordednegativesalesgrowthand/orgrowthofnumberofstores,only18enterprisesrecordeddouble-digitgrowthinbothsalesandnumberofstores(Exhibit3).

Source:ChinaChainStoreandFranchiseAssociation,compiledbyFungBusinessIntelligenceRankin2018EnterpriseSalesgrowthNumberofstoresgrowthMajorretailformats1Suning.

comGroupCo.

,Ltd.

38.

4%183.

3%Homeelectronics,conveniencestores,B2Conlinewebsite6YonghuiSuperstoresCo.

,Ltd.

17.

4%58.

2%Supermarket7BeijingEasyhomeNewRetailDevelopmentCo.

,Ltd.

13.

1%35.

9%Homedecorationandfurniturestore20IntimeRetail(Group)Co.

,Ltd.

30.

5%23.

5%Departmentstore26RedStarMacallineGroupCorporationLtd.

23.

8%22.

6%Homedecorationandfurniturestore30A.

S.

WatsonGroup(China)10.

3%10.

3%Healthandbeautystore39MeiyijiaConvenienceStoreCo.

,Ltd.

37.

3%33.

5%Conveniencestore47FreshippoSupermarket300.

0%396.

7%Supermarket54XinyulouDepartmentStoreGroupCo.

,Ltd.

17.

3%13.

8%Departmentstore58KidswantChildrenProductsCo.

,Ltd.

47.

2%25.

6%Childrenswear59DashenlinPharmaceuticalGroupCo.

,Ltd.

18.

3%23.

3%Pharmacy60FamilyMartChina18.

3%17.

9%Conveniencestore62ShenzhenPagodaIndustrialDevelopmentCo.

,Ltd.

33.

1%32.

2%Fruitstore79Seven-ElevenChina25.

3%12.

0%Conveniencestore85DazhangGroup36.

8%16.

7%Shoppingmall,supermarket94Lawson(China)Holdings,Inc.

38.

0%41.

0%Conveniencestore95XinjiangWinkaTimesDepartmentStoreCo.

,Ltd.

19.

7%144.

4%Departmentstore99YunnanJianzhijiaHealth-ChainCo.

,Ltd.

17.

9%16.

3%PharmacyExhibit3:Enterprisesrecordeddouble-digitgrowthinbothsalesandnumberofstores,20185Conveniencestorescontinuetowitnessthefastestsalesgrowth;departmentstoresandhypermarketsseelowsingle-digitgrowthConveniencestorescontinuedtogaintraction.

Amongallretailformats,in2018,conveniencestoresrecordedthehighestsalesgrowthat21.

1%yoy,upfrom16.

9%yoyin2017,whilethegrowthrateforstorenumberswas18.

0%yoy,similarto18.

1%yoyin2017.

Onthecontrary,departmentstoresrecordedsalesgrowthof3.

5%yoy,whilehypermarketsandsupermarketrecordedsalesgrowthof2.

5%yoyonly(Exhibit4),muchlowerthantheaverageoftheTop100s.

Source:ChinaChainStoreandFranchiseAssociation,compiledbyFungBusinessIntelligenceRetailformatyoygrowthofsales(%)yoygrowthofnumberofstores(%)Conveniencestores21.

118.

0Departmentstores3.

53.

9Hypermarketsandsupermarkets2.

53.

6Exhibit4:YoygrowthofsalesandnumberofstoresoftheTop100s,byretailformat,2018Conveniencestores62.

5%ofthenewstoreopeningsofTop100swereconveniencestores.

MeiyijiaConvenienceStore(Rank#39,upfrom#54in2017)continuedtobethemarketleaderintheconveniencestoresegment(excludeforecourtconveniencestoreplayers),withsalesrevenueamountingto16,809millionyuanin2018,up37.

3%yoyandstorenumbersreaching15,559,up33.

5%yoy.

Exhibit5showsthetopconveniencestoreoperatorsamongtheTop100sbynumberofstores.

Mostoftheseconveniencestoreoperatorsareregionalplayers,andmostofthemoperatesingleformat,i.

e.

conveniencestore.

6Rankin2018EnterpriseConveniencestorebrandNo.

ofstores1SinopecGroup#EasyJoy27,2592PetroChinaCo.

