statedrecovery教程

recovery教程 时间:2021-02-20 阅读:()

AdvancedElectronicsPracticeApost–COVID-19commercial-recoverystrategyforB2BcompaniesArecentsurveyprovidesinsightsaboutthestrategiesthatcanhelpB2BcompaniesrecoverquicklyfromtheCOVID-19crisis.

July2020JorgGreuel/GettyImagesbyMintiRay,StefanoRedaelli,DamianRudich,andAndrewJ.

WongLeadersofB2Bcompaniesthatprimarilyservecustomersinsectorssuchasautomotive,energy,mining,andtelecommunicationsaretryingtomitigateCOVID-19'seconomicfalloutandhumantollbyensuringworkplacesafety,increasingliquidity,andkeepingsupplychainsmoving.

Thepressureshavebeensointensethatfewarelookingaheadtothereturntowork,whenproductionlineswillrampuptofullcapacity.

Thoseforward-thinkingexecutiveswhodocontemplatetherecoverymayhavedifficultycreatingasolidplan,becauseCOVID-19hasintroducedunprecedentedcomplexityintotheiroperations.

OurglobalB2BDecision-MakerPulseSurvey,mostrecentlyconductedinlateApril2020,reflectedthewidespreaduncertaintyaboutfutureprospects.

Ofthemorethan3,700respondents,allwithsomeresponsibilityforB2Bpurchasesorsales,45percentbelievedtheeconomywouldreboundintwotothreemonths,whiletheremaindersaidthatcouldtakesixto12monthsorevenlonger.

ThesedivergentattitudesmayshowthatbusinessleadersareunsureaboutthelastingfinancialeffectsofCOVID-19.

Theymayalsoreflectthevaryingimpactofthecoronavirusindifferentgeographies:whilesomeregionsandcompanieswillsoonbereadyforramp-up,othersarestillclosedorfunctioningbelowcapacity.

AlthoughB2Bcompaniesmaybelievethattheirfocusonliquidityandothershort-termconcernsisjustified,itcouldbecostly.

Ourresearchsuggeststhatcompaniesaremorelikelytothriveiftheyactaggressivelytocapturemarketshareduringdownturnsratherthanwaitfortherecoverytobegin.

Thisagility,combinedwithafocusoncustomervalueandsupport,oftengivescompaniesafirst-moveradvantagethatotherplayerscannotmatch.

Firstmoversduringthecurrentcrisiscouldemergestrongerinthenextnormal.

TohelpB2Bleadersdevelopsolidlong-termstrategies,weresearchedthetrendsnowtransformingthemarketplace,lookingforthemesthataffectallplayers.

WealsoreviewedinsightsfromtheglobalB2BDecision-MakerPulseSurvey.

Withthisinformation,wewereabletoidentifythemostimportantelementsofasuccessfulrecoveryforB2Bplayers,whichneednewstrategiestohelpthemidentifyandcapturenewopportunitiesquickly,aswellasgo-to-marketmodelsthatincreasetheimportanceofdigitalandremotesales.

Andwiththesuddenexplosionofe-commerce,thischannelneedsmoreattentionandsupport—especiallybecausetheshiftfromin-personsalescouldbepermanent.

Alsocriticalinthenextnormal:theabilitytocreatetailoredpricingstrategiesforeachcustomerandanagileapproachtoaccelerateproductinnovation.

IdentifyingspecificgrowthpocketsCOVID-19hasupendeddemandpatternsacrosssectors,renderingtraditionalforecastingmethodsinaccurate.

Theeconomicscenariosthatwillemergeoverthenextfewyearswilldifferwidelybycountry,dependingonthelocalimpactofthecoronavirus,governmentstimuluspackages,andotherfactors.

Evenwithincountries,industriesmayrecoveratdifferentspeeds.

Withsuchuncertainty,B2Bcompaniescannotexpecttoachievehistoricalreturnsfromtheircurrentcustomerbaseandproductmix.

Agilitywillbeessentialindevelopingnewgrowthstrategies,sincetheearlydaysoftheCOVID-19crisisshowhowquicklynewopportunitiescanemerge,aswellashowrapidlysomethrivingmarketscanslowdown.

Forinstance,semiconductorcompaniesexpectthatdemandwillplummetintheautomotiveandseveralothersegmentsin2020butwillincreaseinthewired-communicationendmarket.

Togetreal-timevisibilityintomarkets,B2Bcompaniesshouldevaluateinformationoncompetitorsandleadingindicators,aswellasCOVID-specificdata.

Announcementsthatplantsarereopeningorthatgovernmentsarerelaxinglockdownscanprovideimportantcluesaboutdemand,marketchallenges,andtherate2ofviralspread.

Informationonhistoricvolumesindifferentcountriesorindustriesmayalsohelp,thoughcompaniesmaynotseedemandreturntoformerlevelsimmediately.

Toprovideinsights,thisinformationmustbeverydetailed—forinstance,saleswithinmicrogeographiesorzipcodes.

Aftergatheringthesedata,B2Bcompaniescancreatedifferentscenariostoshowhowdemandmightevolve,lookingatproducts,customersegments,andregion.

Theinsightsfromthisanalysiswillallowcompaniestofindpocketsofopportunity.

Oneimportantfocus:determiningwhichsegmentsarelikelytorecoverfirstandwhetherdemandintheseareaswillexceedorfallbelowpreviouslevels.

Insomecases,B2Bcompaniesmayfindthattheyshouldaddnewproductstotheirpipelinesorpursuedifferentcustomersegments.

Oncethetargetopportunitiesareidentified,marketingandsalesteamsmustadaptquickly.

B2Bcompaniesshouldnotonlyeliminatebureaucraticrequirementsthatmightslowthemdownbutalsogiveteamsthefreedomtoadjusttheirstrategiesasthemarketevolve.

Forinstance,companiesmightneedtoreallocateresourcesandstaffortoupdatesalesincentives.

Thosethatmaintainadashboardshowingdetailedinformationonopportunitiesbymicrogeography,endmarketorvertical,andcustomersegmentmayspotshiftingdemandpatternsmorequickly.

Reshapingthego-to-marketapproachforthenextnormalInoursurvey,96percentofrespondentsstatedthatCOVID-19hadnecessitatedchangesintheirgo-to-marketmodels(Exhibit1).

Manyhadtoshiftfromin-personinteractionstoremotesales,atleasttosomeextent.

Thesalesstaffsofsome,forexample,makecontactwithbuyerssolelythroughphoneorwebchannels.

Remotesalesinteractionswillbethenormfortheforeseeablefutureasphysical-distancingrequirementsandtravelrestrictionspersist.

Exhibit1MostoftheB2Bcompaniesinoursurveyshiftedtheirgo-to-marketmodelsinresponsetotheCOVID-19crisis.

Question:Inwhatwayswasyourcompany'sproductorservicesoldbeforeCOVID-19Question:Nowtoday,inwhatwaysisyourcompany'sproductorservicesoldduringCOVID-19Source:McKinseyCOVID-19B2BDecision-MakerPulse#2,4/20–4/28/2020(n=3,755)WebExhibitofGo-to-marketsalesmodelduringCOVID19,%ofrespondentsIn-person/fieldsalesteam:MeetingwithcustomersfacetofaceInsidesalesteam:PhoneinteractionsOnlinesupport:Chattingwithcustomersviavideo/website/mobileappOtherE-commerce:Productsandservicessolddirectlyonline—nosalesrepresentativeDuringCOVID-19BeforeCOVID-19554652462140625133MostoftheB2Bcompaniesinoursurveyshiftedtheirgo-to-marketmodelsinresponsetotheCOVID-19crisis.

