趋于hao.rising.cn

hao.rising.cn 时间:2021-03-20 阅读:()

Tuesday,August9,2016CompanyReportChinaMerchantsSecurities(HK)Co.

,Ltd.

HongKongEquityResearchPleaseseepenultimatepageforadditionalimportantdisclosures.

ChinaMerchantsSecurities(CMS)isaforeignbroker-dealerunregisteredintheUSA.

CMSresearchispreparedbyresearchanalystswhoarenotregisteredintheUSA.

CMSresearchisdistributedintheUSApursuanttoRule15a-6oftheSecuritiesExchangeActof1934solelybyRosenblattSecurities,anSECregisteredandFINRA-memberbroker-dealer.

1GeelyAutomobile(175HK)Platformandhigh-endstrategiesmaturing.

2016-18EstrongearningsgrowthJulysalesgrew64%drivenbySUVnewmodels.

Geelyraisedannualsalestargetby10%to660,000unitsSuccessofplatformandhigh-endstrategiesreflectedbystrongsales.

ThefoundationofhighfuturegrowthisnowsetTPraisedtoHK$7.

0.

Ourestimatesare6-19%aboveconsensusJulysalesgrew64%,Geely'sannualsalestargetup10%Geelyrecordedsalesvolumeof49,000unitsinJuly(+64%YoYor4%MoM).

JulyYTDsaleswas329,000units(+17%YoY),equivalentto55%ofitsannualsalestargetof600,000units.

Julysalesgrowthwasmainlydrivenby:(1)thecombinedmonthlysalesgrowthofSUVandcrossoverSUVat411%YoY;(2)thesalesvolumeofXindihaoat16,000units(+41%YoY)andNewVisionat8,200units(+47%YoY);and(3)thesalesvolumeofBoruiat3,400units,basicallyflatMoMandYoYduetothecapacityconstraintofChunxiaoplant.

High-endstrategysuccessful,newproductsalesbeatBoyuesmonthlysalesvolumehasexceeded10,000unitsandweexpect250,000unitswillbesoldnextyear.

ThesalesvolumegrowthofEmgrandGSisfasterthanexpectedandweestimate8,000-10,000unitswillbesoldbythisyearend.

Since2015,Geelysboutique/high-endstrategyhasbeensuccessful,judgingfromitsrapidlyrisingproportionofhigh-endmodels,theextremelyhighsuccessratesofnewproductsandmarketrecognitionPlatformstrategymaturing,newmodelslaunchingfastGeelywilllaunchitsCMAplatformSUVmodelin1H17(presumablyA+grade).

Asnewmodelsarelaunchingfastwithmuchquickerintroductionofnewproductsandmorecomprehensivecoverage(sedan+SUV+MPV),itsplatformR&Dandproductioncapacityareseentobematuring.

Valuationstillattractivedespiterecentrally.

2017E8.

8xP/Ebelowhistoricalaverage(11.

1x)anditspeers(9.

2x)Onthebackofbetter-than-expectedsales,weraisedGeelys2016-18Esalesby6.

9%/14.

5%/14.

2%andNPby20.

8%/33.

8%/36.

0%,aboveconsensusby6.

4%/12.

8%/19.

0%.

WeraisedTPtoHK$7.

0,implying11.

1xFY17EP/E,closetoitshistoricalaverageof11xforwardP/E.

Stockisat8.

8xFY17EP/E,lowerthanitspeersaverageof9.

2xFY17EP/E.

FinancialsRMBmn201420152016E2017E2018ERevenue21,73830,13842,42363,93279,085Growth(%)-24.

3%38.

6%40.

8%50.

7%23.

7%Netprofit1,4312,2613,5434,7265,784Growth(%)-46.

3%58.

0%56.

7%33.

4%22.

4%EPS(RMB)0.

160.

260.

400.

540.

66DPS(RMB)0.

020.

030.

050.

060.

08P/E(x)29.

018.

411.

78.

87.

2P/B(x)2.

42.

11.

91.

61.

3ROE(%)8.

3%11.

6%16.

3%17.

9%18.

2%Sources:Companydata,CMS(HK)estimatesLiangYonghuo+8675582904571liangy6@cmschina.

com.

cnWHAT'SNEWEarningsandTPupgradedBUYPreviousBUYPriceHK$5.

4912-monthTargetPrice(Potentialup/downside)HK$7.

00(+28%)PreviousHK$5.

20PricePerformanceSource:Bigdata%1m6m12m175HK28.

084.

874.

3HSI6.

714.

8(9.

7)Auto&AutoPartsHangSengIndex22146HSCEI9132KeyData52-weekrange(HK$)2.

4-5.

69Marketcap(HK$mn)48328Avg.

dailyvolume(mn)58.

32BVPS(HK$)2.

22ShareholdingStructureGeelyHolding42.

62%No.

ofsharesoutstanding(mn)8802Freefloat56%RelatedResearchGeelyAutomobile(175HK)-Sitevisittakeaways:Boyuecapacityrampingup;eyeson7DCT2016/7/5GeelyAutomobile(175HK)-SUVproductstofurthergrowonCMAplatform2016/6/8.

GeelyAutomobile(175HK)-SUVseriesenrichedwiththeadditionofEmgrandGS2016/5/6GeelyAutomobile(175HK)–Forexlossalreadypricedin,focusonSUVstrategy2016/1/19GeelyAutomobile(175HK)-High-endproductlineswellestablished2015/10/13-40-20020406080100Aug/15Nov/15Mar/16Jul/16(%)175HSIIndexTuesday,August9,2016Thisisanextractfrom"吉利汽车(175HK)-平台化战略及高端化路线趋于成熟,2016-18E利润强劲增长"datedAug.

8,20162Figure1:GeelysmonthlysalesvolumeFigure2:Rapidgrowthinnetprofit(RMBmillion)Sources:Companydata,CMS(HK)Sources:Companydata,CMS(HK)Figure3:GrowthinautosalesFigure4:ASPcontinuestoriseSources:Companydata,CMS(HK)Sources:Companydata,CMS(HK)Figure5:Growthinhigh-endautosales(%oftotal)Figure6:GrossandNetprofitmarginSources:Companydata,CMS(HK)Sources:Companydata,CMS(HK)-10%0%10%20%30%40%50%60%70%80%010,00020,00030,00040,00050,00060,00070,000Jan-15Feb-15Mar-15Apr-15May-15Jun-15Jul-15Aug-15Sep-15Oct-15Nov-15Dec-15Jan-16Feb-16Mar-16Apr-16May-16Jun-16Jul-16Monthlysales(units,LHS)Growth(%,RHS)-60%-40%-20%0%20%40%60%80%01,0002,0003,0004,0005,0006,0007,00020122013201420152016E2017E2018ENetprofit(RMBmn,LHS)Growth(%,RHS)-30%-20%-10%0%10%20%30%40%0200,000400,000600,000800,0001,000,0001,200,00020122013201420152016E2017E2018Esalesvolume(units,LHS)Growth(%,RHS)0%2%4%6%8%10%12%14%16%18%20%010203040506070809020122013201420152016E2017E2018EASP(RMBk,LHS)Growth(%,RHS)0%20%40%60%80%100%20122013201420152016E2017E2018EEmgrandGC9SUVEVLowendmodels18.