,Ltd.

#uSmile19,7003DongguanSugar&LiquorGroupMeiyijiaConvenienceStoreCo.

,Ltd.

Meiyijia15,5594SuningXiaodianSuningXiaodian4,5085GuangdongTianfuChainBusinessCo.

,Ltd.

Tianfu4,2126ChengduHongqiChainstoreCo.

,Ltd.

Hongqi2,8177FamilyMartChinaFamilyMart2,5718C&UGroupShizu;Zhishang2,1419Lawson(China)Holdings,Inc.

*Lawson1,97310Seven-ElevenChina7-Eleven1,882Exhibit5:Top10conveniencestoreoperatorsamongtheTop100s,2018(Rankedbynumberofstores)Source:ChinaChainStoreandFranchiseAssociation,compiledbyFungBusinessIntelligence#Forecourtconveniencestoreplayers*NumberofstoresofLawsonincludestorescooperativelyopenedwithregionalplayerssuchasZhongbaiandChaoshifa.

DepartmentstoresSalesperformanceofdepartmentstoresvariedin2018.

Ontheonehand,amongtheTop100swithnegativesalesgrowthand/orgrowthofnumberofstores,halfofthemweredepartmentstoreoperators.

Ontheotherhand,somedepartmentstoreoperatorsrecordedstunningresultsin2018.

RegionalplayerXinyulouDepartmentStore(Rank#54),forexample,achievedsalesgrowthof17.

3%yoyandnumberofstoresgrowthof13.

8%yoyin2018.

Itadoptsaself-operatedmodelwithhighproportionofdirectsales,whichsetsanexampleforotherdepartmentstoreplayers.

Meanwhile,IntimeRetail(Rank#20)recordedstunningsalesgrowthof30.

5%yoy,whilegrowthinnumberofstoreswas23.

5%yoy.

SinceitsprivatizationbyAlibabainearly2017,IntimeRetailhasbeentransformedgreatlybyAlibabaasatestinggroundtoexploreomnichannelstrategieswithAlibaba.

Hypermarkets/supermarketsOperatingcostsforhypermarkets/supermarketscontinuedtorisein2018.

Laborcostswentupby13%yoyandrentalcostsincreasedby10.

6%yoy.

Foreignhypermarkets/supermarketsshowedsoundperformancein2018,withprofitmarginreaching23.

2%,higherthanthesector'saverageof21.

5%.

7Top100switnessrobustonlinesalesgrowth;foreignplayersactivelyexpandomnichannelbusinessAdoptingomnichannelstrategyisoneofthemajorinitiativesoftheTop100s.

OnlinesalesgrowthoftheTop100sincreasedby55.

5%yoy,lowerthan78.

9%yoyin2017butstillmuchhigherthanthenationalonlineretailsalesgrowthof23.

9%yoy.

Ofwhich,onlinesalesgrowthoftheforeignplayersamongtheTop100swas61.

4%yoy,5.

9pptshigherthantheaverageoftheTop100s.

Foreignplayersactivelyexpandedtheiromnichannelbusinessin2018–Carrefour(Rank#12)partneredwithTencenttoexpandonlinebusiness;Walmart(Rank#5)partneredwithJDDaojiatoprovideO2Odeliveryservice;Aeon(Rank#43)andItoYokado(Rank#83)launchedtheirownB2Cwebsites;Ikea(Rank#36)launcheditsWeChatMiniProgram,etc.

RegionalleadersseeslowergrowthRegionalplayersamongtheTop100susuallyoperatemultipleretailformatstoachieveahighermarketshareintheregionalmarket.

Amongtheseregionalplayers,thosebasedinprovincialcapitalsorintier1andtier2citiesrecordedsalesgrowthof4.

2%yoyandnumberofstoresgrowthof5.

5%yoy;whileenterpriseslocatedinprefecture-levelcitiesandcounty-levelcitiesrecordedsalesgrowthof4.

9%yoyandnumberofstoresgrowthof-0.

7%yoy.

BothsalesandnumberofstoregrowthwereslowerthanthatoftheaveragegrowthoftheTop100s.