3UnlikemanyotherchangespromptedbyCOVID-19,thisshifthashadsomepositiveconsequences—andcouldactuallybringnewopportunities.

Oursurveyshowedthatrespondentsweremorelikelytocitedigitalthantraditionalchannelswhenaskedaboutthebestwaytoresearchsuppliers(Exhibit2).

Websitesofsuppliers,onlinematerialsfromthem,andlivechatswereratedthemostvaluableresources.

Inadditiontostrengtheningcustomerbonds,strongdigitalchannelsmayoftenhelpB2Bcompaniesreducetheirsalescosts.

Overall,about65percentofsurveyrespondentssaidinlateAprilthattheirnewgo-to-marketmodelswereequallyormoreeffectiveinreachingcustomersthantheirformersalesmethodswere—upmorethan10percentsincetheearlyAprilsurvey(Exhibit3).

Withsuchhighsatisfaction,manybusinesseswillprobablyquestionwhethertheyshouldeverreturntotheoldstatusquo.

Infact,about80percentstatedthattheyweresomewhatorverylikelytosustainthechangesfor12monthsorlonger.

Ifthisholdstrue,B2BcompaniesacrossExhibit2Surveyrespondentsnowbelievedigitalchannelsaremostvaluablewhenresearchingsuppliers.

Question:Whatwaysofinteractingwithasupplierwouldbemostbeneficialtoyouwhenresearching/consideringsuppliersgoingforwardRankupto3thatwouldbemostbeneficial.

Afree-responseoptionwasgiven,but0%ofrespondentsfilleditoutin2020.

Source:McKinseyCOVID-19B2BDecision-MakerPulse#1,3/30–4/9/2020(n=3,619)WebExhibitofMostbenecialsupplierinteractionsforresearching/consideringsuppliers,%ofrespondentsrankingintop3SupplierwebsiteOnlinematerialfromsupplierInformationonmobileappWebsearchPostonsocialmedia/onlineLivechatEmailfromsalesrepTextfromsalesrepReferralfromsomeoneinmyindustryCustomerreferralTradeshowIndustrypublicationPrintmaterialfromsupplierMeetingsalesrepinpersonCallfromsalesrepDirectmailfromsalesrepDigitalSelf-serveDirectedTraditionalSelf-serveDirected25222020172420111716141311232215Surveyrespondentsnowbelievedigitalchannelsaremostvaluablewhenresearchingsuppliers.

4industriescouldrevisittheirgo-to-marketmodelsoverthenextyear,andmanywillresolvetoembeddigitalandremotesalesoptionsalongtheentirecustomerdecisionjourney.

Althoughmostcompaniesbenefitfromtheirexpandeddigitalgo-to-marketchannels,othersobviouslystrugglewiththem.

Customersexpectaremoteexperienceofhighquality,andcompaniesmuststriveforimprovementinthisareaiftheywanttocutsalescostsandincreasecustomersatisfaction.

SomeB2Bplayershavealreadymadebigchangestoimprovetheirdigitalapproach.

Onecompany,forinstance,isaskingveteraninsidesalesrepresentativestocross-trainfieldreps.

Anotherhasopenedavirtualshowroomtoreplacecanceledorpostponedtradeshows.

Althougheachcompanymustdevelopago-to-marketmodeluniquetoitscircumstancesandcustomerbase,astrongapproachtoimprovingdigitalandremotesaleswilltypicallyincludethefollowingsteps:—Discover.

Companiesshouldconductafact-basedcustomersegmentationthatconsiderseconomics(includingpotentialrevenuesandprofits)andpreferenceswithineachgroup.

Togettherightlevelofdetail,customersurveysandinterviewsareessential.

Exhibit3About65percentofsurveyrespondentsbelievethenewsalesmodelisequallyormoreeectivethantheirpre-COVID-19models.

Note:Figuresmaynotsumto100%,becauseofrounding.

Question:Howeffectiveisyourcompany'snewsalesmodelatreachingandservingcustomersSource:McKinseyCOVID-19B2BDecision-MakerPulse#1,3/30–4/9/2020(n=3,619);McKinseyCOVID-19USB2BDecision-MakerPulse#2,4/20–4/28/2020(n=3,755)WebExhibitofEectivenessofnewsalesmodelinreachingandservingcustomers,%ofrespondentsMuchlesseffectiveApr9Apr28SomewhatlesseffectiveAseffectiveasbeforeSomewhatmoreeffectiveMuchmoreeffective9182739112529287754%aseffective,ormoreso,comparedwithbeforeCOVID-19MuchlesseffectiveSomewhatlesseffectiveAseffectiveasbeforeSomewhatmoreeffectiveMuchmoreeffective65%aseffective,ormoreso,comparedwithbeforeCOVID-19About65percentofsurveyrespondentsbelievethenewsalesmodelisequallyormoreeffectivethantheirpre-COVID-19models.

5—Design.

Inthisphase,companiesdefinetherightgo-to-marketmodelforeachsegment.

Themodelshouldconsiderdirectchannels(includingkeyaccountmanagersandinsidesalesreps)andindirectchannels(suchasdistributorsandthirdpartye-commerceplayers).

Companiesmustalsomapemployeestonewrolesanddeterminetheirterritories,accountcoverage,andrevenuegoals.

Intandem,theyshouldensurethattheirperformance-managementapproach,organizationalcapabilities,systems,andtoolsareappropriate.

—Build.

Beforescalingupthenewgo-to-marketmodel,companiesshouldcommunicatechangesinroles,territories,accounts,andKPIstoallrelevantpersonnel.

Theywillalsoneedtocommunicatewiththeircustomersaboutanychangesandcreatetransitionplans.

—Sustain.

Companiesshouldregularlycheckinwithcustomerstoensurethattheyhaveaqualityexperienceduringthetransition.

Adherencetothenewmodelandstrongperformancemanagementarecriticaltosustainingvalueaftercompaniesimplementanewgo-to-marketmodel.

Asalways,theyshouldalsocontinuetoupgradetheskillsoftheiremployeesthroughongoingtraining.

Turbocharginge-commercegrowthB2Be-commerceaccountedfor$1.

2trillioninrevenuesin2018,andthenumberswillprobablyincrease.

Ourlatestglobalsurveyshowedthattheyareupbymorethan20percentsincetheonsetofCOVID-19andthatdigitalinteractionsaretwotimesmoreimportanttocustomersnowthantheywerebeforethepandemic.

ThebenefitsoftheshifttoB2Be-commercecouldbeimmense,sincecompaniesthatembeddigitalsalesintotheirgo-to-marketmodelsee5-timesfasterrevenuegrowth,comparedwithpreviouslevels,aswellas30percenthigheracquisitionefficiency,andcostreductionsof40to60percentwithinsales.

Manycompaniesarealreadytryingtointroduceorenhancetheirdigitalchannels.

Onelargee-commercesite,forexample,hasimplementedsolutionstosupportautodealers,includingonlinetradeshowsandfreightservices.

Forcompaniesthatwanttofollowasimilarpath,somecriticalstepsareessential.

