Prometeonbitchina

CHAPTERIIIRECENTPOLICYDEVELOPMENTSANDKEYISSUESA.

NATIONALINVESTMENTPOLICIES1.

OveralltrendsMostcountriescontinuedtoactivelyattractFDIin2017,andtheshareofinvestmentliberalizationorpromotionmeasuresincreasedcomparedwith2016.

However,theoverallshareofrestrictiveorregulatoryinvestmentpolicymeasureshassignificantlyincreasedinrecentmonthsandsomecountrieshavebecomemorecriticalofforeigntakeovers.

Also,additionalwaysandmeanstostrengtheninvestmentscreeningmechanismsareunderdiscussion,particularlyinsomedevelopedcountries.

In2017,accordingtoUNCTAD'scount,65economiesadopted126policymeasuresrelatedtoforeigninvestment.

1Thesefiguresconstitutethehighestnumberofcountriesoverthepastdecade,aswellasthehighestnumberofpolicychanges.

Ofatotalof126investmentpolicymeasures,93liberalized,promotedorfacilitatedinvestment,while18introducedrestrictionsorregulations.

Theremaining15wereofaneutralorindeterminatenature(tableIII.

1).

Theshareofinvestmentliberalizationandpromotionamongallmeasuresclimbedto84percent–anincreaseoffivepercentagepointscomparedwith2016(figureIII.

1).

Newinvestmentrestrictionsorregulationsforforeigninvestorsweremainlybasedonconsiderationsofnationalsecurity,localproducers'competitivenessorforeignownershipoflandandnaturalresources.

Byregion,developingcountriesinAsiacontinuedtotaketheleadinadoptinginvestmentpolicymeasures.

CountriesinAfrica,thetransitioneconomiesandEuropealsointroducednumerousmeasures(figureIII.

2).

Incontrasttotheoverallfavourabledevelopmentsforforeigninvestmentin2017,theshareofmoreTableIII.

1.

Changesinnationalinvestmentpolicies,2003–2017(Numberofmeasures)Item200320042005200620072008200920102011201220132014201520162017Numberofcountriesthatintroducedchanges597977704940465451576041495965Numberofregulatorychanges12516414412679688911686928774100125126Liberalization/promotion1131421181045851617762656352758493Restriction/regulation122025221915243321212112142218Neutral/indeterminatea-21-224636310111915Source:UNCTAD,InvestmentPolicyMonitordatabase.

aInsomecases,theexpectedimpactofthepolicymeasuresontheinvestmentisundetermined.

FigureIII.

1.

Changesinnationalinvestmentpolicies,20032017(Percent)Liberalization/PromotionRestriction/Regulation2003200520072009201120132015201784160255075100Source:UNCTAD,InvestmentPolicyMonitordatabase.

80restrictiveorregulatoryinvestmentpolicymeasuresincreasedsignificantlyinrecentmonths.

FromOctober2017toApril2018,about30percentofnewlyintroducedmeasureswererestrictiveorregulatory.

Somecountriesaretakingamorecriticalstancetowardsforeigntakeovers,inparticularwhentheyrelatetonationalsecurityorthesaleofstrategicdomesticassets.

Inaddition,waysandmeanstofurtherstrengtheninvestmentscreeningmechanismsarebeingdiscussed,particularlyinsomedevelopedcountries(seechapterIV.

C.

2.

d).

a.

Investmentliberalizationprominentin2017Investmentliberalizationwasamongtheprominentfeaturesofpolicymeasuresin2017.

2Aboutonethirdofpolicymeasureswererelatedtopartialorfullinvestmentliberalizationinindustriessuchastransport,energyandmanufacturing.

(i)CountriesinAsiaparticularlyactiveininvestmentliberalizationAsinpreviousyears,emergingeconomiesinAsiawerethemostactive.

Chinareviseditsforeigninvestmentnegativelistfor11freetradezones,liftinginvestmentrestrictionsinanumberofindustries.

ItalsoissuedanupdatedversionofitsInvestmentIndustryGuidanceCatalogue,whichreducedthenumberofrestrictivemeasuresfortheentryofforeigninvestmentfrom93to63andopenedupmoreactivitiesinservices,manufacturingandmining.

Italsoissuedaguidelinethatlistsbusinessesinwhichoutboundinvestmentisencouraged,limitedorprohibited.

InApril2018,thecountryannouncedatimelinefortheliberalizationoftheautomobileandfinancialindustries.

InJanuary2018,Indialiberalizedrulesoninwardinvestmentinseveralindustriesincludingsingle-brandretailtrading,airlinesandpowerexchanges.

TheLaoPeople'sDemocraticRepublicabolishedtheminimumregisteredcapitalrequirementsforcertainforeigninvestors.

