siftingpoweredbyecshop

poweredbyecshop 时间:2021-04-12 阅读:()

PoweredbyiPlanner.

NETOnlineBusinessPlanSoftwareCompanyBusinessPlanHI-TECHADVISERS2012-201418/01/201212:22:56(GMT)ExecutiveSummary.

3CompanyOverview.

4ProductsandServices.

5PricingandSales6MarketingStrategy.

7Competition.

8ManagementandStaffing.

9Implementation.

10FinancialProjections.

113Getstartedwithyourbusinessplan–www.

iplanner.

netExecutiveSummaryHi-TechAdvisers(HTA)willbeformedasaconsultingcompanyspecializinginmarketingofhightechnologyproductsininternationalmarkets.

Itsfoundersareformermarketersofconsultingservices,personalcomputersoftwareandmarketresearch,allininternationalmarkets.

TheyarefoundingHi-TechAdviserstoformalizetheconsultingservicestheyoffer.

MissionHi-TechAdvisersoffershigh-techmanufacturersareliable,highqualityalternativetoin-houseresourcesforbusinessdevelopment,marketdevelopmentandchanneldevelopmentonaninternationalscale.

Atruealternativetoinhouseresourcesoffersaveryhighlevelofpracticalexperience,knowhow,contactsandconfidentiality.

ClientsmustknowthatworkingwithHTAisamoreprofessional,lessriskywaytodevelopnewareaseventhanworkingcompletelyinhousewiththeirownpeople.

HTAmustalsobeabletomaintainfinancialbalance,chargingahighvalueforitsservicesanddeliveringanevenhighervaluetoitsclients.

InitialfocuswillbedevelopmentintheEuropeanandLatinAmericanmarkets,orforEuropeanclientsintheUnitedStatesmarket.

KeystoSuccess1.

Excellenceinfulfillingthepromisecompletelyconfidential,reliable,trustworthyexpertiseandinformation.

2.

Developingvisibilitytogeneratenewbusinessleads.

3.

Leveragingfromasinglepoolofexpertiseintomultiplerevenuegenerationopportunities:retainerconsulting,projectconsulting,marketresearch,andmarketresearchpublishedreports.

Mainfinancialmeasures201220132014Cash3,42252,939114,404Salesrevenue1,175,0001,800,0002,450,000Netprofitforfinancialyear-112,50976,547210,178Operatingmargin-9.

58%4.

25%8.

58%Owners'equity22,491159,038349,216Returnonequity(peryear)-500%48.

1%60.

2%4CompanyOverviewHi-TechAdvisers(HTA)isanewcompanyprovidinghigh-levelexpertiseininternationalhigh-techbusinessdevelopment,channeldevelopment,distributionstrategiesandmarketingofhightechproducts.

Itwillfocusinitiallyonprovidingtwokindsofinternationaltriangles:1.

ProvidingUnitedStatesclientswithdevelopmentforEuropeanandLatinAmericanmarkets.

2.

ProvidingUnitedKingdomandEuropeanclientswithdevelopmentfortheUSandLatinAmericanmarkets.

5Asitgrowsitwilltakeonpeopleandconsultingworkinrelatedmarkets,suchastherestofLatinAmericaandtheFarEast,alsosimilarmarkets.

Asitgrowsitwilllookforadditionalleveragebytakingbrokeragepositionsandrepresentationpositionstocreatepercentageholdingsinproductresults.

HTAwillbecreatedasaCaliforniaCcorporationbasedinSanJose,ownedbyitsprincipalinvestorsandprincipaloperators.

Asofthiswritingithasnotbeencharteredyetandisstillconsideringalternativesoflegalformation.

Theinitialofficewillbeestablishedinaqualityofficespaceinthe"SiliconValley"areaofCalifornia,theheartoftheU.

S.

hightechandsoftwareindustry.

HTAoffersexpertiseinchanneldistribution,channeldevelopment,andmarketdevelopment,soldandpackagedinvariouswaysthatallowclientstochoosetheirpreferredrelationship:theseincludesmallbusinessconsultingrelationships,projectbasedconsulting,relationshipandalliancebrokering,salesrepresentationandmarketrepresentation,project-basedmarketresearch,publishedmarketresearchandinformationforumevents.

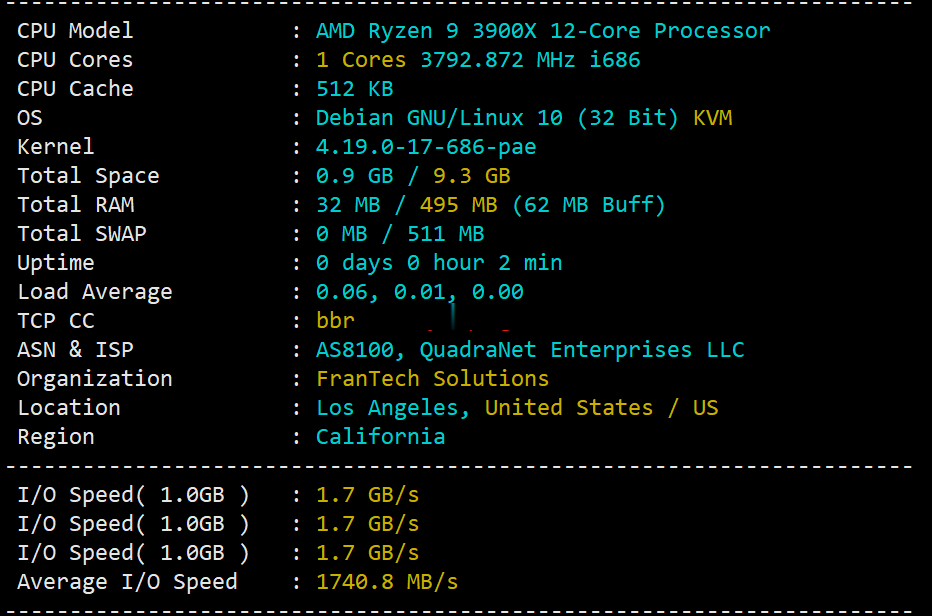

Pic1.

HTAHeadquartersProductsandServicesHTAofferstheexpertiseahigh-technologycompanyneedstodevelopnewproductdistributionandnewmarketsegmentsinnewmarkets.

Thiscanbetakenashigh-levelretainerconsulting,marketresearchreports,orproject-basedconsulting.

Retainerconsulting-werepresentaclientcompanyasanextensionofitsbusinessdevelopmentandmarketdevelopmentfunctions.

Thisbeginswithcompleteunderstandingoftheclientcompany'ssituation,objectives,businessplan,andconstraints.

