July76aav.com

76aav.com 时间:2021-04-07 阅读:()

StatisticsMarch2010InterestRateDerivativesIndexDerivativesEquityDerivativesMONTRALEXCHANGEINC.

InterestRateVolumeVolume%Volume%VolumeVolume%OpenInterestOpenInterest%OpenInterest%DerivativesMarch2010March2009variationFeb.

2010variationYTD2010YTD2009variationMarch2010March2009variationFeb.

2010variationBAX1,446,955618,079134.

1%1,070,28135.

2%3,279,9701,427,043129.

8%366,120227,97160.

6%406,228-9.

9%OBX25,3569,211175.

3%24,7502.

4%71,02334,710104.

6%55,37116,138243.

1%80,884-31.

5%CGB401,545366,5139.

6%630,090-36.

3%1,405,6761,363,5293.

1%161,263139,70915.

4%142,81912.

9%CGZ00N/A0N/A00N/A00N/A0N/AOGB0100-100.

0%1,325-100.

0%2,8976,598-56.

1%1,3254,884-72.

9%1,3250.

0%LGB00N/A0N/A00N/A00N/A0N/AONX00N/A0N/A00N/A00N/A0N/ACGF0N/AN/A0N/A0N/AN/A0N/AN/A0N/ASCF2N/AN/A4-50.

0%6N/AN/A0N/AN/A0N/ASubtotal1,873,858993,90388.

5%1,726,4508.

5%4,759,5722,831,88068.

1%584,079388,70250.

3%631,256-7.

5%IndexDerivativesSXF487,097581,972-16.

3%221,403120.

0%930,3171,098,726-15.

3%125,209121,2363.

3%126,520-1.

0%SXA00N/A0N/A020-100.

0%00N/A0N/ASXB84100.

0%0N/A856-85.

7%84100.

0%4100.

0%SXH00N/A0N/A00N/A00N/A0N/ASXY00N/A0N/A050-100.

0%00N/A0N/ASXO(LTIncluded)10,8121,725526.

8%2,457340.

0%15,6269,25068.

9%9,2005,88456.

4%5,23775.

7%Subtotal497,917583,701-14.

7%223,860122.

4%945,9511,108,102-14.

6%134,417127,1245.

7%131,7612.

0%ETFOptionsXIU(LTincluded)191,848143,76433.

4%50,599279.

2%382,772301,42227.

0%373,165179,394108.

0%447,562-16.

6%COW19012058.

3%34458.

8%420203106.

9%22018419.

6%16235.

8%HGD236N/AN/A2321.

7%590N/AN/A697N/AN/A866-13.

2%HGU596N/AN/A5508.

4%1,816N/AN/A752N/AN/A949-16.

3%HXD350946-63.

0%681-48.

6%2,0032,466-18.

8%79458236.

4%1,648-51.

8%HXU1621,409-88.

5%12430.

6%4293,584-88.

0%2451,494-83.

6%465-47.

3%XDV34430313.

5%17893.

3%874325168.

9%652262148.

9%743-12.

2%XIC444181145.

3%107315.

0%943201369.

2%707131439.

7%1,037-31.

8%XRE3648-25.

0%114-68.

4%42548785.

4%555431190.

7%1,166-52.

4%HOD1,113N/AN/A74649.

2%2,965N/AN/A840N/AN/A69920.

2%HOU4,082N/AN/A6,149-33.

6%19,938N/AN/A18,844N/AN/A50,310-62.

5%HFD192N/AN/A11862.

7%482N/AN/A353N/AN/A450-21.

6%HFU205N/AN/A42388.

1%343N/AN/A242N/AN/A117106.

8%XIN503N/AN/A34745.

0%1,293N/AN/A1,125N/AN/A1,191-5.

5%XSP703N/AN/A1,165-39.

7%2,043N/AN/A1,894N/AN/A1,7627.

5%HED40N/AN/A125-68.

0%196N/AN/A132N/AN/A145-9.

0%HEU106N/AN/A121-12.

4%248N/AN/A179N/AN/A218-17.

9%GAS11,050N/AN/A9,97210.

8%27,649N/AN/A15,395N/AN/A17,933-14.

2%XCB810N/AN/A150440.

0%1,055N/AN/A1,317N/AN/A78168.

6%XSB140N/AN/A10335.

9%408N/AN/A788N/AN/A826-4.

6%HND933N/AN/A982-5.

0%2,873N/AN/A813N/AN/A1,023-20.

5%HNU6,835N/AN/A4,74244.

1%18,388N/AN/A5,580N/AN/A2,737103.

9%CGL86N/AN/A0N/A86N/AN/A86N/AN/A0N/AXGD/XGL(LTincluded)21,5666,721220.

9%6,257244.

7%38,41318,551107.

1%15,1059,81553.

9%21,252-28.

9%XFN13,03017,033-23.

5%20,283-35.

8%54,65260,450-9.

6%8,65034,175-74.

7%62,208-86.

1%XIT9495-1.

1%149-36.

9%400418-4.

3%146314-53.

5%295-50.

5%XMA4145342-92.

3%571-27.

5%1,5276,048-74.

8%2,584533800.

0%-51.

6%2,690-3.

9%XEG/XEX(LTincluded)5,8645,6863.

1%12,691-53.

8%37,25511,688218.

7%14,9789,05065.

5%18,579-19.

4%Subtotal261,972181,64844.

2%117,332123.

3%600,486405,40448.

1%466,838240,78293.

9%637,814-26.

8%EquityDerivativesEquityOptions1,210,5111,283,066-5.

7%1,091,33510.

9%3,577,5913,584,877-0.

2%1,532,0801,257,35221.

8%1,451,2015.

6%LongTermOptions31,64740,451-21.

8%25,20425.

6%81,682123,704-34.

0%148,854234,588-36.

5%136,2339.

3%Subtotal1,242,1581,323,517-6.

1%1,116,53911.

3%3,659,2733,708,581-1.

3%1,680,9341,491,94012.

7%1,587,4345.

9%SubtotalEquityOpt.

+ETF1,504,1301,505,165-0.

1%1,233,87121.

9%4,259,7594,113,9853.

5%2,147,7721,732,72224.

0%2,225,248-3.

5%CurrencyOptionsUSX1,3513,129-56.

8%94343.

3%4,0395,682-28.

9%1,2731,533-17.

0%1,335-4.

6%CO2eDerivativesMCX00N/A0N/A010-100.

0%259267-3.

0%2590.

0%TOTAL3,877,2563,085,89825.

6%3,185,12421.

7%9,969,3218,059,65923.

7%2,867,8002,250,34827.

4%2,989,859-4.

1%BAX:Three-monthCanadianBankers'AcceptanceFuturesXFN:iUnitsS&P/TSXCappedFinancialsIndexFundCGL:ClaymoreGoldBullionETFCGB:Ten-yearGovernmentofCanadaBondFuturesXIT:iUnitsS&P/TSXCappedInformationTechnologyIndexFundXDV:OptionsoniSharesDJCanadaSelectDividendIndexFundCGZ:Two-yearGovernmentofCanadaBondFuturesXMA:iUnitsS&P/TSXCappedMaterialsIndexFundXIC:OptionsoniSharesCDNS&P/TSXCappedCompositeIndexFundCGF:Five-YearGovernmentofCanadaBondFuturesGAS:ClaymoreNaturalGasCommodityETFXRE:OptionsoniSharesCDNS&P/TSXCappedREITIndexFundOBX:OptionsonThree-monthCanadianBankers'AcceptanceFuturesXEG:iUnitsS&P/TSXCappedEnergyIndexFundSXF:S&PCanada60FuturesOGB:OptiononTen-yearGovernmentofCanadaBondFuturesHOD:HorizonsBetaProNYMEXCrudeOilBearPlusETFSXA:S&P/TSXCappedGoldIndexLGB:OptiononThirty-yearGovernmentofCanadaBondFuturesHOU:HorizonsBetaProNYMEXCrudeOilBullPlusETFSXB:S&P/TSXCappedFinancialsIndexXIU:OptionsoniSharesCDNLargeCap60IndexHFD:HorizonsBetaProS&P/TSXCappedFinancialsBearPlusETFSXH:S&P/TSXCappedInformationTechnologyIndexCOW:ClaymoreGlobalAgricultureHFU:HorizonsBetaProS&P/TSXCappedFinancialsBullPlusETFSXY:S&P/TSXCappedEnergyIndexHGD:HorizonsBetaProS&P/TSXGlobalGoldBearPlusFundHED:HorizonsBetaProS&P/TSXCapEnergyBear+ETFMCX-FuturesContractsonCanadaCarbonDioxideEquivalent(CO2e)UnitsHGU:HorizonsBetaProS&P/TSXGlobalGoldPlusPlusFundHEU:HorizonsBetaProS&P/TSXCapEnergyBull+ETFUSX:OptionsontheUSdollarHXD:HorizonsBetaProS&P/TSX60BearPlusFundHND:HorizonsBetaProNYMEXNaturalGasBearPlusFundHXU:HorizonsBetaProS&P/TSX60BullPlusFundHNU:HorizonsBetaProNYMEXNaturalGasBullPlusFundXGD:iUnitsS&P/TSXCappedGoldIndexFundXCB:iSharesCDNDEX-CorporateBondIndexFundXIN:iSharesCDNMSCIEAFE100%HedgedtoCADDollarsIndexFundXSP:iSharesCDNS&P500HedgedtoCADDollarsIndexFundXSB:iSharesCDNDEXShortTermBondIndexFundAllreportedfuturesandoptionsfiguresrepresentcleareddataasprovidedbytheCanadianDerivativesClearingCorporation(CDCC).

MonthlyVolumesYear-to-DateVolumesMonthEndOpenInterestMONTRALEXCHANGEINC.