Facingintensecompetitionfromforeignrivalsandnationalenterprises,togetherwiththerapidgrowthofe-commerceplayers,regionalenterprisesneedtoinnovateandtransformtoretaintheircompetitiveness.

OurviewsIn2018,theperformanceofleadingretailersimprovedconsiderably,butchallengesremained.

Indeed,thegrowthoftheretailsectorwasmainlyattributedtofavorablepoliciesbythegovernmenttoincreasedomesticconsumption,aswellasthecapitalinjectionsfrominvestors.

Operationefficienciesandprofitmarginsofsomeretailersremainedlow.

Moreover,someretailerstappedintootherretailformatstoextendcustomerreach,butmanywerestillexploringthenewbusinessesandprofitabilitywasunclear.

FungBusinessIntelligencebelievesin2019,transformationandmergerandacquisitionactivitieswillcontinuetotakeplaceintheretailsector.

Tobettersuitthechangingneedsofconsumers,goingforward,weexpecttheTop100stocontinuetoadoptformatinnovationandstoreoptimizationstrategiestoseeknewbreakthroughsandimproveefficiencies.

Meanwhile,weakerplayersthatcannotadjusttothechangingmarketconditionsaresettofacebiggerchallenges,orwillbeacquiredbystrongercounterparts.

2018wasayearofchangeandchallengeforbusinesses.

TheescalatingChina-U.

S.

tradewarhasandwillcontinuetonegativelyimpactbotheconomies,particularlytheChineseeconomyinviewofitsmassivetradesurpluswiththeU.

S.

China'sretailsectorisexpectedtobeimpactedbythetradewarwithdampenedconsumersentimentandsofteningretailsalesgrowth.

Meanwhile,inthe"NewConsumption"era,theretailsectorisundergoingrapidtransformationandprofoundchanges.

RetailersneedtorampupeffortstotransformandreinventtheirbusinessestocatertothenewneedsofChineseconsumers.

ReferencesPleaseclickhereforthefullreportbyCCFA(inChinese).

ContactsAsiaDistributionandRetailTeresaLamVicePresidentE:teresalam@fung1937.

comChristyLiSeniorResearchManagerEmail:christyli@fung1937.

comFungBusinessIntelligence10/FLiFungTower888CheungShaWanRoadKowloon,HongKongT:(852)23002470F:(852)26351598E:fbicgroup@fung1937.

comCopyright2019FungBusinessIntelligence.

Allrightsreserved.

ThoughFungBusinessIntelligenceendeavourstoensuretheinformationprovidedinthispublicationisaccurateandupdated,nolegalliabilitycanbeattachedastothecontentshereof.

ReproductionorredistributionofthismaterialwithoutpriorwrittenconsentoftheFungBusinessIntelligenceisprohibited.

TotalsalesoftheTop100sin2018were2.

4trillionyuan,up7.

7%year-on-year(yoy),accountingfor6.

3%ofthetotalretailsalesofconsumergoods.

Suning.

comGroupCo.

,Ltd.

,GomeRetailHoldingsLtd.

andChinaResourcesVanguardCo.

,Ltd.

remainedthetopthreeretailchainoperatorsbyretailsales,withnochangeintherankingsoverthepreviousyear.

Byretailformat,conveniencestoresrecordedthehighestyoysalesgrowthof21.

1%yoyin2018.

Top100scontinuedtoseerobustonlinesalesgrowthof55.

5%yoy.

AsiaDistributionandRetailMay2019Top100retailchainoperatorsinChina,2018-KeyfindingsandtakeawaysChinaRetail2Exhibit1:TheTop100s'shareinnationalretailsales,2008-2018Source:ChinaChainStoreandFranchiseAssociation,compiledbyFungBusinessIntelligenceMajorfindingsGrowthpaceoftheTop100sremainssteadyin2018TotalsalesoftheTop100sin2018amountedto2.

4trillionyuan,up7.

7%yoy.

Thegrowthratewasslightlyslowerthanthatof8.

0%yoyin2017,andalsoslowerthanforthenationaltotalretailsalesofconsumergoodsof9.

0%yoy.

TotalnumberofstoresoftheTop100sreachedaround138,000,up16.

0%yoy.