Wethenrepresenttheclientcompanyquietlyandconfidentially,siftingthroughnewmarketdevelopmentsandnewopportunitiesasisappropriatetotheclient,representingtheclientininitialtalkswithpossibleallies,vendorsandchannels.

6Projectconsulting-Proposedandbilledonaper-projectandper-milestonebasis,projectconsultingoffersaclientcompanyawaytoharnessourspecificqualitiesanduseourexpertisetosolvespecificproblems,developandwritebusinessplans,developspecificinformation,software.

Marketresearch-groupstudiesavailabletoselectedclientsat$5,000perunit.

Agroupstudyispackagedandpublished,acompletestudyofaspecificmarket,channel,ortopic.

ExamplesmightbestudiesofdevelopingconsumerchannelsinBrazilorMexico,orimplicationsofchangingmarginsinsoftware.

InthefutureHTAwillbroadenthecoveragebyexpandingintocoverageofadditionalmarkets(e.

g.

allofLatinAmerica,FarEast,WesternEurope)andadditionalproductareas(e.

g.

telecommunications,web-basedsoftwareandtechnologyintegration).

Wearealsostudyingthepossibilityofnewsletterorelectronicnewsletterservices,orperhapsspecialon-topicreports.

PricingandSalesHTAwillbepricedattheupperedgeofwhatthemarketwillbear,competingwiththenamebrandconsultants.

Consultingshouldbebasedon$5,000perdayforprojectconsulting,$2,000perdayformarketresearch,and$10,000permonthandupforretainerconsulting.

Marketresearchreportsshouldbepricedat$5,000perreport,whichwillofcourserequirethatreportsbeverywellplanned,focusedonveryimportanttopicsverywellpresented.

Theannualsalesprojections,grossmarginsandcostofsalesareincludedhereinthefollowingtables.

Salesrevenue(USD)Productsandservices201220132014RetainerConsulting400,000650,0001,000,000ProjectConsulting500,000750,000900,000MarketResearch200,000300,000400,000StrategicReports75,000100,000150,0001,175,0001,800,0002,450,000Grossmargin(%)Productsandservices201220132014RetainerConsulting858585ProjectConsulting858585MarketResearch303030StrategicReports7070707Costofsales(USD)Productsandservices201220132014RetainerConsulting60,00097,500150,000ProjectConsulting75,000112,500135,000MarketResearch140,000210,000280,000StrategicReports22,50030,00045,000297,500450,000610,000Break-evenanalysis(USD)201220132014Salesrevenue1,175,0001,800,0002,450,000Costofsales297,500450,000610,000Variableexpenses,total297,500450,000610,000Laborcost727,260897,0001,110,900Otheroperatingexpenses265,000322,500455,000Depreciationoffixedassets5,00015,00015,000Financialexpenses5,25030,44825,569Fixedexpenses,total1,002,5101,264,9481,606,469Grossmargin74.

7%75%75.

1%Break-evensalesrevenue1,342,3911,686,5972,139,049Salesrevenueabovebreak-even0113,403310,951MarketingStrategyHTAwillbefocusingonhigh-technologymanufacturersofcomputerhardwareandsoftware,services,networking,whowanttosellintomarketsintheUnitedStates,UnitedKingdom,Europe,andLatinAmerica.

Thesearemostlylargercompanies,andoccasionallymedium-sizedcompanies.

8Ourmostimportantgroupofpotentialcustomersareexecutivesinlargercorporations.

Thesearemarketingmanagers,generalmanagers,salesmanagers,sometimeschargedwithinternationalfocusandsometimeschargedwithmarketorevenspecificchannelfocus.

Theydonotwanttowastetheirtimeorrisktheirmoneylookingforbargaininformationorquestionableexpertise.

Astheygointomarketslookingatnewopportunities,theyareverysensitivetoriskingtheircompany'snameandreputation.

Theconsultingindustryispulverizedanddisorganized,thousandsofsmallerconsultingorganizationsandindividualconsultantsforeveryoneofthefewdozenwell-knowncompanies.

Consultingisadisorganizedindustry,withparticipantsrangingfrommajorinternationalnamebrandconsultantstotensofthousandsofindividuals.

OneofHTA'schallengeswillbeestablishingitselfasa"real"consultingcompany,positionedasarelativelyriskfreecorporatepurchase.

Atthehighestlevelarethefewwellestablishedmajornamesinmanagementconsulting.

Mostoftheseareorganizedaspartnershipsestablishedinmajormarketsaroundtheworld,linkedtogetherbyinterconnectingdirectorsandsharingthenameandcorporatewisdom.

Someevolvedfromaccountingcompaniesandsomefrommanagementconsulting.

Thesecompanieschargeveryhighratesforconsultingandmaintainrelativelyhighoverheadstructuresandfulfillmentstructuresbasedonpartnerssellingandjuniorassociatesfulfilling.

Attheintermediatelevelaresomefunctionspecificormarketspecificconsultants,suchasthemarketresearchfirmsorchanneldevelopmentfirms.

MarketsegmentationLargemanufacturercorporations-ourmostimportantmarketsegmentisthelargemanufacturerofhigh-technologyproducts,suchasApple,Hewlett-Packard,IBM,Microsoft.

ThesecompanieswillbecallingonHTAfordevelopmentfunctionsthatarebetterspunoffthanmanagedin-house,andformarketresearch,andformarketforums.

Mediumsizedgrowthcompanies:particularlyinsoftware,multimedia,andsomerelatedhighgrowthfields,HTAwillbeabletoofferanattractivedevelopmentalternativetothecompanythatismanagementconstrainedandunabletoaddressopportunitiesinnewmarketsandnewmarketsegments.

CompetitionThecompetitioncomesinseveralforms:1.

Themostsignificantcompetitionisnoconsultingatall,companieschoosingtodobusinessdevelopment,planningandchanneldevelopmentandmarketresearchin-house.

Theirownmanagersdothisontheirown,aspartoftheirregularbusinessfunctions.

Ourkeyadvantageincompetitionwithin-housedevelopmentisthatmanagersarealreadyoverloadedwithresponsibilities,theydon'thavetimeforadditionalresponsibilitiesinnewmarketdevelopmentornewchanneldevelopment.

Also,HTAcanapproachalliances,vendors,andchannelsona9confidentialbasis,gatheringinformationandmakinginitialcontactsinwaysthatthecorporatemanagerscan't.

2.

Thehigh-levelprestigemanagementconsulting:McKinsey,BostonConsultingGroup,etc.

Theseareessentiallygeneralistswhotaketheirname-brandmanagementconsultingintospecialtyareas.