HistoricalInterestRateDerivativeStatistics2010YTD20092008200720062005FuturesContractsVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestBAX3,279,970366,1207,668,781308,0989,958,833220,39115,237,958369,95616,702,302393,07811,157,298331,916CGB1,405,676161,2635,310,537130,9327,363,569137,0319,337,754214,8077,691,797335,2154,692,287162,620CGZ0000006,363085,3011,905132,6373,884CGF001600TOTAL4,685,646527,38312,979,478439,03017,345,955363,29224,595,857587,01424,481,675730,19815,982,222498,420FuturesOptionsOGB2,8971,32512,5311,69723,5535,87013,7822,2512,2750OBX71,02355,371234,86184,023282,19023,075748,99143,646605,80678,861377,37044,375TOTAL73,92056,696247,39285,720305,74328,945762,77345,897608,08178,861377,37044,375BondOptionsOBA2,8971,32512,5311,69723,5535,87013,7822,2512,2750752TOTAL2,8971,32512,5311,69723,5535,87013,7822,2512,2750752BAX:Three-monthCanadianBankers'AcceptanceFuturesOBX:OptionsonThree-monthCanadianBankers'AcceptanceFuturesCGB:Ten-yearGovernmentofCanadaBondFuturesOGB:OptiononTen-yearGovernmentofCanadaBondFuturesHistoricalIndexDerivativeStatistics2010YTD20092008200720062005FuturesContractsVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestSXF930,317125,2094,157,917115,3164,575,352111,5623,885,872149,9123,064,695166,6352,234,406109,823SXA0020091,186010,9081,56023,64529,898481SXB8894424,12929,0141,27014002660SXH000000002201720SXY00110028,76205,58511010,157313,662101TOTAL930,325125,2174,158,141115,3204,719,429111,5643,911,379152,8523,098,659166,6402,258,404110,405OptionsonIndexDerivativesSXO15,6269,20034,0562,24138,6663,54226,4841,71657,9741,69127,8974,813XIU382,772373,1651,956,588422,547661,28685,484364,92428,436317,63742,166176,49832,970COW4202201,4601616444HGD5906972,728967HGU1,8167524,789888HXD2,00379413,1371,4023,882356HXU42924510,1096377,6651,443XDV8746523,159666XIC9437073,022927XRE4255551,978948HOD2,9658409,491740HOU19,93818,84475,43947,638HFD4823532,662432HFU3432422,553134XIN1,2931,1251,624541XSP2,0431,8941,268500HED196132634141HEU248179378128GAS27,64915,39579,44415,902XCB1,0551,3171,280580XSB408788763661HND2,873813451266HNU18,3885,5802,0381,517CGL8686N/AN/AXGD38,41315,105114,88419,12158,43812,24589,4359,455144,6959,759111,5028,220XFN54,6528,650356,04043,807195,82013,128101,49912,404130,73028,80999,07914,054XIT4001462,1102383,24853814,98992710,0181,7367,9421,890XEG37,25514,978121,06414,35080,83816,132158,1789,635234,61119,263227,26829,687XMA1,5272,58414,6692,6815,81131359,37126911,0121,700XEG37,25514,978121,06414,350TOTAL616,112476,0382,817,818580,7611,055,718133,225814,88062,842906,677105,124650,18691,634SXF:S&PCanada60FuturesXIU:OptionsoniUnitsS&P/TSE60IndeXIU:OptionsoniUnitsS&P/TSE60IndexParticipationFundSXA,SXB,SXH,SXY:FuturesonS&P/TSEsectorialindicesHistoricalEquityDerivativeStatistics2010YTD20092008200720062005EquityOptionsVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestEquityOptions3,577,5911,532,08014,196,2571,417,61414,003,5551,266,47011,903,4021,470,00310,629,7491,144,9108,768,028992,293LongTermOptions81,682148,854311,004129,506630,044186,895730,658275,879787,009335,062641,910267,027TOTAL3,659,2731,680,93414,507,2611,547,12014,633,5991,453,36512,634,0601,745,88211,416,7581,479,9729,409,9381,259,320MONTRALEXCHANGEINC.

-averagesTradingDays2010200920102009Total6225062251January20212021February19191919March23222322April2121May2020June2222July2222August2020Septmber2121October2121November2021December2121InterestRateAve.

DailyvolumeDailyAve.

Volume%DailyAve.

Volume%DailyAve.

VolumeDailyAve.

Volume%DailyAve.

Volume%DerivativesMarch2010March2009variationFeb.

2010variationYTD.

2010YTD2009variation2009variationBAX62,91128,095123.

9%56,33111.

7%52,90323,017129.

8%30,67572.

5%OBX1,102419163.

3%1,303-15.

4%1,146560104.

6%93921.

9%CGB17,45816,6604.

8%33,163-47.

4%22,67221,9923.

1%21,2426.

7%CGZ(6)00N/A0N/A00N/A0N/AOGB05-100.

0%70-100.

0%47106-56.

1%50-6.

8%LGB(9)00N/A0N/A00N/A0N/AONX00N/A0N/A00N/A0N/ACGF(15)0N/AN/A0N/A0N/AN/A68-100.

0%SCF(17)0N/AN/A0N/A0N/AN/A7-98.

7%Subtotal(*)81,47245,17780.

3%86,323-5.

6%76,76745,67568.

1%52,96045.

0%IndexDerivativesSXF21,17826,453-19.

9%11,65381.

7%15,00517,721-15.

3%16,565-9.

4%SXA(2)00N/A0N/A00-100.

0%0-100.

0%SXB(2)0091.

3%0N/A01-85.

7%0-65.

5%SXH(2)00N/A0N/A00N/A0N/ASXY(2)00N/A0N/A01-100.

0%0-100.

0%SXO(LTtermincluded)47078499.

5%129263.

5%25214968.

9%13685.

8%Subtotal(*)21,64926,532-18.

4%11,19393.

4%15,25717,873-14.

6%16,702-8.

6%ETFOptionsXIU(LTIncluded)8,3416,53527.

6%2,663213.

2%6,1744,86227.

0%7,795-20.

8%COW(12)8551.

4%2361.

6%73106.

9%616.

5%XDV(13)15148.

6%959.

6%1412N/A15-3.

6%XIC(13)198134.

6%6242.

8%157N/A15-1.

4%XRE(13)22-28.

3%6-73.

9%72N/A10-32.

1%HGD(14)10N/AN/A12-16.

0%10N/AN/A17-42.

4%HGU(14)26N/AN/A29-10.

5%29N/AN/A290.

9%HXD(10)1543-64.

6%36-57.

5%3240-18.

8%52-38.

3%HXU(10)764-89.

0%77.

9%758-88.

0%40-82.

8%HOD(16)48N/AN/A3923.

2%48N/AN/A58-17.

9%HOU(16)177N/AN/A324-45.

2%322N/AN/A463-30.

5%HFD(16)8N/AN/A634.

4%8N/AN/A16-52.

4%HFU(16)9N/AN/A2303.

2%6N/AN/A16-64.

7%XIN(16)22N/AN/A1819.

7%21N/AN/A10109.

3%XSP(16)31N/AN/A61-50.

2%33N/AN/A8323.

6%HED(18)2N/AN/A7-73.

6%3N/AN/A6-46.

6%HEU(18)5N/AN/A6-27.

6%4N/AN/A413.

2%GAS(18)480N/AN/A525-8.

5%446N/AN/A742-39.

9%XCB(18)35N/AN/A8346.

1%17N/AN/A1242.

2%XSB(19)6N/AN/A512.

3%7N/AN/A10-31.

9%HND(20)41N/AN/A52-21.

5%46N/AN/A3533.

6%HNU(20)297N/AN/A25019.

1%297N/AN/A15789.

2%CGL(21)4N/AN/A0N/A2N/AN/AN/AN/AXGD/XGL(4)(LTIncluded)938306207%329184.

7%620299-36%45835.

4%XFN(4)567774-27%1,068-46.

9%88197512975%1,418-37.

9%XIT(4)44-5%8-47.

9%67-93%8-23.

3%XMA(8)18243-93%30-40.

1%2598-87%58-57.

9%XEG/XEX(LTincluded)255258-1%668-61.

8%601189-91%48224.

6%Subtotal11,3908,25737.

9%6,17584.

4%9,6856,55147.

8%11,091-12.

7%EquityDerivativesEquityOptions52,63158,321-9.

8%57,439-8.

4%57,70357,821-0.

2%56,5592.

0%LongTermOptions1,3761,839-25.

2%1,3273.

7%1,3171,995-34.

0%1,2396.

3%Subtotal54,00760,160-10.

2%55,827-3.

3%59,02159,816-1.

3%57,7982.

1%SubtotalEquityOpt.

+ETF(*)65,39768,417-4.

4%62,0025.

5%68,70666,3673.

5%68,889-0.

3%CurrencyOptionsUSX(7)59142-58.

7%5018.

4%6592-28.

9%119-45.

3%CO2eDerivativesMCX(11)00N/A0N/A00N/A0-100.

0%TOTAL(*)168,576140,26820.

2%167,6380.

6%160,796129,99523.

7%138,45816.

1%2-ListedonApril29,20028-ListedonSept.

26,200615-ListedonApril17,20094-ListedonApril21,20039-ListedonNov.

30,200716-ListedonMay8,2009*Thesenumbersarebasedonthenumberoftotaltradedcontracts5-ListedonJune23,200310-ListedonFeb.

25,200817-ListedonMay13,2009dividedbythenumberoftradingdaysduringthesameperiod6-ListedonMay03,200411-ListedonMay30,200818-ListedonJuly29,20097-ListedonSept.

26,200512-ListedonOctober6,200819-ListedonSept.

9,200913-ListedonFebruary23,200920-ListedonDec.

14,200914-ListedonApril6,200921-ListedonFeb.

19,2010AllreportedfuturesandoptionsfiguresrepresentclearedandcompensateddataasprovidedbytheCanadianDerivativesClearingCorporation(CDCC).

Index/Equity/ETF/CurrencyDerivativesInterestRateDerivativesMontréalExchangeInc.

-MonthlyOptionsSummary-MarchVolumeValueTransactionsOpenInterestCallsPutsTotalCallsPutsTotalCallsPutsTotal31-Mar-101AdvantageOil&GasLtd.

AAV5492387874236813910562785318711,1292BarrickGoldCorporationABX27,67717,02644,7037,203,4413,760,57010,964,0112,5861,2133,79975,3083HaryWinstonDiamondCorp.

ABZ/HW45025770723,58524,42048,0052130511,3974AstralMediaInc.

ACM56614370943,81017,11560,9253317507155ARCEnergyTrustAET5389563325,6709,45035,120356416616Agnico-EagleMinesLtd.

AEM6,6292,7189,3471,594,816922,2082,517,0248623671,2298,8617GroupeAeroplanInc.

AER38319057329,38810,25539,6434423676708AlamosGoldInc.

AGI1,7702,3884,158209,095269,860478,9555429837,5659AgriumIncAGU9,9394,31814,2573,593,289902,6174,495,9061,4315021,93314,65110LaSociétédeGestionAGFLimitéeAGF3,5333013,834239,22019,330258,550121361574,03911AlliedNevadaGoldCorp.

ANV3,1513,9767,127428,745447,685876,43028326011,56212AthabascaPotashInc.

API30302,1002,1002262813GroupeAeconInc.

ARE47924372253,35018,70572,05559258496314AurizonMinesLtd.

ARZ9771098788,06520088,265851861,70715ATSAutomationToolingSystemsInc.

ATA783511316,8702,07518,94594133,15916AlimentationCouche-TardInc.

ATD1,3985281,926134,33555,515189,850105621672,71517AtlanticPowerCorporationATP67912780682,4907,73090,22072138576318BrookfieldAssetManagementinc.

BAM8833891,27277,41530,915108,330103441473,52419BombardierInc.

Cl.

BSVBBD19,40312,00731,4101,109,338422,3671,531,70564218482651,21220CorporationCottBCB63113276323,9857,69031,6757214861,17721BCEInc.

BCE13,8983,86117,7591,370,489291,3791,661,8687402771,01719,68322IESI-BFCLtd.

BIN19717837517,53510,82028,3552619451,63323BircheliffEnergyLtd.

BIR6593671,02667,30036,320103,6205138892,74924BallardPowerSystemsBLD375304059,8601,10010,9602042493225BankofMontrealBMO34,45814,79849,2568,393,3532,162,62010,555,9732,0451,0913,13654,95926BankersPetroleumLtd.