Thegrowthofnumberofstoreswas9.

1%yoyaftertakingouttheeffectoftherapidincreaseinthenumberofconveniencestores(includingSuningXiaodian),similartothegrowthratein2017.

AsshowninExhibit1,theTop100smadeuponly6.

3%ofthetotalretailsalesofconsumergoods,downfrom11.

1%in2008,indicatingtheincreasinglyfragmentednatureofChina'sretailmarket.

Exhibit2showstheTop10retailchainoperatorsbyretailsalesin2018.

Suning.

comGroupCo.

,Ltd.

rankedthetopwithtotalsalesof336.

8billionyuan,followedbyGomeRetailHoldingsLtd.

andChinaResourcesVanguardCo.

,Ltd.

Therankingsforthetop5enterprisesarethesameasthepreviousyear.

AveragegrossprofitmarginoftheTop100swas18.

3%in2018,upfrom17.

9%in2017.

3Source:ChinaChainStoreandFranchiseAssociation,compiledbyFungBusinessIntelligence#SalesofChinaResourcesVanguardCo.

Ltd.

includedsalesofSuguoSupermarket.

Thepre-taxsalesforSuguoSupermarketwere27,550millionyuanin2018.

*EstimatesRankin2018Rankin2017EnterpriseSales,pre-tax(millionyuan)yoygrowth(%)Numberofstoresyoygrowth(%)11Suning.

comGroupCo.

,Ltd.

336,75738.

4%11,064183.

3%22GomeRetailHoldingsLtd.

138,184-10.

1%2,12232.

3%33ChinaResourcesVanguardCo.

,Ltd.

#101,254-2.

3%3,1920.

9%44SunArtRetailGroupLtd.

95,9000.

5%4076.

3%55Walmart(China)InvestmentCo.

,Ltd.

80,490*0.

3%4410.

0%66YonghuiSuperstoresCo.

,Ltd.

76,768*17.

4%1,27558.

2%7N/ABeijingEasyhomeNewRetailDevelopmentCo.

,Ltd.

71,00013.

1%30335.

9%87ChongqingGeneralTrading(Group)Co.

,Ltd.

67,48913.

3%413-2.

4%99SinopecGroup62,00019.

0%27,2595.

8%108LianhuaSupermarketHoldingsCo.

,Ltd.

49,229-2.

9%3,371-1.

5%Exhibit2:Top10chainretailers,2018(Rankedbyretailsales)422enterprisesoutoftheTop100srecordednegativesalesgrowthin2018,comparedwith21enterprisesin2017.

30enterprisesrecordednegativesalesgrowthand/orgrowthofnumberofstores,only18enterprisesrecordeddouble-digitgrowthinbothsalesandnumberofstores(Exhibit3).

Source:ChinaChainStoreandFranchiseAssociation,compiledbyFungBusinessIntelligenceRankin2018EnterpriseSalesgrowthNumberofstoresgrowthMajorretailformats1Suning.

comGroupCo.

,Ltd.

38.

4%183.

3%Homeelectronics,conveniencestores,B2Conlinewebsite6YonghuiSuperstoresCo.

,Ltd.

17.

4%58.

2%Supermarket7BeijingEasyhomeNewRetailDevelopmentCo.

,Ltd.

13.

1%35.

9%Homedecorationandfurniturestore20IntimeRetail(Group)Co.

,Ltd.

30.

5%23.

5%Departmentstore26RedStarMacallineGroupCorporationLtd.

23.

8%22.

6%Homedecorationandfurniturestore30A.

S.

WatsonGroup(China)10.

3%10.

3%Healthandbeautystore39MeiyijiaConvenienceStoreCo.

,Ltd.

37.

3%33.

5%Conveniencestore47FreshippoSupermarket300.

0%396.

7%Supermarket54XinyulouDepartmentStoreGroupCo.

,Ltd.

17.

3%13.

8%Departmentstore58KidswantChildrenProductsCo.

,Ltd.

47.

2%25.

6%Childrenswear59DashenlinPharmaceuticalGroupCo.

,Ltd.

18.

3%23.

3%Pharmacy60FamilyMartChina18.

3%17.