First,B2Bcompaniesshoulddesigne-commercesolutionswithcustomersinmind,alwaysfocusingontheirjourneysandpainpoints.

Andratherthanattemptingtolaunchadigitalbusinessmodelacrossallproducts,services,andmarkets,companiesshouldinitiallyfocusonalimitednumberofofferingsandgeographies.

Oncetheygainsometractionthere,theycanscaleuptheire-commercesolutionsthroughouttheorganization.

Sincemanyemployeesmaybenewtoe-commerce,B2Bcompaniesshouldassignownerstodifferenttasksandmakeresponsibilitiesclear.

Forinstance,theymightcreateatechnologyanddesignteamtodefinethesitearchitectureandtolinkvariousITsystems,suchasthoseforwarehousemanagementandorderhandling.

Anoperationsteamcouldtakechargeofsettingupthewarehouse.

Aproduct-assortmentteamcouldanalyzeoptions;choosethetopSKUsforlaunch;obtainsamplestophotograph,measure,anddescribe;andperhapsdevelopDigitalinteractionsaretwotimesmoreimportanttocustomersnowthantheywerebeforethepandemic.

6creativeonline-onlybundles.

Themarketingteam'snewresponsibilitiescouldincludesettingupastructuredcustomer-relationship-managementsystemanddevelopingcampaignstodrivehigh-qualitytraffictothecompany'ssite.

AsB2Bcompaniesexperimentwithincreasedlevelsofe-commerce,theymayneedtotestanditeratedifferentapproachesquickly.

Theymightidentifyeffectivesolutionsmoreeasilybyestablishingtherightmetricsandkeyperformanceindicators.

Inadditiontomonitoringthenumberofsalesorthenumberofpeoplewhoswitchtoe-commercefromotherchannels,B2Bcompaniesshouldlookatverydetaileddatainthreeareas:traffic,conversions,andaverageordervalue.

Foreachcustomercohort,togiveoneexample,theycouldmeasuremicroconversions—smallstepstowardapurchase—anddetermineifanyuser-experiencefeaturesonthewebsiteseemedtoincreasetherate.

B2Bcompaniesshouldalsokeepthefocusoncustomersbycontinuallyanalyzingthee-commerceprocesstouncoverpainpointsandbottlenecks.

Usinganagileapproach,theycanprioritizeissues,rapidlytestanditeratesolutions,andscalethemassoonaspossible.

AdaptingpricestosuitcustomerneedsB2Bcompanieshavecloselywatchedtheirspendingasthecoronavirushasshutdownplants,cutdemand,andhurtthebottomline.

Inourlatestsurvey,about54percentofrespondentssaidthattheircompanieshaddecreasedoverallbudgets—ashiftthatcouldhaveimplicationsforproductpricing,sincebuyersmaybelookingfordeals(Exhibit4).

Thecompaniesoftheremainingrespondentshadkeptbudgetsataboutthesamelevel(24percent)orincreasedthem(21percent).

About42percentexpectedtomakeadditionalreductionsinthenearfuture.

Thesebudgetcutswereconsistentacrossmostcategoriesandindustries,showingthewide-reachingimpactofCOVID-19.

Withdemandvolatileandbudgetstrendingdownacrossmostcategories,pricingisunderpressurefromB2Bbuyers.

Theirsupplierswillhaveonequestiontopofmind:"HowcanIhelpmycustomerswhoarestrugglingintheneartermwhileensuringthesustainabilityofmyownbusinessduringandaftertherecovery"Theanswerwillinvolvedevelopingcreativeandflexiblesolutionsthatgofarbeyondtoplinepricereductions.

Nosinglepricingstrategyworksinallcases,butmanyB2Bcompanieshavealreadydevelopedcustomizedoffers:—Atechplayerprovidedcustomerswith90-dayfreeaccesstoimportantsoftwaretohelpthemrespondtoCOVID-19'sdisruptions.

Exhibit4ManyB2Bcompanieshavealreadycuttheirbudgetsandalsoexpectadditionalreductions.

Note:Figuresmaynotsumto100%,becauseofrounding.

Includessurveyrespondentsfrom(Braziln=400),(Chinan=400),(Francen=200),(Germanyn=400),(Indian=400),(USn=619),(Italyn=400),(Japann=200),(SouthKorean=201),(Spainn=200),(UKn=199).

Question:Howhasthecoronavirus(COVID-19)situationaffectedyourcompany'sbudgetforthefollowingareasQuestion:Howdoyouthinkspendingonthefollowingmaychangeinthenext2weeks"Aboutthesame"refersto±3%changeinbudget.

Source:McKinseyCOVID-19B2BDecision-MakerPulse#1,3/30–4/9/2020(n=3,619);McKinseyCOVID-19B2BDecision-MakerPulse#2,4/20–4/28/2020(n=3,755)WebExhibitofGlobalspendingshiftsasaresultofCOVID19,%ofspendchanges(asofApr28)CompanybudgetInthenext2weeksReducedIncreasedAboutthesameReducedIncreasedAboutthesame212454273242ManyB2Bcompanieshavealreadycuttheirbudgetsandalsoexpectadditionalreductions.

7—Atelecomcompanywaivedlatefeesandguaranteedthatsmallbusinesseswouldsuffernoserviceinterruptionsforseveralmonths.

—Anindustrial-servicesproviderintroducednewoptions,smallerinscope,thatcouldbesoldatlowerpricesandbettermetcustomerneedsMorebroadly,allindustryleadershavebeenprovidingtheirdistributedsalesforceswithbettertoolsandanalytics,whichhelpthemevaluatepricing-relatedtrade-offs.

Withoutthisassistance,theymighthavedifficultymakingdecisionsrapidly.

Todeveloptherightofferforeachaccount,B2Bcompaniesmustcloselyunderstandcustomersandtheirevolvingneeds:whileonebuyermightvalueone-timediscounts,anothercouldpreferdebundledofferings.

B2Bcompaniesshouldalsoconsiderdemandwhenadjustingpricesforspecificcustomersorproductcategories,ratherthanmakecarte-blanchedecisionscoveringmultiplecategories.

Manyloyal,dependablecustomersmaybestrugglingduringthecrisis.

Theydeservespecialpricingconsideration,sincelong-termaccountsaretheprimarysourceofcashflowandorganicgrowth.

IfB2Bcompaniesaccommodatetheneedsofsuchcustomersnow,theywillstrengthenlong-standingrelationshipsandbuildgreaterloyalty.

Whenthepandemicendsanddemandbeginstosurge,long-timecustomerscouldonceagainprovetobethegreatestsourceofB2Brevenues.

Beyondlowerchurnandattrition,B2Bcompaniesthatgetpricingrightwilldecreasecostsforcustomerserviceandaccountacquisition.

Tobuildastrongpricingfoundation,leadersshouldensurethatallrelevantstaff—especiallythoseinsales,salessupport,andpricing—havetheessentialcapabilities.

Forinstance,pricingteamsmustknowhowtocreatetailoredofferswhilesalesrepresentativesmayneedadditionalcommunicationstrainingifremoteinteractionscontinueandrelationship-basedsellingbecomesmoredifficult.

Foroverallguidance,B2Bcompaniesmightconsidercreatingacross-functionalvaluecouncilthatpreventspanickyreactionsandprovidesclearguidelinesandobjectivesforthecommercialteam.