BNK2,0576262,683150,92533,830184,755174532271,64227BankofNova-ScotiaBNS36,95414,13851,0925,825,8662,260,6638,086,5292,3357953,13045,09628BrookfieldPropertiesCorp.

BPO14,36149214,853562,95528,047591,0021524119314,17229BiovailCorporationBVF2,2373172,554137,58519,190156,775198262244,63130CAEInc.

CAE1,2552951,55083,21010,92594,135114221361,80431CascadesInc.

CAS1822020216,88095017,8301822054332CogecoCbleinc.

CCA83420854106,1151,650107,7653423690033CamecoCorp.

CCO/CCV14,6173,57218,189598,784412,4901,011,27456723680325,12134Curd`AleneMinesCorp.

CDM4163645231,09211,91043,0025345794835CanforCorp.

CFP3157038530,6303,70034,3302783582036CenterraGoldInc.

CG3,9561,5355,491407,040145,960553,000883512313,08337CIFinancialIncCIX1631833469,70022,52032,2202619452,52538CORUSEntertainmentInc.

CJR112401527,0353,65010,6851441847539ConsolidatedThompsonIronMinesCLM1,9275282,455179,49027,905207,3951664320913,56040CelesticaInc.

SVCLS2,5771,0953,672103,00554,000157,005122291514,07141CelticExplorationLtd.

CLT2448032460,6655,00065,6652162731942CDNImperialBankofComm.

CM30,16813,35043,5187,637,5772,661,34210,298,9191,5549772,53135,00043CanadianNaturalResourcesCNQ13,4834,25117,7342,875,448729,2743,604,7221,1074621,56921,74744CanadianNationalRailwayCNR/CNX6,0782,1108,1881,183,983382,7951,566,77863918382210,49845CanadianSandsTrustCOS2,5256,0328,557204,716564,405769,12123815539312,33646CanadianPacificRailwayCP3,1291,0224,151564,220127,790692,0104091105195,51247CrescentPointEnergyCorp.

CPG3,0543,1826,236282,456394,365676,82129318047312,02848CapitalPowerCorporationCPX65913279132,91517,63050,5457114851,16049CrewEnergyCR7774131,190100,08039,810139,89086421282,35250ChartwellSeniorsHousingRealEstateInvestmentTCSH33150150119,73051CorrienteResourcesInc.

CTQ1005006001,00040,00041,00012364052ColossusMineralsInc.

CSI1,0671131,180129,2009,200138,40098141121,74953CanadianUtilitiesLimitedCU2,6061732,779255,05520,475275,530113201334,32054CanadianTireLimitéeCTC8672361,103163,72542,135205,8606228902,36755CenovusEnergyInc.

CVE3,4401,0974,537375,45095,365470,8152941074014,93456CanadianWesternBankCWB1,1366821,818135,11567,895203,01082401223,63257CallowayRealEstateInvestmentTrustCWT1825436952,0252,72063914958DetourGoldCorp.

DGC8,0684,10612,174845,340373,2001,218,5401101812815,63359DragonWaveInc.

DWI1,4954991,994186,85049,100235,950143471901,62460DomtarInc.

DTC/UFS27268340283,40019,935303,33569107935461EncanaCorporationECA14,8734,62819,5011,392,224635,8112,028,0351,0184001,41822,96962EuropeanGoldfieldsLtd.

EGU40401,4001,400558363EldoradoGoldCorporationELD8,1751,5909,765557,27285,488642,7602618834914,50964EmeraInc.

EMA6323751,00734,88032,20067,08086451314,85365EnbridgeENB2,8815893,470532,39063,750596,1402886635411,14266EquinoxMineralsLtd.

EQN5,473615,534111,4002,985114,385554599,47767FondsEnerplusRessourcesERF1771793569,51018,89528,4051518331,14868EnsignEnergyServicesInc.

ESI28411339715,6855,40021,0853012421,22069FairborneEnergyLtd.

FEL6771,6302,30720,22056,14076,360581622204,44970FirstQuantumMineralsLtd.

FM20,3894,59224,9814,766,3401,760,8056,527,14556335591810,38371Franco-NevadaCorporationFNV4,4061,0885,494488,650100,425589,0751969028617,61972FNXMiningCompanyInc.

FNX5,4696,18311,652633,520225,925859,4453371274647,61173FronteerDevelopmentGroupInc.

FRG6852070524,70019024,890602621,01574FortisInc.

FTS1,4254451,870197,10068,530265,630150431935,93475FinningInternationalInc.

FTT45826071836,77011,22547,9955319721,31476GoldcorpInc.

G18,0098,86826,8772,898,1431,511,1544,409,2972,0758822,95731,88977GammonGoldInc.

GAM1,7537292,482138,13562,910201,045129511802,98178CGIInc.

(Groupe)ClASVGIB1,3673731,740142,68015,295157,975108121202,11779GildanActivewearInc.

GIL475186661113,83040,105153,9355111623,64780GerdauAmeristeelCorp.

GNA40312052317,4506,87524,32545115610,62681GalleonEnergyInc.

GO4,9751,7926,767365,05069,993435,043175702456,84782GranTierraEnergyInc.

GTE3121032218,37075019,1203713866183CorporationdeSécuritéGardaWorldGW4232544837,40575038,155493521,39784GreatWestLifeCoGWO9323831,315141,29027,380168,670130441745,26485HudBayMineralsInc.

HBM6,0842,4078,491485,285171,185656,47043515158610,35486HighpineOil&GasLtd.

HPX30861162,0501,2203,27045918187H&RRealEstateInvestmentTrustHR402422,9001703,07042641388HuskyEnergyInc.

HSE4,5032,9437,446510,819412,811923,63039220759920,39289IndustrialAllianceIns.

andFin.

ServicesIncIAG2,0921572,249176,75016,705193,4556019792,73290IGMFinancialInc.

IGM8072431,05087,39026,920114,310105291341,86791IntactCorporationFinancièreIFC/IIC564163727109,31011,105120,4155318711,17492IAMGoldCorp.

IMG12,8022,16114,963755,586219,589975,1753801365167,57693CorporationMinièreInmetIMN3,4992,1855,684718,380760,2451,478,6254762186947,17694ImperialOilLimitedIMO1,6231,5843,207329,910119,280449,190163982616,93495InternationalTowerHillMinesLtd.

ITH2020400400222096IvahoeMinesLtd.

IVN1,2372311,468122,80032,215155,015140241642,22597JaguarMiningInc.

JAG9642951,25992,08021,700113,78085291141,29398KinrossK12,1713,65015,821850,553303,0611,153,6149172661,18319,93599KingswayFinancialServicesInc.

KFS445100KeeganResourcesInc.

KGN1451455,6305,6301515145101LoblawCompaniesLtd.

L2,2044522,656157,36560,930218,295964614211,865102LululemonAthleticaInc.

LLL1,0827551,837243,230147,155390,385135812161,416103LundinMiningCorp.

LUN2,6621542,816154,7904,685159,475173151884,953104ManitobaTelecomMBT2,1017752,876187,53085,735273,265152702225,559105MDSInc.

MDS3657681,13310,67548,83059,5053659951,800106ManulifeFinancialMFC29,2298,68637,9152,689,942595,1453,285,0871,4425111,95362,949107MinefindersCorporationLtd.

MFL3911,1201,51135,205129,780164,9853617532,552108MagnaInternationalClAMG41615557181,98532,075114,0604923721,368109MigaoCorporationMGO1023513715,7902,00017,7908311659110MétroInc.

MRU7123651,077156,95040,060197,01087371241,392111MullenGroupLtd.

MTL101511525,3656,56011,92513619312112MethanexCorporationMX1,2245211,745133,220123,010256,230120401603,091113NationalBankofCanadaNA6,6271,4818,1081,697,006305,7552,002,76150612663216,540114NikoResourcesLtd.

NKO4911,1071,598176,330563,810740,14062441063,434115NortelNetworksCorp.

NT/NTX1,763116NewGoldInc.

NGD1,1002761,37659,19513,77072,965100251253,671117NuVistaEnergyLtd.

NVA2009529513,4506,07519,525201131835118NovaGoldResourcesInc.

NG94901847,8456,45014,29514923449119NexenInc.

NXY5,7791,3687,147420,466157,146577,6123239742013,099120OnexCorp.

OCX8,252958,347471,4554,445475,900909997,343121OPTI.

CanadaInc.

OPC646506967,6475,80013,447335382,612122CorporationMinièreOsiskoOSK10,62512,63923,264603,380554,4901,157,8701845323720,364123OpenTextCorp.

OTC5964641,06091,99548,530140,5255627834,662124PanAmericanSilverCorp.

PAA2,6508533,503453,50596,590550,095210822924,697125PetrobankEnergy&ResourcesLtd.

PBG3,7811,9505,731874,600317,7051,192,3053401665068,662126PetroBakkenEnergyLtd.

PBN2,3092,9675,276252,105337,200589,3051591713305,016127Petro-CanadaCom/VarPCA3310914233,17022,16055,330811192,490128PrecisionDrillingCorp.

PD/PDQ40214454625,7956,53032,3254216581,081129PaladinResourcesPDN4954053514,5142,70017,214414453,906130PengrowthEnergyTrustPGF4464048636,2204,05040,270253281,049131GroupeJeanCoutuInc.

PJC1,0761331,20982,02111,32093,34191141055,114132PetromineralesLtd.

PMG5,0124585,4701,378,35069,4701,447,820310503603,669133PotashPOT13,0996,59319,6925,777,7651,700,3167,478,0811,9887582,74614,807134ParamountResourcesLtd.

POU/POQ751196947111,84523,095134,9405327802,179135PowerCorp.

POW9722811,253106,58527,890134,475144391833,282136PacificRubialesEnergyCorp.

PRE22,0521,63923,6914,091,910192,5454,284,4555399763625,875137PowerCorp.

FINPWF1,8042732,077148,88520,435169,320187342214,528138PennWestEnergyTrustPWT1,3881271,51599,20510,980110,18594131072,075139ProEXEnergyLtd.

PXE2,1621552,31770,77012,18082,950129141432,010140QLTPhototherapeuticsInc.

QLT4526251423,3802,56025,94049857958141QuadraMiningLtd.

QUA9,3805,03414,4141,040,020493,4411,533,46149917567411,194142RedBackMiningInc.

RBI22,5675,22027,7872,943,280584,2203,527,50028410639030,096143RogersCommunicationClBRCI/RCY4,2341,0065,240558,495103,645662,14029010539518,259144RioCanRealEstateInvestmentTrustREI684723,8855004,385122141,238145ResearchInMotionRIM25,8509,53635,3869,458,2452,358,19311,816,4384,2191,3805,59921,141146RubiconMineralsCorp.

RMX1,304451,34993,5852,57596,16010551102,748147RonaInc.

RON28429557912,97522,69435,6692519443,085148MétauxRusselInc.

RUS1,3159732,288142,08436,860178,9441921062983,804149RoyalBankofCanadaRY/RYX40,82212,01652,8386,277,5531,832,6318,110,1842,3037913,09475,928150SherrittInternationalCorporationS5,8442,1377,981560,555101,024661,5793301014318,981151SaputoInc.