InitsnewlyadoptedCompaniesAct,Myanmarallowedforeigninvestorstoholdupto35percentofsharesinadomesticcompanywithoutthecompanylosingitscategorizationasa"localcompany".

Italsopermittedforeigncompaniestoengageintradingoffertilizers,seeds,pesticides,hospitalequipmentandconstructionmaterials.

Previously,onlylocalcompaniesandjointventuresoflocalandforeigncompanieswereallowedtodoso.

SaudiArabiafullyliberalizedforeigninvestmentinengineeringservicesandassociatedconsultancyservices,providedthattheinvestorcompanyisatleast10yearsoldandoperatesinatleastfourcountries.

VietNamamendedthelistofconditionalbusinesslinesunderwhichdomesticandforeigncompaniesmustsatisfycertain"businessconditions"(e.

g.

technicalandstaffingrequirements).

Although16businesslineswereaddedtothelist,24–outofatotalof267–wereremoved.

Somenoteworthyinvestmentliberalizationmeasureshavebeenundertakeninotherregions.

Forexample,Egyptintroducedanewlawforthesettingupofanaturalgasregulatoryauthoritychargedwithlicensinganddevisingaplantoopenthegasmarkettocompetition.

Mexicoincreasedforeignownershipcapsforthesupplyoffuelsandlubricantsforships,aircraftandrailwayequipment,aswellasforcertainairtransportservices.

TheUnitedRepublicofTanzaniaallowedforeigninvestorstoacquiresharesinthelistedpaid-upcapitalFigureIII.

2.

Regionaldistributionofnationalinvestmentpolicymeasuresin2017(Numberofmeasures)661216181848NorthAmericaOtherdevelopedcountriesLatinAmericaandtheCaribbeanAfricaTransitioneconomiesEuropeDevelopingAsia49311512865Source:UNCTAD,InvestmentPolicyMonitordatabase.

81ofatelecommunicationcompany.

Zimbabweremovedthemajority-indigenousthreshold,exceptinthediamondandplatinumindustries.

In2018,Angolapassedanewinvestmentlawabolishingajointventurerequirementforforeigninvestorsandtheminimuminvestmentrequirement.

Thelawdoesnotapplytoinvestmentsinoilandminingexplorationaswellasotheractivitiesrelatedtofinancialinstitutionsgovernedbyspecificlaw.

(ii)OngoingprivatizationinseveralcountriesAnotherimportantinvestmentpolicyfeaturein2017wasprivatization.

Severalcountriesundertookfullorpartialprivatizations,benefitingbothdomesticandforeigninvestors.

Forinstance,BrazilawardedthreeEuropeangroupstherightstooperatefourairports.

TheGovernmentofCted'IvoireapprovedthesaleofStateminingcompanySodemi's30percentstakeintheItygoldproject.

GreecesignedaconcessioncontractwithaGermanconsortiumconcerning14regionalairports.

In2018,thecountryconcludedthesaleofa67percentstakeinThessalonikiPorttoaconsortiumofinvestors.

Montenegrosoldthepublicstakeinoneofthecountry'smajorportoperators(LukaBar)andinarailcargofirm(Montecargo).

PortugalsignedanagreementwithprivateequityfundLoneStartosella75percentstakeinState-rescuedlenderNovoBanco.

UzbekistanissuedadecreetosimplifytheproceduresandspeeduptheprocessofsaleofStateproperty,andtoeliminateadministrativebarrierstoprivatization.

VietNamprivatizeda54percentstakeinitslargestbrewer(Sabeco).

ItalsoissuedadecreetofacilitateprivatizationofState-ownedenterprisesby,forinstance,shorteningthelock-inperiodofstrategicpartners.

b.

OngoingeffortsforinvestmentfacilitationandpromotionInvestmentfacilitationandpromotioncontinuedtobeamajorelementofnewinvestmentpolicymeasuresin2017.

(i)NumerouscountriessimplifiedadministrativeproceduresArgentinapublishedadecreewith170measuresaimedateliminatingrulesandregulationsconsideredtoreducethecountry'scompetitiveness.

Australiaintroducedaseriesofchangestoitsforeigninvestmentframeworkbysimplifyingrelatedregulationsandthefeeframework.

Azerbaijanestablishedasingleonlineportalfortheissuanceofbusinesslicensesandpermits.

Beninlaunchedanonlineplatform(iGuide),providinginformationfordomesticandforeigninvestorsonbuildinganddevelopingbusinessplans.

Colombiamodernizeditsforeigninvestmentregistrationscheme,inparticularbyeliminatingregistrationdeadlines.

TheDominicanRepublicestablishedProDominicana,anentitytaskedwiththepromotionandfacilitationofforeigndirectinvestment(FDI)andexports.