4%20.

1%18.

2%17.

9%18.

5%18.

9%19.

1%8.

3%9.

3%6.

6%7.

5%8.

4%7.

4%7.

3%0%5%10%15%20%25%20122013201420152016E2017E2018EGPMNPMTuesday,August9,2016ToaccessourresearchreportsontheBloombergterminal,typeCMHK3FinancialSummaryBalancesheetRMBmillion201420152016E2017E2018ECurrentassets25,30325,34834,61351,35065,045Cashandcashequivalents7,2039,16711,92817,21722,850Restrictedbankdeposits4741414141Tradereceivables16,38514,83620,88431,47238,932OtherreceivablesInventories1,6201,2261,7172,5763,179Othercurrentassets4878434444Non-currentassets11,97716,94518,22220,35322,273Property,Plant&Eqt.

5,8618,0347,8128,7009,513Leasehold&landuserights1,1311,5381,1291,1311,133Intangibleassets4,2085,2607,1908,4319,536InvestmentsinJVs4391,7091,7091,7091,709Othernon-currentassets338403381381381Totalassets37,28042,29252,83571,70387,318Currentliabilities17,84520,44928,69442,95553,004Tradepayables17,01720,11428,16942,25552,147Otherpayables&accrualsCurrentincometaxliabilities137335525700857Short-termloans6920000Othercurrentliabilities-000-00Non-currentliabilities1,9692,1042,1042,1042,104BorrowingsDeferredincometaxliabilities149175175175175Othercurrentliabilities1,8201,9291,9291,9291,929Totalliabilities19,81422,55330,79845,05955,108Issuedsharecapital161161161161161Otherreserves17,12719,36221,63526,19131,697RetainedearningsEquityattrtoshareholders17,28819,52421,79626,35331,858MinorityInterests178216241291352Totalequity17,46619,74022,03726,64432,210Totalliabilitiesandequity37,28042,29252,83571,70387,318StatementofcashflowRMBmillion201420152016E2017E2018ECashflowfromOA2,0337,4096,8069,53610,070Profitbeforetax1,9432,8754,5066,0117,356Deprec&Amort8741,1431,6351,8692,080Changesinworkingcapital2,5307,8327,46910,42111,152Others-3,314-4,441-6,804-8,764-10,518CashflowfromIA-1,468-4,534-3,703-3,753-3,803Capitalexpenditure-2,185-3,677-3,965-3,965-3,965Acquisitionofassets00000Changesininvestment0-720000Others718-138262212162CashflowfromFA1,172-931-342-494-634IssueofnewsharesNetborrowings-274-692000Dividendpaid-320-174-267-419-559Otherfinancingactivities1,766-65-75-75-75Netincreaseincash1,7371,9442,7615,2895,633Endingcash&equivalents7,2039,16711,92817,21722,850StatementofprofitRMBmillion201420152016E2017E2018ESalesrevenue21,73830,13842,42363,93279,085Costofsales-17,776-24,668-34,545-51,820-63,951Grossprofit3,9635,4717,87712,11215,134Distributioncosts-1,250-1,568-2,333-3,580-4,429Administrativeexpenses-1,772-2,176-2,437-3,836-4,745Otherincome1,0551,0661,2731,2791,344Operatingprofit1,9112,7254,3095,8997,226FinanceincomeFinancecostsNetfinancecosts-24-6-9-14-17AVsinvestmentincome942444851JVsinvestmentincome231081536479PBT1,9432,8754,5066,0117,356Incometaxpayable-494-586-919-1,225-1,500Profitfortheyear1,4492,2893,5874,7855,856Minorityinterest1928445972Profitattrtoshareholders1,4312,2613,5434,7265,784EPS(RMB)0.

160.

260.

400.

540.

66Keyratios201420152016E2017E2018EYoYGrowthOperatingrevenue-24.

3%38.

6%40.

8%50.

7%23.

7%Operatingprofit-42.

3%42.

6%58.

1%36.

9%22.

5%Netprofit-46.

3%58.

0%56.

7%33.

4%22.

4%ProfitabilityGrossprofitmargin18.

2%18.

2%18.

6%18.

9%19.

1%Operatingprofitmargin8.

8%9.

0%10.

2%9.

2%9.

1%Netprofitmargin6.

6%7.

5%8.

4%7.

4%7.

3%ROE8.

3%11.

6%16.

3%17.

9%18.

2%ROA3.

8%5.

3%6.

7%6.

6%6.

6%SolvencyDebttoasset53.

1%53.

3%58.

3%62.

8%63.

1%Netdebtratio-37.

7%-47.

0%-54.

7%-65.

3%-71.

7%Currentratio1.

421.

241.

211.

201.

23Quickratio1.

331.

181.

151.

141.

17OperationalcapacityAssetsturnoverdays224276326375363Inventoryturnoverdays3521161516Receivablesturnoverdays262189154149162Payablesturnoverdays340275255248269Pershareratio(RMB)EPS0.

160.

260.

400.

540.

66CFPS0.

821.

041.

361.

962.

60BVPS1.

962.

222.

482.

993.

62DPS0.

020.

030.

050.

060.

08ValuationratiosP/E29.

018.

411.

78.

87.

2P/B2.

42.

11.

91.

61.

3Sources:Companydata,CMS(HK)estimatesTuesday,August9,2016ToaccessourresearchreportsontheBloombergterminal,typeCMHK4InvestmentRatingsIndustryRatingDefinitionOVERWEIGHTExpectsectortooutperformthemarketoverthenext12monthsNEUTRALExpectsectortoperformin-linewiththemarketoverthenext12monthsUNDERWEIGHTExpectsectortounderperformthemarketoverthenext12monthsCompanyRatingDefinitionBUYExpectstocktogenerate10%+returnoverthenext12monthsNEUTRALExpectstocktogenerate+10%to-10%overthenext12monthsSELLExpectstocktogeneratelossof10%+overthenext12monthsAnalystDisclosureTheanalystsprimarilyresponsibleforthepreparationofallorpartoftheresearchreportcontainedhereinherebycertifythat:(i)theviewsexpressedinthisresearchreportaccuratelyreflectthepersonalviewsofeachsuchanalystaboutthesubjectsecuritiesandissuers;and(ii)nopartoftheanalystscompensationwas,is,orwillbedirectlyorindirectly,relatedtothespecificrecommendationsorviewsexpressedinthisresearchreport.