Theirotherveryimportantweaknessisthemanagementstructurethathasthepartnerssellingnewjobs,andinexperiencedassociatesdeliveringthework.

Wecompeteagainstthemasexpertsinourspecificfields,andwiththeguaranteethatourclientswillhavethetop-levelpeopledoingtheactualwork.

3.

Thethirdgeneralkindofcompetitoristheinternationalmarketresearchcompany:Dataquest,StanfordResearchInstitute,etc.

Thesecompaniesareformidablecompetitorsforpublishedmarketresearchandmarketforums,butcannotprovidethekindofhigh-levelconsultingthatHTAwillprovide.

4.

Thefourthkindofcompetitionisthemarket-specificsmallerhouse.

Forexample:NomuraResearchinJapan.

5.

Salesrepresentation,brokeringanddealcatalystsareanad-hocbusinessformthatwillbedefinedindetailbythespecificnatureofeachindividualcase.

ManagementandStaffingTheinitialmanagementteamdependsonthefoundersthemselves,withlittleback-up.

Aswegrowwewilltakeonadditionalconsultinghelp,plusgraphic/editorial,sales,andmarketing.

HTAshouldbemainlymanagedbyworkingpartners.

Inthebeginningweassume3-5partners.

WewillinviteoneinternationalpartnerfromEurope.

Theorganizationhastobeveryflatinthebeginning,witheachofthefoundersresponsibleforhisorherownworkandmanagement.

TheHTAbusinessrequiresaveryhighlevelofinternationalexperienceandexpertise,whichmeansthatitwillnotbeeasilyleverageableinthecommonconsultingcompanymodeinwhichpartnersrunthebusinessandmakesales,whileassociatesfulfill.

Partnerswillnecessarilybeinvolvedinthefulfillmentofthecorebusinessproposition,providingtheexpertisetotheclients.

Theinitialpersonnelplanisstilltentative.

Itshouldinvolve3-5partners,1-3consultants,1strongmarketingperson,anofficemanager.

Laterweaddmorepartners,consultantsandandsalesstaff.

Theannualpersonalestimatesareincludedinthetablespresentedbelow.

HeadcountPersonnel201220132014Partners457Consultants444Marketingmanager01110Salesreps222Officemanager111111315Monthlysalary(USD)Personnel201220132014Partners5,2005,5006,000Consultants5,1005,2005,300Marketingmanager4,6004,7004,800Salesreps4,2004,4004,600Officemanager3,1003,2003,300Laborcost(USD)201220132014Wagesandsalaries632,400780,000966,000Socialsecuritycosts94,860117,000144,900Laborcost727,260897,0001,110,900REVENUES1,175,0001,800,0002,450,000Laborcosttorevenues61.

9%49.

8%45.

3%ImplementationTotalstart-upexpense(includinglegalcosts,branding,stationery,otheronetimeexpenses)cometo$30,000.

Theannualoverheadexpenseestimatesarepresentedinthetablebelow.

Start-upassetsrequiredinclude$50,000infixedassetslikeofficefurniture,computers,softwareandotherequipmentandtools.

11Otheroperatingexpenses(USD)Otheroperatingexpenses201220132014Startupexpenses30,00000Marketing50,00060,00070,000Travel100,000150,000250,000Officeexpensesandutilities75,000100,000120,000Insurance5,0005,0005,000Otherfixedexpenses5,0007,50010,000265,000322,500455,000Assetspurchasevalue(USD)Fixedassets201220132014Startupfixedassets(equipment)50,00000Newoffice0500,000050,000500,0000FinancialProjectionsThepaid-incapitalfrompartnersandotherinvestorswillbe$135,000.

Anannuityloanwillbetakenfromabankinamountof$500,000for60months.

Theperformancemeasures,businessplanfinancialprojectionsandbreak-evenanalysisarepresentedbelow.

Performancemeasures(USD)201220132014Salesrevenue1,175,0001,800,0002,450,000Exportsales000Costofsales297,500450,000610,000Grossprofit877,5001,350,0001,840,000Otheroperatingrevenueandexpenses000Otheroperatingexpenses265,000322,500455,000Laborcost727,260897,0001,110,900Depreciationoffixedassets5,00015,00015,000Operatingprofit-119,760115,500259,100EBITDA-114,760130,500274,100Financialincomeandexpenses-5,250-30,448-25,569Profitbeforeincometax-125,01085,052233,531Incometaxexpense-12,5018,50523,353Profit-112,50976,547210,178Operatingmargin-9.

58%4.

25%8.

58%Grossmargin74.

7%75%75.

1%Salesperemployee106,818138,462163,333Valueadded612,5001,027,5001,385,000Valueaddedperemployee55,68279,03892,33312Returnonequity(peryear)-500%48.

1%60.

2%Quickratio1.

040.

908.

52Currentratio1.

040.

908.

52ISCR-21.

94.

2910.

7DSCR01.

081.

79Debttoequityratio3.

333.

041.

02Debttocapitalratio76.

9%75.

3%50.

5%Receivablescollectionperiod,days15.

015.

015.

0Payableperiod,days15.

015.

015.

0Inventoryperiod,days000Incomestatements(USD)201220132014Salesrevenue1,175,0001,800,0002,450,000Exportsales000Otheroperatingrevenue000Costofsales297,500450,000610,000Otheroperatingexpenses265,000322,500455,000LaborcostWagesandsalaries632,400780,000966,000Socialsecuritycosts94,860117,000144,900Totallaborcost727,260897,0001,110,900Depreciationoffixedassets5,00015,00015,000Operatingprofit-119,760115,500259,100FinancialexpensesInterestexpense5,25030,44825,569Totalfinancialexpenses5,25030,44825,569Profitbeforeincometax-125,01085,052233,531Incometaxexpense-12,5018,50523,353Netprofitforfinancialyear-112,50976,547210,178Balancesheets(USD)201220132014ASSETSCurrentassetsCash3,42252,939114,404ReceivablesandprepaymentsTradereceivables48,96875,006102,087Prepaidanddeferredtaxes12,5013,9960.