Withpriceadjustmentsbecomingmorecommon,B2Bcompaniesshouldmaintaindisciplineinprocessesandperformancemanagement.

Iftheyagreetofurtherpricereductionsordecidenottoenforcecontracts,theyshouldensurethatsuchmovestrulyhelpcustomerrelationships.

B2Bcompaniesmightalsowanttoreviewpricingstrategiesmorefrequently,sincethecustomerlandscapewillcontinuetoevolverapidly.

Withpriceadjustmentsbecomingmorecommon,B2Bcompaniesshouldmaintaindisciplineinprocessesandperformancemanagement.

8Rapidlyintroducingnewproducts—orreengineeringcurrentonesInourglobalB2BDecision-MakerPulseSurvey,morethan90percentofexecutivessaidtheyexpectCOVID-19tobringfundamentalchangestotheircompanies.

Butmanyofthemareputtingproductinnovationonthebackburnertoconservecash,minimizerisk,andshoreupthecorebusiness.

Somerespondentsalsowanttowaituntiltheyhavemoreclarityaboutfutureeconomicdevelopments.

Whilethishesitationisunderstandable,experienceshowsthatcompanieswinbyinvestingininnovationintimesofcrisis.

Duringpastdownturns,suchcompaniestypicallyachievedtotalreturnstoshareholders10percenthigherthanthoseoftheirpeersandalsooutperformedthemarketbymorethan30percentduringtherecoveryyears.

Innovatorsachievethesegainsbecausetheyrealizethattheirlong-timebusinessmodelsmaynolongerdeliverthesamereturnswhenacrisisalterscustomerneeds.

Ratherthanstickingtothestatusquo,innovatorsadaptearlytosuitthenewenvironment.

Bythetimethecrisisendsanddemandrecovers,theirnewofferingsarereadyforlaunch.

Meanwhile,companiesthathesitatedtoinnovatemayhavefewnewproductstoenticecustomers.

WithCOVID-19,B2Bcompanieshaveauniqueopportunitytoinnovatebecausecustomerneedsareevolvingsorapidlyandmovinginsuchunexpecteddirections.

Sucheffortsmayinvolvecreatingnewproducts,modifyingorupgradingofferingstosatisfymarketdemand,orrefreshingthevalueproposition.

Considerafewrecentexamples:—Atechnologycompanyrapidlycreatedasuiteofremotesolutions,includingthoseformaintenancesupportandspare-partstocking,toensurethatbusinesseshaveaccesstofieldoperatorsandserviceengineers.

—Ahousehold-appliancecompanydesigned,developed,andproducedaventilatorintendays.

—AnothertechnologycompanyreconfigureditsdigitalassistanttoanswerCOVID-19questionsfromemployeesandcustomers.

—Afinancial-servicesandmobile-paymentcompanymodifieditsproductstoallowtouchlesspayments,disablesignaturerequirements,andfacilitatee-commerce.

Everyinnovativeproductcomeswithsomedegreeofrisk;companiescannotbesuretheirinvestmentswillpayoff.

Unexpectedtechnologicalobstaclesorlower-than-anticipateddemandcouldalsodiminishtheprospectsofsuchcompanies.

AlthoughB2Bplayerscannoteliminateeveryunknownfromtheinnovationprocess,theycanincreasetheiroddsofsuccessbyresearchingcustomerneeds.

Aswesaidearlier,COVID-19hasshifteddemandinunexpectedwaysbecausebuyershavenewpriorities.

Afteranalyzingmarketdynamicsandchangingcustomerneeds,B2Bcompaniesmaydiscoverthattheirbusinessmodelsareobsoleteandtheirportfolioshavegaps.

Althoughagilityisessential,manyB2Bcompaniesstillhavecomplexorganizationalstructuresandprocessesthatslowdownproductdevelopment.

Inthenextnormal,cross-functionalteams,withrepresentativesfromproductdevelopment,sales,customersupport,andothergroups,shouldfollowanagileapproachtocreatenewofferings.

Weeklydesignsprintsinwhichteamsfocusondesigningspecificproductfeaturesmayspeedthingsup.

9DesignedbyGlobalEditorialServicesCopyright2020McKinsey&Company.

Allrightsreserved.

MintiRayisanassociatepartnerinMcKinsey'sPhiladelphiaoffice.

StefanoRedaelliisaseniorpartnerinMcKinsey'sStamfordoffice,whereDamianRudichisanassociatepartner.

AndrewWongisanassociatepartnerintheChicagooffice.

TheauthorswouldliketothankSaravanaSivanandhamforhiscontributionstothisarticle.

B2Bcompanies,likeplayersinmostotherindustries,willbedealingwithchallengesarisingfromCOVID-19foryears.

Atpresent,mostleadersatthesecompaniesaresoconsumedwithsurvivingtheimmediatecrisisthattheyarenotlookingaheadtotherecoveryphase,whendemandwillagainbegintogrow.

Butleaderscouldincreasetheoddsoflong-termsuccessiftheyfocusedoninnovationduringtheCOVID-19crisisbylookingatnewproducts,strategies,andorganizationalstructures.

Thosefirstmoversmaygainanearlyadvantagethattheircompetitorsfinddifficulttomatch.

10

July2020JorgGreuel/GettyImagesbyMintiRay,StefanoRedaelli,DamianRudich,andAndrewJ.

WongLeadersofB2Bcompaniesthatprimarilyservecustomersinsectorssuchasautomotive,energy,mining,andtelecommunicationsaretryingtomitigateCOVID-19'seconomicfalloutandhumantollbyensuringworkplacesafety,increasingliquidity,andkeepingsupplychainsmoving.

Thepressureshavebeensointensethatfewarelookingaheadtothereturntowork,whenproductionlineswillrampuptofullcapacity.

Thoseforward-thinkingexecutiveswhodocontemplatetherecoverymayhavedifficultycreatingasolidplan,becauseCOVID-19hasintroducedunprecedentedcomplexityintotheiroperations.

OurglobalB2BDecision-MakerPulseSurvey,mostrecentlyconductedinlateApril2020,reflectedthewidespreaduncertaintyaboutfutureprospects.

Ofthemorethan3,700respondents,allwithsomeresponsibilityforB2Bpurchasesorsales,45percentbelievedtheeconomywouldreboundintwotothreemonths,whiletheremaindersaidthatcouldtakesixto12monthsorevenlonger.

ThesedivergentattitudesmayshowthatbusinessleadersareunsureaboutthelastingfinancialeffectsofCOVID-19.

Theymayalsoreflectthevaryingimpactofthecoronavirusindifferentgeographies:whilesomeregionsandcompanieswillsoonbereadyforramp-up,othersarestillclosedorfunctioningbelowcapacity.

AlthoughB2Bcompaniesmaybelievethattheirfocusonliquidityandothershort-termconcernsisjustified,itcouldbecostly.

Ourresearchsuggeststhatcompaniesaremorelikelytothriveiftheyactaggressivelytocapturemarketshareduringdownturnsratherthanwaitfortherecoverytobegin.

Thisagility,combinedwithafocusoncustomervalueandsupport,oftengivescompaniesafirst-moveradvantagethatotherplayerscannotmatch.

Firstmoversduringthecurrentcrisiscouldemergestrongerinthenextnormal.