RegulatoryDisclosurePleaserefertotheimportantdisclosuresonourwebsitehttp://www.

newone.

com.

hk/cmshk/en/disclosure.

html.

DisclaimerThisdocumentispreparedbyChinaMerchantsSecurities(HK)Co.

,Limited("CMSHK").

CMSHKisalicensedcorporationtocarryonType1(dealinginsecurities),Type2(dealinginfutures),Type4(advisingonsecurities),Type6(advisingoncorporatefinance)andType9(assetmanagement)regulatedactivitiesundertheSecuritiesandFuturesOrdinance(Chapter571).

Thisdocumentisforinformationpurposeonly.

Neithertheinformationnoropinionexpressedshallbeconstrued,expresslyorimpliedly,asanadvice,offerorsolicitationofanoffer,invitation,advertisement,inducement,recommendationorrepresentationofanykindorformwhatsoevertobuyorsellanysecurity,financialinstrumentoranyinvestmentorotherspecificproduct.

Thesecurities,instrumentsorstrategiesdiscussedinthisdocumentmaynotbesuitableforallinvestors,andcertaininvestorsmaynotbeeligibletoparticipateinsomeorallofthem.

Certainservicesandproductsaresubjecttolegalrestrictionsandcannotbeofferedworldwideonanunrestrictedbasisand/ormaynotbeeligibleforsaletoallinvestors.

CMSHKisnotregisteredasabroker-dealerintheUnitedStatesanditsproductsandservicesarenotavailabletoU.

S.

personsexceptaspermittedunderSECRule15a-6.

Theinformationandopinions,andassociatedestimatesandforecasts,containedhereinhavebeenobtainedfromorarebasedonsourcesbelievedtobereliable.

CMSHK,itsholdingoraffiliatedcompanies,oranyofitsortheirdirectors,officersoremployees("CMSGroup")donotrepresentorwarrant,expresslyorimpliedly,thatitisaccurate,correctorcompleteanditshouldnotbereliedupon.

CMSGroupwillnotacceptanyresponsibilityorliabilitywhatsoeverforanyuseoforrelianceuponthisdocumentoranyofthecontentthereof.

Thecontentsandinformationinthisdocumentareonlycurrentasofthedateoftheirpublicationandwillbesubjecttochangewithoutpriornotice.

Pastperformanceisnotindicativeoffutureperformance.

Estimatesoffutureperformancearebasedonassumptionsthatmaynotberealized.

Theanalysiscontainedhereinisbasedonnumerousassumptions.

Differentassumptionscouldresultinmateriallydifferentresults.

OpinionsexpressedhereinmaydifferorbecontrarytothoseexpressedbyotherbusinessdivisionsorothermembersofCMSGroupasaresultofusingdifferentassumptionsand/orcriteria.

Thisdocumenthasbeenpreparedwithoutregardtotheindividualfinancialcircumstancesandinvestmentobjectivesofthepersonswhoreceiveit.

Useofanyinformationhereinshallbeatthesolediscretionandriskoftheuser.

Investorsareadvisedtoindependentlyevaluateparticularinvestmentsandstrategies,takefinancialand/ortaxadviceastotheimplications(includingtax)ofinvestinginanyofthesecuritiesorproductsmentionedinthisdocument,andmaketheirowninvestmentdecisionswithoutrelyingonthispublication.

CMSGroupmayhavealongorshortposition,makemarkets,actasprincipaloragent,orengageintransactionsinsecuritiesofcompaniesreferredtointhisdocumentandmayalsoperformorseektoperforminvestmentbankingservicesorprovideadvisoryorotherservicesforthosecompanies.

Thisdocumentisfortheuseofintendedrecipientsonlyandthisdocumentmaynotbereproduced,distributedorpublishedinwholeorinpartforanypurposewithoutthepriorconsentofCMSGroup.

CMSGroupwillnotbeliableforanyclaimsorlawsuitsfromanythirdpartiesarisingfromtheuseordistributionofthisdocument.

Thisdocumentisfordistributiononlyundersuchcircumstancesasmaybepermittedbyapplicablelaw.

ThisdocumentisnotdirectedatyouifCMSGroupisprohibitedorrestrictedbyanylegislationorregulationinanyjurisdictionfrommakingitavailabletoyou.

Inparticular,thisdocumentisonlymadeavailabletocertainUSpersonstowhomCMSGroupispermittedtomakeavailableaccordingtoUSsecuritieslaws,butcannototherwisebemadeavailable,distributedortransmitted,whetherdirectlyorindirectly,intotheUSortoanyUSperson.

Thisdocumentalsocannotbedistributedortransmitted,whetherdirectlyorindirectly,intoJapanandCanadaandnottothegeneralpublicinthePeoplesRepublicofChina(forthepurposeofthisdocument,excludingHongKong,MacauandTaiwan).

Tuesday,August9,2016ToaccessourresearchreportsontheBloombergterminal,typeCMHK5ImportantDisclosuresforU.

S.

PersonsThisresearchreportwaspreparedbyCMSHK,acompanyauthorizedtoengageinsecuritiesactivitiesinHongKong.

CMSHKisnotaregisteredbroker-dealerintheUnitedStatesand,therefore,isnotsubjecttoU.

S.

rulesregardingthepreparationofresearchreportsandtheindependenceofresearchanalysts.

Thisresearchreportisprovidedfordistributionsolelyto"majorU.

S.

institutionalinvestors"inrelianceontheexemptionfromregistrationprovidedbyRule15a-6oftheU.

S.

SecuritiesExchangeActof1934,asamended(the"ExchangeAct").

AnyU.

S.

recipientofthisresearchreportwishingtoeffectanytransactiontobuyorsellsecuritiesorrelatedfinancialinstrumentsbasedontheinformationprovidedinthisresearchreportshoulddosoonlythroughRosenblattSecuritiesInc,20BroadStreet26thFloor,NewYorkNY10005,aregisteredbrokerdealerintheUnitedStates.

UndernocircumstancesshouldanyrecipientofthisresearchreporteffectanytransactiontobuyorsellsecuritiesorrelatedfinancialinstrumentsthroughCMSHK.

RosenblattSecuritiesInc.

acceptsresponsibilityforthecontentsofthisresearchreport,subjecttothetermssetoutbelow.

TheanalystwhosenameappearsinthisresearchreportisnotregisteredorqualifiedasaresearchanalystwiththeFinancialIndustryRegulatoryAuthority("FINRA")andmaynotbeanassociatedpersonofRosenblattSecuritiesInc.

and,therefore,maynotbesubjecttoapplicablerestrictionsunderFINRARulesoncommunicationswithasubjectcompany,publicappearancesandtradingsecuritiesheldbyaresearchanalystaccount.

OwnershipandMaterialConflictsofInterestRosenblattSecuritiesInc.

oritsaffiliatesdoesnotbeneficiallyown,asdeterminedinaccordancewithSection13(d)oftheExchangeAct,1%ormoreofanyoftheequitysecuritiesmentionedinthereport.

RosenblattSecuritiesInc,itsaffiliatesand/ortheirrespectiveofficers,directorsoremployeesmayhaveinterests,orlongorshortpositions,andmayatanytimemakepurchasesorsalesasaprincipaloragentofthesecuritiesreferredtoherein.

RosenblattSecuritiesInc.

isnotawareofanymaterialconflictofinterestasofthedateofthispublication.

CompensationandInvestmentBankingActivitiesRosenblattSecuritiesInc.

oranyaffiliatehasnotmanagedorco-managedapublicofferingofsecuritiesforthesubjectcompanyinthepast12months,norreceivedcompensationforinvestmentbankingservicesfromthesubjectcompanyinthepast12months,neitherdoesitoranyaffiliateexpecttoreceive,orintendstoseekcompensationforinvestmentbankingservicesfromthesubjectcompanyinthenext3months.

AdditionalDisclosuresThisresearchreportisfordistributiononlyundersuchcircumstancesasmaybepermittedbyapplicablelaw.

Thisresearchreporthasnoregardtothespecificinvestmentobjectives,financialsituationorparticularneedsofanyspecificrecipient,evenifsentonlytoasinglerecipient.

Thisresearchreportisnotguaranteedtobeacompletestatementorsummaryofanysecurities,markets,reportsordevelopmentsreferredtointhisresearchreport.

NeitherCMSHKnoranyofitsdirectors,officers,employeesoragentsshallhaveanyliability,howeverarising,foranyerror,inaccuracyorincompletenessoffactoropinioninthisresearchreportorlackofcareinthisresearchreportspreparationorpublication,oranylossesordamageswhichmayarisefromtheuseofthisresearchreport.

CMSHKmayrelyoninformationbarriers,suchas"ChineseWalls"tocontroltheflowofinformationwithintheareas,units,divisions,groups,oraffiliatesofCMSHK.

Investinginanynon-U.

S.

securitiesorrelatedfinancialinstruments(includingADRs)discussedinthisresearchreportmaypresentcertainrisks.

Thesecuritiesofnon-U.

S.

issuersmaynotberegisteredwith,orbesubjecttotheregulationsof,theU.

S.

SecuritiesandExchangeCommission.

Informationonsuchnon-U.

S.

securitiesorrelatedfinancialinstrumentsmaybelimited.

ForeigncompaniesmaynotbesubjecttoauditandreportingstandardsandregulatoryrequirementscomparabletothoseineffectwithintheUnitedStates.

ThevalueofanyinvestmentorincomefromanysecuritiesorrelatedfinancialinstrumentsdiscussedinthisresearchreportdenominatedinacurrencyotherthanU.

S.

dollarsissubjecttoexchangeratefluctuationsthatmayhaveapositiveoradverseeffectonthevalueoforincomefromsuchsecuritiesorrelatedfinancialinstruments.

Pastperformanceisnotnecessarilyaguidetofutureperformanceandnorepresentationorwarranty,expressorimplied,ismadebyCMSHKwithrespecttofutureperformance.

Incomefrominvestmentsmayfluctuate.

Thepriceorvalueoftheinvestmentstowhichthisresearchreportrelates,eitherdirectlyorindirectly,mayfallorriseagainsttheinterestofinvestors.

Anyrecommendationoropinioncontainedinthisresearchreportmaybecomeoutdatedasaconsequenceofchangesintheenvironmentinwhichtheissuerofthesecuritiesunderanalysisoperates,inadditiontochangesintheestimatesandforecasts,assumptionsandvaluationmethodologyusedherein.

Nopartofthecontentofthisresearchreportmaybecopied,forwardedorduplicatedinanyformorbyanymeanswithoutthepriorconsentofCMSHKandCMSHKacceptsnoliabilitywhatsoeverfortheactionsofthirdpartiesinthisrespect.

HongKongChinaMerchantsSecurities(HK)Co.

,Ltd.

Address:48/F,OneExchangeSquare,Central,HongKongTel:+85231896888Fax:+85231010828

,Ltd.

HongKongEquityResearchPleaseseepenultimatepageforadditionalimportantdisclosures.

ChinaMerchantsSecurities(CMS)isaforeignbroker-dealerunregisteredintheUSA.

CMSresearchispreparedbyresearchanalystswhoarenotregisteredintheUSA.

CMSresearchisdistributedintheUSApursuanttoRule15a-6oftheSecuritiesExchangeActof1934solelybyRosenblattSecurities,anSECregisteredandFINRA-memberbroker-dealer.

1GeelyAutomobile(175HK)Platformandhigh-endstrategiesmaturing.

2016-18EstrongearningsgrowthJulysalesgrew64%drivenbySUVnewmodels.

Geelyraisedannualsalestargetby10%to660,000unitsSuccessofplatformandhigh-endstrategiesreflectedbystrongsales.

ThefoundationofhighfuturegrowthisnowsetTPraisedtoHK$7.

0.

Ourestimatesare6-19%aboveconsensusJulysalesgrew64%,Geely'sannualsalestargetup10%Geelyrecordedsalesvolumeof49,000unitsinJuly(+64%YoYor4%MoM).

JulyYTDsaleswas329,000units(+17%YoY),equivalentto55%ofitsannualsalestargetof600,000units.

Julysalesgrowthwasmainlydrivenby:(1)thecombinedmonthlysalesgrowthofSUVandcrossoverSUVat411%YoY;(2)thesalesvolumeofXindihaoat16,000units(+41%YoY)andNewVisionat8,200units(+47%YoY);and(3)thesalesvolumeofBoruiat3,400units,basicallyflatMoMandYoYduetothecapacityconstraintofChunxiaoplant.