9%Conveniencestore62ShenzhenPagodaIndustrialDevelopmentCo.

,Ltd.

33.

1%32.

2%Fruitstore79Seven-ElevenChina25.

3%12.

0%Conveniencestore85DazhangGroup36.

8%16.

7%Shoppingmall,supermarket94Lawson(China)Holdings,Inc.

38.

0%41.

0%Conveniencestore95XinjiangWinkaTimesDepartmentStoreCo.

,Ltd.

19.

7%144.

4%Departmentstore99YunnanJianzhijiaHealth-ChainCo.

,Ltd.

17.

9%16.

3%PharmacyExhibit3:Enterprisesrecordeddouble-digitgrowthinbothsalesandnumberofstores,20185Conveniencestorescontinuetowitnessthefastestsalesgrowth;departmentstoresandhypermarketsseelowsingle-digitgrowthConveniencestorescontinuedtogaintraction.

Amongallretailformats,in2018,conveniencestoresrecordedthehighestsalesgrowthat21.

1%yoy,upfrom16.

9%yoyin2017,whilethegrowthrateforstorenumberswas18.

0%yoy,similarto18.

1%yoyin2017.

Onthecontrary,departmentstoresrecordedsalesgrowthof3.

5%yoy,whilehypermarketsandsupermarketrecordedsalesgrowthof2.

5%yoyonly(Exhibit4),muchlowerthantheaverageoftheTop100s.

Source:ChinaChainStoreandFranchiseAssociation,compiledbyFungBusinessIntelligenceRetailformatyoygrowthofsales(%)yoygrowthofnumberofstores(%)Conveniencestores21.

118.

0Departmentstores3.

53.

9Hypermarketsandsupermarkets2.

53.

6Exhibit4:YoygrowthofsalesandnumberofstoresoftheTop100s,byretailformat,2018Conveniencestores62.

5%ofthenewstoreopeningsofTop100swereconveniencestores.

MeiyijiaConvenienceStore(Rank#39,upfrom#54in2017)continuedtobethemarketleaderintheconveniencestoresegment(excludeforecourtconveniencestoreplayers),withsalesrevenueamountingto16,809millionyuanin2018,up37.

3%yoyandstorenumbersreaching15,559,up33.

5%yoy.

Exhibit5showsthetopconveniencestoreoperatorsamongtheTop100sbynumberofstores.

Mostoftheseconveniencestoreoperatorsareregionalplayers,andmostofthemoperatesingleformat,i.

e.

conveniencestore.

6Rankin2018EnterpriseConveniencestorebrandNo.

ofstores1SinopecGroup#EasyJoy27,2592PetroChinaCo.

,Ltd.

#uSmile19,7003DongguanSugar&LiquorGroupMeiyijiaConvenienceStoreCo.

,Ltd.

Meiyijia15,5594SuningXiaodianSuningXiaodian4,5085GuangdongTianfuChainBusinessCo.

,Ltd.

Tianfu4,2126ChengduHongqiChainstoreCo.

,Ltd.

Hongqi2,8177FamilyMartChinaFamilyMart2,5718C&UGroupShizu;Zhishang2,1419Lawson(China)Holdings,Inc.

*Lawson1,97310Seven-ElevenChina7-Eleven1,882Exhibit5:Top10conveniencestoreoperatorsamongtheTop100s,2018(Rankedbynumberofstores)Source:ChinaChainStoreandFranchiseAssociation,compiledbyFungBusinessIntelligence#Forecourtconveniencestoreplayers*NumberofstoresofLawsonincludestorescooperativelyopenedwithregionalplayerssuchasZhongbaiandChaoshifa.

DepartmentstoresSalesperformanceofdepartmentstoresvariedin2018.

Ontheonehand,amongtheTop100swithnegativesalesgrowthand/orgrowthofnumberofstores,halfofthemweredepartmentstoreoperators.

Ontheotherhand,somedepartmentstoreoperatorsrecordedstunningresultsin2018.

RegionalplayerXinyulouDepartmentStore(Rank#54),forexample,achievedsalesgrowthof17.

3%yoyandnumberofstoresgrowthof13.

8%yoyin2018.