TohelpB2Bleadersdevelopsolidlong-termstrategies,weresearchedthetrendsnowtransformingthemarketplace,lookingforthemesthataffectallplayers.

WealsoreviewedinsightsfromtheglobalB2BDecision-MakerPulseSurvey.

Withthisinformation,wewereabletoidentifythemostimportantelementsofasuccessfulrecoveryforB2Bplayers,whichneednewstrategiestohelpthemidentifyandcapturenewopportunitiesquickly,aswellasgo-to-marketmodelsthatincreasetheimportanceofdigitalandremotesales.

Andwiththesuddenexplosionofe-commerce,thischannelneedsmoreattentionandsupport—especiallybecausetheshiftfromin-personsalescouldbepermanent.

Alsocriticalinthenextnormal:theabilitytocreatetailoredpricingstrategiesforeachcustomerandanagileapproachtoaccelerateproductinnovation.

IdentifyingspecificgrowthpocketsCOVID-19hasupendeddemandpatternsacrosssectors,renderingtraditionalforecastingmethodsinaccurate.

Theeconomicscenariosthatwillemergeoverthenextfewyearswilldifferwidelybycountry,dependingonthelocalimpactofthecoronavirus,governmentstimuluspackages,andotherfactors.

Evenwithincountries,industriesmayrecoveratdifferentspeeds.

Withsuchuncertainty,B2Bcompaniescannotexpecttoachievehistoricalreturnsfromtheircurrentcustomerbaseandproductmix.

Agilitywillbeessentialindevelopingnewgrowthstrategies,sincetheearlydaysoftheCOVID-19crisisshowhowquicklynewopportunitiescanemerge,aswellashowrapidlysomethrivingmarketscanslowdown.

Forinstance,semiconductorcompaniesexpectthatdemandwillplummetintheautomotiveandseveralothersegmentsin2020butwillincreaseinthewired-communicationendmarket.

Togetreal-timevisibilityintomarkets,B2Bcompaniesshouldevaluateinformationoncompetitorsandleadingindicators,aswellasCOVID-specificdata.

Announcementsthatplantsarereopeningorthatgovernmentsarerelaxinglockdownscanprovideimportantcluesaboutdemand,marketchallenges,andtherate2ofviralspread.

Informationonhistoricvolumesindifferentcountriesorindustriesmayalsohelp,thoughcompaniesmaynotseedemandreturntoformerlevelsimmediately.

Toprovideinsights,thisinformationmustbeverydetailed—forinstance,saleswithinmicrogeographiesorzipcodes.

Aftergatheringthesedata,B2Bcompaniescancreatedifferentscenariostoshowhowdemandmightevolve,lookingatproducts,customersegments,andregion.

Theinsightsfromthisanalysiswillallowcompaniestofindpocketsofopportunity.

Oneimportantfocus:determiningwhichsegmentsarelikelytorecoverfirstandwhetherdemandintheseareaswillexceedorfallbelowpreviouslevels.

Insomecases,B2Bcompaniesmayfindthattheyshouldaddnewproductstotheirpipelinesorpursuedifferentcustomersegments.

Oncethetargetopportunitiesareidentified,marketingandsalesteamsmustadaptquickly.

B2Bcompaniesshouldnotonlyeliminatebureaucraticrequirementsthatmightslowthemdownbutalsogiveteamsthefreedomtoadjusttheirstrategiesasthemarketevolve.

Forinstance,companiesmightneedtoreallocateresourcesandstaffortoupdatesalesincentives.

Thosethatmaintainadashboardshowingdetailedinformationonopportunitiesbymicrogeography,endmarketorvertical,andcustomersegmentmayspotshiftingdemandpatternsmorequickly.

Reshapingthego-to-marketapproachforthenextnormalInoursurvey,96percentofrespondentsstatedthatCOVID-19hadnecessitatedchangesintheirgo-to-marketmodels(Exhibit1).

Manyhadtoshiftfromin-personinteractionstoremotesales,atleasttosomeextent.

Thesalesstaffsofsome,forexample,makecontactwithbuyerssolelythroughphoneorwebchannels.

Remotesalesinteractionswillbethenormfortheforeseeablefutureasphysical-distancingrequirementsandtravelrestrictionspersist.

Exhibit1MostoftheB2Bcompaniesinoursurveyshiftedtheirgo-to-marketmodelsinresponsetotheCOVID-19crisis.

Question:Inwhatwayswasyourcompany'sproductorservicesoldbeforeCOVID-19Question:Nowtoday,inwhatwaysisyourcompany'sproductorservicesoldduringCOVID-19Source:McKinseyCOVID-19B2BDecision-MakerPulse#2,4/20–4/28/2020(n=3,755)WebExhibitofGo-to-marketsalesmodelduringCOVID19,%ofrespondentsIn-person/fieldsalesteam:MeetingwithcustomersfacetofaceInsidesalesteam:PhoneinteractionsOnlinesupport:Chattingwithcustomersviavideo/website/mobileappOtherE-commerce:Productsandservicessolddirectlyonline—nosalesrepresentativeDuringCOVID-19BeforeCOVID-19554652462140625133MostoftheB2Bcompaniesinoursurveyshiftedtheirgo-to-marketmodelsinresponsetotheCOVID-19crisis.

3UnlikemanyotherchangespromptedbyCOVID-19,thisshifthashadsomepositiveconsequences—andcouldactuallybringnewopportunities.

Oursurveyshowedthatrespondentsweremorelikelytocitedigitalthantraditionalchannelswhenaskedaboutthebestwaytoresearchsuppliers(Exhibit2).

Websitesofsuppliers,onlinematerialsfromthem,andlivechatswereratedthemostvaluableresources.

Inadditiontostrengtheningcustomerbonds,strongdigitalchannelsmayoftenhelpB2Bcompaniesreducetheirsalescosts.

Overall,about65percentofsurveyrespondentssaidinlateAprilthattheirnewgo-to-marketmodelswereequallyormoreeffectiveinreachingcustomersthantheirformersalesmethodswere—upmorethan10percentsincetheearlyAprilsurvey(Exhibit3).

Withsuchhighsatisfaction,manybusinesseswillprobablyquestionwhethertheyshouldeverreturntotheoldstatusquo.

Infact,about80percentstatedthattheyweresomewhatorverylikelytosustainthechangesfor12monthsorlonger.

Ifthisholdstrue,B2BcompaniesacrossExhibit2Surveyrespondentsnowbelievedigitalchannelsaremostvaluablewhenresearchingsuppliers.

Question:Whatwaysofinteractingwithasupplierwouldbemostbeneficialtoyouwhenresearching/consideringsuppliersgoingforwardRankupto3thatwouldbemostbeneficial.

Afree-responseoptionwasgiven,but0%ofrespondentsfilleditoutin2020.

Source:McKinseyCOVID-19B2BDecision-MakerPulse#1,3/30–4/9/2020(n=3,619)WebExhibitofMostbenecialsupplierinteractionsforresearching/consideringsuppliers,%ofrespondentsrankingintop3SupplierwebsiteOnlinematerialfromsupplierInformationonmobileappWebsearchPostonsocialmedia/onlineLivechatEmailfromsalesrepTextfromsalesrepReferralfromsomeoneinmyindustryCustomerreferralTradeshowIndustrypublicationPrintmaterialfromsupplierMeetingsalesrepinpersonCallfromsalesrepDirectmailfromsalesrepDigitalSelf-serveDirectedTraditionalSelf-serveDirected25222020172420111716141311232215Surveyrespondentsnowbelievedigitalchannelsaremostvaluablewhenresearchingsuppliers.