EgyptpromulgatedtheIndustrialPermitsActanditsexecutiveregulations,aimingtoeaseproceduresforobtaininglicensesforindustrialestablishments.

ThecountryalsoputintoeffectanewInvestmentLaw,aimingtopromotedomesticandforeigninvestmentbyofferingfurtherincentives,reducingbureaucracyandsimplifyingadministrativeprocesses.

IndiaabolisheditsForeignInvestmentPromotionBoardandissuedstandardoperatingproceduresforhandlingFDIproposals,suchasthedesignationofcompetentauthoritiesandtimeframesforapplications.

Indonesiareplacedthelicenserequirementforestablishingabusinesswithaprocedureforregisteringaninvestment.

Jordansimplifiedregulationstostimulateinvestmentandimprovethebusinessenvironment.

MauritiusintroducedtheBusinessFacilitationAct2017,toeliminateregulatoryandadministrativebottleneckstoinvestment.

ThePhilippineslaunchedadigitalplatformcalledthePhilippineBusinessDataBank,aimingtoshortenthetimeneededforapplyingforandrenewingpermits.

SouthAfricalaunched82the"InvestSAOne-StopShopInitiative"asafocalpointoftheGovernment,coordinatingandfacilitatingregistrationandlicensingproceduresforallinvestors.

(ii)InvestmentincentivesremainanimportantpromotiontoolSomecountriesintroducedfiscalandfinancialincentivestoattractforeigninvestment.

TheRepublicofKorearestructuredtaxincentivesforforeigncompaniesengagedinhigh-techbusinessesandextendedtheirbenefits.

TheLaoPeople'sDemocraticRepublicpromulgatedanewinvestmentpromotionlaw,offeringvariousincentivestoattractinvestmentinbothpromotedindustriesandhardshipareas.

MoroccoenactedanewFinanceLaw,whichprovides,interalia,forcorporateincometaxexemptionsfornewlyestablishedindustrialcompaniesforacertainperiod.

Nigeriagranted"PioneerStatus"tothecreativeindustryandpublishedalistof27newindustriesthatareeligibletoenjoythePioneerStatusincentive.

ThailandintroduceditsnewInvestmentPromotionActtoprovidemoreincentivesforadvancedtechnologyandinnovationactivitiesaswellasresearchanddevelopment(R&D).

Tunisiapassedabillontaxincentives,aimingtostreamlinethatsystembyfocusingontheprioritiesofthenextperiod.

TheUnitedStatesintroducedtheTaxCutsandJobsAct,whichprovidesacorporateincometaxcutandothermeasurestoencourageMNEstobringoverseasfundsbackhome.

(iii)EstablishmentofnewSEZsSeveralcountriesestablishedspecialeconomiczones(SEZs)orrevisedpoliciesrelatedtoexistingSEZs.

Forinstance,BangladeshapprovedtheconstructionoffournewSEZs.

CongointroducedtwolawsimplementingthepolicyofdiversificationoftheCongoleseeconomyandcreatingSEZs.

Egyptissuedadecreeestablishingthe"GoldenTriangleEconomicZone".

MexicoestablishedthreenewSEZsinPuertoChiapas,CoatzacoalcosandLázaroCárdenas–LaUnión.

VietNamprovidedsomeincentivesfortheHoaLacHi-TechPark,includingpreferentialtaxtreatment,landuseincentivesandfavourableconditionsforimmigrationofforeignemployees.

ZimbabweexemptedinvestorsoperatinginSEZsfrompayingdutyonimportedcapitalequipment,materialsandproductsontheconditionthattheyareusedinSEZs.

In2018,ThailandenactedtheEasternEconomicCorridor(EEC)Act,whichprovidesincentivesforinvestorsintheEEC,suchastaxgrants,therighttolandownershipandtheissuanceofvisas.

(iv)ReformofdomesticinvestmentdisputeresolutionsystemMeanwhile,acoupleofcountriesreformedtheirdomesticsystemsofinvestmentdisputeresolution.

FijiandQatareachenactednewarbitrationlawsbasedlargelyontheModelLawonInternationalCommercialArbitrationoftheUnitedNationsCommissiononInternationalTradeLaw(UNCITRAL).

SaudiArabiaissuedImplementingRegulationsoftheArbitrationLaw,toenhanceitsbusinessenvironment.

c.

Newinvestmentrestrictionsorregulationsmainlyreflectconcernsaboutnationalsecurityandforeignownershipoflandandnaturalresources(i)IncreasingconcernsaboutimplicationsofforeigninvestmentfornationalsecuritySomecountriesintroducednewinvestmentrestrictionsorregulations,mainlyreflectingconcernsaboutnationalsecurityconsiderationsorforeigninvestmentinstrategicindustries.

Forinstance,ChinarestrictedcertainoutwardinvestmentbyspecificState-83ownedenterprises.