00Othershort-termreceivables000InventoriesInventories000Totalcurrentassets64,890131,940216,491FixedassetsTangibleassetsMachinenyandequipment50,000550,000550,000Less:Accumulateddepreciation-5,000-20,000-35,000Total45,000530,000515,000Totalfixedassets45,000530,000515,000Totalassets109,890661,940731,49113LIABILITIESandOWNERS'EQUITYLiabilitiesCurrentliabilitiesLoanliabilitiesShort-termloansandnotes000Currentportionoflong-termloanliabilities50,000127,2950Total50,000127,2950DebtsandprepaymentsTradecreditors,goods12,39918,75125,418Tradecreditors,other000Employee-relatedliabilities000VAT(GST)000Total12,39918,75125,418Totalcurrentliabilities62,399146,04625,418Long-termliabilitiesLong-termloanliabilitiesLoans,notesandfinancialleasepayables25,000356,857356,857Deferredgrantrevenue000Totallong-termliabilities25,000356,857356,857Totalliabilities87,399502,902382,275Owners'equitySharecapitalinnominalvalue135,000195,000195,000Sharepremium000Retainedprofit/loss0-112,509-55,962Currentyearprofit-112,50976,547210,178Totalowners'equity22,491159,038349,216Totalliabilitiesandowners'equity109,890661,940731,491Cashflowstatement(1-6month)(USD)Jan-2012Feb-2012Mar-2012Apr-2012May-2012Jun-2012CASHFLOWSFROMOPERATINGACTIVITIESInflowsPaymentsfromcustomers48,95897,91597,91597,91597,91597,915Receiptofgrantfinancing(operatingexpenses)000000Receiptofgrantfinancing(personnelexpenses)000000Receiptofotheroperatingrevenue000000Total48,95897,91597,91597,91597,91597,915OutflowsPaymentstovendors(goods)12,39624,79124,79124,79124,79124,791Paymentofsalariesandwages52,70052,70052,70052,70052,70052,700Socialsecuritycosts7,9057,9057,9057,9057,9057,905Paymentstovendors(operatingexpenses)29,58129,58129,58119,58119,58119,581Total102,582114,977114,977104,977104,977104,977Netcashflowfromoperatingactivities-53,624-17,062-17,062-7,062-7,062-7,062CASHFLOWSFROMINVESTINGACTIVITIESReceiptofgrantfinancing(assets)000000Total000000OutflowsPaymentstovendors(assets)50,00000000Total50,00000000Netcashflowfrominvestingactivities-50,0000000014CASHFLOWSFROMFINANCINGACTIVITIESInflowsInflowsofnominalvalue135,00000000Inflowsofsharepremium000000Loanamountsreceived75,00000000Total210,00000000OutflowsPrincipalrepayments000000Interestexpense438438438438438438Dividends(nettoshareholders)000000Paymentofcorporateincometax000000Corporateincometaxondividends000000VATReturn000000Total438438438438438438Netcashflowfromfinancingactivities209,563-438-438-438-438-438Netchangeincashandcashequivalents105,938-17,500-17,500-7,500-7,500-7,500Cashandcashequivalentsatthebeginning0105,93888,43970,93963,44055,940Cashandcashequivalentsattheend105,93888,43970,93963,44055,94048,441Cashflowstatement(3-6quarter)(USD)Q3-2012Q4-2012Q1-2013Q2-2013CASHFLOWSFROMOPERATINGACTIVITIESInflowsPaymentsfromcustomers293,745293,755423,965449,997Receiptofgrantfinancing(operatingexpenses)0000Receiptofgrantfinancing(personnelexpenses)0000Receiptofotheroperatingrevenue0000Total293,745293,755423,965449,997OutflowsPaymentstovendors(goods)74,37374,377106,149112,499Paymentofsalariesandwages158,100158,100195,000195,000Socialsecuritycosts23,71523,71529,25029,250Paymentstovendors(operatingexpenses)58,74358,77180,62280,622Total314,931314,963411,021417,371Netcashflowfromoperatingactivities-21,186-21,20812,94432,626CASHFLOWSFROMINVESTINGACTIVITIESReceiptofgrantfinancing(assets)0000Total0000OutflowsPaymentstovendors(assets)00500,0000Total00500,0000Netcashflowfrominvestingactivities00-500,0000CASHFLOWSFROMFINANCINGACTIVITIESInflowsInflowsofnominalvalue0060,0000Inflowsofsharepremium0000Loanamountsreceived00500,0000Total00560,0000OutflowsPrincipalrepayments0012,49812,498Interestexpense1,3131,3136,1678,448Dividends(nettoshareholders)0000Paymentofcorporateincometax0000Corporateincometaxondividends0000VATReturn000015Total1,3131,31318,66520,946Netcashflowfromfinancingactivities-1,313-1,313541,335-20,946Netchangeincashandcashequivalents-22,499-22,52054,28011,680Cashandcashequivalentsatthebeginning48,44125,9423,42257,701Cashandcashequivalentsattheend25,9423,42257,70169,381Cashflowstatement(1-4year)(USD)201220132014CASHFLOWSFROMOPERATINGACTIVITIESInflowsPaymentsfromcustomers1,126,0331,773,9622,422,919Receiptofgrantfinancing(operatingexpenses)000Receiptofgrantfinancing(personnelexpenses)000Receiptofotheroperatingrevenue000Total1,126,0331,773,9622,422,919OutflowsPaymentstovendors(goods)285,101443,648603,333Paymentofsalariesandwages632,400780,000966,000Socialsecuritycosts94,860117,000144,900Paymentstovendors(operatingexpenses)265,000322,500455,000Total1,277,3611,663,1482,169,233Netcashflowfromoperatingactivities-151,328110,814253,686CASHFLOWSFROMINVESTINGACTIVITIESReceiptofgrantfinancing(assets)000Total000OutflowsPaymentstovendors(assets)50,000500,0000Total50,000500,0000Netcashflowfrominvestingactivities-50,000-500,0000CASHFLOWSFROMFINANCINGACTIVITIESInflowsInflowsofnominalvalue135,00060,0000Inflowsofsharepremium000Loanamountsreceived75,000500,0000Total210,000560,0000OutflowsPrincipalrepayments090,849127,295Interestexpense5,25030,44825,569Dividends(nettoshareholders)0020,000Paymentofcorporateincometax0019,357Corporateincometaxondividends000VATReturn000Total5,250121,297192,221Netcashflowfromfinancingactivities204,750438,703-192,221Netchangeincashandcashequivalents3,42249,51761,465Cashandcashequivalentsatthebeginning03,42252,939Cashandcashequivalentsattheend3,42252,939114,40416Capitalstructure(USD)201220132014Currentassets64,890131,940216,491Fixedassets45,000530,000515,000Currentliabilities62,399146,04625,418Long-termliabilities25,000356,857356,857Owners'equity22,491159,038349,216Getstartedwithyourbusinessplan–www.

iplanner.

net

NETOnlineBusinessPlanSoftwareCompanyBusinessPlanHI-TECHADVISERS2012-201418/01/201212:22:56(GMT)ExecutiveSummary.

3CompanyOverview.

4ProductsandServices.