Itadoptsaself-operatedmodelwithhighproportionofdirectsales,whichsetsanexampleforotherdepartmentstoreplayers.

Meanwhile,IntimeRetail(Rank#20)recordedstunningsalesgrowthof30.

5%yoy,whilegrowthinnumberofstoreswas23.

5%yoy.

SinceitsprivatizationbyAlibabainearly2017,IntimeRetailhasbeentransformedgreatlybyAlibabaasatestinggroundtoexploreomnichannelstrategieswithAlibaba.

Hypermarkets/supermarketsOperatingcostsforhypermarkets/supermarketscontinuedtorisein2018.

Laborcostswentupby13%yoyandrentalcostsincreasedby10.

6%yoy.

Foreignhypermarkets/supermarketsshowedsoundperformancein2018,withprofitmarginreaching23.

2%,higherthanthesector'saverageof21.

5%.

7Top100switnessrobustonlinesalesgrowth;foreignplayersactivelyexpandomnichannelbusinessAdoptingomnichannelstrategyisoneofthemajorinitiativesoftheTop100s.

OnlinesalesgrowthoftheTop100sincreasedby55.

5%yoy,lowerthan78.

9%yoyin2017butstillmuchhigherthanthenationalonlineretailsalesgrowthof23.

9%yoy.

Ofwhich,onlinesalesgrowthoftheforeignplayersamongtheTop100swas61.

4%yoy,5.

9pptshigherthantheaverageoftheTop100s.

Foreignplayersactivelyexpandedtheiromnichannelbusinessin2018–Carrefour(Rank#12)partneredwithTencenttoexpandonlinebusiness;Walmart(Rank#5)partneredwithJDDaojiatoprovideO2Odeliveryservice;Aeon(Rank#43)andItoYokado(Rank#83)launchedtheirownB2Cwebsites;Ikea(Rank#36)launcheditsWeChatMiniProgram,etc.

RegionalleadersseeslowergrowthRegionalplayersamongtheTop100susuallyoperatemultipleretailformatstoachieveahighermarketshareintheregionalmarket.

Amongtheseregionalplayers,thosebasedinprovincialcapitalsorintier1andtier2citiesrecordedsalesgrowthof4.

2%yoyandnumberofstoresgrowthof5.

5%yoy;whileenterpriseslocatedinprefecture-levelcitiesandcounty-levelcitiesrecordedsalesgrowthof4.

9%yoyandnumberofstoresgrowthof-0.

7%yoy.

BothsalesandnumberofstoregrowthwereslowerthanthatoftheaveragegrowthoftheTop100s.

Facingintensecompetitionfromforeignrivalsandnationalenterprises,togetherwiththerapidgrowthofe-commerceplayers,regionalenterprisesneedtoinnovateandtransformtoretaintheircompetitiveness.

OurviewsIn2018,theperformanceofleadingretailersimprovedconsiderably,butchallengesremained.

Indeed,thegrowthoftheretailsectorwasmainlyattributedtofavorablepoliciesbythegovernmenttoincreasedomesticconsumption,aswellasthecapitalinjectionsfrominvestors.

Operationefficienciesandprofitmarginsofsomeretailersremainedlow.

Moreover,someretailerstappedintootherretailformatstoextendcustomerreach,butmanywerestillexploringthenewbusinessesandprofitabilitywasunclear.

FungBusinessIntelligencebelievesin2019,transformationandmergerandacquisitionactivitieswillcontinuetotakeplaceintheretailsector.

Tobettersuitthechangingneedsofconsumers,goingforward,weexpecttheTop100stocontinuetoadoptformatinnovationandstoreoptimizationstrategiestoseeknewbreakthroughsandimproveefficiencies.

Meanwhile,weakerplayersthatcannotadjusttothechangingmarketconditionsaresettofacebiggerchallenges,orwillbeacquiredbystrongercounterparts.

2018wasayearofchangeandchallengeforbusinesses.

TheescalatingChina-U.

S.

tradewarhasandwillcontinuetonegativelyimpactbotheconomies,particularlytheChineseeconomyinviewofitsmassivetradesurpluswiththeU.

S.

China'sretailsectorisexpectedtobeimpactedbythetradewarwithdampenedconsumersentimentandsofteningretailsalesgrowth.