GermanyandJapanintroducedamendmentstotheirforeigninvestmentreviewmechanisms,mainlytoclarifyrulesandaddressshortcomingsthatwereidentifiedintheirapplication.

ItalyextendedtheGovernment'sso-called"goldenpowers"toblocktakeoversinhigh-techindustriesbynon-EUcompaniesthatmayposeaseriousthreattoessentialnationalinterestsorpresentarisktopublicorderandnationalsecurity.

TheRussianFederationintroducedcertainprohibitionsforinwardinvestmentbyoffshorecompanies.

ItnowalsorequirespriorGovernmentapprovalforforeigninvestmentincertaintransactionsinvolvingassetsofstrategicimportancefornationaldefenceandstatesecurity.

TheBolivarianRepublicofVenezuelapublishedthenewConstitutionalLawonForeignProductiveInvestment.

Amongotherchanges,itstatesthatforeigninvestorsmaynotparticipatedirectlyorindirectlyinnationalpoliticaldebates.

In2018,Lithuaniaamendedalawrelatedtoenterprises,mainlyseekingtosafeguardnationalsecurityincertaineconomicsectorsorwheninvestingincertainprotectedzones.

Morerecently,furtherchangestoinvestmentscreeningproceduresrelatedtonationalsecurityhavebeenconsideredorpreparedinseveraldevelopedeconomies.

Forexample,followinganinitiativebyFrance,GermanyandItaly,3theEuropeanCommissionproposedinSeptember2017toestablishanEU-wideFDIscreeningframework,mainlytoprotectlegitimateinterestswithregardtoFDIthatraisesconcernsaboutsecurityorpublicorder.

4InOctober2017,theGovernmentoftheUnitedKingdompublishedaGreenPaper,"NationalSecurityandInfrastructureInvestmentReview",askingforcommentsonproposednewstructuresforreviewingforeigninvestments.

5InJanuary2018,theUnitedStatesGovernmentstatedthatitsupportstheCongress'seffortstopassthe"ForeignInvestmentRiskReviewModernizationActof2017".

TheActwouldexpandthescopeoftransactionsreviewablebytheCommitteeonForeignInvestmentintheUnitedStates(CFIUS)tomoreeffectivelyaddressnationalsecurityconcerns.

6(ii)NewregulationsonaccessofforeigninvestorstolandandnaturalresourcesSeveralcountriesadoptednewregulationsonownershipoflandornaturalresourcesbyforeigninvestors.

Australiaintroducedanannualchargeonforeignownersofunderutilizedresidentialpropertyandincreasedfeesthatforeigninvestorsmustpaywhenseekingapprovaltopurchaseresidentialrealestate.

Italsointroducedaquantitativerestrictionontheacquisitionofcertainrealestateassetsbyforeigners.

TerritorialsubdivisionsofCanadaintroducedtheNon-ResidentSpeculationTax,relatingtotheacquisitionofresidentialpropertyinareaswithoverheatedhousingmarkets.

NewZealandtightenedscreeningproceduresforforeignacquisitionsofsensitiveland.

SouthAfricaintroducedanewMiningCharter,whichraisestheminimumthresholdforblackownershipofminingcompanies.

TheUnitedRepublicofTanzaniaadoptednewmininglaws,requiring,amongotherelements,thattheGovernmentobtainatleasta16percentstakeinminingandenergyprojects.

(iii)SomecountriesintroducednewlocalcontentrequirementsSeveralcountriesimposedlocalcontentrequirementsforinvestors.

Forexample,Indonesiaincreasedtheminimumlocalcontentrequirementfordomesticallyproduced4GsmartphonesthataresoldintheIndonesianmarket,from20percentto30percent.

Kenyareinforcedthelocalprocurementrequirementsforexistingmineralrightsholders.

In2018,theUnitedRepublicofTanzaniaadoptedseparate"MiningRegulationsonLocalContent"topromotetheuseoflocalexpertise,goodsandservices,businessesandfinancingintheminingvaluechain.

842.

MergercontrolsaffectingforeigninvestorsIn2017,severalhost-countrygovernmentsraisedobjectionstovariousforeigntakeoverattempts,inparticularwhentheyinvolvedthesaleofcriticalorstrategicdomesticassetstoforeigninvestors.

Amongallcross-borderM&Aswithavalueexceeding$100million,therewereatleast10dealswithdrawnforregulatoryorpoliticalreasons–3morethanin2016(WIR17,p.

105).

Calculatedonthebasisofthenumberofdeals,thisrepresentsapproximately17percentofallcross-borderM&Asexceeding$100millionin2017.

Theapproximategrossvalueofthe10withdrawndealswasroughly$35.

3billion.