High-endstrategysuccessful,newproductsalesbeatBoyuesmonthlysalesvolumehasexceeded10,000unitsandweexpect250,000unitswillbesoldnextyear.

ThesalesvolumegrowthofEmgrandGSisfasterthanexpectedandweestimate8,000-10,000unitswillbesoldbythisyearend.

Since2015,Geelysboutique/high-endstrategyhasbeensuccessful,judgingfromitsrapidlyrisingproportionofhigh-endmodels,theextremelyhighsuccessratesofnewproductsandmarketrecognitionPlatformstrategymaturing,newmodelslaunchingfastGeelywilllaunchitsCMAplatformSUVmodelin1H17(presumablyA+grade).

Asnewmodelsarelaunchingfastwithmuchquickerintroductionofnewproductsandmorecomprehensivecoverage(sedan+SUV+MPV),itsplatformR&Dandproductioncapacityareseentobematuring.

Valuationstillattractivedespiterecentrally.

2017E8.

8xP/Ebelowhistoricalaverage(11.

1x)anditspeers(9.

2x)Onthebackofbetter-than-expectedsales,weraisedGeelys2016-18Esalesby6.

9%/14.

5%/14.

2%andNPby20.

8%/33.

8%/36.

0%,aboveconsensusby6.

4%/12.

8%/19.

0%.

WeraisedTPtoHK$7.

0,implying11.

1xFY17EP/E,closetoitshistoricalaverageof11xforwardP/E.

Stockisat8.

8xFY17EP/E,lowerthanitspeersaverageof9.

2xFY17EP/E.

FinancialsRMBmn201420152016E2017E2018ERevenue21,73830,13842,42363,93279,085Growth(%)-24.

3%38.

6%40.

8%50.

7%23.

7%Netprofit1,4312,2613,5434,7265,784Growth(%)-46.

3%58.

0%56.

7%33.

4%22.

4%EPS(RMB)0.

160.

260.

400.

540.

66DPS(RMB)0.

020.

030.

050.

060.

08P/E(x)29.

018.

411.

78.

87.

2P/B(x)2.

42.

11.

91.

61.

3ROE(%)8.

3%11.

6%16.

3%17.

9%18.

2%Sources:Companydata,CMS(HK)estimatesLiangYonghuo+8675582904571liangy6@cmschina.

com.

cnWHAT'SNEWEarningsandTPupgradedBUYPreviousBUYPriceHK$5.

4912-monthTargetPrice(Potentialup/downside)HK$7.

00(+28%)PreviousHK$5.

20PricePerformanceSource:Bigdata%1m6m12m175HK28.

084.

874.

3HSI6.

714.

8(9.

7)Auto&AutoPartsHangSengIndex22146HSCEI9132KeyData52-weekrange(HK$)2.

4-5.

69Marketcap(HK$mn)48328Avg.

dailyvolume(mn)58.

32BVPS(HK$)2.

22ShareholdingStructureGeelyHolding42.

62%No.

ofsharesoutstanding(mn)8802Freefloat56%RelatedResearchGeelyAutomobile(175HK)-Sitevisittakeaways:Boyuecapacityrampingup;eyeson7DCT2016/7/5GeelyAutomobile(175HK)-SUVproductstofurthergrowonCMAplatform2016/6/8.

GeelyAutomobile(175HK)-SUVseriesenrichedwiththeadditionofEmgrandGS2016/5/6GeelyAutomobile(175HK)–Forexlossalreadypricedin,focusonSUVstrategy2016/1/19GeelyAutomobile(175HK)-High-endproductlineswellestablished2015/10/13-40-20020406080100Aug/15Nov/15Mar/16Jul/16(%)175HSIIndexTuesday,August9,2016Thisisanextractfrom"吉利汽车(175HK)-平台化战略及高端化路线趋于成熟,2016-18E利润强劲增长"datedAug.

8,20162Figure1:GeelysmonthlysalesvolumeFigure2:Rapidgrowthinnetprofit(RMBmillion)Sources:Companydata,CMS(HK)Sources:Companydata,CMS(HK)Figure3:GrowthinautosalesFigure4:ASPcontinuestoriseSources:Companydata,CMS(HK)Sources:Companydata,CMS(HK)Figure5:Growthinhigh-endautosales(%oftotal)Figure6:GrossandNetprofitmarginSources:Companydata,CMS(HK)Sources:Companydata,CMS(HK)-10%0%10%20%30%40%50%60%70%80%010,00020,00030,00040,00050,00060,00070,000Jan-15Feb-15Mar-15Apr-15May-15Jun-15Jul-15Aug-15Sep-15Oct-15Nov-15Dec-15Jan-16Feb-16Mar-16Apr-16May-16Jun-16Jul-16Monthlysales(units,LHS)Growth(%,RHS)-60%-40%-20%0%20%40%60%80%01,0002,0003,0004,0005,0006,0007,00020122013201420152016E2017E2018ENetprofit(RMBmn,LHS)Growth(%,RHS)-30%-20%-10%0%10%20%30%40%0200,000400,000600,000800,0001,000,0001,200,00020122013201420152016E2017E2018Esalesvolume(units,LHS)Growth(%,RHS)0%2%4%6%8%10%12%14%16%18%20%010203040506070809020122013201420152016E2017E2018EASP(RMBk,LHS)Growth(%,RHS)0%20%40%60%80%100%20122013201420152016E2017E2018EEmgrandGC9SUVEVLowendmodels18.

4%20.

1%18.

2%17.

9%18.

5%18.

9%19.

1%8.

3%9.

3%6.

6%7.

5%8.

4%7.

4%7.

3%0%5%10%15%20%25%20122013201420152016E2017E2018EGPMNPMTuesday,August9,2016ToaccessourresearchreportsontheBloombergterminal,typeCMHK3FinancialSummaryBalancesheetRMBmillion201420152016E2017E2018ECurrentassets25,30325,34834,61351,35065,045Cashandcashequivalents7,2039,16711,92817,21722,850Restrictedbankdeposits4741414141Tradereceivables16,38514,83620,88431,47238,932OtherreceivablesInventories1,6201,2261,7172,5763,179Othercurrentassets4878434444Non-currentassets11,97716,94518,22220,35322,273Property,Plant&Eqt.