5PricingandSales6MarketingStrategy.

7Competition.

8ManagementandStaffing.

9Implementation.

10FinancialProjections.

113Getstartedwithyourbusinessplan–www.

iplanner.

netExecutiveSummaryHi-TechAdvisers(HTA)willbeformedasaconsultingcompanyspecializinginmarketingofhightechnologyproductsininternationalmarkets.

Itsfoundersareformermarketersofconsultingservices,personalcomputersoftwareandmarketresearch,allininternationalmarkets.

TheyarefoundingHi-TechAdviserstoformalizetheconsultingservicestheyoffer.

MissionHi-TechAdvisersoffershigh-techmanufacturersareliable,highqualityalternativetoin-houseresourcesforbusinessdevelopment,marketdevelopmentandchanneldevelopmentonaninternationalscale.

Atruealternativetoinhouseresourcesoffersaveryhighlevelofpracticalexperience,knowhow,contactsandconfidentiality.

ClientsmustknowthatworkingwithHTAisamoreprofessional,lessriskywaytodevelopnewareaseventhanworkingcompletelyinhousewiththeirownpeople.

HTAmustalsobeabletomaintainfinancialbalance,chargingahighvalueforitsservicesanddeliveringanevenhighervaluetoitsclients.

InitialfocuswillbedevelopmentintheEuropeanandLatinAmericanmarkets,orforEuropeanclientsintheUnitedStatesmarket.

KeystoSuccess1.

Excellenceinfulfillingthepromisecompletelyconfidential,reliable,trustworthyexpertiseandinformation.

2.

Developingvisibilitytogeneratenewbusinessleads.

3.

Leveragingfromasinglepoolofexpertiseintomultiplerevenuegenerationopportunities:retainerconsulting,projectconsulting,marketresearch,andmarketresearchpublishedreports.

Mainfinancialmeasures201220132014Cash3,42252,939114,404Salesrevenue1,175,0001,800,0002,450,000Netprofitforfinancialyear-112,50976,547210,178Operatingmargin-9.

58%4.

25%8.

58%Owners'equity22,491159,038349,216Returnonequity(peryear)-500%48.

1%60.

2%4CompanyOverviewHi-TechAdvisers(HTA)isanewcompanyprovidinghigh-levelexpertiseininternationalhigh-techbusinessdevelopment,channeldevelopment,distributionstrategiesandmarketingofhightechproducts.

Itwillfocusinitiallyonprovidingtwokindsofinternationaltriangles:1.

ProvidingUnitedStatesclientswithdevelopmentforEuropeanandLatinAmericanmarkets.

2.

ProvidingUnitedKingdomandEuropeanclientswithdevelopmentfortheUSandLatinAmericanmarkets.

5Asitgrowsitwilltakeonpeopleandconsultingworkinrelatedmarkets,suchastherestofLatinAmericaandtheFarEast,alsosimilarmarkets.

Asitgrowsitwilllookforadditionalleveragebytakingbrokeragepositionsandrepresentationpositionstocreatepercentageholdingsinproductresults.

HTAwillbecreatedasaCaliforniaCcorporationbasedinSanJose,ownedbyitsprincipalinvestorsandprincipaloperators.

Asofthiswritingithasnotbeencharteredyetandisstillconsideringalternativesoflegalformation.

Theinitialofficewillbeestablishedinaqualityofficespaceinthe"SiliconValley"areaofCalifornia,theheartoftheU.

S.

hightechandsoftwareindustry.

HTAoffersexpertiseinchanneldistribution,channeldevelopment,andmarketdevelopment,soldandpackagedinvariouswaysthatallowclientstochoosetheirpreferredrelationship:theseincludesmallbusinessconsultingrelationships,projectbasedconsulting,relationshipandalliancebrokering,salesrepresentationandmarketrepresentation,project-basedmarketresearch,publishedmarketresearchandinformationforumevents.

Pic1.

HTAHeadquartersProductsandServicesHTAofferstheexpertiseahigh-technologycompanyneedstodevelopnewproductdistributionandnewmarketsegmentsinnewmarkets.

Thiscanbetakenashigh-levelretainerconsulting,marketresearchreports,orproject-basedconsulting.

Retainerconsulting-werepresentaclientcompanyasanextensionofitsbusinessdevelopmentandmarketdevelopmentfunctions.

Thisbeginswithcompleteunderstandingoftheclientcompany'ssituation,objectives,businessplan,andconstraints.

Wethenrepresenttheclientcompanyquietlyandconfidentially,siftingthroughnewmarketdevelopmentsandnewopportunitiesasisappropriatetotheclient,representingtheclientininitialtalkswithpossibleallies,vendorsandchannels.

6Projectconsulting-Proposedandbilledonaper-projectandper-milestonebasis,projectconsultingoffersaclientcompanyawaytoharnessourspecificqualitiesanduseourexpertisetosolvespecificproblems,developandwritebusinessplans,developspecificinformation,software.

Marketresearch-groupstudiesavailabletoselectedclientsat$5,000perunit.

Agroupstudyispackagedandpublished,acompletestudyofaspecificmarket,channel,ortopic.

ExamplesmightbestudiesofdevelopingconsumerchannelsinBrazilorMexico,orimplicationsofchangingmarginsinsoftware.

InthefutureHTAwillbroadenthecoveragebyexpandingintocoverageofadditionalmarkets(e.

g.

allofLatinAmerica,FarEast,WesternEurope)andadditionalproductareas(e.

g.

telecommunications,web-basedsoftwareandtechnologyintegration).

Wearealsostudyingthepossibilityofnewsletterorelectronicnewsletterservices,orperhapsspecialon-topicreports.

PricingandSalesHTAwillbepricedattheupperedgeofwhatthemarketwillbear,competingwiththenamebrandconsultants.

Consultingshouldbebasedon$5,000perdayforprojectconsulting,$2,000perdayformarketresearch,and$10,000permonthandupforretainerconsulting.

Marketresearchreportsshouldbepricedat$5,000perreport,whichwillofcourserequirethatreportsbeverywellplanned,focusedonveryimportanttopicsverywellpresented.

Theannualsalesprojections,grossmarginsandcostofsalesareincludedhereinthefollowingtables.