Ofthe12M&Asthathadavalueover$50millionandupto$100million,onewaswithdrawnforregulatoryreasons.

ThemainindustriesinwhichM&Aswerewithdrawnforregulatoryorpoliticalreasonswerehigh-techmanufacturing(e.

g.

semiconductorsandelectronics),financialservices,digitalmappingservices,securityservicesandtelecommunication.

Asfarasthehomeeconomiesoftargetedcompaniesareconcerned,theUnitedStatesrankedfirst,followedbyNewZealand.

Onthebuyer'sside,investorsfromChinawerepredominantlyaffected.

Ofthe11withdrawndealsin2017,3wereterminatedinthescreeningprocessbecauseofconcernsrelatedtonationalsecurity.

AllrelatedtoattemptsbyChineseorGermaninvestorstoacquiretheassetsofhigh-techfirms,includinginsemiconductormanufacturing.

FiveM&Aswerewithdrawnin2017becauseofconcernsbycompetitionauthorities,andoneforeigntakeoverwasabortedforprudentialregulatoryreasons.

Withregardtothelatter,theplannedacquisitionwasdeclinedbytheNewZealandauthority,whichwasnotabletodeterminetheownershipstructureoftheacquiringgroup.

Inaddition,oneM&Awaswithdrawnin2017forotherregulatoryreasonsandanotheronebecausethecompaniesinvolveddidnotwanttowaitlongerforhost-countryapproval(tableIII.

2).

Inthefirstfourmonthsof2018,thetrendfrom2017continuedandevenintensified(tableIII.

3).

FromJanuarytoApril2018,sevendealswereabandoned,mostlyintheUnitedStates,whichismorethan60percentofallthedealswithdrawnin2017.

85TableIII.

2.

Foreigntakeoverswithdrawnforregulatoryorpoliticalreasonsin2017(Illustrativelist)FornationalsecurityreasonsInneonTechnologiesAG–CreeInc,WolfspeedaOn16February2017,CreeInc(UnitedStates)announcedthatitwouldterminateitsagreementtosellWolfspeed,whichincludesitssiliconcarbidesubstratebusiness,toInneonTechnologiesAG(Germany).

Itstatedthat"CreeandInneonhavebeenunabletoidentifyalternativeswhichwouldaddressthenationalsecurityconcernsoftheCommitteeonForeignInvestmentintheUnitedStates(CFIUS),andasaresult,theproposedtransactionwillbeterminated.

"CanyonBridgeCapitalPartnersLLC–LatticeSemiconductorCorporationbOn13September2017,thepresidentoftheUnitedStatesissuedanorderprohibitingtheacquisitionofLatticeSemiconductorCorporationbyaChinese-backedprivateequityrm.

ThepresidentfollowedarecommendationoftheCFIUS,whichhadfoundthattheacquisitionbyagroupofinvestors,includingtheState-controlledventurecapitalfund,wouldposeathreattoUnitedStatesnationalsecurity.

AconsortiumledbyNavinfoCo–HEREInternationalBVcOn26September2017,agroupofinvestorsledbythedigitalmapproviderNavInfoCo(China)abandoneditsproposedacquisitionofa10percentminoritystakeinthedigitalmappingserviceandsoftwarecompanyHEREInternationalBV,followingoppositionfromtheCFIUS.

ForcompetitionreasonsBainCapitalFundIVLP–ResiluxNVdOn28March2017,BainCapitalFundIV(UnitedStates)withdrewitsplanstolaunchatenderoffertoacquiretheentiresharecapitalofResiluxNV,aBelgium-basedpackagingcompany,inaleveragedbuyouttransactionbecauseofanantitrustrulinginGermanyfortheintendedcombinedacquisition.

LondonStockExchange–DeutscheBrseAGeOn29March2017,theEuropeanCommissionvetoedtheplannedmergerbetweenDeutscheBrseAGandtheLondonStockExchangeGroup.

TheCommissionfoundthatbycombiningtheactivitiesoftwoofthemajorstockexchangeoperators,adefactomonopolyinthemarketsofbondswouldhavebeencreatedand,inaddition,themergerwouldhaveremovedhorizontalcompetitionforthetradingandclearingofsinglestockequityderivatives.

Thevalueofthisdealwasestimatedtoamounttoroughly$31billion.

ZIMENSPZOO–KonsalnetHoldingSAfZIMENSPZO,aunitofaChinesesecuritycompany,withdrewitsplanstoacquireKonsalnetHoldingSA(Poland),aproviderofsecurityguardandpatrolservices,becauseofconcernsaboutaconcentrationissueraisedbythePolishCompetitionAuthorityinApril2017.

VeroInsuranceNewZealandLtd–TowerLtdgVeroInsuranceNewZealandLtd,ultimatelyownedbySuncorpGroup–anAustraliannancialcompany–withdrewitsoffertoacquiretheremaining80percentshareinTowerLtd,aNewZealand–basedinsurancecompany.