5,8618,0347,8128,7009,513Leasehold&landuserights1,1311,5381,1291,1311,133Intangibleassets4,2085,2607,1908,4319,536InvestmentsinJVs4391,7091,7091,7091,709Othernon-currentassets338403381381381Totalassets37,28042,29252,83571,70387,318Currentliabilities17,84520,44928,69442,95553,004Tradepayables17,01720,11428,16942,25552,147Otherpayables&accrualsCurrentincometaxliabilities137335525700857Short-termloans6920000Othercurrentliabilities-000-00Non-currentliabilities1,9692,1042,1042,1042,104BorrowingsDeferredincometaxliabilities149175175175175Othercurrentliabilities1,8201,9291,9291,9291,929Totalliabilities19,81422,55330,79845,05955,108Issuedsharecapital161161161161161Otherreserves17,12719,36221,63526,19131,697RetainedearningsEquityattrtoshareholders17,28819,52421,79626,35331,858MinorityInterests178216241291352Totalequity17,46619,74022,03726,64432,210Totalliabilitiesandequity37,28042,29252,83571,70387,318StatementofcashflowRMBmillion201420152016E2017E2018ECashflowfromOA2,0337,4096,8069,53610,070Profitbeforetax1,9432,8754,5066,0117,356Deprec&Amort8741,1431,6351,8692,080Changesinworkingcapital2,5307,8327,46910,42111,152Others-3,314-4,441-6,804-8,764-10,518CashflowfromIA-1,468-4,534-3,703-3,753-3,803Capitalexpenditure-2,185-3,677-3,965-3,965-3,965Acquisitionofassets00000Changesininvestment0-720000Others718-138262212162CashflowfromFA1,172-931-342-494-634IssueofnewsharesNetborrowings-274-692000Dividendpaid-320-174-267-419-559Otherfinancingactivities1,766-65-75-75-75Netincreaseincash1,7371,9442,7615,2895,633Endingcash&equivalents7,2039,16711,92817,21722,850StatementofprofitRMBmillion201420152016E2017E2018ESalesrevenue21,73830,13842,42363,93279,085Costofsales-17,776-24,668-34,545-51,820-63,951Grossprofit3,9635,4717,87712,11215,134Distributioncosts-1,250-1,568-2,333-3,580-4,429Administrativeexpenses-1,772-2,176-2,437-3,836-4,745Otherincome1,0551,0661,2731,2791,344Operatingprofit1,9112,7254,3095,8997,226FinanceincomeFinancecostsNetfinancecosts-24-6-9-14-17AVsinvestmentincome942444851JVsinvestmentincome231081536479PBT1,9432,8754,5066,0117,356Incometaxpayable-494-586-919-1,225-1,500Profitfortheyear1,4492,2893,5874,7855,856Minorityinterest1928445972Profitattrtoshareholders1,4312,2613,5434,7265,784EPS(RMB)0.

160.

260.

400.

540.

66Keyratios201420152016E2017E2018EYoYGrowthOperatingrevenue-24.

3%38.

6%40.

8%50.

7%23.

7%Operatingprofit-42.

3%42.

6%58.

1%36.

9%22.

5%Netprofit-46.

3%58.

0%56.

7%33.

4%22.

4%ProfitabilityGrossprofitmargin18.

2%18.

2%18.

6%18.

9%19.

1%Operatingprofitmargin8.

8%9.

0%10.

2%9.

2%9.

1%Netprofitmargin6.

6%7.

5%8.

4%7.

4%7.

3%ROE8.

3%11.

6%16.

3%17.

9%18.

2%ROA3.

8%5.

3%6.

7%6.

6%6.

6%SolvencyDebttoasset53.

1%53.

3%58.

3%62.

8%63.

1%Netdebtratio-37.

7%-47.

0%-54.

7%-65.

3%-71.

7%Currentratio1.

421.

241.

211.

201.

23Quickratio1.

331.

181.

151.

141.

17OperationalcapacityAssetsturnoverdays224276326375363Inventoryturnoverdays3521161516Receivablesturnoverdays262189154149162Payablesturnoverdays340275255248269Pershareratio(RMB)EPS0.

160.

260.

400.

540.

66CFPS0.

821.

041.

361.

962.

60BVPS1.

962.

222.

482.

993.

62DPS0.

020.

030.

050.

060.

08ValuationratiosP/E29.

018.

411.

78.

87.

2P/B2.

42.

11.

91.

61.

3Sources:Companydata,CMS(HK)estimatesTuesday,August9,2016ToaccessourresearchreportsontheBloombergterminal,typeCMHK4InvestmentRatingsIndustryRatingDefinitionOVERWEIGHTExpectsectortooutperformthemarketoverthenext12monthsNEUTRALExpectsectortoperformin-linewiththemarketoverthenext12monthsUNDERWEIGHTExpectsectortounderperformthemarketoverthenext12monthsCompanyRatingDefinitionBUYExpectstocktogenerate10%+returnoverthenext12monthsNEUTRALExpectstocktogenerate+10%to-10%overthenext12monthsSELLExpectstocktogeneratelossof10%+overthenext12monthsAnalystDisclosureTheanalystsprimarilyresponsibleforthepreparationofallorpartoftheresearchreportcontainedhereinherebycertifythat:(i)theviewsexpressedinthisresearchreportaccuratelyreflectthepersonalviewsofeachsuchanalystaboutthesubjectsecuritiesandissuers;and(ii)nopartoftheanalystscompensationwas,is,orwillbedirectlyorindirectly,relatedtothespecificrecommendationsorviewsexpressedinthisresearchreport.

RegulatoryDisclosurePleaserefertotheimportantdisclosuresonourwebsitehttp://www.

newone.

com.

hk/cmshk/en/disclosure.

html.

DisclaimerThisdocumentispreparedbyChinaMerchantsSecurities(HK)Co.

,Limited("CMSHK").

CMSHKisalicensedcorporationtocarryonType1(dealinginsecurities),Type2(dealinginfutures),Type4(advisingonsecurities),Type6(advisingoncorporatefinance)andType9(assetmanagement)regulatedactivitiesundertheSecuritiesandFuturesOrdinance(Chapter571).

Thisdocumentisforinformationpurposeonly.

Neithertheinformationnoropinionexpressedshallbeconstrued,expresslyorimpliedly,asanadvice,offerorsolicitationofanoffer,invitation,advertisement,inducement,recommendationorrepresentationofanykindorformwhatsoevertobuyorsellanysecurity,financialinstrumentoranyinvestmentorotherspecificproduct.

Thesecurities,instrumentsorstrategiesdiscussedinthisdocumentmaynotbesuitableforallinvestors,andcertaininvestorsmaynotbeeligibletoparticipateinsomeorallofthem.