Salesrevenue(USD)Productsandservices201220132014RetainerConsulting400,000650,0001,000,000ProjectConsulting500,000750,000900,000MarketResearch200,000300,000400,000StrategicReports75,000100,000150,0001,175,0001,800,0002,450,000Grossmargin(%)Productsandservices201220132014RetainerConsulting858585ProjectConsulting858585MarketResearch303030StrategicReports7070707Costofsales(USD)Productsandservices201220132014RetainerConsulting60,00097,500150,000ProjectConsulting75,000112,500135,000MarketResearch140,000210,000280,000StrategicReports22,50030,00045,000297,500450,000610,000Break-evenanalysis(USD)201220132014Salesrevenue1,175,0001,800,0002,450,000Costofsales297,500450,000610,000Variableexpenses,total297,500450,000610,000Laborcost727,260897,0001,110,900Otheroperatingexpenses265,000322,500455,000Depreciationoffixedassets5,00015,00015,000Financialexpenses5,25030,44825,569Fixedexpenses,total1,002,5101,264,9481,606,469Grossmargin74.

7%75%75.

1%Break-evensalesrevenue1,342,3911,686,5972,139,049Salesrevenueabovebreak-even0113,403310,951MarketingStrategyHTAwillbefocusingonhigh-technologymanufacturersofcomputerhardwareandsoftware,services,networking,whowanttosellintomarketsintheUnitedStates,UnitedKingdom,Europe,andLatinAmerica.

Thesearemostlylargercompanies,andoccasionallymedium-sizedcompanies.

8Ourmostimportantgroupofpotentialcustomersareexecutivesinlargercorporations.

Thesearemarketingmanagers,generalmanagers,salesmanagers,sometimeschargedwithinternationalfocusandsometimeschargedwithmarketorevenspecificchannelfocus.

Theydonotwanttowastetheirtimeorrisktheirmoneylookingforbargaininformationorquestionableexpertise.

Astheygointomarketslookingatnewopportunities,theyareverysensitivetoriskingtheircompany'snameandreputation.

Theconsultingindustryispulverizedanddisorganized,thousandsofsmallerconsultingorganizationsandindividualconsultantsforeveryoneofthefewdozenwell-knowncompanies.

Consultingisadisorganizedindustry,withparticipantsrangingfrommajorinternationalnamebrandconsultantstotensofthousandsofindividuals.

OneofHTA'schallengeswillbeestablishingitselfasa"real"consultingcompany,positionedasarelativelyriskfreecorporatepurchase.

Atthehighestlevelarethefewwellestablishedmajornamesinmanagementconsulting.

Mostoftheseareorganizedaspartnershipsestablishedinmajormarketsaroundtheworld,linkedtogetherbyinterconnectingdirectorsandsharingthenameandcorporatewisdom.

Someevolvedfromaccountingcompaniesandsomefrommanagementconsulting.

Thesecompanieschargeveryhighratesforconsultingandmaintainrelativelyhighoverheadstructuresandfulfillmentstructuresbasedonpartnerssellingandjuniorassociatesfulfilling.

Attheintermediatelevelaresomefunctionspecificormarketspecificconsultants,suchasthemarketresearchfirmsorchanneldevelopmentfirms.

MarketsegmentationLargemanufacturercorporations-ourmostimportantmarketsegmentisthelargemanufacturerofhigh-technologyproducts,suchasApple,Hewlett-Packard,IBM,Microsoft.

ThesecompanieswillbecallingonHTAfordevelopmentfunctionsthatarebetterspunoffthanmanagedin-house,andformarketresearch,andformarketforums.

Mediumsizedgrowthcompanies:particularlyinsoftware,multimedia,andsomerelatedhighgrowthfields,HTAwillbeabletoofferanattractivedevelopmentalternativetothecompanythatismanagementconstrainedandunabletoaddressopportunitiesinnewmarketsandnewmarketsegments.

CompetitionThecompetitioncomesinseveralforms:1.

Themostsignificantcompetitionisnoconsultingatall,companieschoosingtodobusinessdevelopment,planningandchanneldevelopmentandmarketresearchin-house.

Theirownmanagersdothisontheirown,aspartoftheirregularbusinessfunctions.

Ourkeyadvantageincompetitionwithin-housedevelopmentisthatmanagersarealreadyoverloadedwithresponsibilities,theydon'thavetimeforadditionalresponsibilitiesinnewmarketdevelopmentornewchanneldevelopment.

Also,HTAcanapproachalliances,vendors,andchannelsona9confidentialbasis,gatheringinformationandmakinginitialcontactsinwaysthatthecorporatemanagerscan't.

2.

Thehigh-levelprestigemanagementconsulting:McKinsey,BostonConsultingGroup,etc.

Theseareessentiallygeneralistswhotaketheirname-brandmanagementconsultingintospecialtyareas.

Theirotherveryimportantweaknessisthemanagementstructurethathasthepartnerssellingnewjobs,andinexperiencedassociatesdeliveringthework.

Wecompeteagainstthemasexpertsinourspecificfields,andwiththeguaranteethatourclientswillhavethetop-levelpeopledoingtheactualwork.

3.

Thethirdgeneralkindofcompetitoristheinternationalmarketresearchcompany:Dataquest,StanfordResearchInstitute,etc.

Thesecompaniesareformidablecompetitorsforpublishedmarketresearchandmarketforums,butcannotprovidethekindofhigh-levelconsultingthatHTAwillprovide.

4.

Thefourthkindofcompetitionisthemarket-specificsmallerhouse.

Forexample:NomuraResearchinJapan.

5.

Salesrepresentation,brokeringanddealcatalystsareanad-hocbusinessformthatwillbedefinedindetailbythespecificnatureofeachindividualcase.

ManagementandStaffingTheinitialmanagementteamdependsonthefoundersthemselves,withlittleback-up.

Aswegrowwewilltakeonadditionalconsultinghelp,plusgraphic/editorial,sales,andmarketing.

HTAshouldbemainlymanagedbyworkingpartners.

Inthebeginningweassume3-5partners.

WewillinviteoneinternationalpartnerfromEurope.

Theorganizationhastobeveryflatinthebeginning,witheachofthefoundersresponsibleforhisorherownworkandmanagement.

TheHTAbusinessrequiresaveryhighlevelofinternationalexperienceandexpertise,whichmeansthatitwillnotbeeasilyleverageableinthecommonconsultingcompanymodeinwhichpartnersrunthebusinessandmakesales,whileassociatesfulfill.

Partnerswillnecessarilybeinvolvedinthefulfillmentofthecorebusinessproposition,providingtheexpertisetotheclients.

Theinitialpersonnelplanisstilltentative.

Itshouldinvolve3-5partners,1-3consultants,1strongmarketingperson,anofficemanager.

Laterweaddmorepartners,consultantsandandsalesstaff.

Theannualpersonalestimatesareincludedinthetablespresentedbelow.