InJuly2017,theCommerceCommissionofNewZealanddeclinedthemergerattemptasitwasnotsatisedthatthemergerwouldnothavetheeffectofsubstantiallylesseningcompetitioninthepersonalinsurancemarket.

MelitaLtd–VodafoneMaltaLtdhOn8December2017,VodafoneGroupPlcwithdrewitsplantocombineVodafoneMalta(awirelesstelecommunicationcarrier)withMelitaLtd,aimingtocreateafullyintegratedcommunicationscompanyinMalta.

Initsmediarelease,VodafonestatedthatthepartiesdecidedtoterminatethetransactionasithadbecomeclearthattheywereunabletosatisfytheMalteseCompetitionAuthority'srequirements.

ForprudentialreasonsTIP-HNANewZealandHoldingsLtd–UDCFinanceLtdiOn21December2017,theOverseasInvestmentOfce(OIO)ofNewZealanddeclinedTIP-HNANewZealandHoldingsLtd'sapplicationtoacquire100percentofthesharesinUDCFinanceLtd(asubsidiaryofANZBank).

TheOIOemphasizedthattheinformationprovidedaboutownershipandcontrolinterestswasnotsufcient.

HNAGroupisaChinesermfromsouthernChinathatoperatesintheaviationbusiness.

ForotherregulatoryreasonsDolphinFundLtd–FIHGroupPlcjInApril2017,DolphinFundLtd–ownedbyanArgentineinvestor–withdrewitsoffertoacquireFIHGroupPlc(UnitedKingdom),whichplaysanimportantroleintheeconomyoftheFalklandIslands.

ThisfollowedtheFalklandIslandsGovernment'slettertoFIH,statingthatiftheownershipofthecompanychangeditcouldlosethestatusthatallowedittoacquirelandwithoutalicense.

Withdrawnwhilewaitingforhost-countryapprovalCowenGroupInc–CEFCChinaEnergyCoLtdkCEFCChinaEnergyCoagreedtoacquirea19.

9percentminoritystakeinCowenGroupInc(UnitedStates),aninvestmentbank,inaprivatelynegotiatedtransaction.

However,on24November2017,bothpartiesannouncedthattheyhadmutuallyagreedtowithdrawfromthelingwiththeCFIUSandnottopursuethedealowingtodelaysanduncertaintyinsecuringapprovalfromtheCFIUS.

Source:UNCTADbasedoncross-borderM/Adatabase(www.

unctad.

org-fdistatistics).

ahttps://www.

sec.

gov/Archives/edgar/data/895419/000089541917000021/ex9918k021617.

htm.

bhttps://www.

treasury.

gov/press-center/press-releases/Pages/sm0157.

aspx.

chttp://www.

navinfo.

com/news/detail.

aspxid=1217&sort=1.

dhttps://www.

resilux.

com/downloads/press/RESILUX-20170328-EN-Resilux%20-%20Bain%20Capital.

pdf.

ehttp://europa.

eu/rapid/press-release_IP-17-789_en.

htm.

fhttps://www.

uokik.

gov.

pl/koncentracje.

phpnews_id=13094&print=1.

ghttp://www.

comcom.

govt.

nz/the-commission/media-centre/media-releases/2017/commission-declines-vero-insurance-clearance-to-acquire-tower-/.

hhttp://www.

vodafone.

com/content/index/media/vodafone-group-releases/2017/termination-merger-malta-and-melita.

html.

ihttps://www.

linz.

govt.

nz/news/2017-12/overseas-investment-ofce-declines-consent-tip-hna.

jhttp://en.

mercopress.

com/2017/04/14/falklands-dolphin-fund-desists-from-taking-over-h-group-at-this-time.

khttp://www.

cowen.

com/news/cowen-and-cefc-china-announce-mutual-agreement-to-withdrawal-from-ling-with-the-cus.

86TableIII.

3.

Foreigntakeoverswithdrawnforregulatoryorpoliticalreasonsin2018,January–April(Illustrativelist)FornationalsecurityreasonsAntFinancialServicesGroup–MoneyGramInternationalIncaOn2January2018,AntFinancial(China)withdrewitsoffertoacquiretheentiresharecapitalofMoneyGramInternationalInc(UnitedStates),aproviderofnancialtransactionservices.

AccordingtoastatementbyMoneyGram,thepartieshadbeenadvisedthatCFIUSclearanceofthemergerwouldnotbeforthcomingandbothpartiesagreedtoterminatethedeal.

BlueFocusInternationalLtd–Cogint,IncbOn20February2018,Cogint,Inc(UnitedStates)adatasolutionsprovider,andBlueFocusInternationalLtd(HongKong,China)agreedtoterminatetheirbusinesscombinationagreement.