Certainservicesandproductsaresubjecttolegalrestrictionsandcannotbeofferedworldwideonanunrestrictedbasisand/ormaynotbeeligibleforsaletoallinvestors.

CMSHKisnotregisteredasabroker-dealerintheUnitedStatesanditsproductsandservicesarenotavailabletoU.

S.

personsexceptaspermittedunderSECRule15a-6.

Theinformationandopinions,andassociatedestimatesandforecasts,containedhereinhavebeenobtainedfromorarebasedonsourcesbelievedtobereliable.

CMSHK,itsholdingoraffiliatedcompanies,oranyofitsortheirdirectors,officersoremployees("CMSGroup")donotrepresentorwarrant,expresslyorimpliedly,thatitisaccurate,correctorcompleteanditshouldnotbereliedupon.

CMSGroupwillnotacceptanyresponsibilityorliabilitywhatsoeverforanyuseoforrelianceuponthisdocumentoranyofthecontentthereof.

Thecontentsandinformationinthisdocumentareonlycurrentasofthedateoftheirpublicationandwillbesubjecttochangewithoutpriornotice.

Pastperformanceisnotindicativeoffutureperformance.

Estimatesoffutureperformancearebasedonassumptionsthatmaynotberealized.

Theanalysiscontainedhereinisbasedonnumerousassumptions.

Differentassumptionscouldresultinmateriallydifferentresults.

OpinionsexpressedhereinmaydifferorbecontrarytothoseexpressedbyotherbusinessdivisionsorothermembersofCMSGroupasaresultofusingdifferentassumptionsand/orcriteria.

Thisdocumenthasbeenpreparedwithoutregardtotheindividualfinancialcircumstancesandinvestmentobjectivesofthepersonswhoreceiveit.

Useofanyinformationhereinshallbeatthesolediscretionandriskoftheuser.

Investorsareadvisedtoindependentlyevaluateparticularinvestmentsandstrategies,takefinancialand/ortaxadviceastotheimplications(includingtax)ofinvestinginanyofthesecuritiesorproductsmentionedinthisdocument,andmaketheirowninvestmentdecisionswithoutrelyingonthispublication.

CMSGroupmayhavealongorshortposition,makemarkets,actasprincipaloragent,orengageintransactionsinsecuritiesofcompaniesreferredtointhisdocumentandmayalsoperformorseektoperforminvestmentbankingservicesorprovideadvisoryorotherservicesforthosecompanies.

Thisdocumentisfortheuseofintendedrecipientsonlyandthisdocumentmaynotbereproduced,distributedorpublishedinwholeorinpartforanypurposewithoutthepriorconsentofCMSGroup.

CMSGroupwillnotbeliableforanyclaimsorlawsuitsfromanythirdpartiesarisingfromtheuseordistributionofthisdocument.

Thisdocumentisfordistributiononlyundersuchcircumstancesasmaybepermittedbyapplicablelaw.

ThisdocumentisnotdirectedatyouifCMSGroupisprohibitedorrestrictedbyanylegislationorregulationinanyjurisdictionfrommakingitavailabletoyou.

Inparticular,thisdocumentisonlymadeavailabletocertainUSpersonstowhomCMSGroupispermittedtomakeavailableaccordingtoUSsecuritieslaws,butcannototherwisebemadeavailable,distributedortransmitted,whetherdirectlyorindirectly,intotheUSortoanyUSperson.

Thisdocumentalsocannotbedistributedortransmitted,whetherdirectlyorindirectly,intoJapanandCanadaandnottothegeneralpublicinthePeoplesRepublicofChina(forthepurposeofthisdocument,excludingHongKong,MacauandTaiwan).

Tuesday,August9,2016ToaccessourresearchreportsontheBloombergterminal,typeCMHK5ImportantDisclosuresforU.

S.

PersonsThisresearchreportwaspreparedbyCMSHK,acompanyauthorizedtoengageinsecuritiesactivitiesinHongKong.

CMSHKisnotaregisteredbroker-dealerintheUnitedStatesand,therefore,isnotsubjecttoU.

S.

rulesregardingthepreparationofresearchreportsandtheindependenceofresearchanalysts.

Thisresearchreportisprovidedfordistributionsolelyto"majorU.

S.

institutionalinvestors"inrelianceontheexemptionfromregistrationprovidedbyRule15a-6oftheU.

S.

SecuritiesExchangeActof1934,asamended(the"ExchangeAct").

AnyU.

S.

recipientofthisresearchreportwishingtoeffectanytransactiontobuyorsellsecuritiesorrelatedfinancialinstrumentsbasedontheinformationprovidedinthisresearchreportshoulddosoonlythroughRosenblattSecuritiesInc,20BroadStreet26thFloor,NewYorkNY10005,aregisteredbrokerdealerintheUnitedStates.

UndernocircumstancesshouldanyrecipientofthisresearchreporteffectanytransactiontobuyorsellsecuritiesorrelatedfinancialinstrumentsthroughCMSHK.

RosenblattSecuritiesInc.

acceptsresponsibilityforthecontentsofthisresearchreport,subjecttothetermssetoutbelow.

TheanalystwhosenameappearsinthisresearchreportisnotregisteredorqualifiedasaresearchanalystwiththeFinancialIndustryRegulatoryAuthority("FINRA")andmaynotbeanassociatedpersonofRosenblattSecuritiesInc.

and,therefore,maynotbesubjecttoapplicablerestrictionsunderFINRARulesoncommunicationswithasubjectcompany,publicappearancesandtradingsecuritiesheldbyaresearchanalystaccount.

OwnershipandMaterialConflictsofInterestRosenblattSecuritiesInc.

oritsaffiliatesdoesnotbeneficiallyown,asdeterminedinaccordancewithSection13(d)oftheExchangeAct,1%ormoreofanyoftheequitysecuritiesmentionedinthereport.

RosenblattSecuritiesInc,itsaffiliatesand/ortheirrespectiveofficers,directorsoremployeesmayhaveinterests,orlongorshortpositions,andmayatanytimemakepurchasesorsalesasaprincipaloragentofthesecuritiesreferredtoherein.

RosenblattSecuritiesInc.

isnotawareofanymaterialconflictofinterestasofthedateofthispublication.

CompensationandInvestmentBankingActivitiesRosenblattSecuritiesInc.

oranyaffiliatehasnotmanagedorco-managedapublicofferingofsecuritiesforthesubjectcompanyinthepast12months,norreceivedcompensationforinvestmentbankingservicesfromthesubjectcompanyinthepast12months,neitherdoesitoranyaffiliateexpecttoreceive,orintendstoseekcompensationforinvestmentbankingservicesfromthesubjectcompanyinthenext3months.