HeadcountPersonnel201220132014Partners457Consultants444Marketingmanager01110Salesreps222Officemanager111111315Monthlysalary(USD)Personnel201220132014Partners5,2005,5006,000Consultants5,1005,2005,300Marketingmanager4,6004,7004,800Salesreps4,2004,4004,600Officemanager3,1003,2003,300Laborcost(USD)201220132014Wagesandsalaries632,400780,000966,000Socialsecuritycosts94,860117,000144,900Laborcost727,260897,0001,110,900REVENUES1,175,0001,800,0002,450,000Laborcosttorevenues61.

9%49.

8%45.

3%ImplementationTotalstart-upexpense(includinglegalcosts,branding,stationery,otheronetimeexpenses)cometo$30,000.

Theannualoverheadexpenseestimatesarepresentedinthetablebelow.

Start-upassetsrequiredinclude$50,000infixedassetslikeofficefurniture,computers,softwareandotherequipmentandtools.

11Otheroperatingexpenses(USD)Otheroperatingexpenses201220132014Startupexpenses30,00000Marketing50,00060,00070,000Travel100,000150,000250,000Officeexpensesandutilities75,000100,000120,000Insurance5,0005,0005,000Otherfixedexpenses5,0007,50010,000265,000322,500455,000Assetspurchasevalue(USD)Fixedassets201220132014Startupfixedassets(equipment)50,00000Newoffice0500,000050,000500,0000FinancialProjectionsThepaid-incapitalfrompartnersandotherinvestorswillbe$135,000.

Anannuityloanwillbetakenfromabankinamountof$500,000for60months.

Theperformancemeasures,businessplanfinancialprojectionsandbreak-evenanalysisarepresentedbelow.

Performancemeasures(USD)201220132014Salesrevenue1,175,0001,800,0002,450,000Exportsales000Costofsales297,500450,000610,000Grossprofit877,5001,350,0001,840,000Otheroperatingrevenueandexpenses000Otheroperatingexpenses265,000322,500455,000Laborcost727,260897,0001,110,900Depreciationoffixedassets5,00015,00015,000Operatingprofit-119,760115,500259,100EBITDA-114,760130,500274,100Financialincomeandexpenses-5,250-30,448-25,569Profitbeforeincometax-125,01085,052233,531Incometaxexpense-12,5018,50523,353Profit-112,50976,547210,178Operatingmargin-9.

58%4.

25%8.

58%Grossmargin74.

7%75%75.

1%Salesperemployee106,818138,462163,333Valueadded612,5001,027,5001,385,000Valueaddedperemployee55,68279,03892,33312Returnonequity(peryear)-500%48.

1%60.

2%Quickratio1.

040.

908.

52Currentratio1.

040.

908.

52ISCR-21.

94.

2910.

7DSCR01.

081.

79Debttoequityratio3.

333.

041.

02Debttocapitalratio76.

9%75.

3%50.

5%Receivablescollectionperiod,days15.

015.

015.

0Payableperiod,days15.

015.

015.

0Inventoryperiod,days000Incomestatements(USD)201220132014Salesrevenue1,175,0001,800,0002,450,000Exportsales000Otheroperatingrevenue000Costofsales297,500450,000610,000Otheroperatingexpenses265,000322,500455,000LaborcostWagesandsalaries632,400780,000966,000Socialsecuritycosts94,860117,000144,900Totallaborcost727,260897,0001,110,900Depreciationoffixedassets5,00015,00015,000Operatingprofit-119,760115,500259,100FinancialexpensesInterestexpense5,25030,44825,569Totalfinancialexpenses5,25030,44825,569Profitbeforeincometax-125,01085,052233,531Incometaxexpense-12,5018,50523,353Netprofitforfinancialyear-112,50976,547210,178Balancesheets(USD)201220132014ASSETSCurrentassetsCash3,42252,939114,404ReceivablesandprepaymentsTradereceivables48,96875,006102,087Prepaidanddeferredtaxes12,5013,9960.