4industriescouldrevisittheirgo-to-marketmodelsoverthenextyear,andmanywillresolvetoembeddigitalandremotesalesoptionsalongtheentirecustomerdecisionjourney.

Althoughmostcompaniesbenefitfromtheirexpandeddigitalgo-to-marketchannels,othersobviouslystrugglewiththem.

Customersexpectaremoteexperienceofhighquality,andcompaniesmuststriveforimprovementinthisareaiftheywanttocutsalescostsandincreasecustomersatisfaction.

SomeB2Bplayershavealreadymadebigchangestoimprovetheirdigitalapproach.

Onecompany,forinstance,isaskingveteraninsidesalesrepresentativestocross-trainfieldreps.

Anotherhasopenedavirtualshowroomtoreplacecanceledorpostponedtradeshows.

Althougheachcompanymustdevelopago-to-marketmodeluniquetoitscircumstancesandcustomerbase,astrongapproachtoimprovingdigitalandremotesaleswilltypicallyincludethefollowingsteps:—Discover.

Companiesshouldconductafact-basedcustomersegmentationthatconsiderseconomics(includingpotentialrevenuesandprofits)andpreferenceswithineachgroup.

Togettherightlevelofdetail,customersurveysandinterviewsareessential.

Exhibit3About65percentofsurveyrespondentsbelievethenewsalesmodelisequallyormoreeectivethantheirpre-COVID-19models.

Note:Figuresmaynotsumto100%,becauseofrounding.

Question:Howeffectiveisyourcompany'snewsalesmodelatreachingandservingcustomersSource:McKinseyCOVID-19B2BDecision-MakerPulse#1,3/30–4/9/2020(n=3,619);McKinseyCOVID-19USB2BDecision-MakerPulse#2,4/20–4/28/2020(n=3,755)WebExhibitofEectivenessofnewsalesmodelinreachingandservingcustomers,%ofrespondentsMuchlesseffectiveApr9Apr28SomewhatlesseffectiveAseffectiveasbeforeSomewhatmoreeffectiveMuchmoreeffective9182739112529287754%aseffective,ormoreso,comparedwithbeforeCOVID-19MuchlesseffectiveSomewhatlesseffectiveAseffectiveasbeforeSomewhatmoreeffectiveMuchmoreeffective65%aseffective,ormoreso,comparedwithbeforeCOVID-19About65percentofsurveyrespondentsbelievethenewsalesmodelisequallyormoreeffectivethantheirpre-COVID-19models.

5—Design.

Inthisphase,companiesdefinetherightgo-to-marketmodelforeachsegment.

Themodelshouldconsiderdirectchannels(includingkeyaccountmanagersandinsidesalesreps)andindirectchannels(suchasdistributorsandthirdpartye-commerceplayers).

Companiesmustalsomapemployeestonewrolesanddeterminetheirterritories,accountcoverage,andrevenuegoals.

Intandem,theyshouldensurethattheirperformance-managementapproach,organizationalcapabilities,systems,andtoolsareappropriate.

—Build.

Beforescalingupthenewgo-to-marketmodel,companiesshouldcommunicatechangesinroles,territories,accounts,andKPIstoallrelevantpersonnel.

Theywillalsoneedtocommunicatewiththeircustomersaboutanychangesandcreatetransitionplans.

—Sustain.

Companiesshouldregularlycheckinwithcustomerstoensurethattheyhaveaqualityexperienceduringthetransition.

Adherencetothenewmodelandstrongperformancemanagementarecriticaltosustainingvalueaftercompaniesimplementanewgo-to-marketmodel.

Asalways,theyshouldalsocontinuetoupgradetheskillsoftheiremployeesthroughongoingtraining.

Turbocharginge-commercegrowthB2Be-commerceaccountedfor$1.

2trillioninrevenuesin2018,andthenumberswillprobablyincrease.

Ourlatestglobalsurveyshowedthattheyareupbymorethan20percentsincetheonsetofCOVID-19andthatdigitalinteractionsaretwotimesmoreimportanttocustomersnowthantheywerebeforethepandemic.

ThebenefitsoftheshifttoB2Be-commercecouldbeimmense,sincecompaniesthatembeddigitalsalesintotheirgo-to-marketmodelsee5-timesfasterrevenuegrowth,comparedwithpreviouslevels,aswellas30percenthigheracquisitionefficiency,andcostreductionsof40to60percentwithinsales.

Manycompaniesarealreadytryingtointroduceorenhancetheirdigitalchannels.

Onelargee-commercesite,forexample,hasimplementedsolutionstosupportautodealers,includingonlinetradeshowsandfreightservices.

Forcompaniesthatwanttofollowasimilarpath,somecriticalstepsareessential.

First,B2Bcompaniesshoulddesigne-commercesolutionswithcustomersinmind,alwaysfocusingontheirjourneysandpainpoints.

Andratherthanattemptingtolaunchadigitalbusinessmodelacrossallproducts,services,andmarkets,companiesshouldinitiallyfocusonalimitednumberofofferingsandgeographies.

Oncetheygainsometractionthere,theycanscaleuptheire-commercesolutionsthroughouttheorganization.

Sincemanyemployeesmaybenewtoe-commerce,B2Bcompaniesshouldassignownerstodifferenttasksandmakeresponsibilitiesclear.

Forinstance,theymightcreateatechnologyanddesignteamtodefinethesitearchitectureandtolinkvariousITsystems,suchasthoseforwarehousemanagementandorderhandling.

Anoperationsteamcouldtakechargeofsettingupthewarehouse.

Aproduct-assortmentteamcouldanalyzeoptions;choosethetopSKUsforlaunch;obtainsamplestophotograph,measure,anddescribe;andperhapsdevelopDigitalinteractionsaretwotimesmoreimportanttocustomersnowthantheywerebeforethepandemic.

6creativeonline-onlybundles.

Themarketingteam'snewresponsibilitiescouldincludesettingupastructuredcustomer-relationship-managementsystemanddevelopingcampaignstodrivehigh-qualitytraffictothecompany'ssite.

AsB2Bcompaniesexperimentwithincreasedlevelsofe-commerce,theymayneedtotestanditeratedifferentapproachesquickly.

Theymightidentifyeffectivesolutionsmoreeasilybyestablishingtherightmetricsandkeyperformanceindicators.

Inadditiontomonitoringthenumberofsalesorthenumberofpeoplewhoswitchtoe-commercefromotherchannels,B2Bcompaniesshouldlookatverydetaileddatainthreeareas:traffic,conversions,andaverageordervalue.

Foreachcustomercohort,togiveoneexample,theycouldmeasuremicroconversions—smallstepstowardapurchase—anddetermineifanyuser-experiencefeaturesonthewebsiteseemedtoincreasetherate.

B2Bcompaniesshouldalsokeepthefocusoncustomersbycontinuallyanalyzingthee-commerceprocesstouncoverpainpointsandbottlenecks.

Usinganagileapproach,theycanprioritizeissues,rapidlytestanditeratesolutions,andscalethemassoonaspossible.