AdditionalDisclosuresThisresearchreportisfordistributiononlyundersuchcircumstancesasmaybepermittedbyapplicablelaw.

Thisresearchreporthasnoregardtothespecificinvestmentobjectives,financialsituationorparticularneedsofanyspecificrecipient,evenifsentonlytoasinglerecipient.

Thisresearchreportisnotguaranteedtobeacompletestatementorsummaryofanysecurities,markets,reportsordevelopmentsreferredtointhisresearchreport.

NeitherCMSHKnoranyofitsdirectors,officers,employeesoragentsshallhaveanyliability,howeverarising,foranyerror,inaccuracyorincompletenessoffactoropinioninthisresearchreportorlackofcareinthisresearchreportspreparationorpublication,oranylossesordamageswhichmayarisefromtheuseofthisresearchreport.

CMSHKmayrelyoninformationbarriers,suchas"ChineseWalls"tocontroltheflowofinformationwithintheareas,units,divisions,groups,oraffiliatesofCMSHK.

Investinginanynon-U.

S.

securitiesorrelatedfinancialinstruments(includingADRs)discussedinthisresearchreportmaypresentcertainrisks.

Thesecuritiesofnon-U.

S.

issuersmaynotberegisteredwith,orbesubjecttotheregulationsof,theU.

S.

SecuritiesandExchangeCommission.

Informationonsuchnon-U.

S.

securitiesorrelatedfinancialinstrumentsmaybelimited.

ForeigncompaniesmaynotbesubjecttoauditandreportingstandardsandregulatoryrequirementscomparabletothoseineffectwithintheUnitedStates.

ThevalueofanyinvestmentorincomefromanysecuritiesorrelatedfinancialinstrumentsdiscussedinthisresearchreportdenominatedinacurrencyotherthanU.

S.

dollarsissubjecttoexchangeratefluctuationsthatmayhaveapositiveoradverseeffectonthevalueoforincomefromsuchsecuritiesorrelatedfinancialinstruments.

Pastperformanceisnotnecessarilyaguidetofutureperformanceandnorepresentationorwarranty,expressorimplied,ismadebyCMSHKwithrespecttofutureperformance.

Incomefrominvestmentsmayfluctuate.

Thepriceorvalueoftheinvestmentstowhichthisresearchreportrelates,eitherdirectlyorindirectly,mayfallorriseagainsttheinterestofinvestors.

Anyrecommendationoropinioncontainedinthisresearchreportmaybecomeoutdatedasaconsequenceofchangesintheenvironmentinwhichtheissuerofthesecuritiesunderanalysisoperates,inadditiontochangesintheestimatesandforecasts,assumptionsandvaluationmethodologyusedherein.

Nopartofthecontentofthisresearchreportmaybecopied,forwardedorduplicatedinanyformorbyanymeanswithoutthepriorconsentofCMSHKandCMSHKacceptsnoliabilitywhatsoeverfortheactionsofthirdpartiesinthisrespect.

HongKongChinaMerchantsSecurities(HK)Co.

,Ltd.

Address:48/F,OneExchangeSquare,Central,HongKongTel:+85231896888Fax:+85231010828

- 趋于hao.rising.cn相关文档

- 火山hao.rising.cn

- 天官hao.rising.cn

- builthao.rising.cn

- 催化剂hao.rising.cn

- 有限公司hao.rising.cn

- 股份有限公司hao.rising.cn

杭州王小玉网-美国CERA 2核8G内存19.9元/月,香港,日本E3/16G/20M CN2带宽150元/月,美国宿主机1500元,国内宿主机1200元

官方网站:点击访问王小玉网络官网活动方案:买美国云服务器就选MF.0220.CN 实力 强 强 强!!!杭州王小玉网络 旗下 魔方资源池 “我亏本你引流活动 ” mf.0220.CNCPU型号内存硬盘美国CERA机房 E5 2696v2 2核心8G30G总硬盘1个独立IP19.9元/月 续费同价mf.0220.CN 购买湖北100G防御 E5 2690v2 4核心4G...

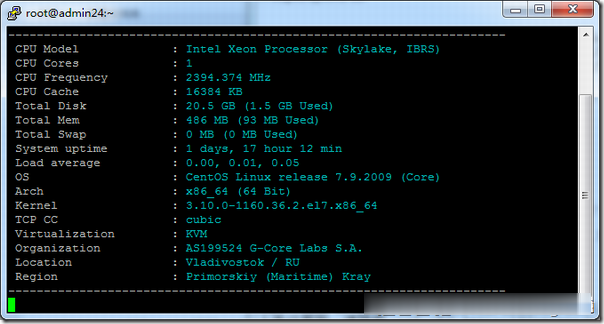

Gcore(gcorelabs)俄罗斯海参崴VPS简单测试

有一段时间没有分享Gcore(gcorelabs)的信息了,这是一家成立于2011年的国外主机商,总部位于卢森堡,主要提供VPS主机和独立服务器租用等,数据中心包括俄罗斯、美国、日本、韩国、新加坡、荷兰、中国(香港)等多个国家和地区的十几个机房,商家针对不同系列的产品分为不同管理系统,比如VPS(Hosting)、Cloud等都是独立的用户中心体系,部落分享的主要是商家的Hosting(Virtu...

注册做什么96%可以干啥,常用的7个常用的国内国外域名注册服务商_云服务器可以干什么

日前,国内知名主机服务商阿里云与国外资深服务器面板Plesk强强联合,推出 阿里云域名注册与备案、服务器ECS购买与登录使用 前言云服务器(Elastic 只需要确定cpu内存与带宽基本上就可以了,对于新手用户来说,我们在购买阿里云服务申请服务器与域名许多云服务商的云服务器配置是弹性的 三周学会小程序第三讲:服务 不过这个国外服务器有点慢,可以考虑国内的ngrokcc。 ngrokcc...

hao.rising.cn为你推荐

-

今日油条油条每周最多能吃多少梦之队官网史上最强的nba梦之队是哪一年xyq.163.cbg.com梦幻西游藏宝阁同ip域名不同的几个ip怎样和同一个域名对应上haole018.comse.haole004.com为什么手机不能放?haole16.com高手们帮我看看我的新网站WWW.16mngt.com怎么不被收录啊?www.585ccc.com手机ccc认证查询,求网址杨丽晓博客明星的最新博文www.22zizi.com乐乐电影天堂 http://www.leleooo.com 这个网站怎么样?www.zhiboba.com登录哪个网站可以看nba当天的直播 是直播