SAP1,2586421,90074,341270,815345,156142642063,295152CorporationShoppersDrugMartSC6,8671,8628,729505,415231,465736,88025915941824,482153ShawCommunicationsSJR/SJX2,0321,1563,188111,41678,405189,821212852975,011154SunLifeFinancialSLF8,9301,85510,785737,459291,0461,028,50536212248419,728155SilverWheatonCorp.

SLW8,5852,08910,674878,411145,9521,024,3639102011,1118,549156SNCLavalinSNC1,7807032,483255,85568,775324,630266893552,881157SuperiorPlusCorp.

SPB39528367821,79025,90047,6904532771,794158SilverStandardRessourcesInc.

SSO8575251,38284,325116,940201,26586641502,836159SuncorEnergyInc.

SU41,12220,85461,9765,043,6363,761,5408,805,1763,1171,1124,22968,688160SilvercorpMetalsInc.

SVM3705042038,1803,72041,900417481,231161SierraWirelessInc.

SW27637965521,66533,07554,740193655967162UraniumOneInc.

SXR/UUU3,3569514,30769,68347,306116,9891724521743,616163SXCHealthSolutionsCorp.

SXC252305557154,63527,210181,845473683874164TelusCorp.

T4,7994,5539,352750,840417,2551,168,09544415159515,167165TransAltaCorporationTA2,0831,0463,129150,16595,025245,190181972787,380166TeckComincoLtd.

TCK45,17514,01859,1938,461,4882,083,26110,544,7492,6041,1003,70490,745167ThompsonCreekMettalsCompanyInc.

TCM3,3221,5944,916277,994123,049401,043168532216,687168TricanWellServicesIncTCW60931992852,51538,18590,7005428821,003169Toronto-DominionBankTD46,83112,24159,07211,034,2312,392,78713,427,0182,7501,1173,86742,233170TrinidadDrillingTDG1,2002021,40277,83012,52590,355106201262,026171TransForceInc.

TFI25826852617,83022,23540,065263056654172Theratechnologiesinc.

TH173TimHortonsInc.

THI2,0341,2973,331316,55579,140395,695195972924,118174TalismanEnergyInc.

TLM7,4114,18811,599851,796365,2311,217,02746921067917,159175ThomsonCorporationTOC9634341,39785,00658,400143,406120551756,821176Sino-ForestCorporationTRE3,3491,3114,660304,650110,945415,5952801264064,568177TransCanadaCorp.

TRP8,5851,92310,5081,237,515204,1861,441,70164515980413,152178UraniumParticipationCorp.

U7120918,3221,0009,32210212412179VentanaGoldCorp.

VEN1,134151,149139,3552,175141,53012031231,181180VeroEnergyInc.

VRO1040502,4001,8004,20014550181SaskatchewanWheatPoolInc.

VT1,7435542,297147,15021,463168,613151381894,568182WestjetAirlinesInc.

WJA81211092290,5555,16095,7157211832,537183GeorgeWestonWN8902441,134198,72544,430243,15585331182,154184TSXGroupX1,5095372,046178,35063,517241,867144652094,405185YellowPagesIncomeFundYLO9061511,05733,25011,86545,1157012821,710186YamanaGoldInc.

YRI11,4227,40918,831814,345518,5451,332,8901,0674531,52017,838Sub-total898,500343,6581,242,158140,712,16748,133,397188,845,56459,83123,03282,8631,680,934NOTE:LongtermOptionsincludedinthevolumeListedonMArch15,2010MontréalExchangeInc.

-MonthlyOptionsSummary-Futures/Bond/Index/iUnitsVolumeValueTransactionsOpenInterestCallsPutsTotalCallsPutsTotalCallsPutsTotal31-Mar-10BAXBAXOptionsOBX11,67313,68325,3563,061,5253,134,2756,195,80027305755,371CGBCGBOptionsOGB0000000001,325S+P/CDA60IndexS+P/CDA60IndexSXO5,2515,56110,8126,039,11013,627,20519,666,3151211252469,200AgricultureETFAgricultureCOW1504019014,1502,10016,25015318220ETFonIndex*XIU44,821147,027191,8483,090,7716,333,5029,424,2737304671,197373,165ETFonSectorsHGD156802367,6255,00012,62514418697ETFonSectorsHGU5267059663,6754,06567,740701282752ETFonSectorsHFD601321923,6754,9258,600131528353ETFonSectorsHFU1258020531,6859,40041,08514822242ETFonIndexHED355401,7275502,277516132ETFonIndexHEU102410614,51536014,87512113179ETFonIndexHXD3262435033,48574034,22532335794ETFonIndexHXU857716212,0107,84519,85512820245ETFonIndexXCB52029081015,28011,55026,8305229811,317ETFonIndexXDV24410034415,7725,49521,267381149652ETFonIndexXIC31313144423,6205,97029,590301545707ETFonIndexXRE333367651,0601,825257555ETFonIndexXIN29321050319,46512,30031,7653121521,125ETFonIndexXSP6535070329,1752,15031,325335381,894ETFonIndexXSB60801401,4502,8504,3006814788ETFonCommodityHOD8512621,11361,12416,82577,949672895840ETFonCommodityHOU3,0431,0394,082233,10633,117266,2232588334118,844ETFonCommodityGAS7,3093,74111,050224,261208,494432,75537213350515,395ETFonCommodityHND770163933105,38517,910123,295732497813ETFonCommodityHNU5,4571,3786,835303,607111,720415,3274681386065,580ETFonCommodityCGL5630863,6507004,350641086Energy*XEG/XEX4,4761,3885,864476,015100,969576,9841967026614,978FinancialServicesXFN9,3393,69113,030531,643290,784822,427137772148,650Gold*XGD/XGL17,5494,01721,5663,527,434147,9693,675,40332915148015,105ITXIT7420947,0757007,7758210146MaterialsXMA1962184148,92028,06036,9801923422,584USD/CADCurrencyOptionsUSX8345171,351185,385159,339344,72471581291,273SubTotal115,350184,141299,49118,147,08524,287,92942,435,0143,2611,5624,823534,007GrandTotal1,013,850527,7991,541,649158,859,25272,421,326231,280,57863,09224,59487,6862,214,941NOTE*:LeapsincludedMontréalExchangeInc.

-CanadianEquityOptionsMarketTradingVolumebySector(*)MTDSectorsVolumeMarch.

2010%duvolumetransigé:VolumeMarch2009variationofvolumetraded:2010-2009VolumeFebruary2010variationofvolumetraded:Feb.

-Jan.

(2010)Materials472,00138.

0%409,10815.

4%443,7556.

37%Industrials55,2154.

4%62,654-11.

9%39,98238.

10%Telecommunications34,3452.

8%34,886-1.

6%34,2030.

42%ConsumerDiscretionary15,7511.

3%39,769-60.

4%21,860-27.

95%Energy220,54917.

8%299,749-26.

4%202,3598.

99%Financials345,67527.

8%399,591-13.

5%289,62319.

35%HealthCare4,2010.

3%2,087101.

3%3,35725.

14%Technology42,4153.

4%23,05484.

0%35,82118.

41%Utilities30,3152.

4%29,7641.

9%18,86060.

74%ConsumerStaples21,6911.

7%22,855-5.

1%26,719-18.

82%Total1,242,158100.

00%1,323,517-6.

1%1,116,53911.

3%YTDSectorsVolumeYTD2010TradeVolume(%)VolumeYTD2009ChangeVolumeYTD2010/YTD2009Materials1,418,78538.

8%1,255,36513.

0%Industrials156,4694.

3%193,497-19.

1%Telecommunications97,5122.

7%128,982-24.

4%ConsumerDiscretionary58,6631.

6%88,646-33.

8%Energy644,89117.

6%711,048-9.

3%Financials988,99727.

0%1,099,419-10.

0%HealthCare12,0620.

3%7,22267.

0%Technology116,0763.

2%65,30377.

7%Utilities69,2361.

9%104,282-33.

6%ConsumerStaples96,5822.

6%54,81776.

2%Total3,659,273100.

00%3,708,581-1.

3%*SectorbreakdownsarebasedontheS&P/TSXIndicesTradedvolumedistributionpersector(YTD)0200,000400,000600,000800,0001,000,0001,200,0001,400,0001,600,000MaterialsIndustrialsTelecomm.

ConsumerDiscretionaryEnergyFinancialsHealthCareTechnologyUtilitiesConsumerStaples20102009Tradedvolumedistributionpersector(MTD)060,000120,000180,000240,000300,000360,000420,000480,000540,000MaterialsIndustrialsTelecomm.

ConsumerDiscretionaryEnergyFinancialsHealthCareTechnologyUtilitiesConsumerStaples20102009BAXThree-MonthCanadianBankers'AcceptanceFuturesDecember2005CGBTen-YearGovernmentofCanadaBondFuturesCGB-volumeandopeninterest0200,000400,000600,000800,0001,000,0001,200,0001,400,0001,600,000volumeopeninterest2007200820092010BAX-volumeandopeninterest0250,000500,000750,0001,000,0001,250,0001,500,0001,750,0002,000,0002,250,0002,500,000volumeopeninterest2007200820092010SXFS&PCanada60IndexFuturesDecember2005EquityOptionsSXF-volumeandopeninterest065,000130,000195,000260,000325,000390,000455,000520,000585,000650,000715,000volumeopeninterest2007200820092010EquityOptions-volumeandopeninterest0200,000400,000600,000800,0001,000,0001,200,0001,400,0001,600,0001,800,0002,000,000volumeopeninterest2007200820092010

InterestRateVolumeVolume%Volume%VolumeVolume%OpenInterestOpenInterest%OpenInterest%DerivativesMarch2010March2009variationFeb.

2010variationYTD2010YTD2009variationMarch2010March2009variationFeb.

2010variationBAX1,446,955618,079134.

1%1,070,28135.

2%3,279,9701,427,043129.

8%366,120227,97160.

6%406,228-9.

9%OBX25,3569,211175.

3%24,7502.

4%71,02334,710104.

6%55,37116,138243.

1%80,884-31.

5%CGB401,545366,5139.

6%630,090-36.

3%1,405,6761,363,5293.

1%161,263139,70915.

4%142,81912.

9%CGZ00N/A0N/A00N/A00N/A0N/AOGB0100-100.

0%1,325-100.

0%2,8976,598-56.

1%1,3254,884-72.

9%1,3250.

0%LGB00N/A0N/A00N/A00N/A0N/AONX00N/A0N/A00N/A00N/A0N/ACGF0N/AN/A0N/A0N/AN/A0N/AN/A0N/ASCF2N/AN/A4-50.

0%6N/AN/A0N/AN/A0N/ASubtotal1,873,858993,90388.

5%1,726,4508.

5%4,759,5722,831,88068.

1%584,079388,70250.

3%631,256-7.

5%IndexDerivativesSXF487,097581,972-16.

3%221,403120.

0%930,3171,098,726-15.

3%125,209121,2363.

3%126,520-1.

0%SXA00N/A0N/A020-100.

0%00N/A0N/ASXB84100.

0%0N/A856-85.