AdaptingpricestosuitcustomerneedsB2Bcompanieshavecloselywatchedtheirspendingasthecoronavirushasshutdownplants,cutdemand,andhurtthebottomline.

Inourlatestsurvey,about54percentofrespondentssaidthattheircompanieshaddecreasedoverallbudgets—ashiftthatcouldhaveimplicationsforproductpricing,sincebuyersmaybelookingfordeals(Exhibit4).

Thecompaniesoftheremainingrespondentshadkeptbudgetsataboutthesamelevel(24percent)orincreasedthem(21percent).

About42percentexpectedtomakeadditionalreductionsinthenearfuture.

Thesebudgetcutswereconsistentacrossmostcategoriesandindustries,showingthewide-reachingimpactofCOVID-19.

Withdemandvolatileandbudgetstrendingdownacrossmostcategories,pricingisunderpressurefromB2Bbuyers.

Theirsupplierswillhaveonequestiontopofmind:"HowcanIhelpmycustomerswhoarestrugglingintheneartermwhileensuringthesustainabilityofmyownbusinessduringandaftertherecovery"Theanswerwillinvolvedevelopingcreativeandflexiblesolutionsthatgofarbeyondtoplinepricereductions.

Nosinglepricingstrategyworksinallcases,butmanyB2Bcompanieshavealreadydevelopedcustomizedoffers:—Atechplayerprovidedcustomerswith90-dayfreeaccesstoimportantsoftwaretohelpthemrespondtoCOVID-19'sdisruptions.

Exhibit4ManyB2Bcompanieshavealreadycuttheirbudgetsandalsoexpectadditionalreductions.

Note:Figuresmaynotsumto100%,becauseofrounding.

Includessurveyrespondentsfrom(Braziln=400),(Chinan=400),(Francen=200),(Germanyn=400),(Indian=400),(USn=619),(Italyn=400),(Japann=200),(SouthKorean=201),(Spainn=200),(UKn=199).

Question:Howhasthecoronavirus(COVID-19)situationaffectedyourcompany'sbudgetforthefollowingareasQuestion:Howdoyouthinkspendingonthefollowingmaychangeinthenext2weeks"Aboutthesame"refersto±3%changeinbudget.

Source:McKinseyCOVID-19B2BDecision-MakerPulse#1,3/30–4/9/2020(n=3,619);McKinseyCOVID-19B2BDecision-MakerPulse#2,4/20–4/28/2020(n=3,755)WebExhibitofGlobalspendingshiftsasaresultofCOVID19,%ofspendchanges(asofApr28)CompanybudgetInthenext2weeksReducedIncreasedAboutthesameReducedIncreasedAboutthesame212454273242ManyB2Bcompanieshavealreadycuttheirbudgetsandalsoexpectadditionalreductions.

7—Atelecomcompanywaivedlatefeesandguaranteedthatsmallbusinesseswouldsuffernoserviceinterruptionsforseveralmonths.

—Anindustrial-servicesproviderintroducednewoptions,smallerinscope,thatcouldbesoldatlowerpricesandbettermetcustomerneedsMorebroadly,allindustryleadershavebeenprovidingtheirdistributedsalesforceswithbettertoolsandanalytics,whichhelpthemevaluatepricing-relatedtrade-offs.

Withoutthisassistance,theymighthavedifficultymakingdecisionsrapidly.

Todeveloptherightofferforeachaccount,B2Bcompaniesmustcloselyunderstandcustomersandtheirevolvingneeds:whileonebuyermightvalueone-timediscounts,anothercouldpreferdebundledofferings.

B2Bcompaniesshouldalsoconsiderdemandwhenadjustingpricesforspecificcustomersorproductcategories,ratherthanmakecarte-blanchedecisionscoveringmultiplecategories.

Manyloyal,dependablecustomersmaybestrugglingduringthecrisis.

Theydeservespecialpricingconsideration,sincelong-termaccountsaretheprimarysourceofcashflowandorganicgrowth.

IfB2Bcompaniesaccommodatetheneedsofsuchcustomersnow,theywillstrengthenlong-standingrelationshipsandbuildgreaterloyalty.

Whenthepandemicendsanddemandbeginstosurge,long-timecustomerscouldonceagainprovetobethegreatestsourceofB2Brevenues.

Beyondlowerchurnandattrition,B2Bcompaniesthatgetpricingrightwilldecreasecostsforcustomerserviceandaccountacquisition.

Tobuildastrongpricingfoundation,leadersshouldensurethatallrelevantstaff—especiallythoseinsales,salessupport,andpricing—havetheessentialcapabilities.

Forinstance,pricingteamsmustknowhowtocreatetailoredofferswhilesalesrepresentativesmayneedadditionalcommunicationstrainingifremoteinteractionscontinueandrelationship-basedsellingbecomesmoredifficult.

Foroverallguidance,B2Bcompaniesmightconsidercreatingacross-functionalvaluecouncilthatpreventspanickyreactionsandprovidesclearguidelinesandobjectivesforthecommercialteam.

Withpriceadjustmentsbecomingmorecommon,B2Bcompaniesshouldmaintaindisciplineinprocessesandperformancemanagement.

Iftheyagreetofurtherpricereductionsordecidenottoenforcecontracts,theyshouldensurethatsuchmovestrulyhelpcustomerrelationships.

B2Bcompaniesmightalsowanttoreviewpricingstrategiesmorefrequently,sincethecustomerlandscapewillcontinuetoevolverapidly.

Withpriceadjustmentsbecomingmorecommon,B2Bcompaniesshouldmaintaindisciplineinprocessesandperformancemanagement.

8Rapidlyintroducingnewproducts—orreengineeringcurrentonesInourglobalB2BDecision-MakerPulseSurvey,morethan90percentofexecutivessaidtheyexpectCOVID-19tobringfundamentalchangestotheircompanies.

Butmanyofthemareputtingproductinnovationonthebackburnertoconservecash,minimizerisk,andshoreupthecorebusiness.

Somerespondentsalsowanttowaituntiltheyhavemoreclarityaboutfutureeconomicdevelopments.

Whilethishesitationisunderstandable,experienceshowsthatcompanieswinbyinvestingininnovationintimesofcrisis.

Duringpastdownturns,suchcompaniestypicallyachievedtotalreturnstoshareholders10percenthigherthanthoseoftheirpeersandalsooutperformedthemarketbymorethan30percentduringtherecoveryyears.

Innovatorsachievethesegainsbecausetheyrealizethattheirlong-timebusinessmodelsmaynolongerdeliverthesamereturnswhenacrisisalterscustomerneeds.

Ratherthanstickingtothestatusquo,innovatorsadaptearlytosuitthenewenvironment.

Bythetimethecrisisendsanddemandrecovers,theirnewofferingsarereadyforlaunch.

Meanwhile,companiesthathesitatedtoinnovatemayhavefewnewproductstoenticecustomers.

WithCOVID-19,B2Bcompanieshaveauniqueopportunitytoinnovatebecausecustomerneedsareevolvingsorapidlyandmovinginsuchunexpecteddirections.

Sucheffortsmayinvolvecreatingnewproducts,modifyingorupgradingofferingstosatisfymarketdemand,orrefreshingthevalueproposition.

Considerafewrecentexamples:—Atechnologycompanyrapidlycreatedasuiteofremotesolutions,includingthoseformaintenancesupportandspare-partstocking,toensurethatbusinesseshaveaccesstofieldoperatorsandserviceengineers.