CogintstatedthattheCFIUShadindicateditsunwillingnesstoapprovethetransaction.

UnicCapitalManagementCoLtd–XcerraCorporationcOn22February2018,Xcerra(UnitedStates),amanufacturerofelectricalsignalsmeasuringandtestinginstruments,terminateditsmergeragreementwithUnicCapitalManagementandtheChinaIntegratedCircuitIndustryInvestmentFund.

XcerrastatedthataftercarefulreviewoffeedbackreceivedfromtheCFIUS,itconsideredthatapprovalofthismergerwouldbehighlyunlikely.

BroadcomLtd–QualcommIncdOn12March2018,thepresidentoftheUnitedStatesprohibitedtheproposedtakeoverofchipmakerQualcomm(UnitedStates)byBroadcom(Singapore)fornationalsecurityreasons.

InFebruary2018,Broadcomhadproposeda$117billionbidforthetakeoverofQualcomm.

ForprudentialreasonsConsortiumledbyChineseinvestors–ChicagoStockExchangeeOn15February2018,theSecuritiesandExchangeCommission(SEC)oftheUnitedStatesrejectedatakeoveroftheChicagoStockExchangebyagroupledbyChinese-basedinvestors.

TheSECsaidinastatementthatthereviewprocesshadraisedquestionsabout"whethertheproposedownershipstructure[would]allowtheCommissiontoexercisesufcientoversightoftheExchange.

"ForotherregulatoryreasonsAeolusTyreCoLtd–PrometeonTyreGroupSrlfAeolusTyreCoLtd(China)withdrewitsoffertoacquiretheremaining90percentstakeinPrometeonTyreGroupSrl(Italy),amanufacturerandwholesaleroftires,fromotherinvestorsinastockswaptransaction.

On4January2018,AeolusreleasedastatementsayingthattheChineseauthoritieshadfailedtograntapprovalfortheoverseasacquisitionbeforethe31December2017deadline.

Therelevantpartieswereunabletoreachaconsensusonanextension,itsaid,sothedealwasterminated.

Withdrawnwhilewaitingforhost-countryapprovalWarburgPincusIndia–TataTechnologiesLtdgInFebruary2018,WarburgPincusIndia,aunitofWarburgPincus(UnitedStates),aprivateequityrm,withdrewitsoffertoacquirea43percentstakeinTataTechnologies,anengineeringserviceanddesignarmofIndia'slargesttruckmaker,TataMotors.

Inamediastatement,TataMotorsstatedthatthedealhasbeenmutuallyterminated"duetodelaysinsecuringregulatoryapprovalsaswellasduetotherecentperformanceofthecompanynotmeetinginternalthresholdsbecauseofmarketchallenges.

"Source:UNCTAD.

ahttps://www.

sec.

gov/Archives/edgar/data/1273931/000119312518000668/d517771d8k.

htm.

bhttps://www.

sec.

gov/Archives/edgar/data/1460329/000129993318000201/htm_55915.

htm.

chttps://www.

sec.

gov/Archives/edgar/data/357020/000119312518054209/d533034d8k.

htm.

dhttps://www.

whitehouse.

gov/presidential-actions/presidential-order-regarding-proposed-takeover-qualcomm-incorporated-broadcom-limited.

ehttps://www.

sec.

gov/rules/sro/chx/2018/34-82727.

pdf.

fhttp://static.

sse.

com.

cn/disclosure/listedinfo/announcement/c/2018-01-05/600469_20180105_6.

pdf.

ghttps://www.

bloombergquint.

com/business/2018/02/05/warburg-pincus-calls-off-tata-tech-investment.

- Prometeonbitchina相关文档

- zgbitchina

- 李春课题组与合成生物系统研究所/生化工程系

- bitchinaBTchina和VeryCD是什么意思?这与87.53有什么关系?

- bitchina怎么下载电影?

- bitchina《绝对计划》蓝野明写的 我们的曲子 谁有啊?录音也行呵 谢谢啦!~~

- bitchina现在哪个浏览器最好用?

Virmach:1核/512M1核M1核512M/夏季美国vps促销,年付$7.2,9月更换AMD平台

virmach怎么样?virmach家这几年非常火,从商家的黑五闪购开始,以超低的价格吸引了大批的国人客户,而且商家的机器还是非常稳定的,站长手里的4.75刀年付已经用了两年了,非常稳定,不过商家到国内的线路一般,目前商家新上了夏季优惠促销,价格低到发指,年付7.2美元起,商家反馈将在9月开始更换AMD+NVMe平台,这个消息从年初就有了,不过一直没有更换,目前这个时间也不确定是否准确。点击进入:...