00Othershort-termreceivables000InventoriesInventories000Totalcurrentassets64,890131,940216,491FixedassetsTangibleassetsMachinenyandequipment50,000550,000550,000Less:Accumulateddepreciation-5,000-20,000-35,000Total45,000530,000515,000Totalfixedassets45,000530,000515,000Totalassets109,890661,940731,49113LIABILITIESandOWNERS'EQUITYLiabilitiesCurrentliabilitiesLoanliabilitiesShort-termloansandnotes000Currentportionoflong-termloanliabilities50,000127,2950Total50,000127,2950DebtsandprepaymentsTradecreditors,goods12,39918,75125,418Tradecreditors,other000Employee-relatedliabilities000VAT(GST)000Total12,39918,75125,418Totalcurrentliabilities62,399146,04625,418Long-termliabilitiesLong-termloanliabilitiesLoans,notesandfinancialleasepayables25,000356,857356,857Deferredgrantrevenue000Totallong-termliabilities25,000356,857356,857Totalliabilities87,399502,902382,275Owners'equitySharecapitalinnominalvalue135,000195,000195,000Sharepremium000Retainedprofit/loss0-112,509-55,962Currentyearprofit-112,50976,547210,178Totalowners'equity22,491159,038349,216Totalliabilitiesandowners'equity109,890661,940731,491Cashflowstatement(1-6month)(USD)Jan-2012Feb-2012Mar-2012Apr-2012May-2012Jun-2012CASHFLOWSFROMOPERATINGACTIVITIESInflowsPaymentsfromcustomers48,95897,91597,91597,91597,91597,915Receiptofgrantfinancing(operatingexpenses)000000Receiptofgrantfinancing(personnelexpenses)000000Receiptofotheroperatingrevenue000000Total48,95897,91597,91597,91597,91597,915OutflowsPaymentstovendors(goods)12,39624,79124,79124,79124,79124,791Paymentofsalariesandwages52,70052,70052,70052,70052,70052,700Socialsecuritycosts7,9057,9057,9057,9057,9057,905Paymentstovendors(operatingexpenses)29,58129,58129,58119,58119,58119,581Total102,582114,977114,977104,977104,977104,977Netcashflowfromoperatingactivities-53,624-17,062-17,062-7,062-7,062-7,062CASHFLOWSFROMINVESTINGACTIVITIESReceiptofgrantfinancing(assets)000000Total000000OutflowsPaymentstovendors(assets)50,00000000Total50,00000000Netcashflowfrominvestingactivities-50,0000000014CASHFLOWSFROMFINANCINGACTIVITIESInflowsInflowsofnominalvalue135,00000000Inflowsofsharepremium000000Loanamountsreceived75,00000000Total210,00000000OutflowsPrincipalrepayments000000Interestexpense438438438438438438Dividends(nettoshareholders)000000Paymentofcorporateincometax000000Corporateincometaxondividends000000VATReturn000000Total438438438438438438Netcashflowfromfinancingactivities209,563-438-438-438-438-438Netchangeincashandcashequivalents105,938-17,500-17,500-7,500-7,500-7,500Cashandcashequivalentsatthebeginning0105,93888,43970,93963,44055,940Cashandcashequivalentsattheend105,93888,43970,93963,44055,94048,441Cashflowstatement(3-6quarter)(USD)Q3-2012Q4-2012Q1-2013Q2-2013CASHFLOWSFROMOPERATINGACTIVITIESInflowsPaymentsfromcustomers293,745293,755423,965449,997Receiptofgrantfinancing(operatingexpenses)0000Receiptofgrantfinancing(personnelexpenses)0000Receiptofotheroperatingrevenue0000Total293,745293,755423,965449,997OutflowsPaymentstovendors(goods)74,37374,377106,149112,499Paymentofsalariesandwages158,100158,100195,000195,000Socialsecuritycosts23,71523,71529,25029,250Paymentstovendors(operatingexpenses)58,74358,77180,62280,622Total314,931314,963411,021417,371Netcashflowfromoperatingactivities-21,186-21,20812,94432,626CASHFLOWSFROMINVESTINGACTIVITIESReceiptofgrantfinancing(assets)0000Total0000OutflowsPaymentstovendors(assets)00500,0000Total00500,0000Netcashflowfrominvestingactivities00-500,0000CASHFLOWSFROMFINANCINGACTIVITIESInflowsInflowsofnominalvalue0060,0000Inflowsofsharepremium0000Loanamountsreceived00500,0000Total00560,0000OutflowsPrincipalrepayments0012,49812,498Interestexpense1,3131,3136,1678,448Dividends(nettoshareholders)0000Paymentofcorporateincometax0000Corporateincometaxondividends0000VATReturn000015Total1,3131,31318,66520,946Netcashflowfromfinancingactivities-1,313-1,313541,335-20,946Netchangeincashandcashequivalents-22,499-22,52054,28011,680Cashandcashequivalentsatthebeginning48,44125,9423,42257,701Cashandcashequivalentsattheend25,9423,42257,70169,381Cashflowstatement(1-4year)(USD)201220132014CASHFLOWSFROMOPERATINGACTIVITIESInflowsPaymentsfromcustomers1,126,0331,773,9622,422,919Receiptofgrantfinancing(operatingexpenses)000Receiptofgrantfinancing(personnelexpenses)000Receiptofotheroperatingrevenue000Total1,126,0331,773,9622,422,919OutflowsPaymentstovendors(goods)285,101443,648603,333Paymentofsalariesandwages632,400780,000966,000Socialsecuritycosts94,860117,000144,900Paymentstovendors(operatingexpenses)265,000322,500455,000Total1,277,3611,663,1482,169,233Netcashflowfromoperatingactivities-151,328110,814253,686CASHFLOWSFROMINVESTINGACTIVITIESReceiptofgrantfinancing(assets)000Total000OutflowsPaymentstovendors(assets)50,000500,0000Total50,000500,0000Netcashflowfrominvestingactivities-50,000-500,0000CASHFLOWSFROMFINANCINGACTIVITIESInflowsInflowsofnominalvalue135,00060,0000Inflowsofsharepremium000Loanamountsreceived75,000500,0000Total210,000560,0000OutflowsPrincipalrepayments090,849127,295Interestexpense5,25030,44825,569Dividends(nettoshareholders)0020,000Paymentofcorporateincometax0019,357Corporateincometaxondividends000VATReturn000Total5,250121,297192,221Netcashflowfromfinancingactivities204,750438,703-192,221Netchangeincashandcashequivalents3,42249,51761,465Cashandcashequivalentsatthebeginning03,42252,939Cashandcashequivalentsattheend3,42252,939114,40416Capitalstructure(USD)201220132014Currentassets64,890131,940216,491Fixedassets45,000530,000515,000Currentliabilities62,399146,04625,418Long-termliabilities25,000356,857356,857Owners'equity22,491159,038349,216Getstartedwithyourbusinessplan–www.

iplanner.

net

- siftingpoweredbyecshop相关文档

- Webpoweredbyecshop

- 电压poweredbyecshop

- P31poweredbyecshop

- 喜玛拉雅poweredbyecshop

- handlepoweredbyecshop

- unternehpoweredbyecshop

friendhosting:(优惠55%)大促销,全场VPS降价55%,9个机房,不限流量

每年的7月的最后一个周五是全球性质的“系统管理员日”,据说是为了感谢系统管理员的辛苦工作....friendhosting决定从现在开始一直到9月8日对其全球9个数据中心的VPS进行4.5折(优惠55%)大促销。所有VPS基于KVM虚拟,给100M带宽,不限制流量,允许自定义上传ISO...官方网站:https://friendhosting.net比特币、信用卡、PayPal、支付宝、微信、we...

buyvm迈阿密机房VPS国内首发测评,高性能平台:AMD Ryzen 9 3900x+DDR4+NVMe+1Gbps带宽不限流量

buyvm的第四个数据中心上线了,位于美国东南沿海的迈阿密市。迈阿密的VPS依旧和buyvm其他机房的一样,KVM虚拟,Ryzen 9 3900x、DDR4、NVMe、1Gbps带宽、不限流量。目前还没有看见buyvm上架迈阿密的block storage,估计不久也会有的。 官方网站:https://my.frantech.ca/cart.php?gid=48 加密货币、信用卡、PayPal、...

阿里云香港 16核32G 20M 999元/月

阿里云香港配置图提速啦是成立于2012年的十分老牌的一个商家这次给大家评测的是 阿里云香港 16核32G 20M 这款产品,单单说价格上就是十分的离谱原价8631元/月的现价只要 999元 而且还有个8折循环优惠。废话不多说直接进入正题。优惠时间 2021年8月20日-2021年9月20日 优惠码 wn789 8折优惠阿里云香港BGP专线 16核32G 10M带宽 优惠购买 399元购买链接阿里云...

poweredbyecshop为你推荐

-

安顺网易yeahflashwind下载了那个FlashWind极速旋风还需要安装吗?怎么安装?怎样使用?wordpress模板wordpress后台默认模板管理在哪里?支付宝调整还款日蚂蚁借呗还款日能改吗支付宝是什么什么是支付宝? 请详细介绍.重庆网站制作重庆网站制作,哪家公司服务,价格都比较好?sns网站有哪些中国都有哪些sns网站?还有它们都是哪个类型的?支持http信息cuteftpcsamy