—Ahousehold-appliancecompanydesigned,developed,andproducedaventilatorintendays.

—AnothertechnologycompanyreconfigureditsdigitalassistanttoanswerCOVID-19questionsfromemployeesandcustomers.

—Afinancial-servicesandmobile-paymentcompanymodifieditsproductstoallowtouchlesspayments,disablesignaturerequirements,andfacilitatee-commerce.

Everyinnovativeproductcomeswithsomedegreeofrisk;companiescannotbesuretheirinvestmentswillpayoff.

Unexpectedtechnologicalobstaclesorlower-than-anticipateddemandcouldalsodiminishtheprospectsofsuchcompanies.

AlthoughB2Bplayerscannoteliminateeveryunknownfromtheinnovationprocess,theycanincreasetheiroddsofsuccessbyresearchingcustomerneeds.

Aswesaidearlier,COVID-19hasshifteddemandinunexpectedwaysbecausebuyershavenewpriorities.

Afteranalyzingmarketdynamicsandchangingcustomerneeds,B2Bcompaniesmaydiscoverthattheirbusinessmodelsareobsoleteandtheirportfolioshavegaps.

Althoughagilityisessential,manyB2Bcompaniesstillhavecomplexorganizationalstructuresandprocessesthatslowdownproductdevelopment.

Inthenextnormal,cross-functionalteams,withrepresentativesfromproductdevelopment,sales,customersupport,andothergroups,shouldfollowanagileapproachtocreatenewofferings.

Weeklydesignsprintsinwhichteamsfocusondesigningspecificproductfeaturesmayspeedthingsup.

9DesignedbyGlobalEditorialServicesCopyright2020McKinsey&Company.

Allrightsreserved.

MintiRayisanassociatepartnerinMcKinsey'sPhiladelphiaoffice.

StefanoRedaelliisaseniorpartnerinMcKinsey'sStamfordoffice,whereDamianRudichisanassociatepartner.

AndrewWongisanassociatepartnerintheChicagooffice.

TheauthorswouldliketothankSaravanaSivanandhamforhiscontributionstothisarticle.

B2Bcompanies,likeplayersinmostotherindustries,willbedealingwithchallengesarisingfromCOVID-19foryears.

Atpresent,mostleadersatthesecompaniesaresoconsumedwithsurvivingtheimmediatecrisisthattheyarenotlookingaheadtotherecoveryphase,whendemandwillagainbegintogrow.

Butleaderscouldincreasetheoddsoflong-termsuccessiftheyfocusedoninnovationduringtheCOVID-19crisisbylookingatnewproducts,strategies,andorganizationalstructures.

Thosefirstmoversmaygainanearlyadvantagethattheircompetitorsfinddifficulttomatch.

10

- statedrecovery教程相关文档

- rebuildrecovery教程

- CUCM的备份和恢复操作通过CLI

- 数据库recovery教程

- 画面recovery教程

- Orlandorecovery教程

- 您的recovery教程

鲸云10美元,香港BGPRM 1核 1G 10Mbps峰值带宽 1TB流量,江西CN2-NAT 1核 512MB内存 100M带宽 ,

WHloud Official Notice(鲸云官方通知)(鲸落 梦之终章)]WHloud RouMu Cloud Hosting若木产品线云主机-香港节点上新预售本次线路均为电信CN2 GIA+移动联通BGP,此机型为正常常规机,建站推荐。本次预售定为国庆后开通,据销售状况决定,照以往经验或有咕咕的可能性,但是大多等待时间不长。均赠送2个快照 2个备份,1个默认ipv4官方网站:https:/...

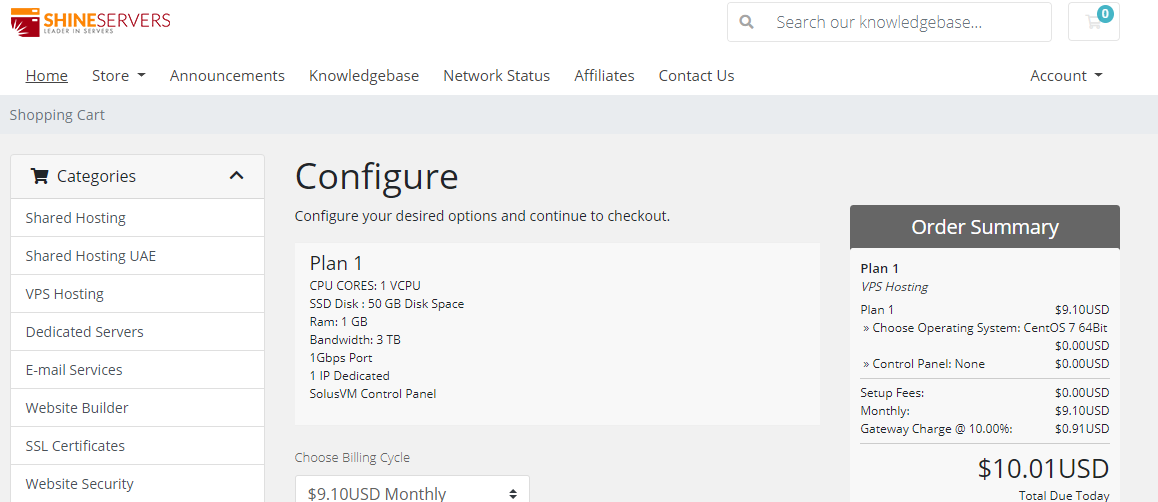

ShineServers(5美元/月)荷兰VPS、阿联酋VPS首月五折/1核1G/50GB硬盘/3TB流量/1Gbps带宽

优惠码50SSDOFF 首月5折50WHTSSD 年付5折15OFF 85折优惠,可循环使用荷兰VPSCPU内存SSD带宽IPv4价格购买1核1G50G1Gbps/3TB1个$ 9.10/月链接2核2G80G1Gbps/5TB1个$ 12.70/月链接2核3G100G1Gbps/7TB1个$ 16.30/月链接3核4G150G1Gbps/10TB1个$ 18.10/月链接阿联酋VPSCPU内存SS...

菠萝云:带宽广州移动大带宽云广州云:广州移动8折优惠,月付39元

菠萝云国人商家,今天分享一下菠萝云的广州移动机房的套餐,广州移动机房分为NAT套餐和VDS套餐,NAT就是只给端口,共享IP,VDS有自己的独立IP,可做站,商家给的带宽起步为200M,最高给到800M,目前有一个8折的优惠,另外VDS有一个下单立减100元的活动,有需要的朋友可以看看。菠萝云优惠套餐:广州移动NAT套餐,开放100个TCP+UDP固定端口,共享IP,8折优惠码:gzydnat-8...

recovery教程为你推荐

-

中国论坛大全天涯论坛的网址?1433端口路由器1433端口怎么开启网站优化方案网站优化方案怎么写?宽带接入服务器用wifi连不上服务器怎么办freebsd安装FreeBSD怎么安装中国杀毒软件排行榜谁知道世界杀毒软件排名?中国杀毒软件排行榜杀毒软件的最新排名?中国的排名?主板温度多少正常电脑主板温度多少正常office2007简体中文版office2007下载安装office2007简体中文版求office2007免费版下载地址 无需破解无需激活无须密钥