Meanwhile,inthe"NewConsumption"era,theretailsectorisundergoingrapidtransformationandprofoundchanges.

RetailersneedtorampupeffortstotransformandreinventtheirbusinessestocatertothenewneedsofChineseconsumers.

ReferencesPleaseclickhereforthefullreportbyCCFA(inChinese).

ContactsAsiaDistributionandRetailTeresaLamVicePresidentE:teresalam@fung1937.

comChristyLiSeniorResearchManagerEmail:christyli@fung1937.

comFungBusinessIntelligence10/FLiFungTower888CheungShaWanRoadKowloon,HongKongT:(852)23002470F:(852)26351598E:fbicgroup@fung1937.

comCopyright2019FungBusinessIntelligence.

Allrightsreserved.

ThoughFungBusinessIntelligenceendeavourstoensuretheinformationprovidedinthispublicationisaccurateandupdated,nolegalliabilitycanbeattachedastothecontentshereof.

ReproductionorredistributionofthismaterialwithoutpriorwrittenconsentoftheFungBusinessIntelligenceisprohibited.

Spinservers:美国圣何塞服务器,双E5/64GB DDR4/2TB SSD/10Gbps端口月流量10TB,$111/月

spinservers怎么样?spinservers大硬盘服务器。Spinservers刚刚在美国圣何塞机房补货120台独立服务器,CPU都是双E5系列,64-512GB DDR4内存,超大SSD或NVMe存储,数量有限,机器都是预部署好的,下单即可上架,无需人工干预,有需要的朋友抓紧下单哦。Spinservers是Majestic Hosting Solutions,LLC旗下站点,主营美国独立...

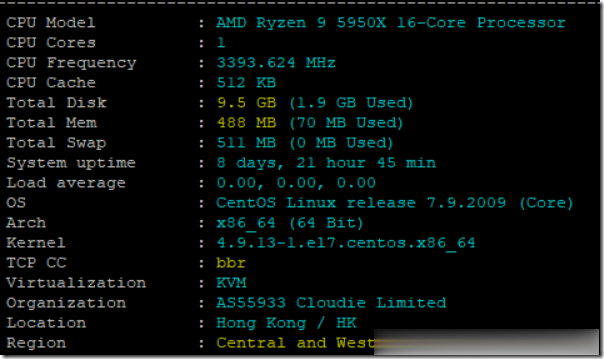

DogYun香港BGP月付14.4元主机简单测试

前些天赵容分享过DogYun(狗云)香港BGP线路AMD 5950X经典低价云服务器的信息(点击查看),刚好账户还有点余额够开个最低配,所以手贱尝试下,这些贴上简单测试信息,方便大家参考。官方网站:www.dogyun.com主机配置我搞的是最低款优惠后14.4元/月的,配置单核,512MB内存,10GB硬盘,300GB/50Mbps月流量。基本信息DogYun的VPS主机管理集成在会员中心,包括...

香港 1核 1G 5M 22元/月 美国 1核 512M 15M 19.36元/月 轻云互联

轻云互联成立于2018年的国人商家,广州轻云互联网络科技有限公司旗下品牌,主要从事VPS、虚拟主机等云计算产品业务,适合建站、新手上车的值得选择,香港三网直连(电信CN2GIA联通移动CN2直连);美国圣何塞(回程三网CN2GIA)线路,所有产品均采用KVM虚拟技术架构,高效售后保障,稳定多年,高性能可用,网络优质,为您的业务保驾护航。官方网站:点击进入广州轻云网络科技有限公司活动规则:用户购买任...

suning.com为你推荐

-

空间邮箱什么邮箱存储空间最大??2020双十一成绩单2020年河南全县初二期末成绩排名?硬盘的工作原理硬盘的工作原理?是怎样存取数据的?蓝色骨头手机宠物的骨头分别代表几级?甲骨文不满赔偿未签合同被辞退的赔偿www.javmoo.comJAV编程怎么做?夏琦薇赞夏琦薇的人有多少?邯郸纠风网邯郸媒体曝光电话多少猴山条约猴的谚语有哪些莱姿蔓蕊姿蔓是什么样的牌子来的