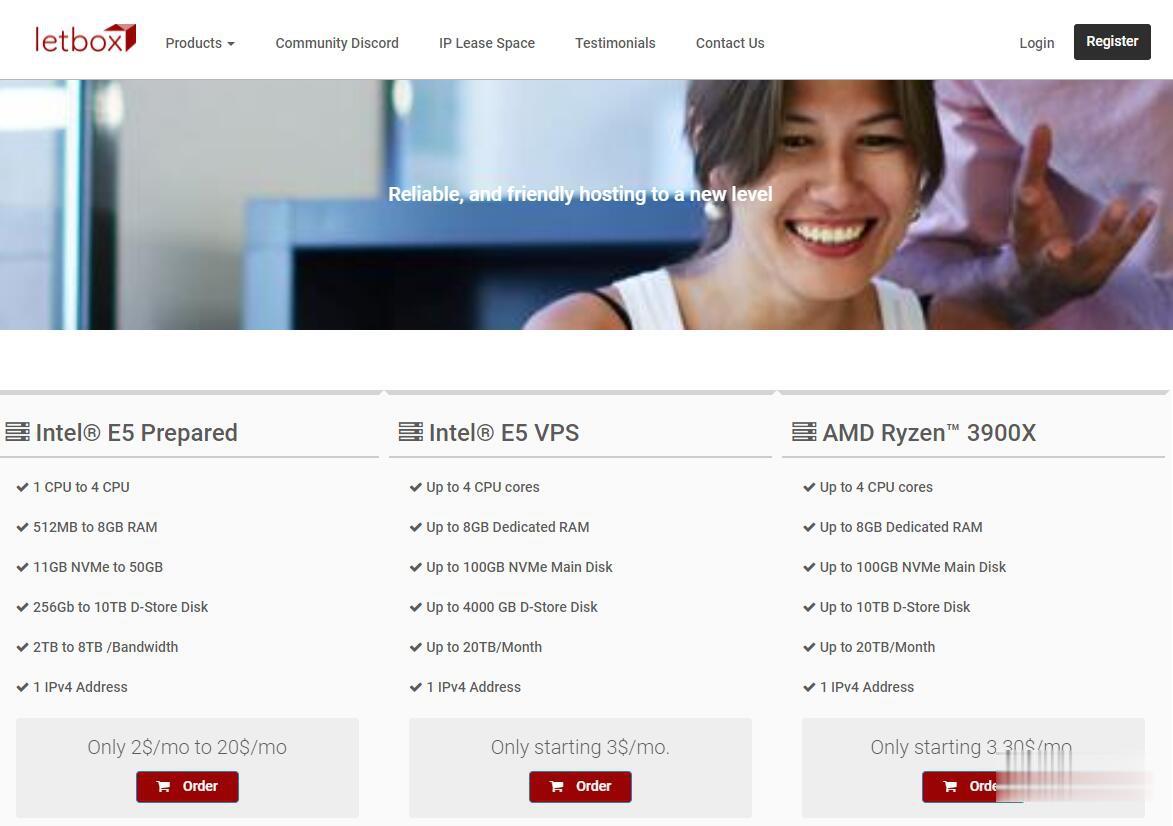

LetBox:美国洛杉矶/新泽西AMD大硬盘VPS,10TB流量,充值返余额,最低3.3美元两个月

LetBox此次促销依然是AMD Ryzen处理器+NVME硬盘+HDD大硬盘,以前是5TB月流量,现在免费升级到10TB月流量。另外还有返余额的活动,如果月付,月付多少返多少;如果季付或者半年付,返25%;如果年付,返10%。依然全部KVM虚拟化,可自定义ISO系统。需要大硬盘vps、大流量vps、便宜AMD VPS的朋友不要错过了。不过LetBox对帐号审核严格,最好注册邮箱和paypal帐号...

Boomer.host:$4.95/年-512MB/5GB/500GB/德克萨斯州(休斯顿)

部落曾经在去年分享过一次Boomer.host的信息,商家自述始于2018年,提供基于OpenVZ架构的VPS主机,配置不高价格较低。最近,主机商又在LET发了几款特价年付主机促销,最低每年仅4.95美元起,有独立IPv4+IPv6,开设在德克萨斯州休斯顿机房。下面列出几款VPS主机配置信息。CPU:1core内存:512MB硬盘:5G SSD流量:500GB/500Mbps架构:KVMIP/面板...

-

互联网周鸿祎http://www.huajinsc.cn/回收卡巴斯基奶粉ios8win10445端口windows server2008怎么开放4443端口css下拉菜单CSS如何把下拉菜单改为上拉菜单itunes备份怎样用itunes备份iphone谷歌sbSb是什么意思?css选择器css有哪些选择器迅雷下载速度迅雷下载快慢和什么有关