7%84100.

0%4100.

0%SXH00N/A0N/A00N/A00N/A0N/ASXY00N/A0N/A050-100.

0%00N/A0N/ASXO(LTIncluded)10,8121,725526.

8%2,457340.

0%15,6269,25068.

9%9,2005,88456.

4%5,23775.

7%Subtotal497,917583,701-14.

7%223,860122.

4%945,9511,108,102-14.

6%134,417127,1245.

7%131,7612.

0%ETFOptionsXIU(LTincluded)191,848143,76433.

4%50,599279.

2%382,772301,42227.

0%373,165179,394108.

0%447,562-16.

6%COW19012058.

3%34458.

8%420203106.

9%22018419.

6%16235.

8%HGD236N/AN/A2321.

7%590N/AN/A697N/AN/A866-13.

2%HGU596N/AN/A5508.

4%1,816N/AN/A752N/AN/A949-16.

3%HXD350946-63.

0%681-48.

6%2,0032,466-18.

8%79458236.

4%1,648-51.

8%HXU1621,409-88.

5%12430.

6%4293,584-88.

0%2451,494-83.

6%465-47.

3%XDV34430313.

5%17893.

3%874325168.

9%652262148.

9%743-12.

2%XIC444181145.

3%107315.

0%943201369.

2%707131439.

7%1,037-31.

8%XRE3648-25.

0%114-68.

4%42548785.

4%555431190.

7%1,166-52.

4%HOD1,113N/AN/A74649.

2%2,965N/AN/A840N/AN/A69920.

2%HOU4,082N/AN/A6,149-33.

6%19,938N/AN/A18,844N/AN/A50,310-62.

5%HFD192N/AN/A11862.

7%482N/AN/A353N/AN/A450-21.

6%HFU205N/AN/A42388.

1%343N/AN/A242N/AN/A117106.

8%XIN503N/AN/A34745.

0%1,293N/AN/A1,125N/AN/A1,191-5.

5%XSP703N/AN/A1,165-39.

7%2,043N/AN/A1,894N/AN/A1,7627.

5%HED40N/AN/A125-68.

0%196N/AN/A132N/AN/A145-9.

0%HEU106N/AN/A121-12.

4%248N/AN/A179N/AN/A218-17.

9%GAS11,050N/AN/A9,97210.

8%27,649N/AN/A15,395N/AN/A17,933-14.

2%XCB810N/AN/A150440.

0%1,055N/AN/A1,317N/AN/A78168.

6%XSB140N/AN/A10335.

9%408N/AN/A788N/AN/A826-4.

6%HND933N/AN/A982-5.

0%2,873N/AN/A813N/AN/A1,023-20.

5%HNU6,835N/AN/A4,74244.

1%18,388N/AN/A5,580N/AN/A2,737103.

9%CGL86N/AN/A0N/A86N/AN/A86N/AN/A0N/AXGD/XGL(LTincluded)21,5666,721220.

9%6,257244.

7%38,41318,551107.

1%15,1059,81553.

9%21,252-28.

9%XFN13,03017,033-23.

5%20,283-35.

8%54,65260,450-9.

6%8,65034,175-74.

7%62,208-86.

1%XIT9495-1.

1%149-36.

9%400418-4.

3%146314-53.

5%295-50.

5%XMA4145342-92.

3%571-27.

5%1,5276,048-74.

8%2,584533800.

0%-51.

6%2,690-3.

9%XEG/XEX(LTincluded)5,8645,6863.

1%12,691-53.

8%37,25511,688218.

7%14,9789,05065.

5%18,579-19.

4%Subtotal261,972181,64844.

2%117,332123.

3%600,486405,40448.

1%466,838240,78293.

9%637,814-26.

8%EquityDerivativesEquityOptions1,210,5111,283,066-5.

7%1,091,33510.

9%3,577,5913,584,877-0.

2%1,532,0801,257,35221.

8%1,451,2015.

6%LongTermOptions31,64740,451-21.

8%25,20425.

6%81,682123,704-34.

0%148,854234,588-36.

5%136,2339.

3%Subtotal1,242,1581,323,517-6.

1%1,116,53911.

3%3,659,2733,708,581-1.

3%1,680,9341,491,94012.

7%1,587,4345.

9%SubtotalEquityOpt.

+ETF1,504,1301,505,165-0.

1%1,233,87121.

9%4,259,7594,113,9853.

5%2,147,7721,732,72224.

0%2,225,248-3.

5%CurrencyOptionsUSX1,3513,129-56.

8%94343.

3%4,0395,682-28.

9%1,2731,533-17.

0%1,335-4.

6%CO2eDerivativesMCX00N/A0N/A010-100.

0%259267-3.

0%2590.

0%TOTAL3,877,2563,085,89825.

6%3,185,12421.

7%9,969,3218,059,65923.

7%2,867,8002,250,34827.

4%2,989,859-4.

1%BAX:Three-monthCanadianBankers'AcceptanceFuturesXFN:iUnitsS&P/TSXCappedFinancialsIndexFundCGL:ClaymoreGoldBullionETFCGB:Ten-yearGovernmentofCanadaBondFuturesXIT:iUnitsS&P/TSXCappedInformationTechnologyIndexFundXDV:OptionsoniSharesDJCanadaSelectDividendIndexFundCGZ:Two-yearGovernmentofCanadaBondFuturesXMA:iUnitsS&P/TSXCappedMaterialsIndexFundXIC:OptionsoniSharesCDNS&P/TSXCappedCompositeIndexFundCGF:Five-YearGovernmentofCanadaBondFuturesGAS:ClaymoreNaturalGasCommodityETFXRE:OptionsoniSharesCDNS&P/TSXCappedREITIndexFundOBX:OptionsonThree-monthCanadianBankers'AcceptanceFuturesXEG:iUnitsS&P/TSXCappedEnergyIndexFundSXF:S&PCanada60FuturesOGB:OptiononTen-yearGovernmentofCanadaBondFuturesHOD:HorizonsBetaProNYMEXCrudeOilBearPlusETFSXA:S&P/TSXCappedGoldIndexLGB:OptiononThirty-yearGovernmentofCanadaBondFuturesHOU:HorizonsBetaProNYMEXCrudeOilBullPlusETFSXB:S&P/TSXCappedFinancialsIndexXIU:OptionsoniSharesCDNLargeCap60IndexHFD:HorizonsBetaProS&P/TSXCappedFinancialsBearPlusETFSXH:S&P/TSXCappedInformationTechnologyIndexCOW:ClaymoreGlobalAgricultureHFU:HorizonsBetaProS&P/TSXCappedFinancialsBullPlusETFSXY:S&P/TSXCappedEnergyIndexHGD:HorizonsBetaProS&P/TSXGlobalGoldBearPlusFundHED:HorizonsBetaProS&P/TSXCapEnergyBear+ETFMCX-FuturesContractsonCanadaCarbonDioxideEquivalent(CO2e)UnitsHGU:HorizonsBetaProS&P/TSXGlobalGoldPlusPlusFundHEU:HorizonsBetaProS&P/TSXCapEnergyBull+ETFUSX:OptionsontheUSdollarHXD:HorizonsBetaProS&P/TSX60BearPlusFundHND:HorizonsBetaProNYMEXNaturalGasBearPlusFundHXU:HorizonsBetaProS&P/TSX60BullPlusFundHNU:HorizonsBetaProNYMEXNaturalGasBullPlusFundXGD:iUnitsS&P/TSXCappedGoldIndexFundXCB:iSharesCDNDEX-CorporateBondIndexFundXIN:iSharesCDNMSCIEAFE100%HedgedtoCADDollarsIndexFundXSP:iSharesCDNS&P500HedgedtoCADDollarsIndexFundXSB:iSharesCDNDEXShortTermBondIndexFundAllreportedfuturesandoptionsfiguresrepresentcleareddataasprovidedbytheCanadianDerivativesClearingCorporation(CDCC).

MonthlyVolumesYear-to-DateVolumesMonthEndOpenInterestMONTRALEXCHANGEINC.

HistoricalInterestRateDerivativeStatistics2010YTD20092008200720062005FuturesContractsVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestBAX3,279,970366,1207,668,781308,0989,958,833220,39115,237,958369,95616,702,302393,07811,157,298331,916CGB1,405,676161,2635,310,537130,9327,363,569137,0319,337,754214,8077,691,797335,2154,692,287162,620CGZ0000006,363085,3011,905132,6373,884CGF001600TOTAL4,685,646527,38312,979,478439,03017,345,955363,29224,595,857587,01424,481,675730,19815,982,222498,420FuturesOptionsOGB2,8971,32512,5311,69723,5535,87013,7822,2512,2750OBX71,02355,371234,86184,023282,19023,075748,99143,646605,80678,861377,37044,375TOTAL73,92056,696247,39285,720305,74328,945762,77345,897608,08178,861377,37044,375BondOptionsOBA2,8971,32512,5311,69723,5535,87013,7822,2512,2750752TOTAL2,8971,32512,5311,69723,5535,87013,7822,2512,2750752BAX:Three-monthCanadianBankers'AcceptanceFuturesOBX:OptionsonThree-monthCanadianBankers'AcceptanceFuturesCGB:Ten-yearGovernmentofCanadaBondFuturesOGB:OptiononTen-yearGovernmentofCanadaBondFuturesHistoricalIndexDerivativeStatistics2010YTD20092008200720062005FuturesContractsVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestSXF930,317125,2094,157,917115,3164,575,352111,5623,885,872149,9123,064,695166,6352,234,406109,823SXA0020091,186010,9081,56023,64529,898481SXB8894424,12929,0141,27014002660SXH000000002201720SXY00110028,76205,58511010,157313,662101TOTAL930,325125,2174,158,141115,3204,719,429111,5643,911,379152,8523,098,659166,6402,258,404110,405OptionsonIndexDerivativesSXO15,6269,20034,0562,24138,6663,54226,4841,71657,9741,69127,8974,813XIU382,772373,1651,956,588422,547661,28685,484364,92428,436317,63742,166176,49832,970COW4202201,4601616444HGD5906972,728967HGU1,8167524,789888HXD2,00379413,1371,4023,882356HXU42924510,1096377,6651,443XDV8746523,159666XIC9437073,022927XRE4255551,978948HOD2,9658409,491740HOU19,93818,84475,43947,638HFD4823532,662432HFU3432422,553134XIN1,2931,1251,624541XSP2,0431,8941,268500HED196132634141HEU248179378128GAS27,64915,39579,44415,902XCB1,0551,3171,280580XSB408788763661HND2,873813451266HNU18,3885,5802,0381,517CGL8686N/AN/AXGD38,41315,105114,88419,12158,43812,24589,4359,455144,6959,759111,5028,220XFN54,6528,650356,04043,807195,82013,128101,49912,404130,73028,80999,07914,054XIT4001462,1102383,24853814,98992710,0181,7367,9421,890XEG37,25514,978121,06414,35080,83816,132158,1789,635234,61119,263227,26829,687XMA1,5272,58414,6692,6815,81131359,37126911,0121,700XEG37,25514,978121,06414,350TOTAL616,112476,0382,817,818580,7611,055,718133,225814,88062,842906,677105,124650,18691,634SXF:S&PCanada60FuturesXIU:OptionsoniUnitsS&P/TSE60IndeXIU:OptionsoniUnitsS&P/TSE60IndexParticipationFundSXA,SXB,SXH,SXY:FuturesonS&P/TSEsectorialindicesHistoricalEquityDerivativeStatistics2010YTD20092008200720062005EquityOptionsVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestVolumeOpenInterestEquityOptions3,577,5911,532,08014,196,2571,417,61414,003,5551,266,47011,903,4021,470,00310,629,7491,144,9108,768,028992,293LongTermOptions81,682148,854311,004129,506630,044186,895730,658275,879787,009335,062641,910267,027TOTAL3,659,2731,680,93414,507,2611,547,12014,633,5991,453,36512,634,0601,745,88211,416,7581,479,9729,409,9381,259,320MONTRALEXCHANGEINC.

-averagesTradingDays2010200920102009Total6225062251January20212021February19191919March23222322April2121May2020June2222July2222August2020Septmber2121October2121November2021December2121InterestRateAve.

DailyvolumeDailyAve.

Volume%DailyAve.

Volume%DailyAve.

VolumeDailyAve.

Volume%DailyAve.

Volume%DerivativesMarch2010March2009variationFeb.

2010variationYTD.

2010YTD2009variation2009variationBAX62,91128,095123.

9%56,33111.

7%52,90323,017129.

8%30,67572.

5%OBX1,102419163.

3%1,303-15.

4%1,146560104.

6%93921.

9%CGB17,45816,6604.

8%33,163-47.

4%22,67221,9923.

1%21,2426.

7%CGZ(6)00N/A0N/A00N/A0N/AOGB05-100.

0%70-100.

0%47106-56.

1%50-6.

8%LGB(9)00N/A0N/A00N/A0N/AONX00N/A0N/A00N/A0N/ACGF(15)0N/AN/A0N/A0N/AN/A68-100.

0%SCF(17)0N/AN/A0N/A0N/AN/A7-98.

7%Subtotal(*)81,47245,17780.

3%86,323-5.

6%76,76745,67568.

1%52,96045.

0%IndexDerivativesSXF21,17826,453-19.

9%11,65381.

7%15,00517,721-15.

3%16,565-9.

4%SXA(2)00N/A0N/A00-100.

0%0-100.

0%SXB(2)0091.

3%0N/A01-85.

7%0-65.

5%SXH(2)00N/A0N/A00N/A0N/ASXY(2)00N/A0N/A01-100.

0%0-100.

0%SXO(LTtermincluded)47078499.

5%129263.

5%25214968.

9%13685.

8%Subtotal(*)21,64926,532-18.

4%11,19393.

4%15,25717,873-14.

6%16,702-8.

6%ETFOptionsXIU(LTIncluded)8,3416,53527.

6%2,663213.

2%6,1744,86227.

0%7,795-20.

8%COW(12)8551.

4%2361.

6%73106.

9%616.

5%XDV(13)15148.

6%959.

6%1412N/A15-3.

6%XIC(13)198134.

6%6242.

8%157N/A15-1.

4%XRE(13)22-28.

3%6-73.

9%72N/A10-32.

1%HGD(14)10N/AN/A12-16.

0%10N/AN/A17-42.

4%HGU(14)26N/AN/A29-10.

5%29N/AN/A290.

9%HXD(10)1543-64.

6%36-57.

5%3240-18.

8%52-38.

3%HXU(10)764-89.

0%77.

9%758-88.

0%40-82.

8%HOD(16)48N/AN/A3923.

2%48N/AN/A58-17.

9%HOU(16)177N/AN/A324-45.

2%322N/AN/A463-30.

5%HFD(16)8N/AN/A634.

4%8N/AN/A16-52.

4%HFU(16)9N/AN/A2303.

2%6N/AN/A16-64.

7%XIN(16)22N/AN/A1819.

7%21N/AN/A10109.

3%XSP(16)31N/AN/A61-50.

2%33N/AN/A8323.

6%HED(18)2N/AN/A7-73.

6%3N/AN/A6-46.

6%HEU(18)5N/AN/A6-27.

6%4N/AN/A413.

2%GAS(18)480N/AN/A525-8.

5%446N/AN/A742-39.

9%XCB(18)35N/AN/A8346.

1%17N/AN/A1242.

2%XSB(19)6N/AN/A512.

3%7N/AN/A10-31.

9%HND(20)41N/AN/A52-21.

5%46N/AN/A3533.

6%HNU(20)297N/AN/A25019.

1%297N/AN/A15789.

2%CGL(21)4N/AN/A0N/A2N/AN/AN/AN/AXGD/XGL(4)(LTIncluded)938306207%329184.

7%620299-36%45835.

4%XFN(4)567774-27%1,068-46.

9%88197512975%1,418-37.

9%XIT(4)44-5%8-47.

9%67-93%8-23.

3%XMA(8)18243-93%30-40.

1%2598-87%58-57.

9%XEG/XEX(LTincluded)255258-1%668-61.

8%601189-91%48224.

6%Subtotal11,3908,25737.

9%6,17584.

4%9,6856,55147.

8%11,091-12.

7%EquityDerivativesEquityOptions52,63158,321-9.

8%57,439-8.

4%57,70357,821-0.

2%56,5592.

0%LongTermOptions1,3761,839-25.

2%1,3273.

7%1,3171,995-34.

0%1,2396.

3%Subtotal54,00760,160-10.

2%55,827-3.

3%59,02159,816-1.

3%57,7982.

1%SubtotalEquityOpt.

+ETF(*)65,39768,417-4.

4%62,0025.

5%68,70666,3673.

5%68,889-0.

3%CurrencyOptionsUSX(7)59142-58.

7%5018.

4%6592-28.

9%119-45.

3%CO2eDerivativesMCX(11)00N/A0N/A00N/A0-100.

0%TOTAL(*)168,576140,26820.

2%167,6380.

6%160,796129,99523.

7%138,45816.

1%2-ListedonApril29,20028-ListedonSept.

26,200615-ListedonApril17,20094-ListedonApril21,20039-ListedonNov.

30,200716-ListedonMay8,2009*Thesenumbersarebasedonthenumberoftotaltradedcontracts5-ListedonJune23,200310-ListedonFeb.

25,200817-ListedonMay13,2009dividedbythenumberoftradingdaysduringthesameperiod6-ListedonMay03,200411-ListedonMay30,200818-ListedonJuly29,20097-ListedonSept.

26,200512-ListedonOctober6,200819-ListedonSept.

9,200913-ListedonFebruary23,200920-ListedonDec.

14,200914-ListedonApril6,200921-ListedonFeb.

19,2010AllreportedfuturesandoptionsfiguresrepresentclearedandcompensateddataasprovidedbytheCanadianDerivativesClearingCorporation(CDCC).

Index/Equity/ETF/CurrencyDerivativesInterestRateDerivativesMontréalExchangeInc.

-MonthlyOptionsSummary-MarchVolumeValueTransactionsOpenInterestCallsPutsTotalCallsPutsTotalCallsPutsTotal31-Mar-101AdvantageOil&GasLtd.

AAV5492387874236813910562785318711,1292BarrickGoldCorporationABX27,67717,02644,7037,203,4413,760,57010,964,0112,5861,2133,79975,3083HaryWinstonDiamondCorp.

ABZ/HW45025770723,58524,42048,0052130511,3974AstralMediaInc.

ACM56614370943,81017,11560,9253317507155ARCEnergyTrustAET5389563325,6709,45035,120356416616Agnico-EagleMinesLtd.

AEM6,6292,7189,3471,594,816922,2082,517,0248623671,2298,8617GroupeAeroplanInc.

AER38319057329,38810,25539,6434423676708AlamosGoldInc.

AGI1,7702,3884,158209,095269,860478,9555429837,5659AgriumIncAGU9,9394,31814,2573,593,289902,6174,495,9061,4315021,93314,65110LaSociétédeGestionAGFLimitéeAGF3,5333013,834239,22019,330258,550121361574,03911AlliedNevadaGoldCorp.

ANV3,1513,9767,127428,745447,685876,43028326011,56212AthabascaPotashInc.

API30302,1002,1002262813GroupeAeconInc.

ARE47924372253,35018,70572,05559258496314AurizonMinesLtd.

ARZ9771098788,06520088,265851861,70715ATSAutomationToolingSystemsInc.

ATA783511316,8702,07518,94594133,15916AlimentationCouche-TardInc.

ATD1,3985281,926134,33555,515189,850105621672,71517AtlanticPowerCorporationATP67912780682,4907,73090,22072138576318BrookfieldAssetManagementinc.

BAM8833891,27277,41530,915108,330103441473,52419BombardierInc.

Cl.

BSVBBD19,40312,00731,4101,109,338422,3671,531,70564218482651,21220CorporationCottBCB63113276323,9857,69031,6757214861,17721BCEInc.

BCE13,8983,86117,7591,370,489291,3791,661,8687402771,01719,68322IESI-BFCLtd.

BIN19717837517,53510,82028,3552619451,63323BircheliffEnergyLtd.

BIR6593671,02667,30036,320103,6205138892,74924BallardPowerSystemsBLD375304059,8601,10010,9602042493225BankofMontrealBMO34,45814,79849,2568,393,3532,162,62010,555,9732,0451,0913,13654,95926BankersPetroleumLtd.

BNK2,0576262,683150,92533,830184,755174532271,64227BankofNova-ScotiaBNS36,95414,13851,0925,825,8662,260,6638,086,5292,3357953,13045,09628BrookfieldPropertiesCorp.

BPO14,36149214,853562,95528,047591,0021524119314,17229BiovailCorporationBVF2,2373172,554137,58519,190156,775198262244,63130CAEInc.

CAE1,2552951,55083,21010,92594,135114221361,80431CascadesInc.

CAS1822020216,88095017,8301822054332CogecoCbleinc.

CCA83420854106,1151,650107,7653423690033CamecoCorp.

CCO/CCV14,6173,57218,189598,784412,4901,011,27456723680325,12134Curd`AleneMinesCorp.

CDM4163645231,09211,91043,0025345794835CanforCorp.

CFP3157038530,6303,70034,3302783582036CenterraGoldInc.

CG3,9561,5355,491407,040145,960553,000883512313,08337CIFinancialIncCIX1631833469,70022,52032,2202619452,52538CORUSEntertainmentInc.

CJR112401527,0353,65010,6851441847539ConsolidatedThompsonIronMinesCLM1,9275282,455179,49027,905207,3951664320913,56040CelesticaInc.

SVCLS2,5771,0953,672103,00554,000157,005122291514,07141CelticExplorationLtd.

CLT2448032460,6655,00065,6652162731942CDNImperialBankofComm.

CM30,16813,35043,5187,637,5772,661,34210,298,9191,5549772,53135,00043CanadianNaturalResourcesCNQ13,4834,25117,7342,875,448729,2743,604,7221,1074621,56921,74744CanadianNationalRailwayCNR/CNX6,0782,1108,1881,183,983382,7951,566,77863918382210,49845CanadianSandsTrustCOS2,5256,0328,557204,716564,405769,12123815539312,33646CanadianPacificRailwayCP3,1291,0224,151564,220127,790692,0104091105195,51247CrescentPointEnergyCorp.

CPG3,0543,1826,236282,456394,365676,82129318047312,02848CapitalPowerCorporationCPX65913279132,91517,63050,5457114851,16049CrewEnergyCR7774131,190100,08039,810139,89086421282,35250ChartwellSeniorsHousingRealEstateInvestmentTCSH33150150119,73051CorrienteResourcesInc.

CTQ1005006001,00040,00041,00012364052ColossusMineralsInc.

CSI1,0671131,180129,2009,200138,40098141121,74953CanadianUtilitiesLimitedCU2,6061732,779255,05520,475275,530113201334,32054CanadianTireLimitéeCTC8672361,103163,72542,135205,8606228902,36755CenovusEnergyInc.

CVE3,4401,0974,537375,45095,365470,8152941074014,93456CanadianWesternBankCWB1,1366821,818135,11567,895203,01082401223,63257CallowayRealEstateInvestmentTrustCWT1825436952,0252,72063914958DetourGoldCorp.

DGC8,0684,10612,174845,340373,2001,218,5401101812815,63359DragonWaveInc.

DWI1,4954991,994186,85049,100235,950143471901,62460DomtarInc.

DTC/UFS27268340283,40019,935303,33569107935461EncanaCorporationECA14,8734,62819,5011,392,224635,8112,028,0351,0184001,41822,96962EuropeanGoldfieldsLtd.

EGU40401,4001,400558363EldoradoGoldCorporationELD8,1751,5909,765557,27285,488642,7602618834914,50964EmeraInc.

EMA6323751,00734,88032,20067,08086451314,85365EnbridgeENB2,8815893,470532,39063,750596,1402886635411,14266EquinoxMineralsLtd.

EQN5,473615,534111,4002,985114,385554599,47767FondsEnerplusRessourcesERF1771793569,51018,89528,4051518331,14868EnsignEnergyServicesInc.

ESI28411339715,6855,40021,0853012421,22069FairborneEnergyLtd.

FEL6771,6302,30720,22056,14076,360581622204,44970FirstQuantumMineralsLtd.

FM20,3894,59224,9814,766,3401,760,8056,527,14556335591810,38371Franco-NevadaCorporationFNV4,4061,0885,494488,650100,425589,0751969028617,61972FNXMiningCompanyInc.

FNX5,4696,18311,652633,520225,925859,4453371274647,61173FronteerDevelopmentGroupInc.

FRG6852070524,70019024,890602621,01574FortisInc.

FTS1,4254451,870197,10068,530265,630150431935,93475FinningInternationalInc.

FTT45826071836,77011,22547,9955319721,31476GoldcorpInc.

G18,0098,86826,8772,898,1431,511,1544,409,2972,0758822,95731,88977GammonGoldInc.

GAM1,7537292,482138,13562,910201,045129511802,98178CGIInc.

(Groupe)ClASVGIB1,3673731,740142,68015,295157,975108121202,11779GildanActivewearInc.

GIL475186661113,83040,105153,9355111623,64780GerdauAmeristeelCorp.

GNA40312052317,4506,87524,32545115610,62681GalleonEnergyInc.

GO4,9751,7926,767365,05069,993435,043175702456,84782GranTierraEnergyInc.

GTE3121032218,37075019,1203713866183CorporationdeSécuritéGardaWorldGW4232544837,40575038,155493521,39784GreatWestLifeCoGWO9323831,315141,29027,380168,670130441745,26485HudBayMineralsInc.

HBM6,0842,4078,491485,285171,185656,47043515158610,35486HighpineOil&GasLtd.

HPX30861162,0501,2203,27045918187H&RRealEstateInvestmentTrustHR402422,9001703,07042641388HuskyEnergyInc.

HSE4,5032,9437,446510,819412,811923,63039220759920,39289IndustrialAllianceIns.

andFin.

ServicesIncIAG2,0921572,249176,75016,705193,4556019792,73290IGMFinancialInc.

IGM8072431,05087,39026,920114,310105291341,86791IntactCorporationFinancièreIFC/IIC564163727109,31011,105120,4155318711,17492IAMGoldCorp.

IMG12,8022,16114,963755,586219,589975,1753801365167,57693CorporationMinièreInmetIMN3,4992,1855,684718,380760,2451,478,6254762186947,17694ImperialOilLimitedIMO1,6231,5843,207329,910119,280449,190163982616,93495InternationalTowerHillMinesLtd.

ITH2020400400222096IvahoeMinesLtd.

IVN1,2372311,468122,80032,215155,015140241642,22597JaguarMiningInc.

JAG9642951,25992,08021,700113,78085291141,29398KinrossK12,1713,65015,821850,553303,0611,153,6149172661,18319,93599KingswayFinancialServicesInc.

KFS445100KeeganResourcesInc.

KGN1451455,6305,6301515145101LoblawCompaniesLtd.

L2,2044522,656157,36560,930218,295964614211,865102LululemonAthleticaInc.

LLL1,0827551,837243,230147,155390,385135812161,416103LundinMiningCorp.

LUN2,6621542,816154,7904,685159,475173151884,953104ManitobaTelecomMBT2,1017752,876187,53085,735273,265152702225,559105MDSInc.

MDS3657681,13310,67548,83059,5053659951,800106ManulifeFinancialMFC29,2298,68637,9152,689,942595,1453,285,0871,4425111,95362,949107MinefindersCorporationLtd.

MFL3911,1201,51135,205129,780164,9853617532,552108MagnaInternationalClAMG41615557181,98532,075114,0604923721,368109MigaoCorporationMGO1023513715,7902,00017,7908311659110MétroInc.

MRU7123651,077156,95040,060197,01087371241,392111MullenGroupLtd.

MTL101511525,3656,56011,92513619312112MethanexCorporationMX1,2245211,745133,220123,010256,230120401603,091113NationalBankofCanadaNA6,6271,4818,1081,697,006305,7552,002,76150612663216,540114NikoResourcesLtd.

NKO4911,1071,598176,330563,810740,14062441063,434115NortelNetworksCorp.

NT/NTX1,763116NewGoldInc.

NGD1,1002761,37659,19513,77072,965100251253,671117NuVistaEnergyLtd.

NVA2009529513,4506,07519,525201131835118NovaGoldResourcesInc.

NG94901847,8456,45014,29514923449119NexenInc.

NXY5,7791,3687,147420,466157,146577,6123239742013,099120OnexCorp.

OCX8,252958,347471,4554,445475,900909997,343121OPTI.

CanadaInc.

OPC646506967,6475,80013,447335382,612122CorporationMinièreOsiskoOSK10,62512,63923,264603,380554,4901,157,8701845323720,364123OpenTextCorp.

OTC5964641,06091,99548,530140,5255627834,662124PanAmericanSilverCorp.

PAA2,6508533,503453,50596,590550,095210822924,697125PetrobankEnergy&ResourcesLtd.

PBG3,7811,9505,731874,600317,7051,192,3053401665068,662126PetroBakkenEnergyLtd.

PBN2,3092,9675,276252,105337,200589,3051591713305,016127Petro-CanadaCom/VarPCA3310914233,17022,16055,330811192,490128PrecisionDrillingCorp.

PD/PDQ40214454625,7956,53032,3254216581,081129PaladinResourcesPDN4954053514,5142,70017,214414453,906130PengrowthEnergyTrustPGF4464048636,2204,05040,270253281,049131GroupeJeanCoutuInc.

PJC1,0761331,20982,02111,32093,34191141055,114132PetromineralesLtd.

PMG5,0124585,4701,378,35069,4701,447,820310503603,669133PotashPOT13,0996,59319,6925,777,7651,700,3167,478,0811,9887582,74614,807134ParamountResourcesLtd.

POU/POQ751196947111,84523,095134,9405327802,179135PowerCorp.

POW9722811,253106,58527,890134,475144391833,282136PacificRubialesEnergyCorp.

PRE22,0521,63923,6914,091,910192,5454,284,4555399763625,875137PowerCorp.

FINPWF1,8042732,077148,88520,435169,320187342214,528138PennWestEnergyTrustPWT1,3881271,51599,20510,980110,18594131072,075139ProEXEnergyLtd.

PXE2,1621552,31770,77012,18082,950129141432,010140QLTPhototherapeuticsInc.

QLT4526251423,3802,56025,94049857958141QuadraMiningLtd.

QUA9,3805,03414,4141,040,020493,4411,533,46149917567411,194142RedBackMiningInc.

RBI22,5675,22027,7872,943,280584,2203,527,50028410639030,096143RogersCommunicationClBRCI/RCY4,2341,0065,240558,495103,645662,14029010539518,259144RioCanRealEstateInvestmentTrustREI684723,8855004,385122141,238145ResearchInMotionRIM25,8509,53635,3869,458,2452,358,19311,816,4384,2191,3805,59921,141146RubiconMineralsCorp.

RMX1,304451,34993,5852,57596,16010551102,748147RonaInc.

RON28429557912,97522,69435,6692519443,085148MétauxRusselInc.

RUS1,3159732,288142,08436,860178,9441921062983,804149RoyalBankofCanadaRY/RYX40,82212,01652,8386,277,5531,832,6318,110,1842,3037913,09475,928150SherrittInternationalCorporationS5,8442,1377,981560,555101,024661,5793301014318,981151SaputoInc.

SAP1,2586421,90074,341270,815345,156142642063,295152CorporationShoppersDrugMartSC6,8671,8628,729505,415231,465736,88025915941824,482153ShawCommunicationsSJR/SJX2,0321,1563,188111,41678,405189,821212852975,011154SunLifeFinancialSLF8,9301,85510,785737,459291,0461,028,50536212248419,728155SilverWheatonCorp.

SLW8,5852,08910,674878,411145,9521,024,3639102011,1118,549156SNCLavalinSNC1,7807032,483255,85568,775324,630266893552,881157SuperiorPlusCorp.

SPB39528367821,79025,90047,6904532771,794158SilverStandardRessourcesInc.

SSO8575251,38284,325116,940201,26586641502,836159SuncorEnergyInc.

SU41,12220,85461,9765,043,6363,761,5408,805,1763,1171,1124,22968,688160SilvercorpMetalsInc.

SVM3705042038,1803,72041,900417481,231161SierraWirelessInc.

SW27637965521,66533,07554,740193655967162UraniumOneInc.

SXR/UUU3,3569514,30769,68347,306116,9891724521743,616163SXCHealthSolutionsCorp.

SXC252305557154,63527,210181,845473683874164TelusCorp.

T4,7994,5539,352750,840417,2551,168,09544415159515,167165TransAltaCorporationTA2,0831,0463,129150,16595,025245,190181972787,380166TeckComincoLtd.

TCK45,17514,01859,1938,461,4882,083,26110,544,7492,6041,1003,70490,745167ThompsonCreekMettalsCompanyInc.

TCM3,3221,5944,916277,994123,049401,043168532216,687168TricanWellServicesIncTCW60931992852,51538,18590,7005428821,003169Toronto-DominionBankTD46,83112,24159,07211,034,2312,392,78713,427,0182,7501,1173,86742,233170TrinidadDrillingTDG1,2002021,40277,83012,52590,355106201262,026171TransForceInc.

TFI25826852617,83022,23540,065263056654172Theratechnologiesinc.

TH173TimHortonsInc.

THI2,0341,2973,331316,55579,140395,695195972924,118174TalismanEnergyInc.

TLM7,4114,18811,599851,796365,2311,217,02746921067917,159175ThomsonCorporationTOC9634341,39785,00658,400143,406120551756,821176Sino-ForestCorporationTRE3,3491,3114,660304,650110,945415,5952801264064,568177TransCanadaCorp.

TRP8,5851,92310,5081,237,515204,1861,441,70164515980413,152178UraniumParticipationCorp.

U7120918,3221,0009,32210212412179VentanaGoldCorp.

VEN1,134151,149139,3552,175141,53012031231,181180VeroEnergyInc.

VRO1040502,4001,8004,20014550181SaskatchewanWheatPoolInc.

VT1,7435542,297147,15021,463168,613151381894,568182WestjetAirlinesInc.

WJA81211092290,5555,16095,7157211832,537183GeorgeWestonWN8902441,134198,72544,430243,15585331182,154184TSXGroupX1,5095372,046178,35063,517241,867144652094,405185YellowPagesIncomeFundYLO9061511,05733,25011,86545,1157012821,710186YamanaGoldInc.

YRI11,4227,40918,831814,345518,5451,332,8901,0674531,52017,838Sub-total898,500343,6581,242,158140,712,16748,133,397188,845,56459,83123,03282,8631,680,934NOTE:LongtermOptionsincludedinthevolumeListedonMArch15,2010MontréalExchangeInc.

-MonthlyOptionsSummary-Futures/Bond/Index/iUnitsVolumeValueTransactionsOpenInterestCallsPutsTotalCallsPutsTotalCallsPutsTotal31-Mar-10BAXBAXOptionsOBX11,67313,68325,3563,061,5253,134,2756,195,80027305755,371CGBCGBOptionsOGB0000000001,325S+P/CDA60IndexS+P/CDA60IndexSXO5,2515,56110,8126,039,11013,627,20519,666,3151211252469,200AgricultureETFAgricultureCOW1504019014,1502,10016,25015318220ETFonIndex*XIU44,821147,027191,8483,090,7716,333,5029,424,2737304671,197373,165ETFonSectorsHGD156802367,6255,00012,62514418697ETFonSectorsHGU5267059663,6754,06567,740701282752ETFonSectorsHFD601321923,6754,9258,600131528353ETFonSectorsHFU1258020531,6859,40041,08514822242ETFonIndexHED355401,7275502,277516132ETFonIndexHEU102410614,51536014,87512113179ETFonIndexHXD3262435033,48574034,22532335794ETFonIndexHXU857716212,0107,84519,85512820245ETFonIndexXCB52029081015,28011,55026,8305229811,317ETFonIndexXDV24410034415,7725,49521,267381149652ETFonIndexXIC31313144423,6205,97029,590301545707ETFonIndexXRE333367651,0601,825257555ETFonIndexXIN29321050319,46512,30031,7653121521,125ETFonIndexXSP6535070329,1752,15031,325335381,894ETFonIndexXSB60801401,4502,8504,3006814788ETFonCommodityHOD8512621,11361,12416,82577,949672895840ETFonCommodityHOU3,0431,0394,082233,10633,117266,2232588334118,844ETFonCommodityGAS7,3093,74111,050224,261208,494432,75537213350515,395ETFonCommodityHND770163933105,38517,910123,295732497813ETFonCommodityHNU5,4571,3786,835303,607111,720415,3274681386065,580ETFonCommodityCGL5630863,6507004,350641086Energy*XEG/XEX4,4761,3885,864476,015100,969576,9841967026614,978FinancialServicesXFN9,3393,69113,030531,643290,784822,427137772148,650Gold*XGD/XGL17,5494,01721,5663,527,434147,9693,675,40332915148015,105ITXIT7420947,0757007,7758210146MaterialsXMA1962184148,92028,06036,9801923422,584USD/CADCurrencyOptionsUSX8345171,351185,385159,339344,72471581291,273SubTotal115,350184,141299,49118,147,08524,287,92942,435,0143,2611,5624,823534,007GrandTotal1,013,850527,7991,541,649158,859,25272,421,326231,280,57863,09224,59487,6862,214,941NOTE*:LeapsincludedMontréalExchangeInc.

-CanadianEquityOptionsMarketTradingVolumebySector(*)MTDSectorsVolumeMarch.

2010%duvolumetransigé:VolumeMarch2009variationofvolumetraded:2010-2009VolumeFebruary2010variationofvolumetraded:Feb.

-Jan.

(2010)Materials472,00138.

0%409,10815.

4%443,7556.

37%Industrials55,2154.

4%62,654-11.

9%39,98238.

10%Telecommunications34,3452.

8%34,886-1.

6%34,2030.

42%ConsumerDiscretionary15,7511.

3%39,769-60.

4%21,860-27.

95%Energy220,54917.

8%299,749-26.

4%202,3598.

99%Financials345,67527.

8%399,591-13.

5%289,62319.

35%HealthCare4,2010.

3%2,087101.

3%3,35725.

14%Technology42,4153.

4%23,05484.

0%35,82118.

41%Utilities30,3152.

4%29,7641.

9%18,86060.

74%ConsumerStaples21,6911.

7%22,855-5.

1%26,719-18.

82%Total1,242,158100.

00%1,323,517-6.

1%1,116,53911.

3%YTDSectorsVolumeYTD2010TradeVolume(%)VolumeYTD2009ChangeVolumeYTD2010/YTD2009Materials1,418,78538.

8%1,255,36513.

0%Industrials156,4694.

3%193,497-19.

1%Telecommunications97,5122.

7%128,982-24.

4%ConsumerDiscretionary58,6631.

6%88,646-33.

8%Energy644,89117.

6%711,048-9.

3%Financials988,99727.

0%1,099,419-10.

0%HealthCare12,0620.

3%7,22267.

0%Technology116,0763.

2%65,30377.

7%Utilities69,2361.

9%104,282-33.

6%ConsumerStaples96,5822.

6%54,81776.

2%Total3,659,273100.

00%3,708,581-1.

3%*SectorbreakdownsarebasedontheS&P/TSXIndicesTradedvolumedistributionpersector(YTD)0200,000400,000600,000800,0001,000,0001,200,0001,400,0001,600,000MaterialsIndustrialsTelecomm.

ConsumerDiscretionaryEnergyFinancialsHealthCareTechnologyUtilitiesConsumerStaples20102009Tradedvolumedistributionpersector(MTD)060,000120,000180,000240,000300,000360,000420,000480,000540,000MaterialsIndustrialsTelecomm.

ConsumerDiscretionaryEnergyFinancialsHealthCareTechnologyUtilitiesConsumerStaples20102009BAXThree-MonthCanadianBankers'AcceptanceFuturesDecember2005CGBTen-YearGovernmentofCanadaBondFuturesCGB-volumeandopeninterest0200,000400,000600,000800,0001,000,0001,200,0001,400,0001,600,000volumeopeninterest2007200820092010BAX-volumeandopeninterest0250,000500,000750,0001,000,0001,250,0001,500,0001,750,0002,000,0002,250,0002,500,000volumeopeninterest2007200820092010SXFS&PCanada60IndexFuturesDecember2005EquityOptionsSXF-volumeandopeninterest065,000130,000195,000260,000325,000390,000455,000520,000585,000650,000715,000volumeopeninterest2007200820092010EquityOptions-volumeandopeninterest0200,000400,000600,000800,0001,000,0001,200,0001,400,0001,600,0001,800,0002,000,000volumeopeninterest2007200820092010

- July76aav.com相关文档

- 881.9976aav.com

- Interactive76aav.com

- 7.76aav.com

- A46676aav.com

- applications76aav.com

- capsid76aav.com

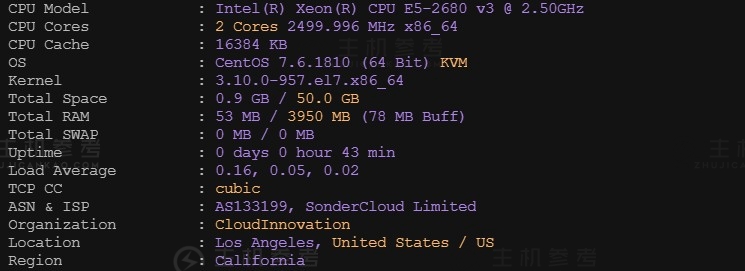

恒创科技SonderCloud,美国VPS综合性能测评报告,美国洛杉矶机房,CN2+BGP优质线路,2核4G内存10Mbps带宽,适用于稳定建站业务需求

最近主机参考拿到了一台恒创科技的美国VPS云服务器测试机器,那具体恒创科技美国云服务器性能到底怎么样呢?主机参考进行了一番VPS测评,大家可以参考一下,总体来说还是非常不错的,是值得购买的。非常适用于稳定建站业务需求。恒创科技服务器怎么样?恒创科技服务器好不好?henghost怎么样?henghost值不值得购买?SonderCloud服务器好不好?恒创科技henghost值不值得购买?恒创科技是...

台湾云服务器整理推荐UCloud/易探云!

台湾云服务器去哪里买?国内有没有哪里的台湾云服务器这块做的比较好的?有很多用户想用台湾云服务器,那么判断哪家台湾云服务器好,不是按照最便宜或最贵的选择,而是根据您的实际使用目的选择服务器,只有最适合您的才是最好的。总体而言,台湾云服务器的稳定性确实要好于大陆。今天,云服务器网(yuntue.com)小编来介绍一下台湾云服务器哪里买和一年需要多少钱!一、UCloud台湾云服务器UCloud上市云商,...

ZJI-全场八折优惠,香港服务器 600元起,还有日本/美国/韩国服务器

月付/年付优惠码:zji 下物理服务器/VDS/虚拟主机空间订单八折终身优惠(长期有效)一、ZJI官网点击直达ZJI官方网站二、特惠香港日本服务器香港大埔:http://hkdb.speedtest.zji.net/香港葵湾:http://hkkw.speedtest.zji.net/日本大阪:http://jpsk.speedtest.zji.net/日本大阪一型 ...

76aav.com为你推荐

-

敬汉卿姓名被抢注12306身份证名字被注册怎么办firetrap牛仔裤的四大品牌是那几个啊?地陷裂口天上顿时露出一个大窟窿地上也裂开了,一到黑幽幽的深沟可以用什么四字词语来?www.55125.cn如何登录www.jbjy.cnwww.baitu.com我看电影网www.5ken.com为什么百度就不上关键字呢se95se.comwww.sea8.com这个网站是用什么做的 需要多少钱javbibitreebibi是什么牌子的kb123.netwww.zhmmjyw.net百度收录慢?5566.com请问如何创建网页(就是www.5566.com.cn这种格式的)45gtv.comLETSCOM是什么牌子?